Are you looking to make some updates to your minor insurance coverage? Navigating the ins and outs of insurance amendments can seem daunting, but it's a straightforward process once you know how to approach it. In this article, we'll break down a practical template to help you effectively communicate your requests for changes. Get ready to simplify your insurance journey and discover how easy it is to protect what matters mostâyou won't want to miss the details!

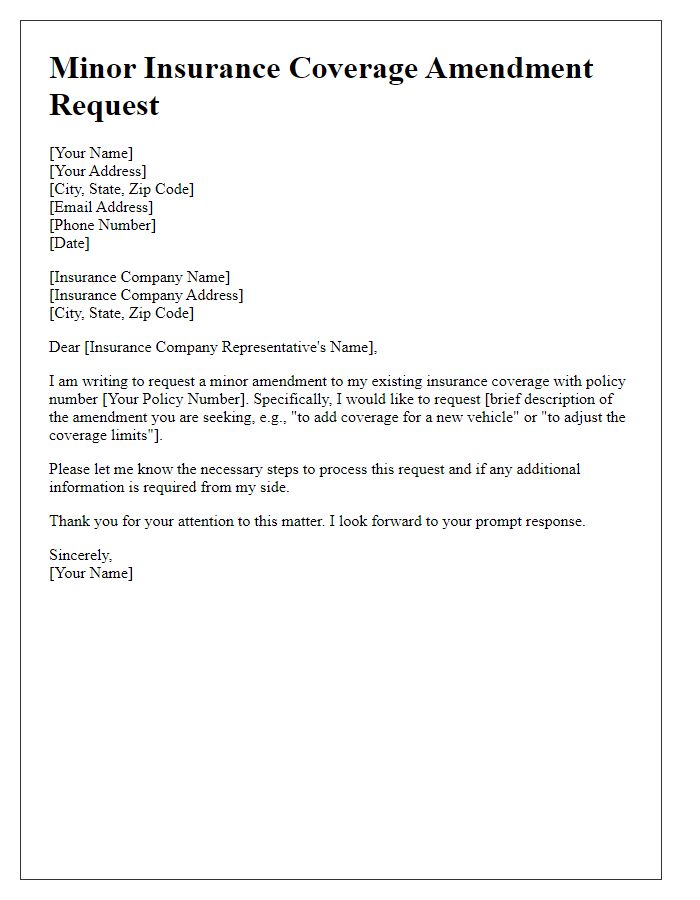

Policyholder Information

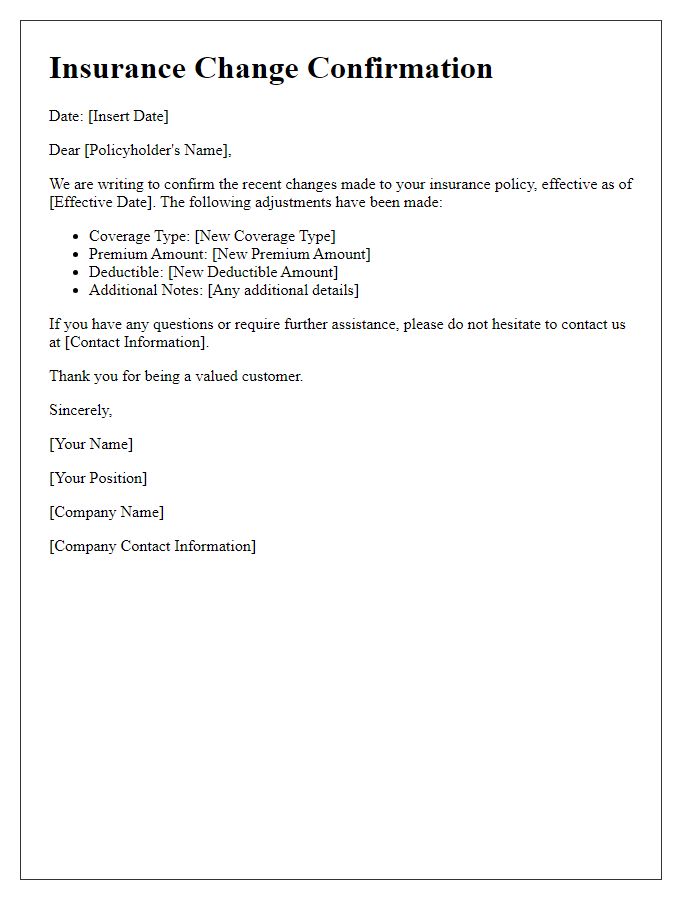

Minor insurance coverage amendments can provide policyholders with additional benefits or adjust existing terms. Policyholders should begin by reviewing specific details of their existing policy, which may include coverage limits, deductibles, and any exclusions. The amendment process can involve completing a specific form or writing a letter detailing the requested changes. Important information such as the policy number, effective date of the policy, and the specific nature of the requested amendment should be accurately noted. Clear communication with the insurance provider can expedite approval, ensuring that the desired changes are effectively integrated into the existing policy framework. Additionally, policyholders may want to understand how these amendments impact premiums or overall coverage in different scenarios, for instance, natural disasters or personal liability incidents, thereby safeguarding their assets comprehensively.

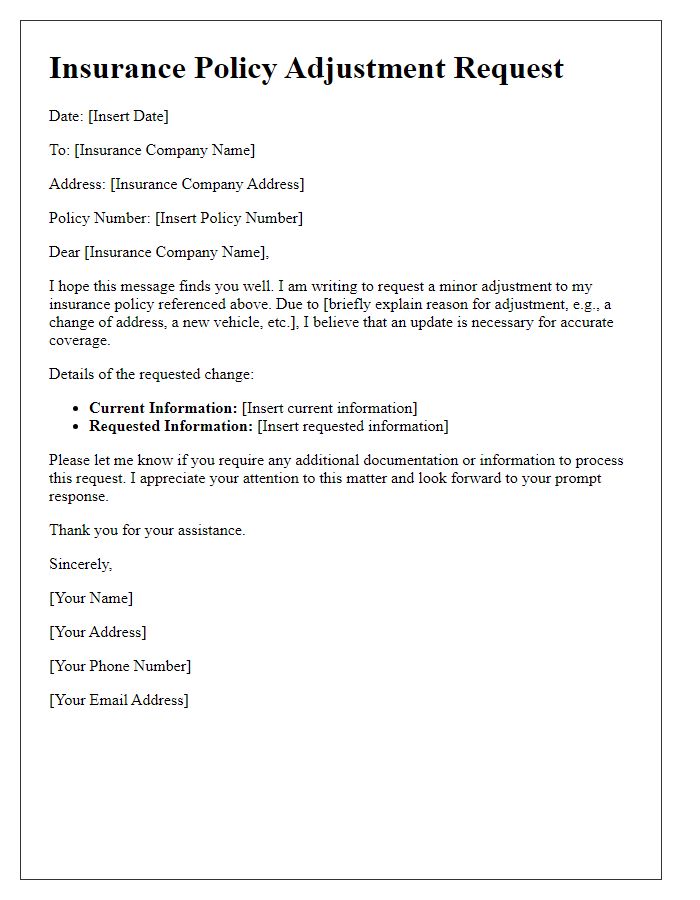

Policy Details

An insurance policy amendment can be crucial for ensuring coverage remains aligned with personal or business needs. For example, a minor insurance coverage amendment may involve adjustments to a Homeowners Insurance Policy. This policy type typically covers damages to a dwelling, personal property, and liability in cases of accidents. Factors like additional structures (such as a shed), increased coverage limits (perhaps from $300,000 to $400,000), or newly acquired valuable items (like a high-end bicycle worth $2,000) may prompt such amendments. Accurate documentation and clear articulation of terms ensure that policyholders maintain adequate protection without unwarranted gaps, particularly in changing circumstances. Regular reviews and timely amendments safeguard against potential risks and losses.

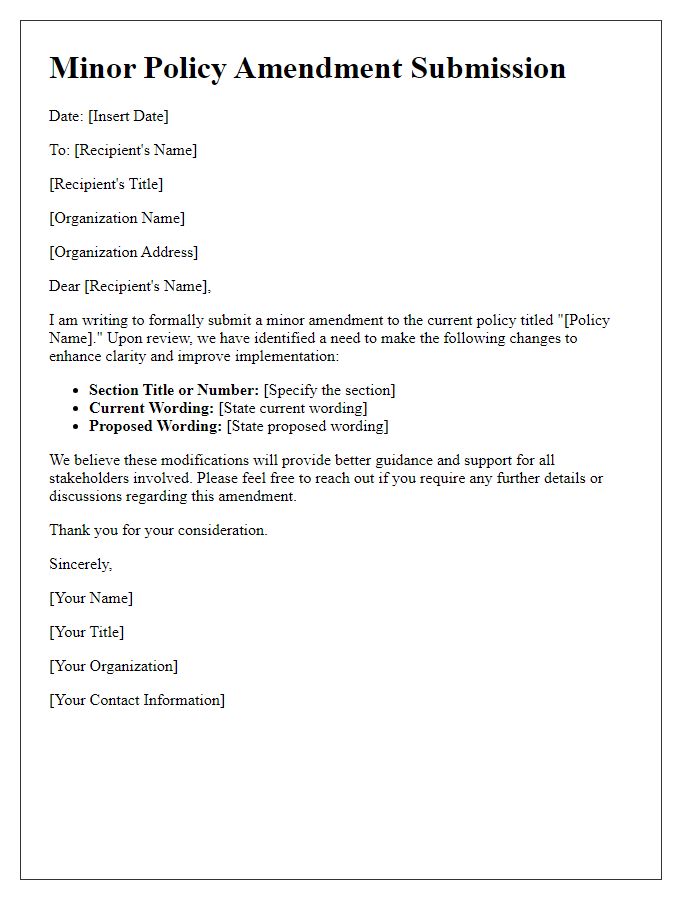

Amendment Request

Minor insurance coverage amendments allow policyholders to make adjustments to their existing coverage plans. The process often involves submitting a formal request detailing the desired changes. Information about the policy number, the specific amendments being requested, and the rationale behind these adjustments is typically required. Policyholders should address their request to the insurance provider, including relevant personal details for identification. Timely submission is crucial to ensure continuous coverage and compliance with policy regulations. Many providers have specific forms or procedures outlined on their websites, making the process clear and systematic for all parties involved.

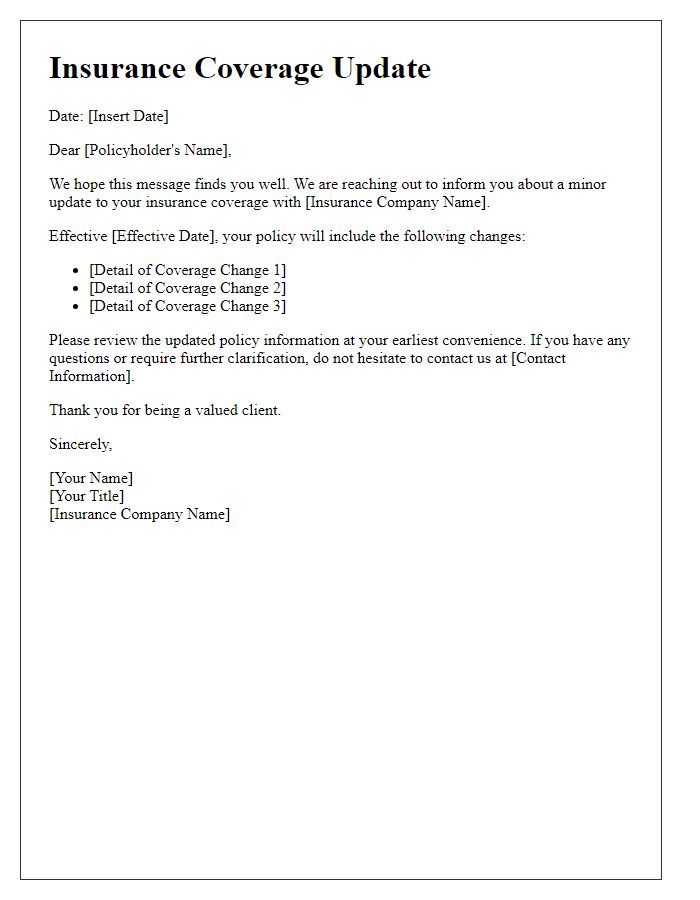

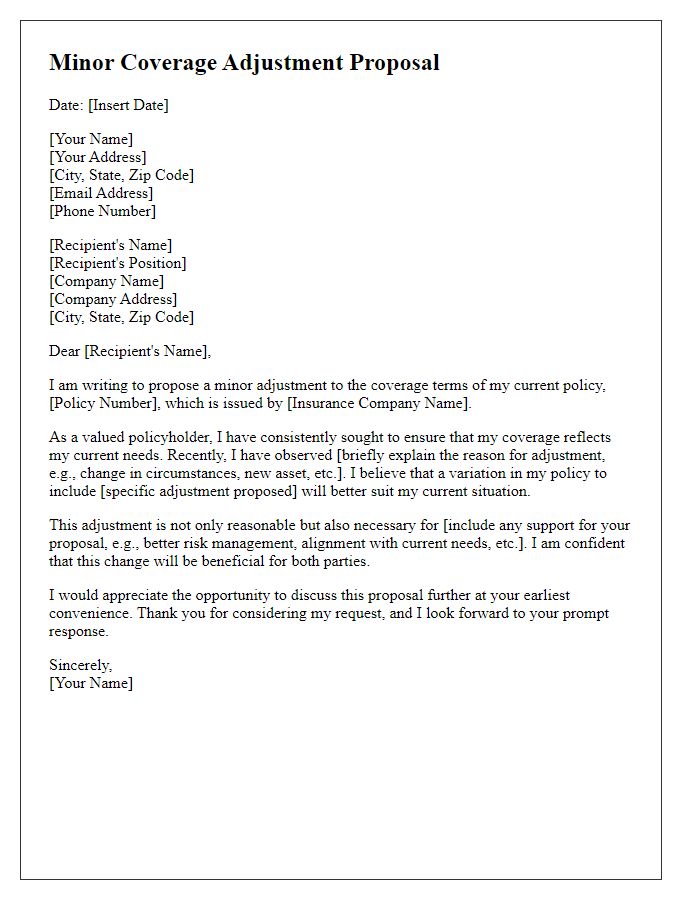

Justification for Change

Minor insurance coverage amendments often require a clear justification to ensure all parties understand the need for adjustments. Common reasons for such changes include changes in personal circumstances, such as a recent relocation to a high-risk area like a flood zone or a new addition to the household, such as adopting a pet, which may affect liability coverage. Additionally, adjustments may arise from the acquisition of new assets, such as purchasing a home in California valued at $600,000 or upgrading to a vehicle worth $30,000, necessitating enhanced property coverage. Furthermore, changes in local regulations or market conditions, such as increases in local insurance premiums due to natural disaster risks, can prompt a reevaluation of existing policies to maintain adequate protection. Addressing these elements ensures comprehensive coverage, aligns with the insured party's current situation, and mitigates potential risks effectively.

Contact Information for Further Communication

In the context of minor insurance coverage amendments, it is essential to provide clear and concise contact information to facilitate further communication. Policyholders should include the name of the insurance company, for instance, Great Assurance Insurance Group, along with a designated contact person's name, such as John Smith, who specializes in customer service. The phone number, preferably a direct line like (555) 123-4567, should be provided for immediate inquiries. Email communication is also crucial; thus, including an email address like john.smith@greatassurance.com allows for efficient correspondence. Additionally, including the office address, for example, 123 Main Street, Suite 400, Denver, CO 80202, ensures policyholders can send any physical documents or requests as needed. Clear delineation of these communication channels guarantees a streamlined amendment process for insurance coverage adjustments.

Comments