Hey there! It's that time of year again when we need to have a chat about your annual premium adjustments. We understand that changes in insurance can be a bit overwhelming, but we're here to guide you through the process and help you understand what to expect. So grab a cup of coffee, settle in, and let's dive into everything you need to know about your revised premiumâkeep reading to get all the details!

Personalized recipient information

Annual premium adjustments can significantly impact policyholders, affecting their financial planning and insurance coverage. Each year, insurers review various factors, including changes in risk assessments and market conditions. For instance, adjustments may reflect shifts in demographics within geographical areas or increased claims frequency for specific policy types. Policyholders could receive notifications outlining the new premium amounts, detailing the rationale behind the adjustment. This information is crucial for understanding how coverage may evolve and can lead to discussions about alternative plans or discounts. Timely communication fosters Transparency while allowing individuals to prepare for any changes in monthly or annual budgeting.

Clear subject line

Annual premium adjustment notifications inform policyholders about changes to their insurance policy rates. These adjustments may be influenced by factors such as claims history, actuarial assessments, overall market trends, and regulatory changes. Notifications should clearly specify the new premium amounts, effective dates, and any rationale for changes. Transparency fosters trust and helps policyholders understand their financial commitments. It is essential to communicate the potential impact on their coverage options and encourage inquiries for clarification. Providing contact details for customer service ensures that policyholders receive prompt assistance regarding their policy adjustments.

Explanation of adjustment reason

Annual premium adjustments reflect changes in risk assessment, underwriting criteria, or claims history. Insurance providers evaluate factors like the insured individual's age, health status, and geographical location, which can influence overall risk. An increase in local crime rates, for instance, can result in higher premiums for homeowners' insurance. Enhanced coverage options or changes in policy terms may also drive adjustments, ensuring policyholders receive adequate protection. Additionally, trends in industry-wide claims may compel insurers to modify rates, particularly if their overall risk pool has incurred significant losses. This proactive approach maintains financial stability and ensures continued service quality.

New premium details

The annual premium adjustment notification details crucial information regarding insurance policy updates. The revised premium amount, effective from January 1, 2024, will now reflect the changes in market conditions and underwriting factors. Policyholders will observe a percentage increase of approximately 8%, bringing the total annual premium to $1,200 for comprehensive coverage. This increase accounts for heightened risk factors, including natural disasters and inflation in the healthcare sector. The notification also emphasizes the importance of reviewing policy benefits and optional coverages to ensure adequate protection, as adjustments may influence coverage levels and deductibles. Policyholders are encouraged to contact customer service representatives for personalized assistance and clarification.

Contact information for queries

Annual premium adjustments influence policyholders' financial commitments, such as the renewal of insurance contracts. Effective communication of changes is essential for customer satisfaction. Organizations provide clear contact information, including phone numbers, email addresses, and office locations, so policyholders can easily reach customer service representatives. These representatives are trained to address queries regarding adjustments, providing explanations of factors that influenced the premium changes, such as claims history, market trends, or legislative alterations. Timely notifications ensure policyholders are not taken by surprise, facilitating better financial planning and maintaining trust in the insurance provider.

Letter Template For Annual Premium Adjustment Notification Samples

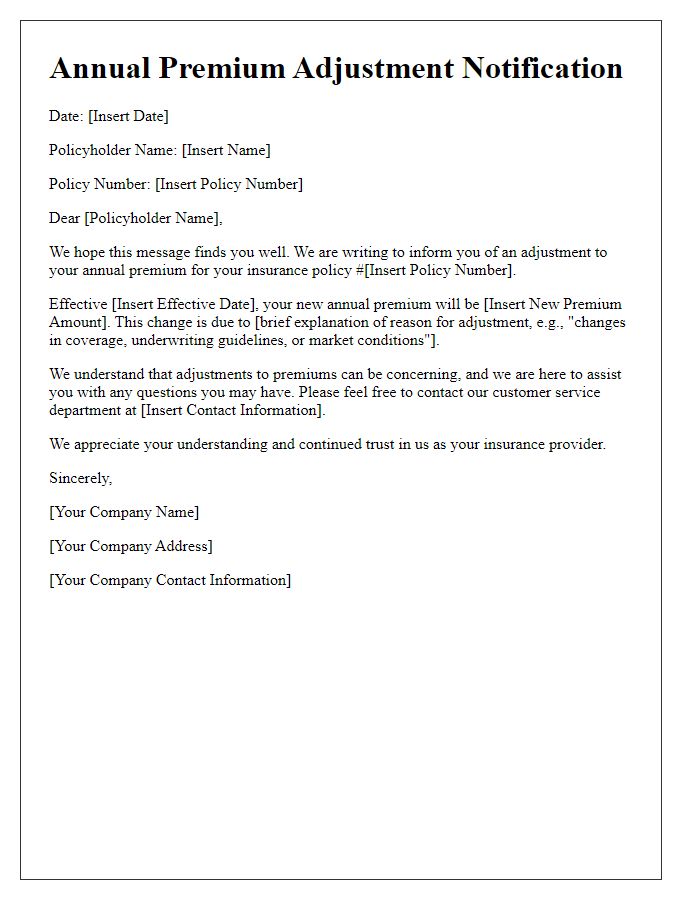

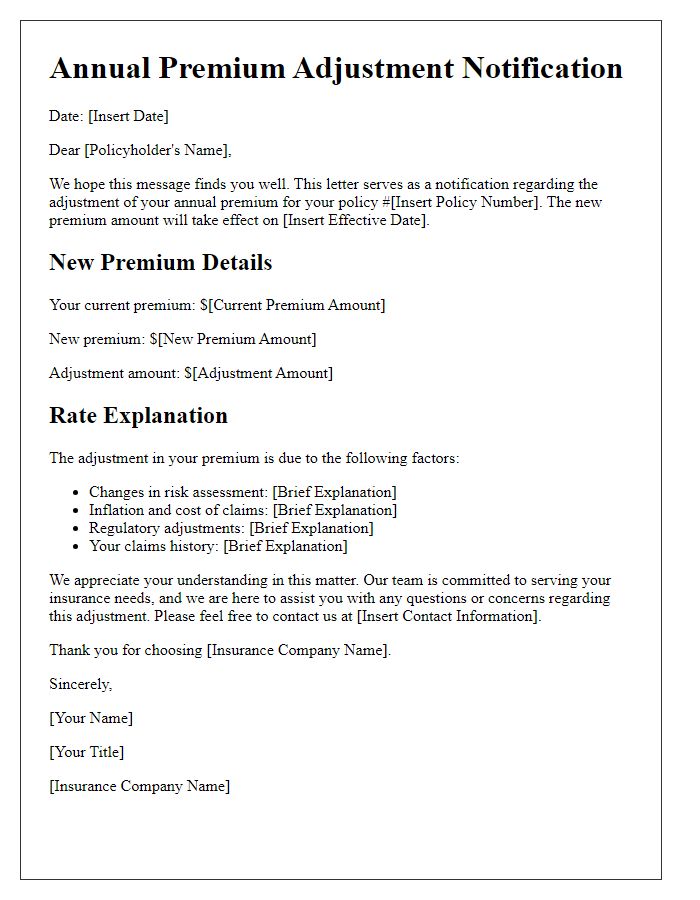

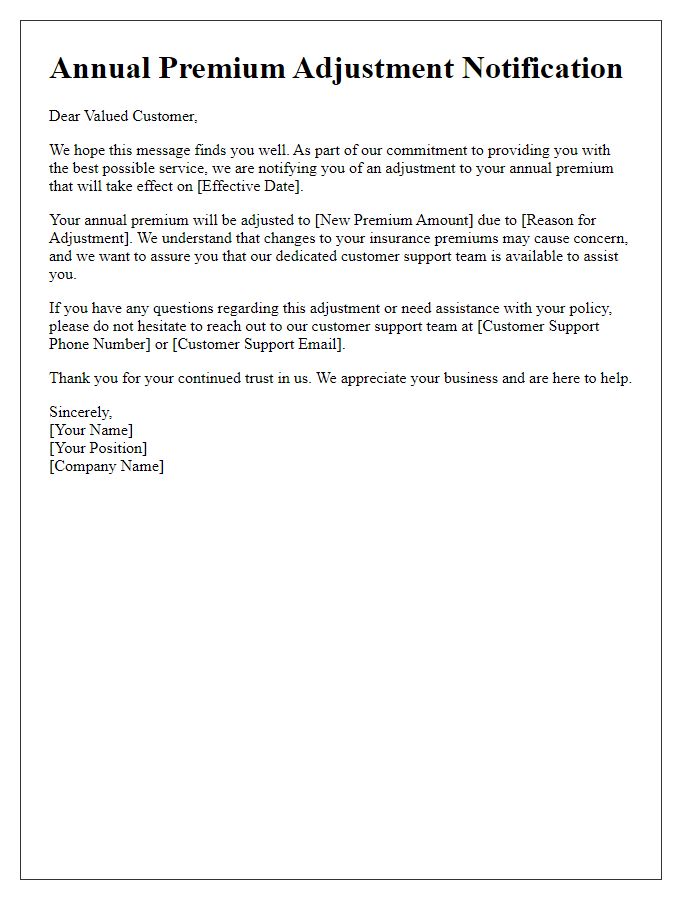

Letter template of annual premium adjustment notification for policyholders

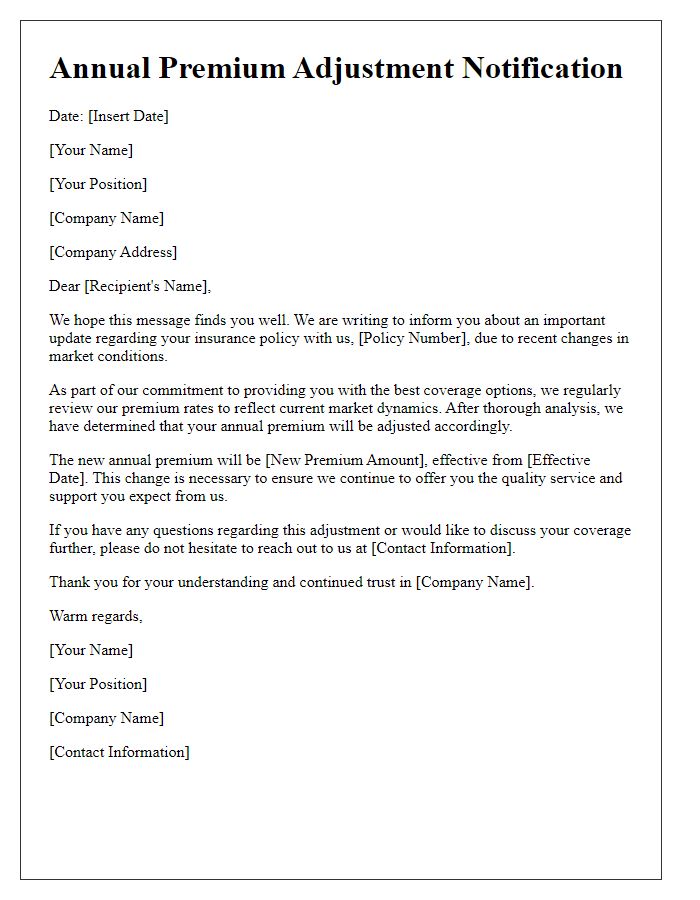

Letter template of annual premium adjustment notification due to market changes

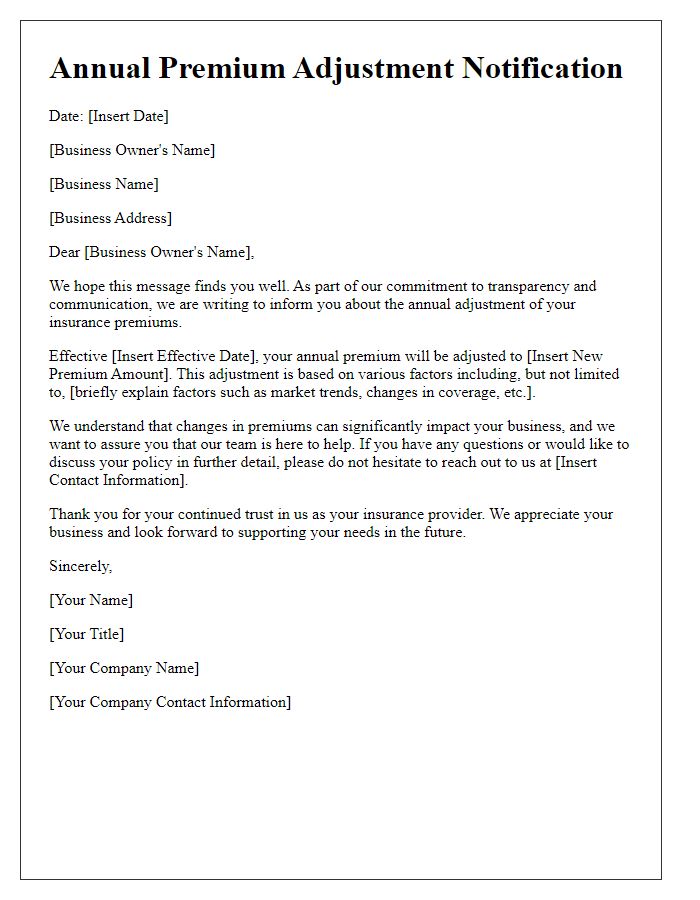

Letter template of annual premium adjustment notification for small business owners

Letter template of annual premium adjustment notification for health insurance subscribers

Letter template of annual premium adjustment notification for life insurance clients

Letter template of annual premium adjustment notification for auto insurance customers

Letter template of annual premium adjustment notification including payment options

Letter template of annual premium adjustment notification with detailed rate explanation

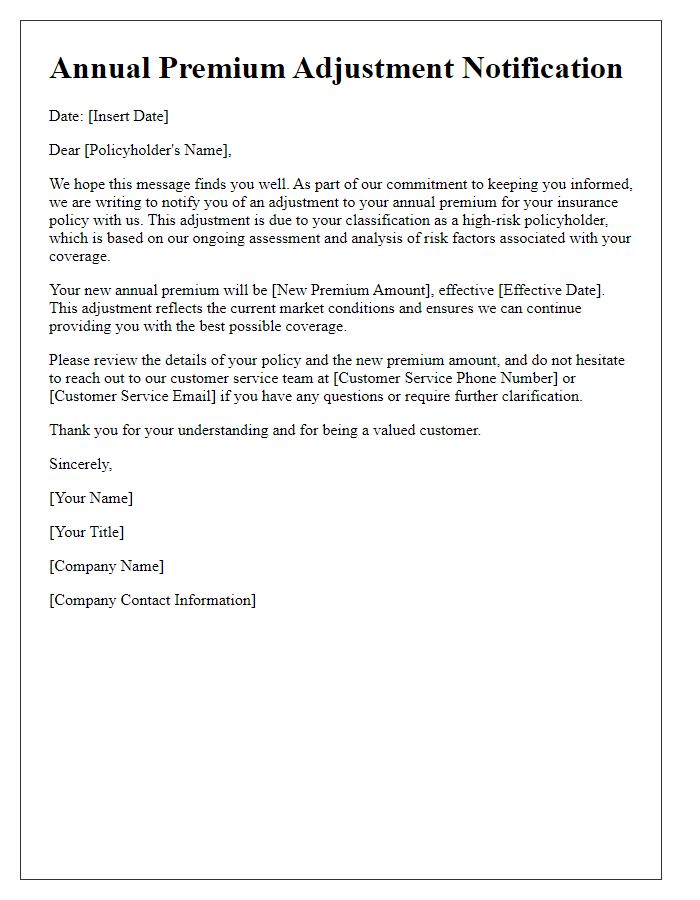

Letter template of annual premium adjustment notification for high-risk policyholders

Comments