Navigating the world of health insurance can feel overwhelming, especially when it comes to ensuring your loved ones have adequate coverage. If you've recently welcomed a new family member or simply need to update your policy, adding dependent coverage is crucial for peace of mind. In this article, we'll break down the steps you need to take, from gathering necessary documentation to understanding your options. So, let's dive in and make the process as simple as possibleâread on to learn how you can protect your family's health today!

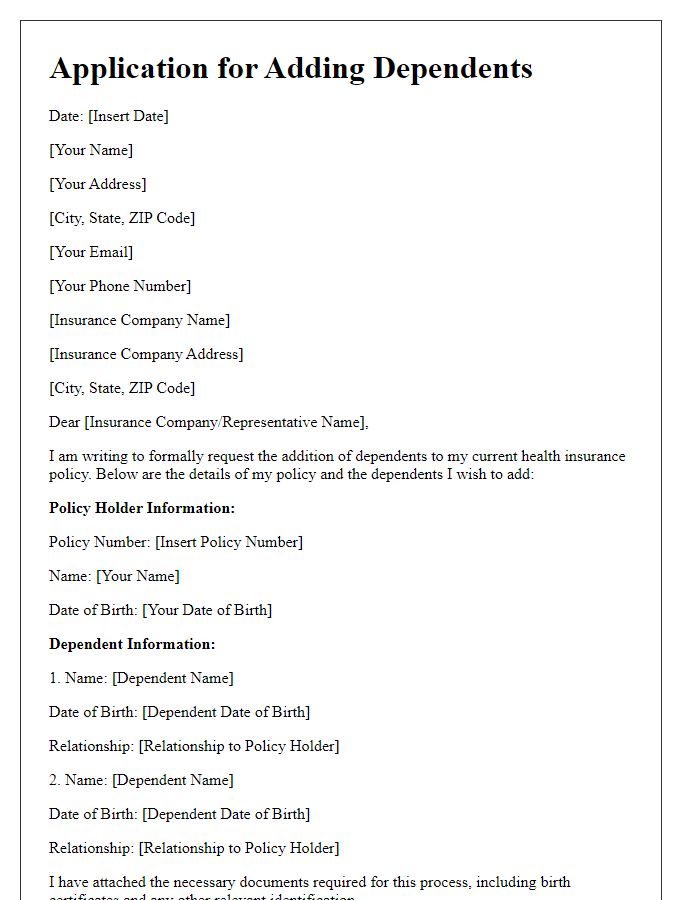

Clear identification of the primary policyholder and dependent(s)

Primary policyholder Jane Smith holds a comprehensive health insurance plan with policy number 123456789 issued by Health Insurance Company, headquartered in New York City. She seeks to add her dependent children, aged 8 and 12, named Emma and Noah respectively, to her policy. This addition requests coverage extending to routine medical services, specialist visits, emergency care, and prescription medications for both dependents, aligning with the benefits outlined in the policy. The effective date for this coverage aims for February 1, 2024, ensuring uninterrupted health access for Emma and Noah.

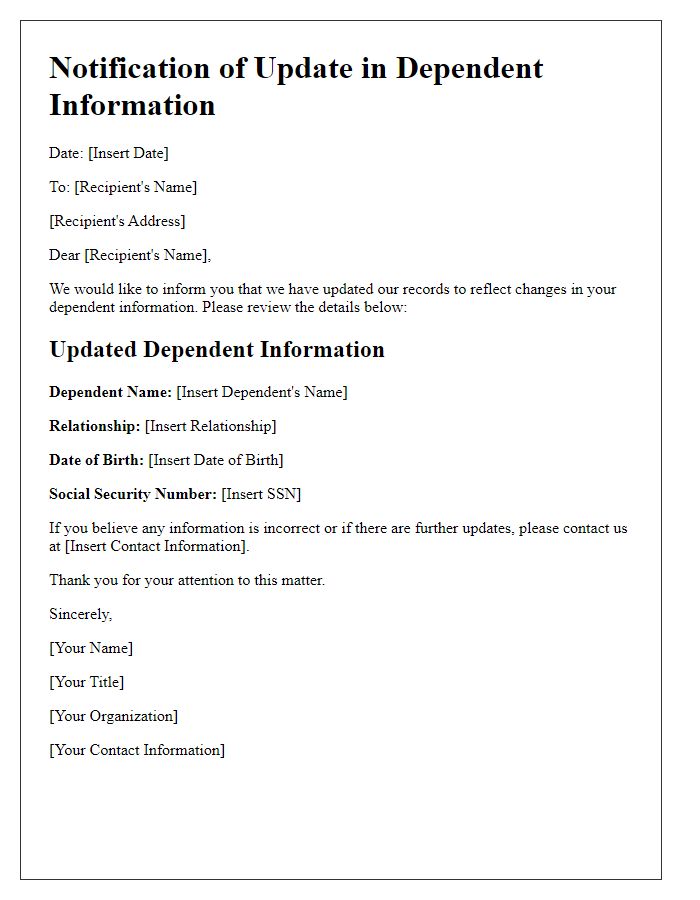

Specific policy details and identification numbers

Dependent coverage addition allows individuals to extend their health insurance plan to include family members, such as children or spouses. For example, in the United States, this often falls under the Affordable Care Act provisions that permit parents to keep their dependents on their health plans until age 26. Specific policy details involve the type of coverage provided, which may include medical, dental, and vision benefits. Identification numbers, such as the policy number (usually a unique string of letters and numbers assigned by an insurance company) and member IDs (individual identifiers for each insured person), are crucial for claims processing and ensuring that dependents receive appropriate healthcare services without interruptions. Understanding these aspects is essential when adding dependents to an existing policy for comprehensive health coverage.

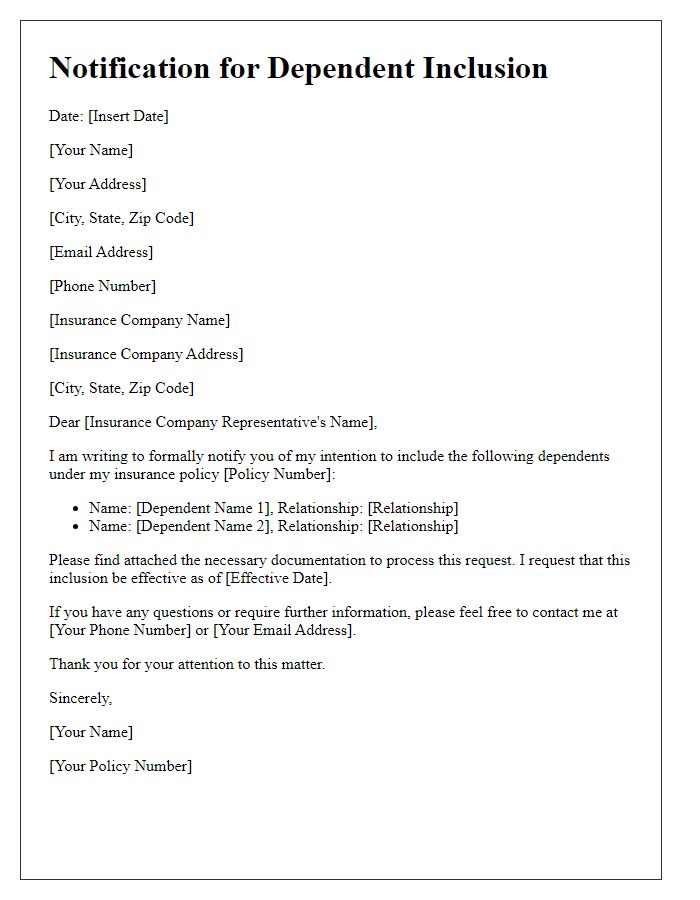

Effective date of coverage addition

Dependent coverage addition can enhance health insurance plans, providing essential benefits for family members. This coverage typically includes spouses, children, and sometimes even extended family members. Effective dates for new coverage often align with the start of policy renewals or changes, such as open enrollment periods, which occur annually in the United States, usually in the fall. For many insurance providers, additional coverage takes effect immediately upon approval, providing prompt access to services like preventive care, hospital visits, and prescription medications. Specific terms for effective dates can vary by plan and carrier, so it's important for policyholders to review their insurance documentation for precise information.

Justification or reason for dependent addition

Adding dependent coverage enhances the security and well-being of family members, ensuring they receive essential healthcare services. Dependents often include spouses, children, or other eligible individuals, crucial for managing and addressing medical needs. Access to preventive care, treatment for chronic conditions, and emergency services can significantly improve health outcomes. Research indicates that families with comprehensive health coverage experience reduced financial stress related to medical bills (approximately 20% lower), fostering a healthier household environment. Additionally, organizations often see increased productivity among employees with dependents receiving proper care, as overall well-being is linked to job performance.

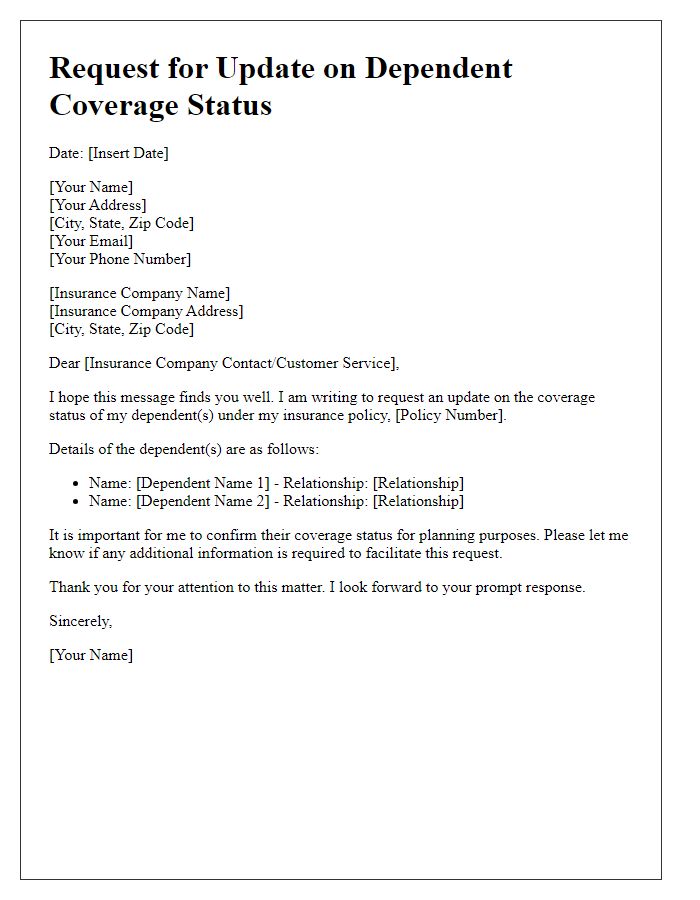

Contact information for further communication and verification

Dependent coverage addition enables policyholders to extend benefits to family members, commonly seen in health insurance plans. Contact details essential for additional inquiries often include the customer service number, typically a toll-free number, and a dedicated email address for claims or coverage changes. A verification process may require personal identification information such as social security numbers for dependents and policy numbers for existing coverage. Proper documentation, like birth certificates or marriage licenses, supports the addition process, ensuring compliance with policy guidelines and efficient enrollment.

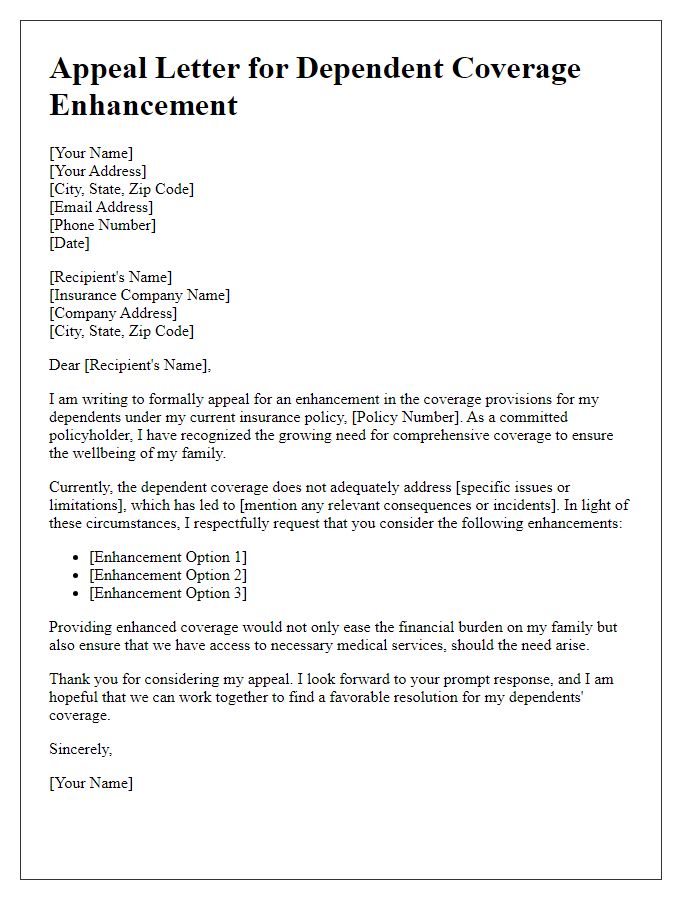

Letter Template For Dependent Coverage Addition Samples

Letter template of application for adding dependents to health insurance

Letter template of notification for dependent inclusion in insurance policy

Letter template of notification letter for updating dependent information

Comments