Are you looking to simplify your insurance experience by transferring your policy? This easy guide will walk you through the steps needed to request a transfer from your current insurance provider seamlessly. With clear instructions and a handy template at your fingertips, you'll be able to ensure that the process is as smooth as possible. Let's dive in and get you one step closer to your hassle-free insurance transition!

Policyholder's Full Name and Contact Information

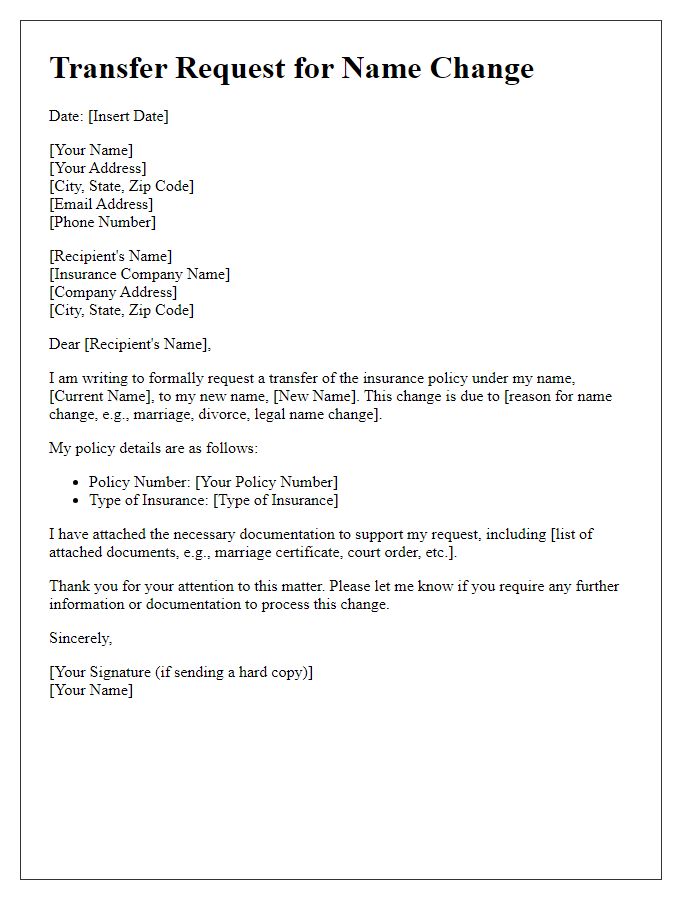

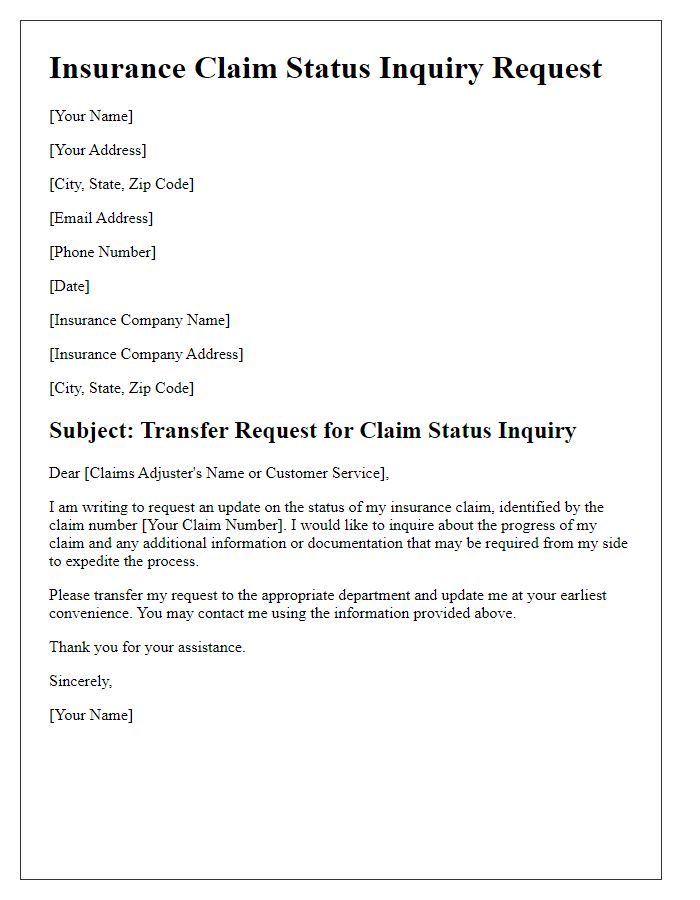

The process of transferring an insurance policy can often require a confirmation of the policyholder's identity and intent. A transfer request letter typically includes critical information such as the policyholder's full name (John Doe), complete contact information (including address, phone number, and email), and specific policy details (policy number 123456), which may include lists of covered items or amounts underwritten by the insurer. The request should state the reasons for the transfer, such as changes in ownership or address. Furthermore, it is important to include the new policyholder's information, ensuring clarity and proper record-keeping. Notifying the insurance company of any changes helps facilitate a smooth transition in ownership and responsibilities of the existing contract.

Current Insurance Policy Details (Policy Number, Provider)

Submitting a transfer request for an insurance policy requires precise information, especially detailing current insurance policy specifics. Current insurance policy details include policy number, a unique identifier assigned to the insurance contract, and the provider, the insurance company responsible for offering the coverage. For example, if the policy number is 123456789 and the provider is Allstate Insurance Company, these details are crucial for identification. Ensuring accurate submission of this information will facilitate a seamless transition to a different insurance provider or policy, minimizing processing delays and ensuring that coverage remains uninterrupted.

New Insurance Provider Details

Insurance transfer requests require careful attention to detail. New insurance provider details must include the provider's name, contact information, policy number, effective date. For example, ABC Insurance Company, located at 123 Insurance Lane, Suite 400, New York, NY 10001, with phone number (555) 123-4567, offers comprehensive coverage. The policy number consists of 12 alphanumeric characters, essential for ensuring accurate coverage transition. Additionally, the effective date, typically set for the beginning of the next month, must be specified to avoid coverage gaps. Proper documentation submission is crucial for compliance and timely processing, ensuring a smooth transition under the new policy terms.

Reason for Transfer Request

A request for an insurance policy transfer often arises due to significant life changes such as relocation, marriage, or the acquisition of new property. Transfers typically involve changing coverage providers or updating policy details in accordance with new circumstances. It is essential to provide clear information about the existing policy number and the desired insurance company, such as Nationwide Insurance or State Farm. Additionally, indicating the reason for the transfer, such as seeking better rates, more comprehensive coverage, or specific policy benefits tailored to new needs, ensures a streamlined communication process with the insurance company. Documenting all relevant details related to the current policy and anticipated changes aids in preventing delays during the transfer process.

Requested Transfer Date and Signature

A request for insurance policy transfer often involves specific details such as the requested transfer date, typically required by the insurance company, and the account holder's signature to authorize the change. This transfer can relate to various types of insurance, including life insurance or auto insurance, and usually requires a completion of forms provided by the insurance provider, like XYZ Insurance Group, which might have specific protocols in place. The request must include precise information such as policy numbers, the current insured's name, and any new insureds, if applicable. Processing times may vary by company, often taking between 7 to 14 business days depending on internal procedures. Proper documentation can expedite the overall transfer process.

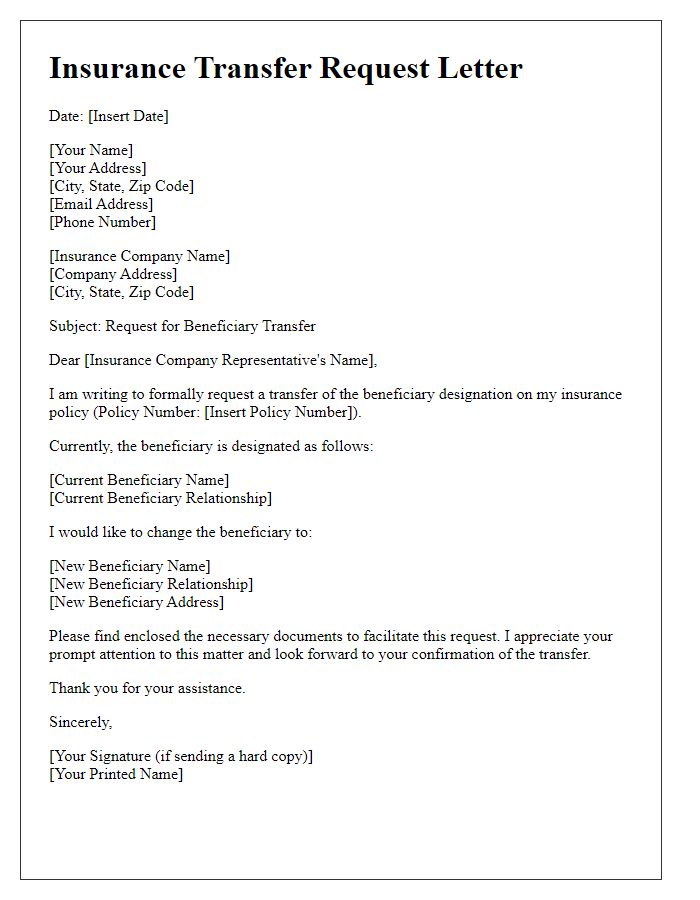

Letter Template For Insurance Company Transfer Request Samples

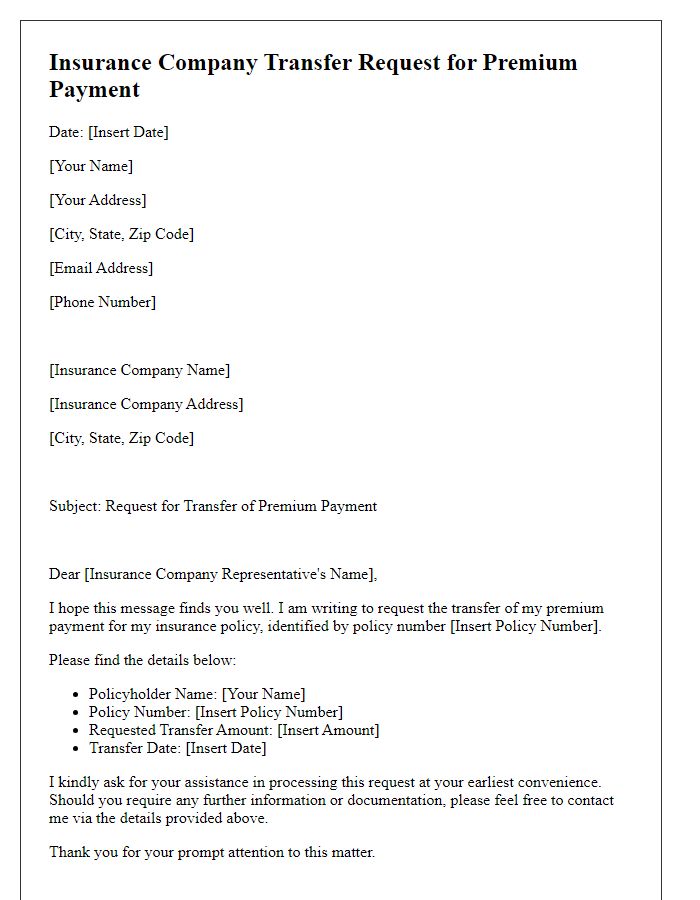

Letter template of insurance company transfer request for premium payment.

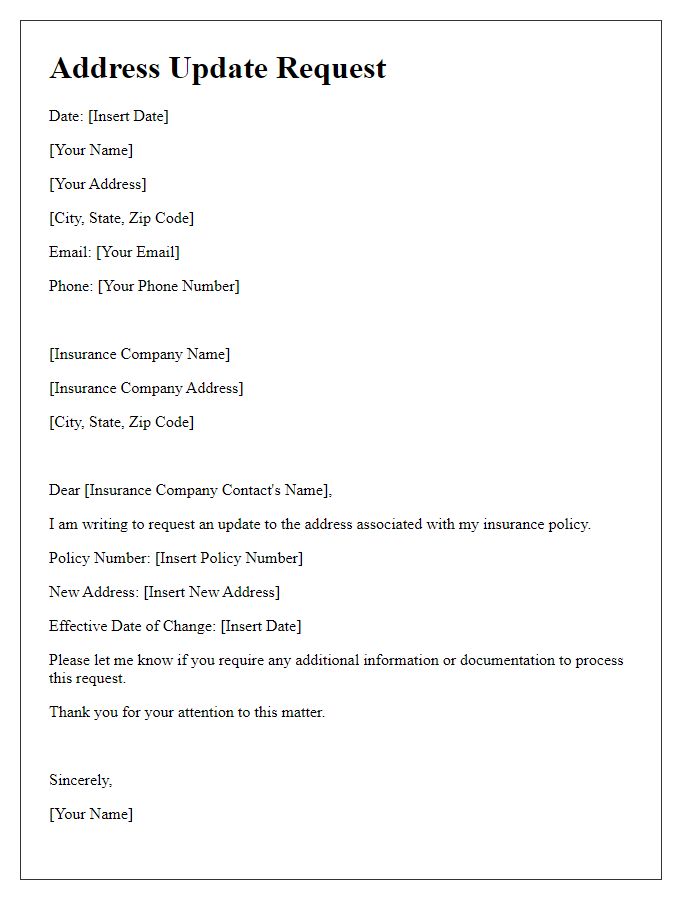

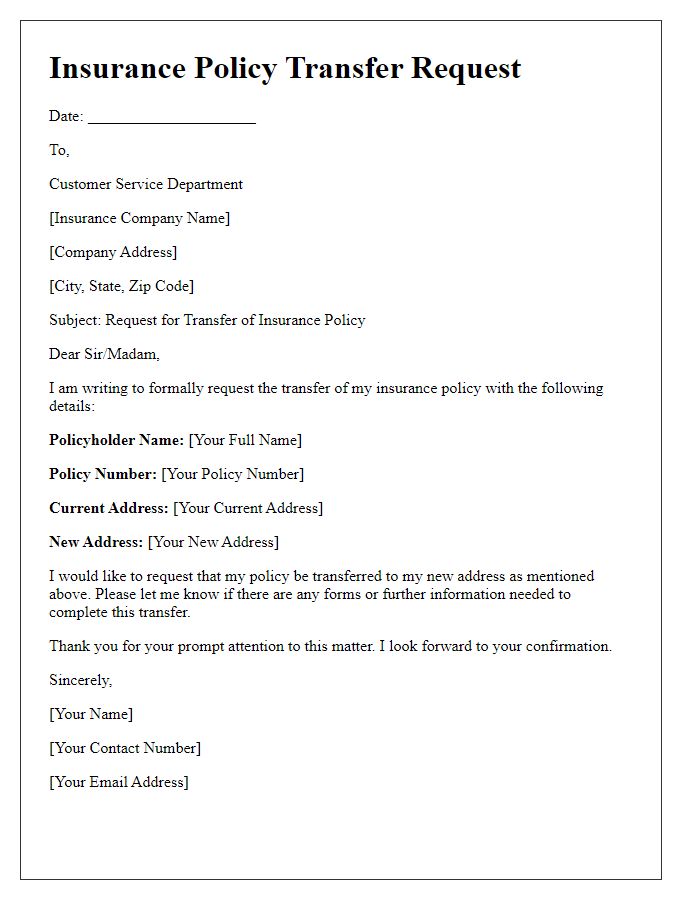

Letter template of insurance company transfer request for address update.

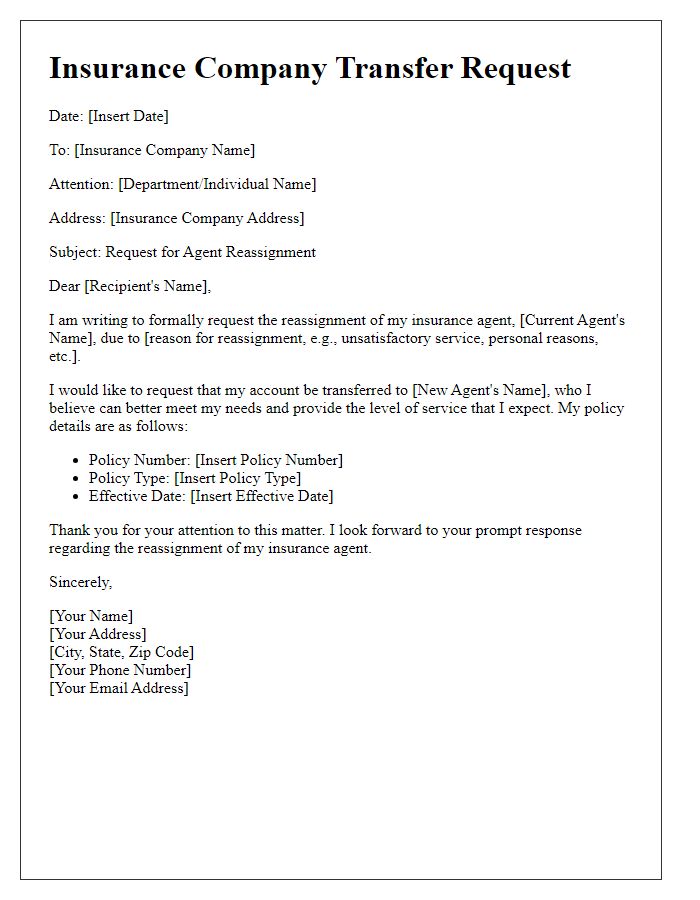

Letter template of insurance company transfer request for agent reassignment.

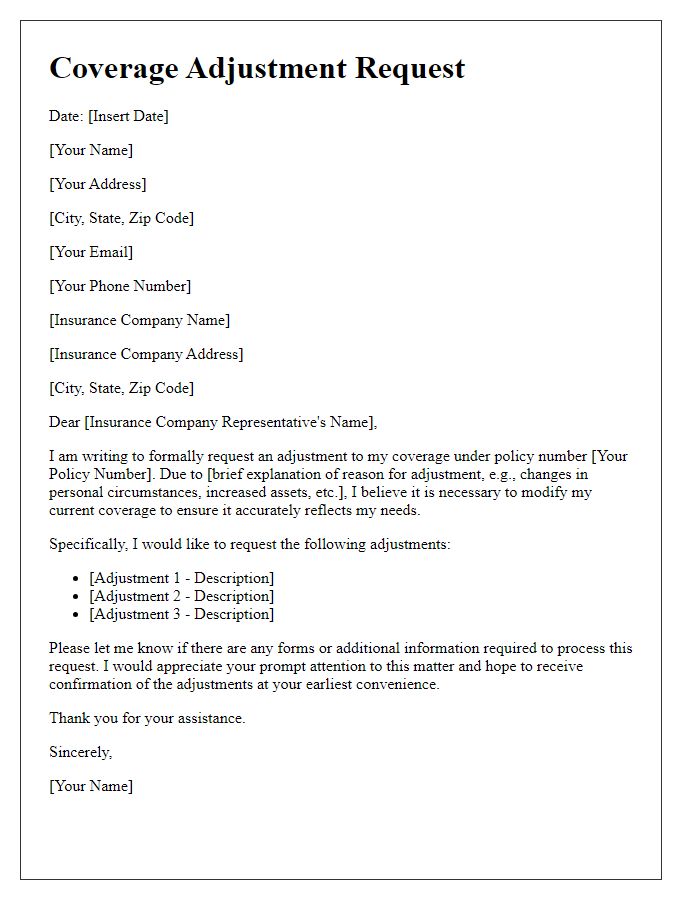

Letter template of insurance company transfer request for coverage adjustment.

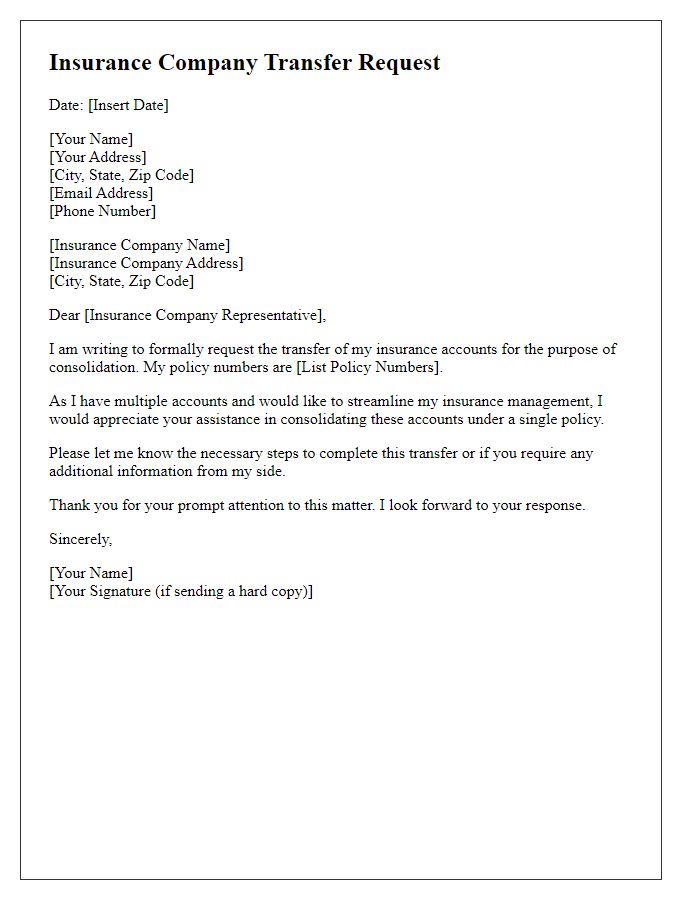

Letter template of insurance company transfer request for account consolidation.

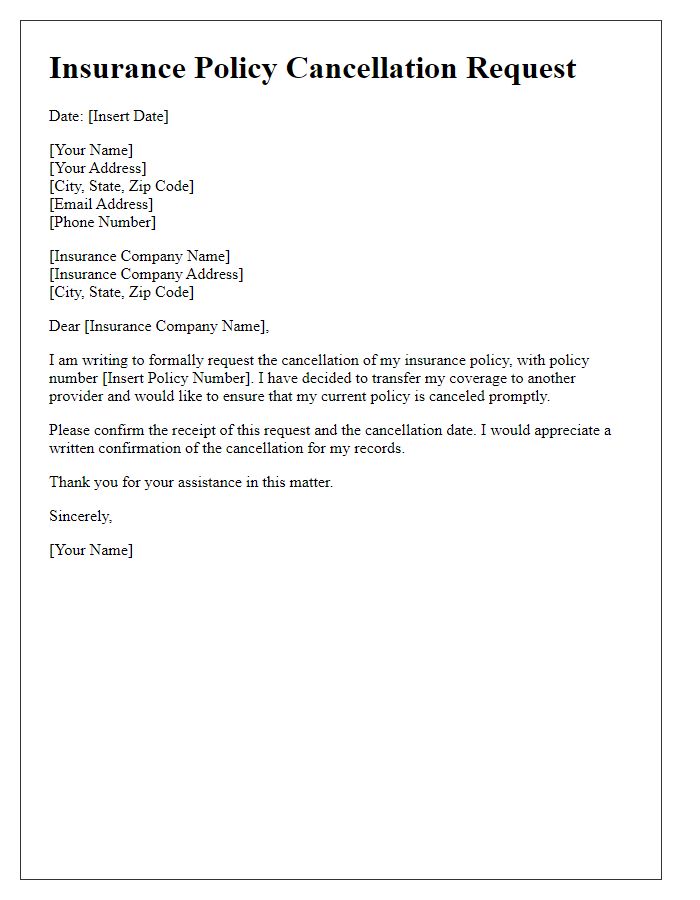

Letter template of insurance company transfer request for cancellation policy.

Comments