Are you curious about how policy riders can enhance your insurance coverage? Understanding the nuances of these additional provisions can be a game-changer for your financial security. In this article, we'll break down the significance of policy riders and how they can address specific needs in your insurance plan. So, let's dive in and explore these valuable options together!

Purpose and Context

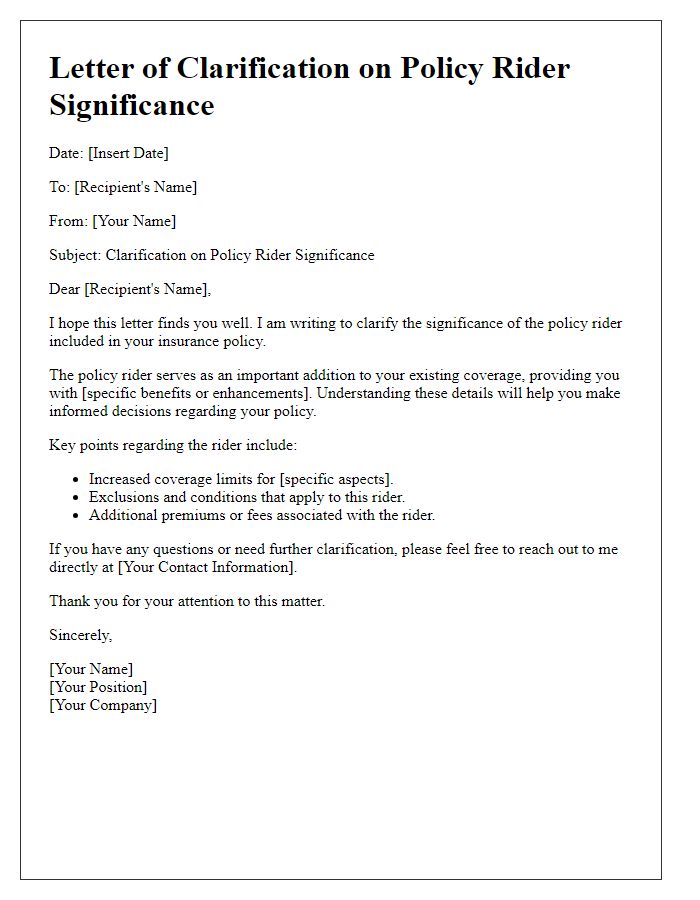

The inclusion of a policy rider significantly enhances the coverage provided by an insurance policy, ensuring that specific additional benefits are available to the policyholder. A rider, which can address various circumstances such as enhanced accident protection or critical illness coverage, serves as an amendment tailored to meet individual needs and provide greater security. The purpose of including a rider typically revolves around expanding the scope of protection and addressing specific risks associated with the insured individual or their assets. Contextually, this may reflect the changing personal circumstances of the policyholder, such as the acquisition of property or changes in family status, thereby necessitating the need for broader coverage options. The relevance of this addition is underscored by the increasing frequency of claims related to unforeseen events in today's fast-paced world.

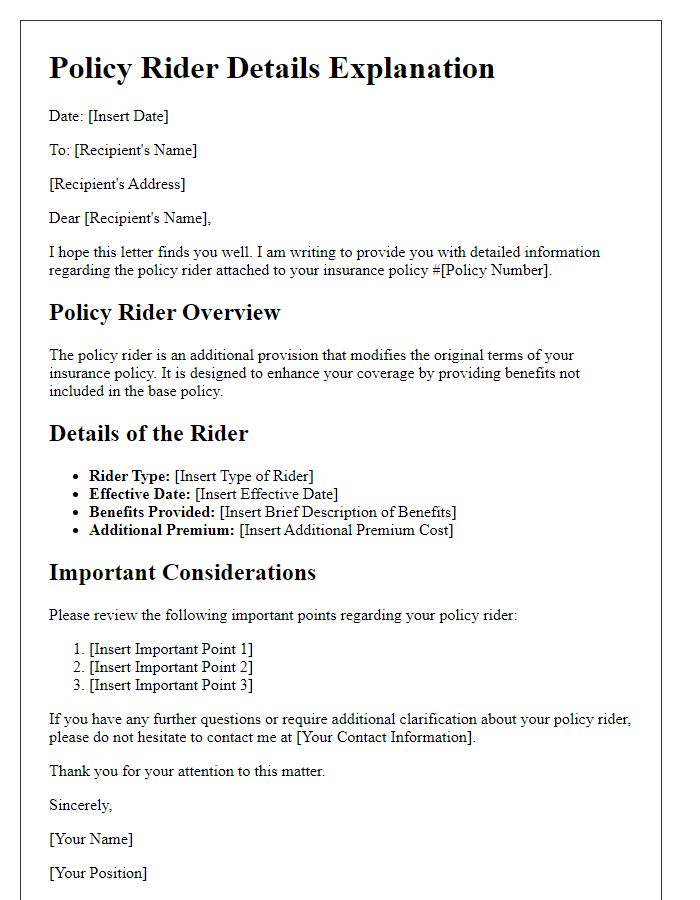

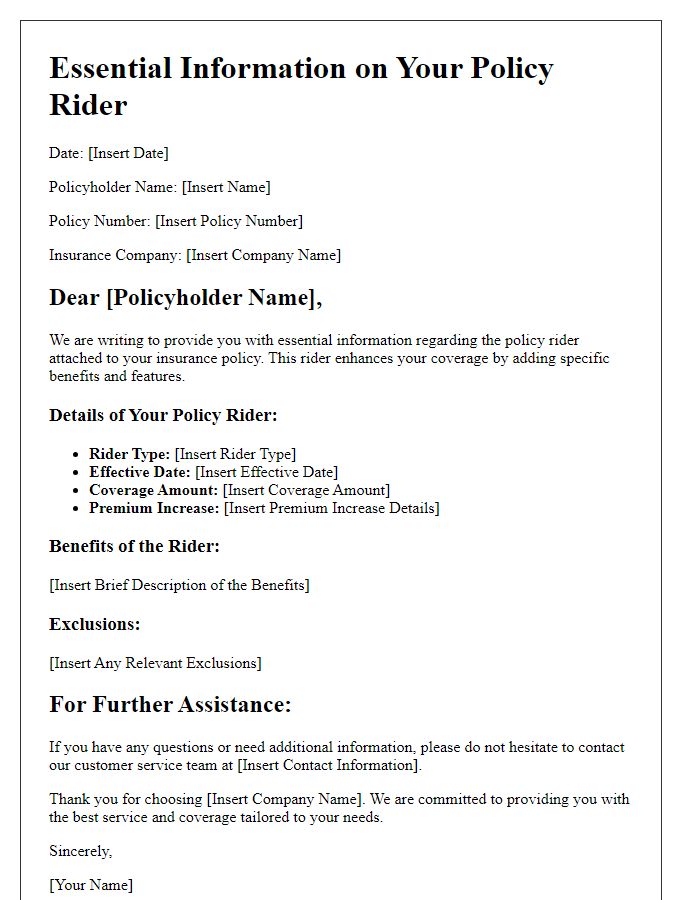

Policy Details and Rider Specifics

Insurance policies often include various riders to enhance coverage. A rider refers to an addition to the standard policy, providing specific benefits like accidental death or critical illness coverage. For instance, a life insurance policy (like term life) might include a critical illness rider, which offers payouts upon diagnosis of serious conditions such as cancer (many types) or heart disease. Additionally, health insurance policies can feature a maternity benefit rider, which provides financial support for pregnancy-related expenses, typically effective for a specified duration, such as 12 months before the due date. Understanding these inclusions is essential for policyholders to ensure comprehensive protection tailored to individual needs.

Benefits and Coverage Enhancements

The policy rider inclusion significantly enhances benefits and coverage. For instance, critical illness riders provide financial protection against specific health conditions, ensuring comprehensive support during medical crises. Increasing policy limits can improve coverage for significant medical expenses, with enhancements that may include options for outpatient services or wellness benefits. Riders, such as accidental death or dismemberment coverage, further safeguard policyholders and their families in unfortunate events. The integration of these riders allows for a tailored insurance experience, addressing unique needs and providing peace of mind in uncertain circumstances.

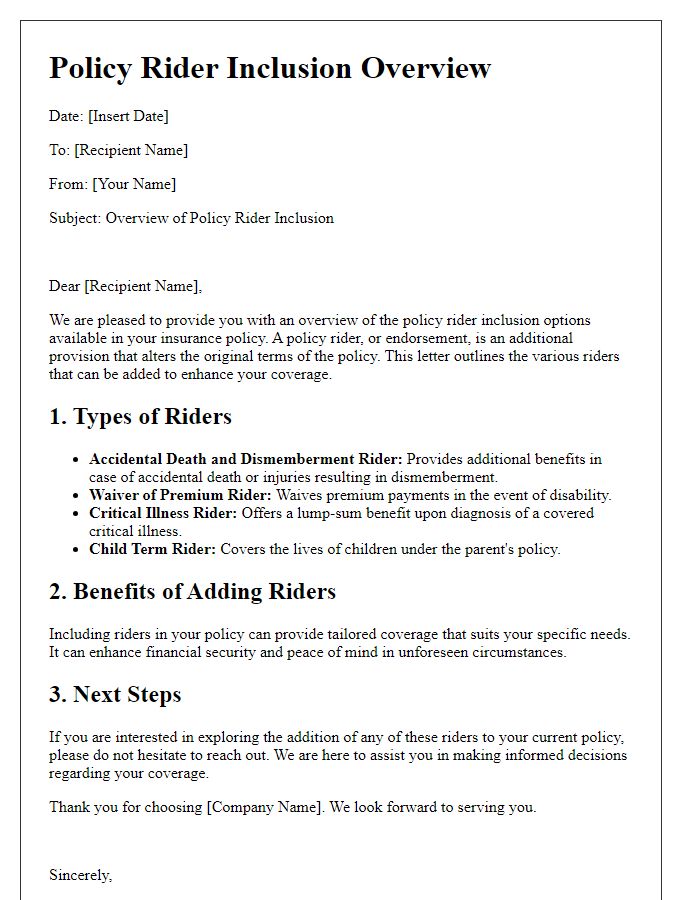

Premium Impact and Cost Analysis

Policy riders, such as health coverage additions, can significantly impact premium rates. Additional coverage options may increase the overall cost of an insurance policy, which affects monthly premium payments. For instance, adding a critical illness rider to a life insurance policy might increase premiums by 20% to 30%, depending on individual health factors and the insurance provider's underwriting guidelines. The assessment of premium changes often involves a cost-benefit analysis that weighs the added financial protection against the increased expense. Policyholders should carefully review rider benefits and consult with an insurance expert to ensure that the additional costs align with their specific coverage needs and financial goals.

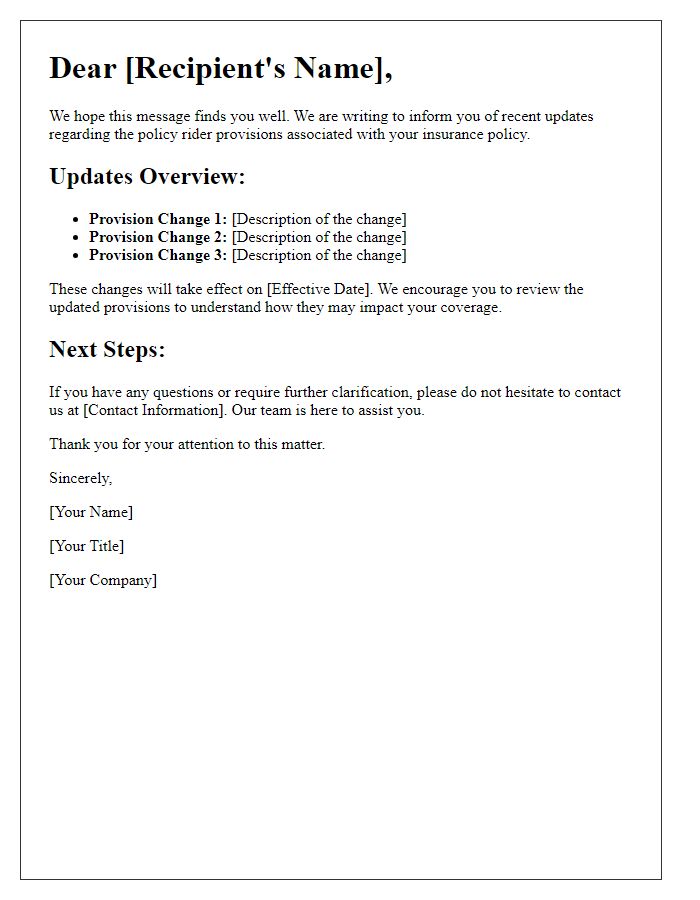

Contact Information and Support

Incorporating rider options in insurance policies can significantly enhance coverage, accommodating individual needs. Riders, such as accidental death benefits and critical illness coverage, provide additional financial security against unforeseen events. Insurance providers, like State Farm or Allstate, issue these policies, which may vary in terms and benefits. Contacting customer support for clarification typically involves reaching out via dedicated helplines or online chat services. These resources, available during business hours, assist policyholders in understanding specific inclusions. Additionally, comprehensive policy documentation outlines all riders, ensuring individuals are fully informed about their benefits and coverage limits.

Comments