Are you navigating the often-stressful process of verifying an insurance payout? Understanding the necessary steps and paperwork can feel overwhelming, but it doesn't have to be! With clear guidance and a straightforward template, you can simplify this journey and ensure that your claim is processed smoothly. Ready to dive into the details and get your insurance payout sorted? Read on for expert tips and a helpful template!

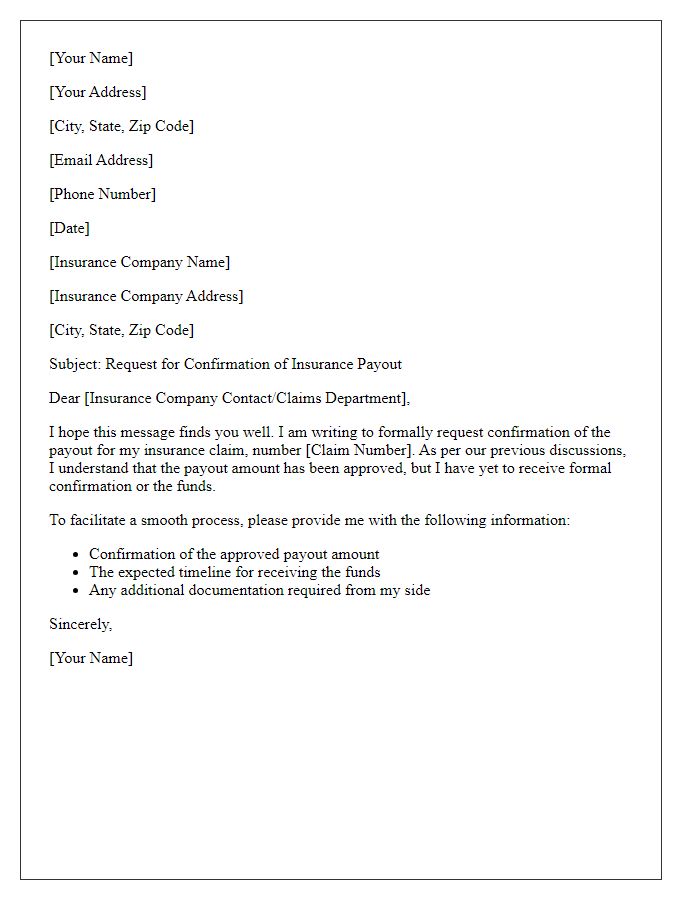

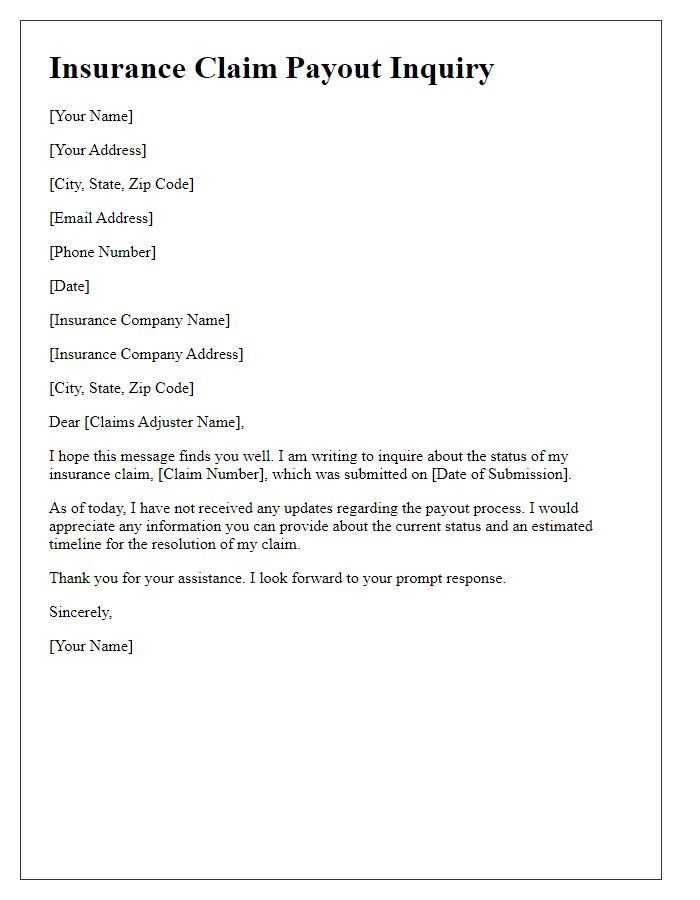

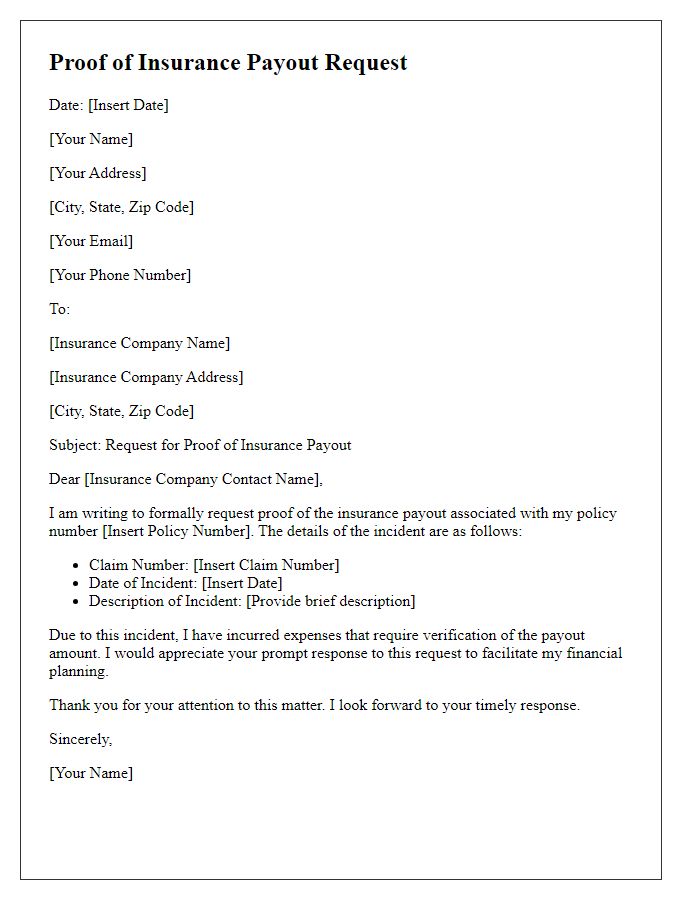

Policyholder information

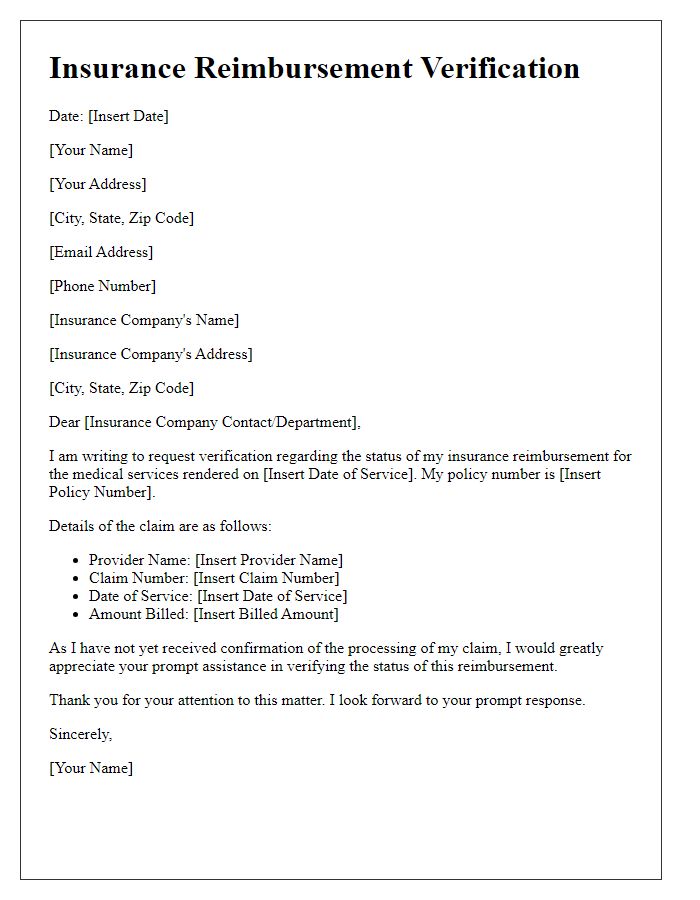

Insurance payouts require thorough verification processes to ensure policyholder eligibility. The policyholder information typically includes crucial details such as full name, policy number (unique identifier for insurance contracts), date of birth (vital for confirming identity), and contact information (for communication purposes). Furthermore, providing the address of the policyholder (including city, state, and zip code) is necessary for local record-keeping. For claims, additional specifics like the date of the incident, type of claim (e.g., health, auto, home), and any supporting documentation (like medical reports or repair estimates) are essential for expedited processing. Accurate and complete policyholder information streamlines the verification process and minimizes delays in insurance payouts.

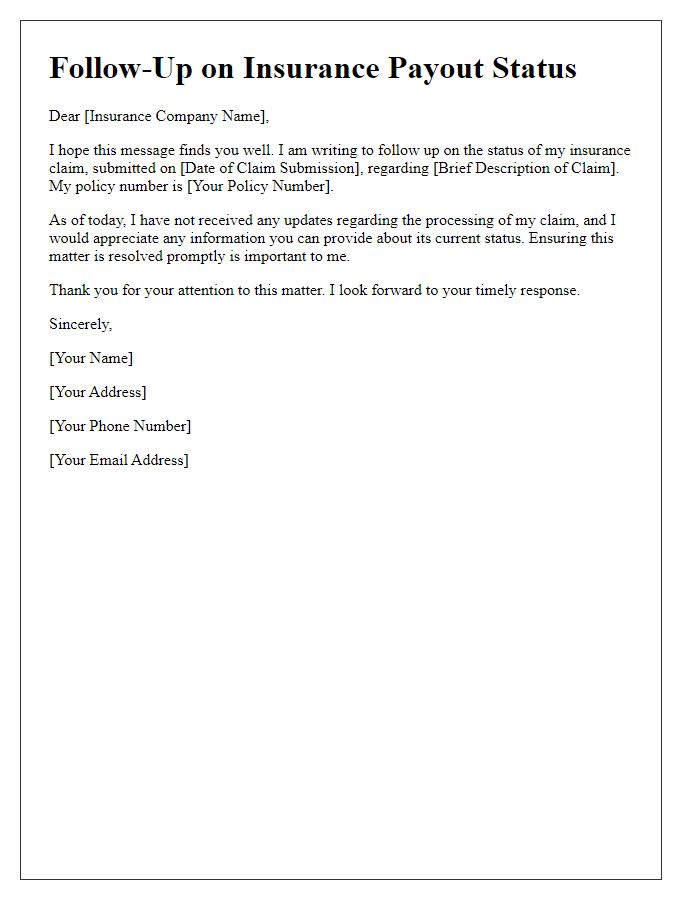

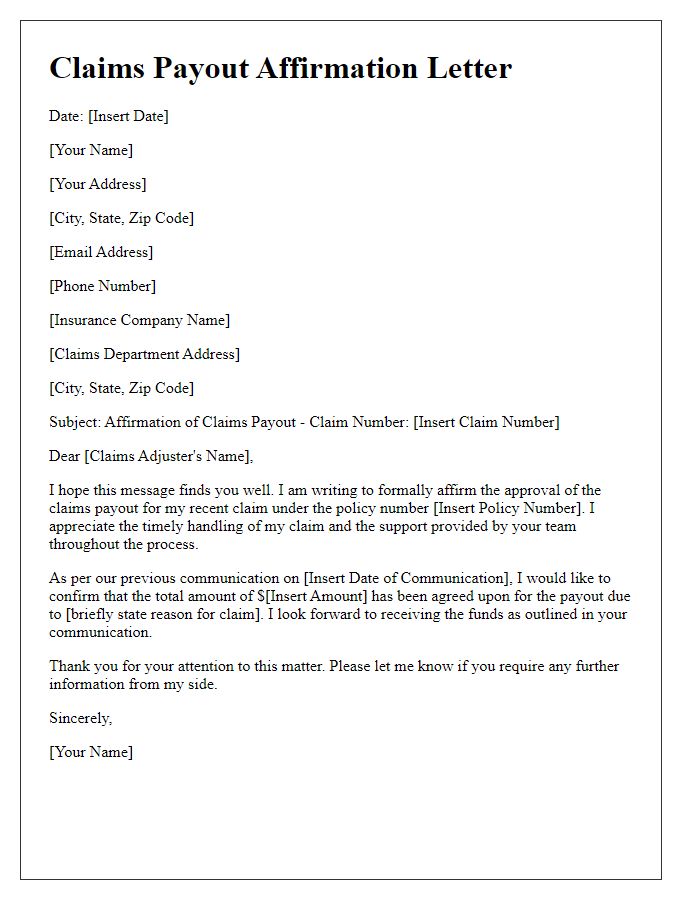

Claim details

The insurance payout process involves several critical steps, including verification of claim details, necessary for receiving compensation. Essential items like the claim number (a unique identifier assigned to each case) must be accurately noted, ensuring streamlined processing. Documentation, such as police reports (submitted when incidents involve accidents) or medical bills (necessary for health-related claims), provides proof of loss or damages incurred. A thorough review of policy terms (specific coverage details outlined in the insurance agreement) is essential, clarifying coverage limits and exclusions that may impact payout amounts. Timeliness of submission also plays a crucial role, as delayed claims might face rejection or reduced compensation. Ultimately, clear communication with the insurance provider (entities like State Farm or Allstate) is vital for ensuring successful claims management and timely payouts.

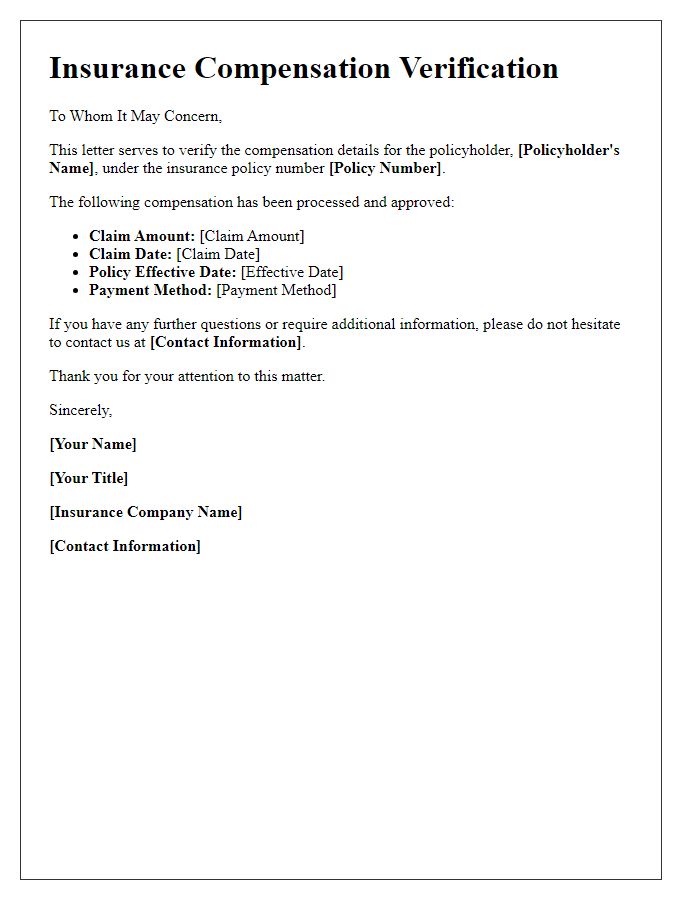

Payout amount

Insurance payout verification often involves the assessment of specific details, such as the payout amount, which is determined by the insurance policy terms. For instance, an insured loss may result in a payout of $50,000 under a homeowners insurance policy after coverage assessment. Documentation related to the policyholder's claim, including loss reports and appraisals, contributes to establishing the verified amount. This process typically requires coordination with the insurance adjuster to ensure compliance with regulatory standards and the timely release of funds, ultimately aiding the policyholder in financial recovery following an incident.

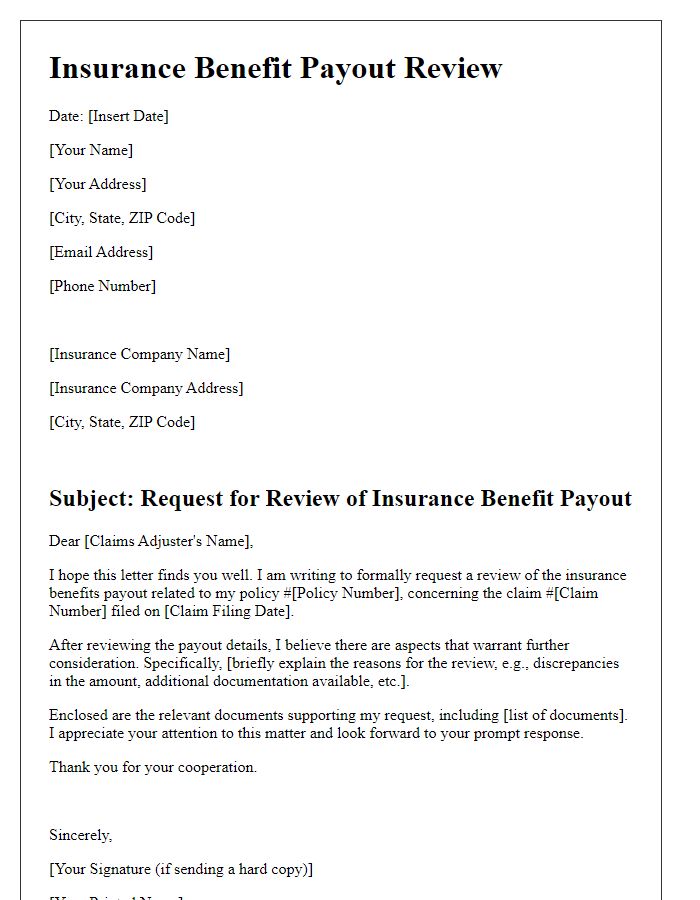

Verification documents required

Insurance payout verification requires specific documents to confirm eligibility for compensation. Essential documents include a completed claim form, which outlines the details of the incident, policy number, and claimant's signature. Additionally, proof of loss documents such as photographs of damages, repair estimates, and police reports enhance the verification process. Identification documents, like a government-issued ID (passport or driver's license), are needed to validate the claimant's identity. Furthermore, any relevant medical records are necessary for claims related to personal injury, highlighting the extent of injuries sustained. Collecting these documents expedites the verification process and ensures timely insurance payouts.

Contact information for inquiries

For insurance payout verification, providing precise contact information is crucial for quick resolutions. Clear details for inquiries should include the insurance company's primary contact number (such as 1-800-123-4567), dedicated customer service email address (for instance, service@insurancecompany.com), and physical mailing address (such as 123 Insurance Lane, Policy City, State, Zip Code). Additionally, including the claims department's direct line (like 1-800-987-6543) can expedite communication. Mentioning operating hours (for example, Monday to Friday, 9 AM to 5 PM) allows customers to reach out at their convenience, ensuring a smoother verification process.

Comments