Are you feeling frustrated with the claims handling process? You're not alone, as many individuals encounter challenges when navigating through the intricacies of claim submissions and resolutions. In this article, we'll explore common pitfalls and offer constructive feedback to improve this often overlooked aspect of customer service. Join us as we delve deeper into effective strategies for enhancing the claims experience!

Clear subject identification

In the realm of insurance claims, the claim handling process is crucial in determining client satisfaction and operational efficiency. Timely communication (responses within 72 hours) is vital for transparency and building trust. Thorough documentation (e.g., photographs, witness statements) enhances the accuracy of assessments and expedites resolution. Additionally, adherence to regulatory guidelines (such as those outlined by the National Association of Insurance Commissioners) significantly influences compliance and mitigates legal risks. Evaluating decision-making criteria (such as coverage limits or exclusions) ensures fair treatment of policyholders and enhances overall service quality. Moreover, feedback mechanisms (like surveys post-claim) can provide critical insights for continuous improvement in processes and client engagement.

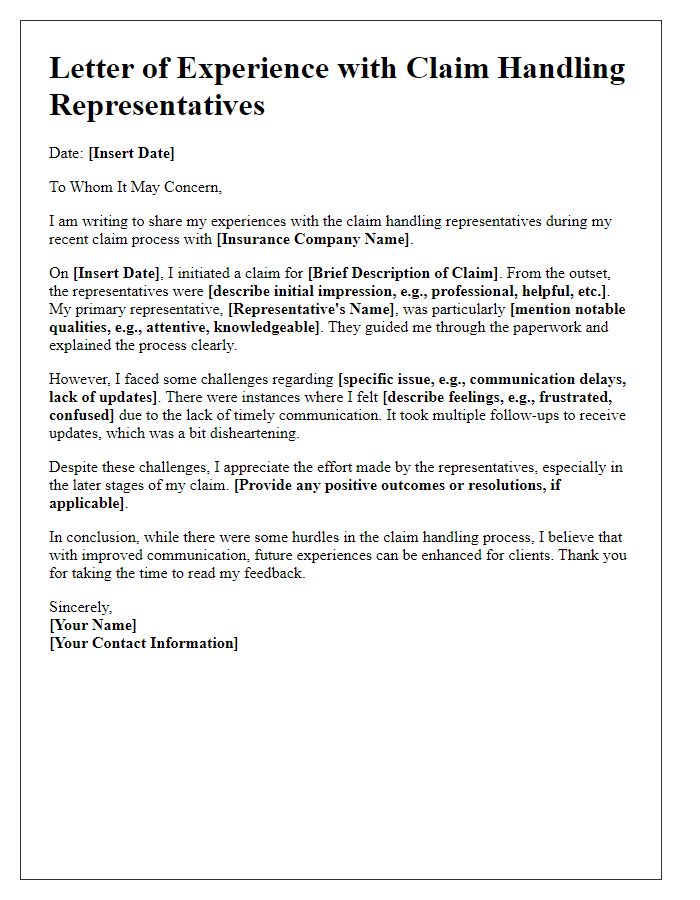

Specific details and timeline

The claim handling process can significantly impact customer satisfaction within the insurance industry, particularly regarding policies managed by major providers like State Farm or Allstate. A crucial event occurred on March 15, 2023, when a customer filed a claim for water damage (approximately $20,000 in estimated repairs) resulting from a burst pipe in their home located in Charlotte, North Carolina. The initial acknowledgment email from the claims department was received on March 16, 2023; however, it lacked detailed next steps and timelines. Subsequent follow-ups on March 22 and April 5 revealed delays in the investigation due to a backlog of similar claims resulting from winter storms. The final settlement offer, made on April 20, 2023, fell short of covering the full repair costs, raising concerns about the adequacy of the assessment process employed by the adjusters. This timeline indicates potential inefficiencies and communication gaps in the claim handling process that merit further scrutiny to enhance customer trust and operational effectiveness.

Objective assessment

Claim handling processes, particularly within insurance companies like XYZ Insurance, often face scrutiny regarding efficiency and clarity. Objective assessment reveals that average claim processing times are approximately 15 days, which exceeds industry standards for timely processing, often set at 10 days. Frequent issues arise from inadequate communication between the claims adjusters and policyholders, leading to increased frustration and confusion. Additionally, a noted 20% of claims experience insufficient documentation requests, causing delays in approvals. This inefficiency not only diminishes customer satisfaction ratings, which currently stand at 75%, but also impacts claims settlement ratios, an essential metric for evaluating company performance and reliability within the competitive landscape of insurance providers. Regular audits and enhancements in training for claims personnel could significantly improve these metrics and overall service quality.

Highlight areas for improvement

The claims handling process in insurance companies often presents significant challenges, including lengthy response times and insufficient communication. Delays in processing claims can lead to customer dissatisfaction, particularly within the first 30 days following the submission, a critical period for claimants relying on timely resolutions. Additionally, inadequate updates on claim status can exacerbate frustrations, with 47% of claimants expressing concerns about being left in the dark regarding their claims. Training for claims adjusters on empathy and effective communication can enhance customer interactions, promoting clearer expectations throughout the process. Implementing technology, such as automated tracking systems or mobile apps, may streamline communication and provide real-time updates, improving overall efficiency and claimant experience. Furthermore, evaluating the standard operating procedures (SOPs) for claims handling can help identify bottlenecks and opportunities for process optimization, ensuring a more seamless and satisfactory experience for all parties involved.

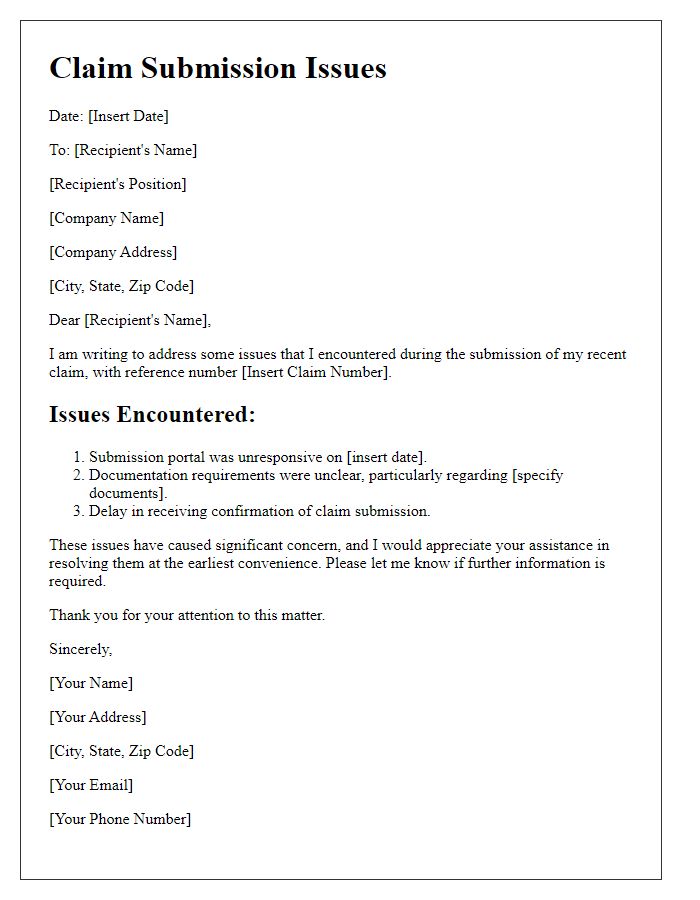

Constructive feedback and suggestions

The claim handling process in insurance companies often experiences inefficiencies that can hinder customer satisfaction. Long wait times (averaging 7-10 business days) for claim updates can lead to frustration among policyholders. Insufficient communication from claim adjusters, which frequently results in confusion regarding required documentation, further exacerbates customer dissatisfaction. Implementing a more transparent tracking system (similar to package tracking) could enhance the user experience by allowing policyholders to monitor the status of their claims in real-time. Regular check-ins via email or SMS notifications about claim progress could improve communication. Additionally, providing comprehensive online resources (including FAQs and instructional videos) on the claims process could empower customers to submit accurate claims from the outset, reducing the overall workload for claims departments.

Comments