Are you considering a reassessment of your insurance policy values? Understanding the intricacies of your coverage can lead to better financial security and peace of mind. In this article, we'll guide you through crafting a compelling letter to request a policy value reassessment, ensuring your needs are met effectively. So grab a cup of coffee and let's dive into the details together!

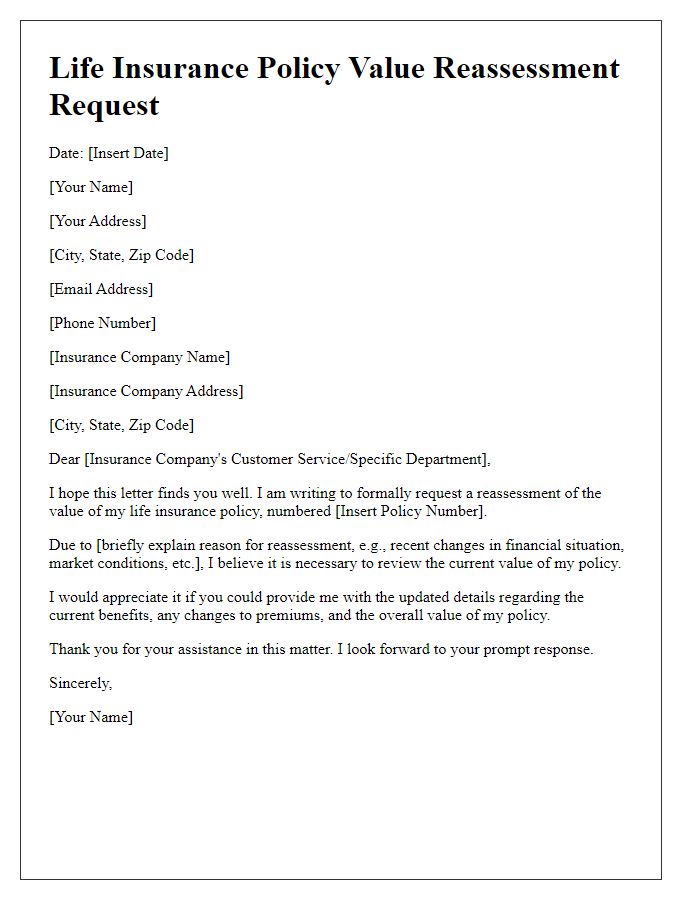

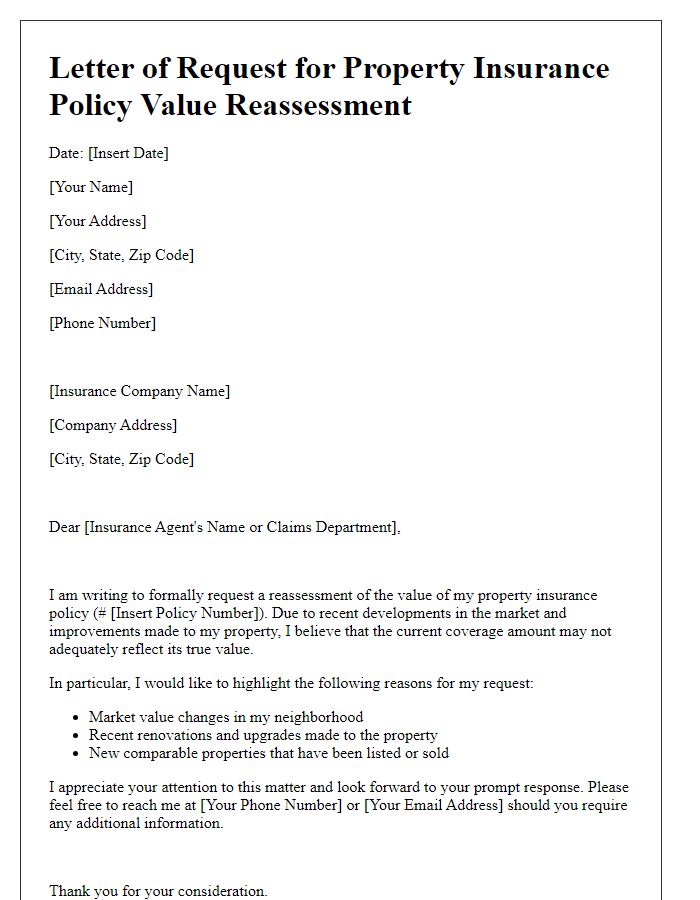

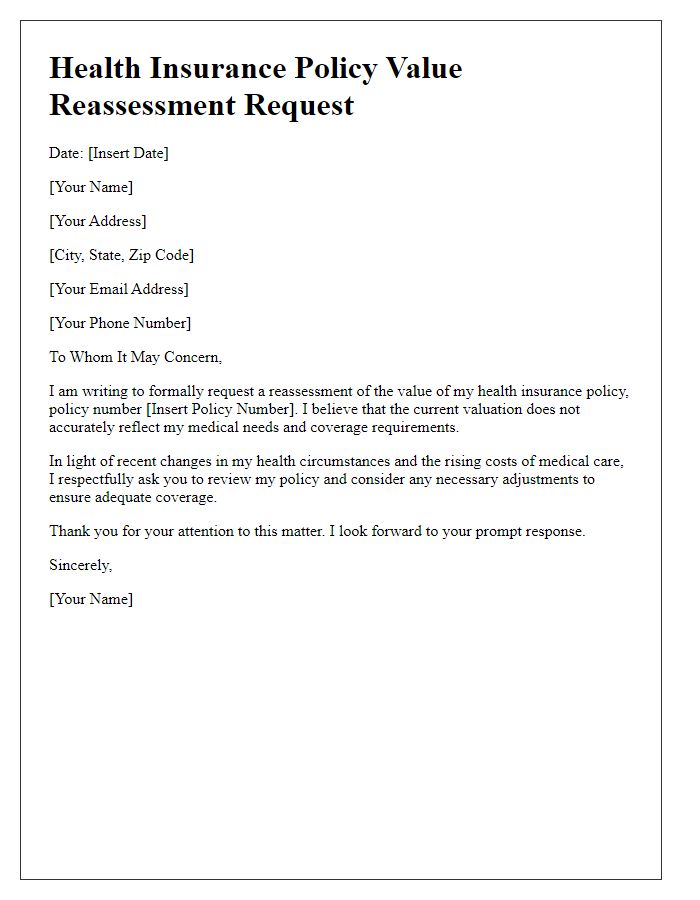

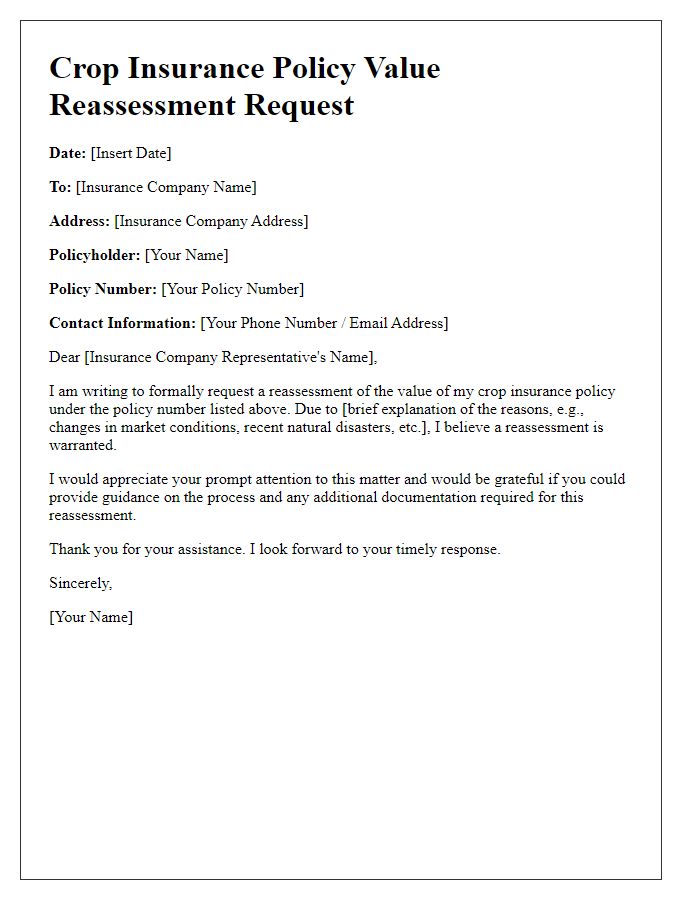

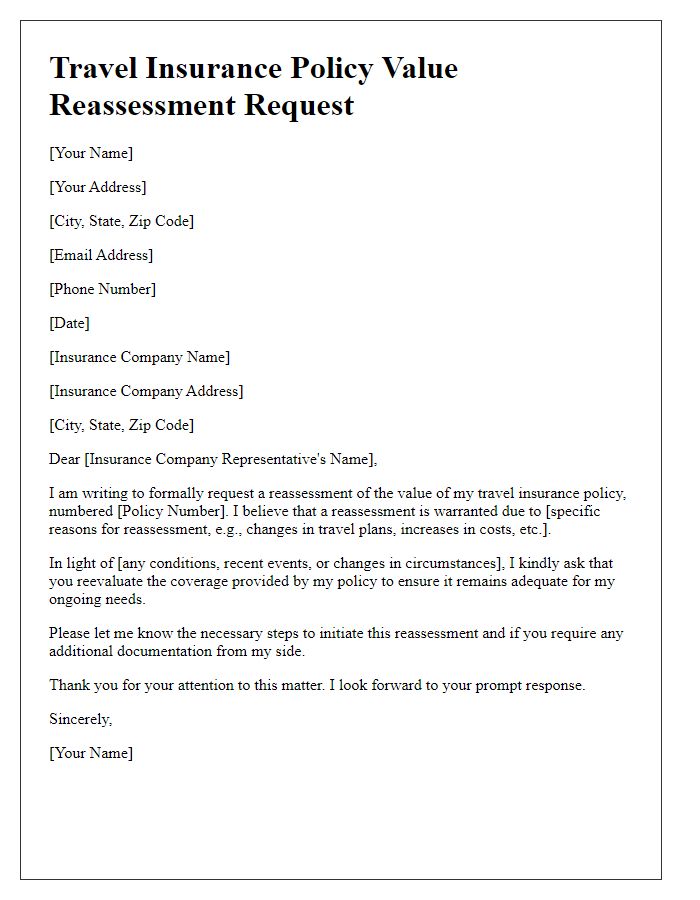

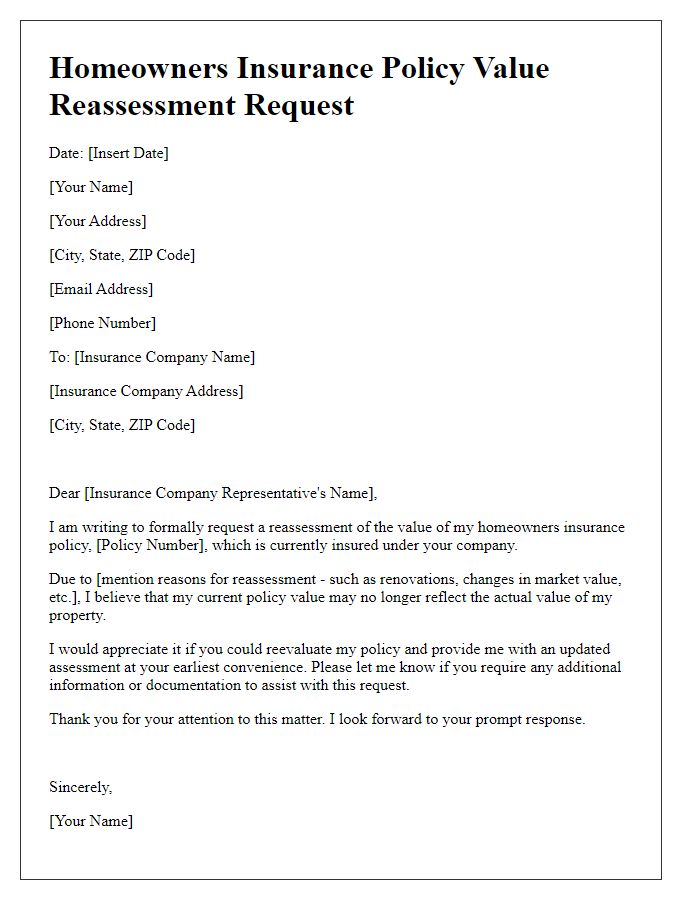

Subject line and reference details

A policy value reassessment request typically involves reviewing the terms of an insurance or financial policy to ensure that the coverage limits and benefits align with current needs. Critical information includes the policy number, insured entity name, and specific date of the policy's initiation. The request should detail the reasons for the reassessment, such as changes in personal circumstances, market conditions, or significant life events. Additionally, relevant figures like the current market value of assets or coverage amounts desired should be included to support the request. Proper reference formatting, including a clear subject line and reference identifiers, ensures streamlined processing by the insurance provider.

Opening salutation and introduction

Requesting a policy value reassessment involves reviewing specific insurance policy details, such as the insurance type (like whole life), policy number (typically numerical), and the insured individual (or entity) associated with the policy. A comprehensive analysis usually considers the current market value based on various factors including age, health status, and external economic conditions influencing policies today. Clients often seek this reassessment to ensure adequate coverage reflecting changing financial landscapes. This process may also incorporate consultation with financial advisors or insurance agents to accurately reassess policy value vis-a-vis individual needs.

Reason for reassessment request

A policy value reassessment request typically stems from various reasons related to changes in financial circumstances, market conditions, or the need for updated coverage. Changes in the policyholder's life, such as the birth of a child or a significant increase in income, may prompt a reassessment of coverage needs. Additionally, fluctuations in property values, healthcare costs, or types of risks may necessitate an evaluation of the policy's current value. Furthermore, regulatory changes or new underwriting guidelines from insurance companies may impact the existing policy terms and prompt a policyholder to seek an updated assessment. Overall, these factors can significantly influence the adequacy and relevance of the current policy value, warranting a comprehensive review.

Specific policy details and supporting evidence

In a policy value reassessment request, critical aspects include the specific policy number, issued by the insurance provider, such as Universal Life Insurance (ULI) or Whole Life Insurance (WLI). Supporting evidence might consist of recent appraisals of assets or property, documenting changes since the initial valuation date, such as market appreciation or depreciation. This documentation can include relevant reports or valuations conducted by a certified appraiser, details of changes in regulations, economic conditions affecting policy value, and any alterations in risk factors associated with the insured assets. Accurate data, such as the current market trends or interest rates, will strengthen the request, emphasizing the necessity for a fair reassessment of the policy's monetary worth.

Closing remarks and contact information

Policy value reassessment requests often require concise closing remarks and contact information for further communication. This section should emphasize appreciation for the reassessment process, express readiness to provide additional information, and encourage a timely response. Including contact details such as an email address or phone number ensures that the recipient can easily reach out for clarifications. Remember to highlight urgency if necessary, especially if the policy value reassessment impacts important financial decisions or upcoming renewals. Proper formatting of contact information is crucial for clarity, facilitating efficient communication.

Comments