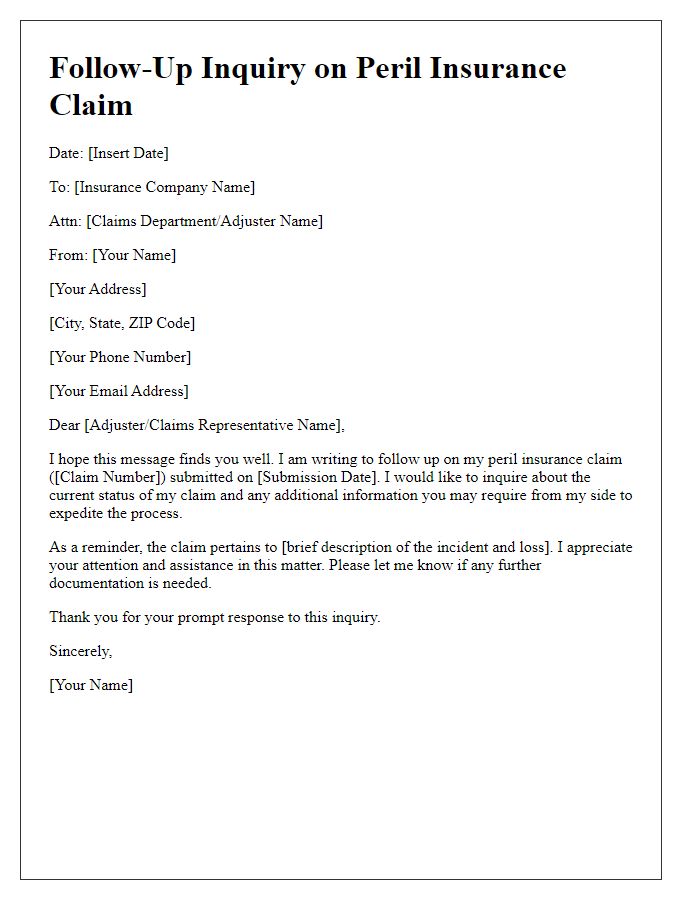

When navigating the often complex world of peril insurance incidents, having a solid letter template at your disposal can make all the difference. Whether you're filing a claim or documenting important details, a well-structured letter can streamline the process and ensure that you communicate clearly with your insurer. This article will walk you through the essential elements of a compelling letter template designed specifically for incident documentation. Curious to learn how to create an effective letter for your peril insurance situation? Keep reading!

Claimant Information

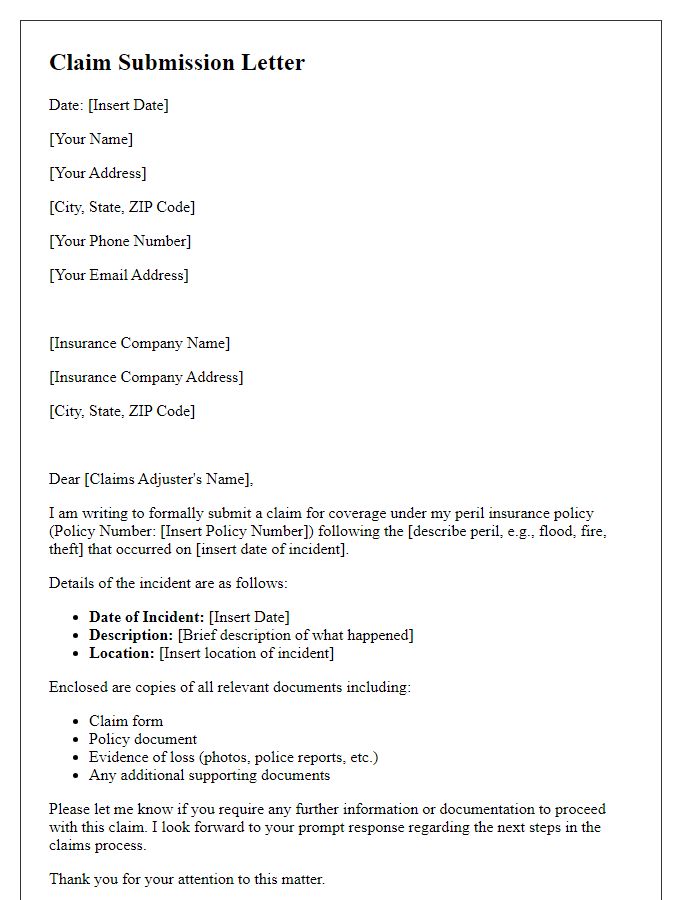

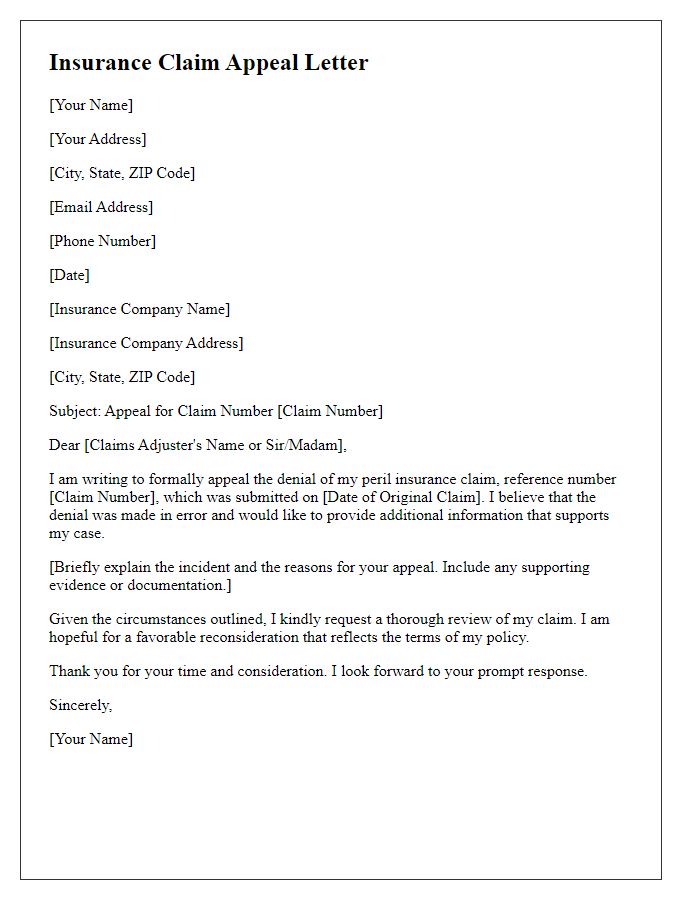

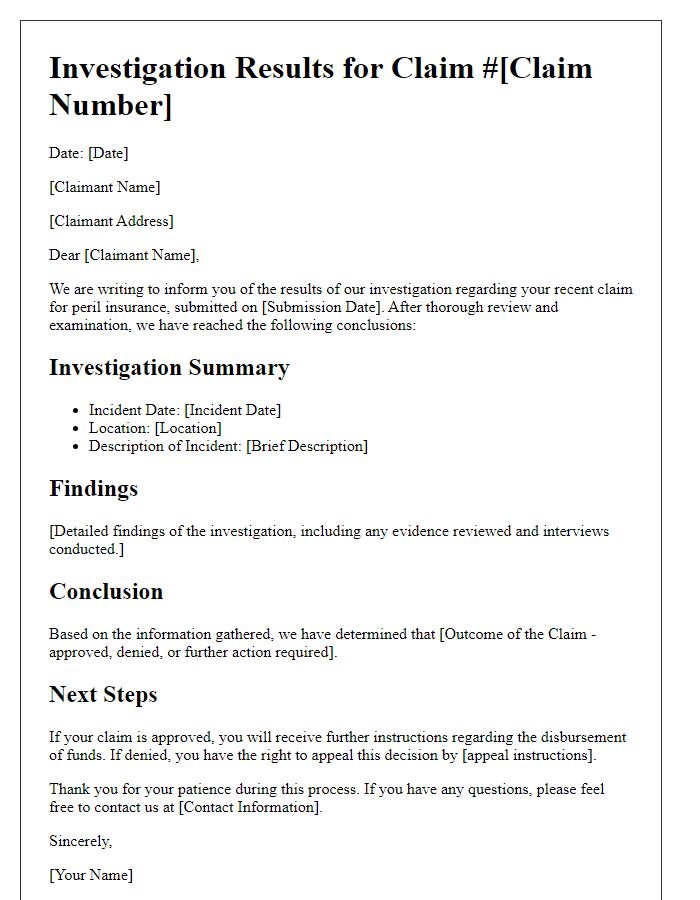

Peril insurance incidents require meticulous documentation, especially concerning claimant information. Essential details include the full name of the claimant, their current address, and date of birth (which may affect policy eligibility). A valid contact number (typically a mobile number for immediate communication) should be noted alongside email address for digital correspondence. It's also important to record policy numbers relevant to the incident, reflecting the specific coverage details. Additional demographic information such as employment status or occupation may influence claims processing and assessment. Accurate and complete documentation streamlines communication with insurance adjusters and facilitates faster claims resolution.

Detailed Incident Description

Peril insurance incidents, such as fire damage, can significantly impact property and belongings, resulting in financial loss. For example, a fire outbreak at a commercial building, like the Smith & Sons Warehouse in Chicago, Illinois, on September 15, 2023, caused substantial destruction. The flames engulfed an area of approximately 5,000 square feet, leading to the total loss of inventory valued at $300,000. Firefighters battled the blaze for over three hours, utilizing advanced equipment and facing challenges such as heavy smoke and structural instability. Following the incident, a comprehensive assessment revealed extensive damage to electrical systems, plumbing, and surrounding infrastructure, further complicating recovery efforts and accelerating repair costs. The incident illustrates the importance of thorough documentation to facilitate claims processing and expedite recovery processes in the aftermath of such events.

Date and Location of Incident

A peril insurance incident documentation requires precise details for accurate processing. The incident date significantly impacts claim timelines, with many insurance policies stipulating a specific window (often 30 days) for reporting. Location of incident denotes the property address or geographical coordinates, essential for assessing damage, risk evaluation, and understanding local regulations. These two key aspects, date and location, frame the context of the occurrence and help insurers evaluate the legitimacy and circumstances surrounding the claim efficiently.

Supporting Evidence and Documentation

Comprehensive incident documentation is crucial in processing peril insurance claims effectively. Essential elements include incident reports detailing the nature of the loss, photographs capturing the extent of damage (preferably timestamped), and repair estimates from licensed contractors. Additional supporting documents encompass police reports in cases of theft or vandalism, maintenance records verifying property upkeep, and inventories listing damaged or lost items with associated values. Secure storage of these documents is vital, ensuring availability for submission during the claims process. Accurate and organized documentation can expedite resolution and improve the likelihood of a favorable insurance outcome.

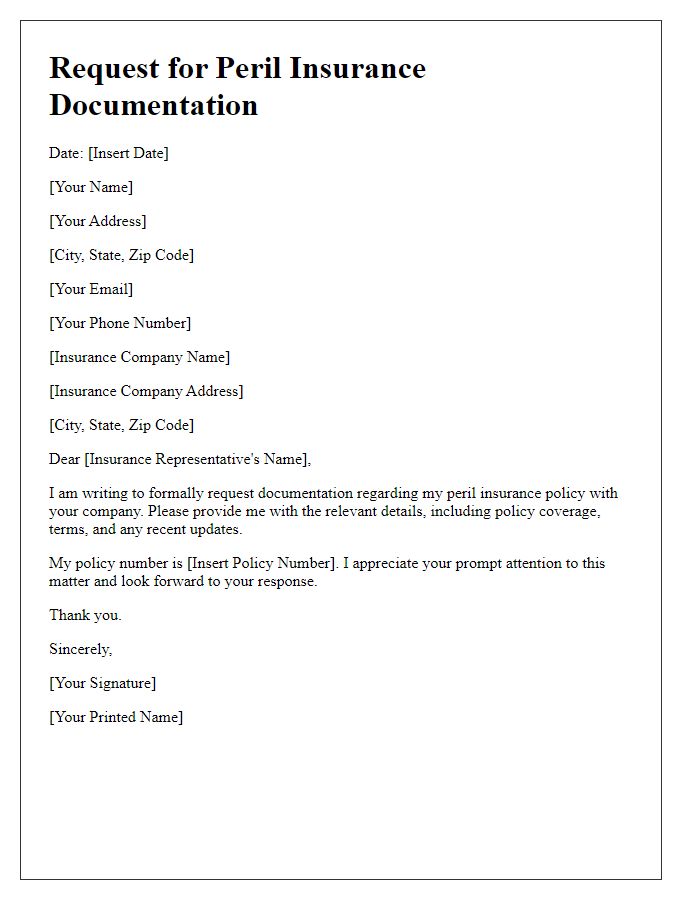

Insurance Policy Details

Peril insurance serves as a critical safety net for individuals and businesses, designed to protect against specific risks or events such as natural disasters, theft, or vandalism. For instance, a homeowner may possess a peril insurance policy covering occurrences like fire damage or flooding, particularly in high-risk areas prone to such events (e.g., coastal regions facing hurricanes or inland areas susceptible to wildfires). Documentation should include essential insurance policy details such as policy number (often unique to each contract), coverage limits (the maximum amount the insurance will pay out), deductibles (the amount the policyholder must pay before coverage kicks in), and terms (the duration of coverage). Additionally, incidents should be documented, specifying the date, type of peril (for example, earthquake, theft, or water damage), and any related claims submitted to ensure a thorough and efficient claims process.

Comments