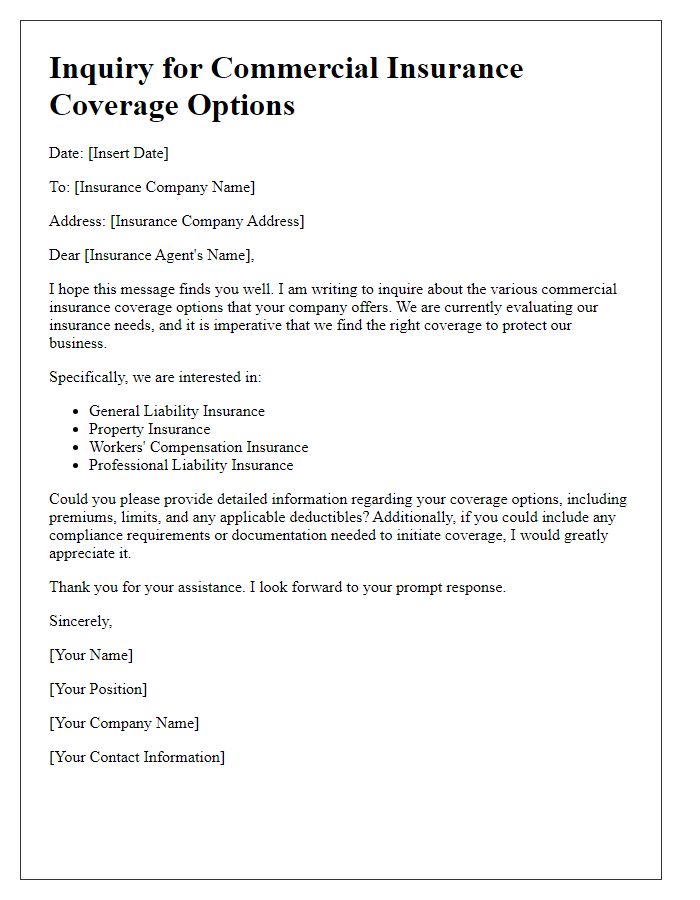

Are you curious about how a commercial insurance policy can protect your business? In today's fast-paced commercial environment, safeguarding your assets and mitigating risks is more important than ever. Understanding the types of coverage available and what best suits your needs can seem overwhelming. Join us as we explore essential tips and insights that will help you navigate the insurance landscape, ensuring you make informed decisions for your business.

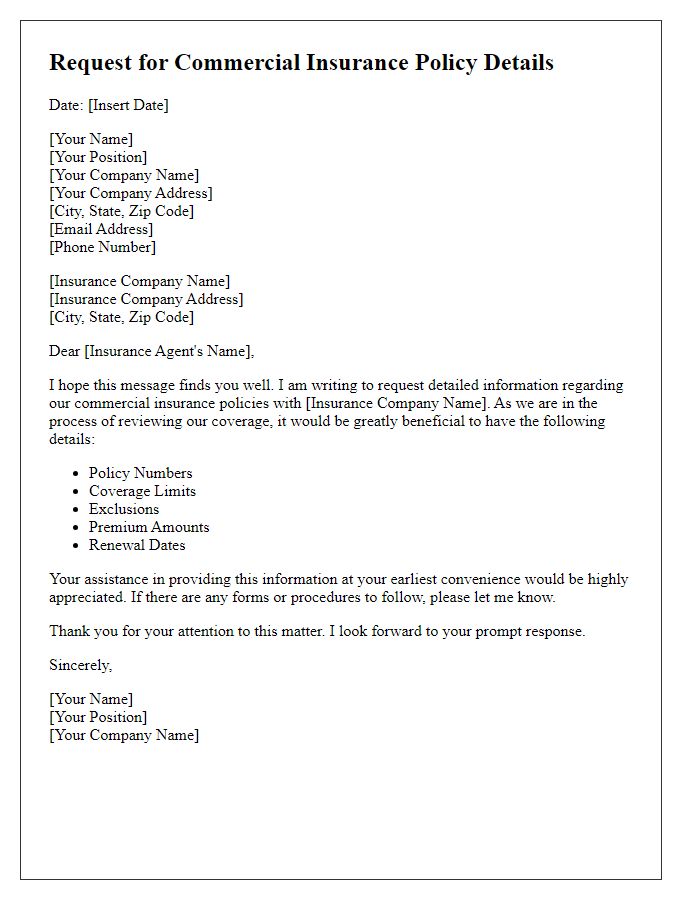

Policy Coverage Details

Commercial insurance policies offer various coverage options essential for protecting businesses from potential risks. These policies typically include general liability insurance, which safeguards against claims of bodily injury or property damage occurring on business premises, often covering up to $1 million per occurrence. Property insurance protects against physical damage to commercial assets, including equipment and inventory, usually covering replacement costs. Business interruption insurance compensates for lost income due to unexpected events like natural disasters, often calculated based on net profit over a specified period. Professional liability insurance, also known as errors and omissions insurance, protects businesses from claims arising from professional services or advice. Coverage limits, deductibles, and exclusions vary greatly among policy providers, making it essential for business owners to thoroughly review their specific needs and compare potential policies.

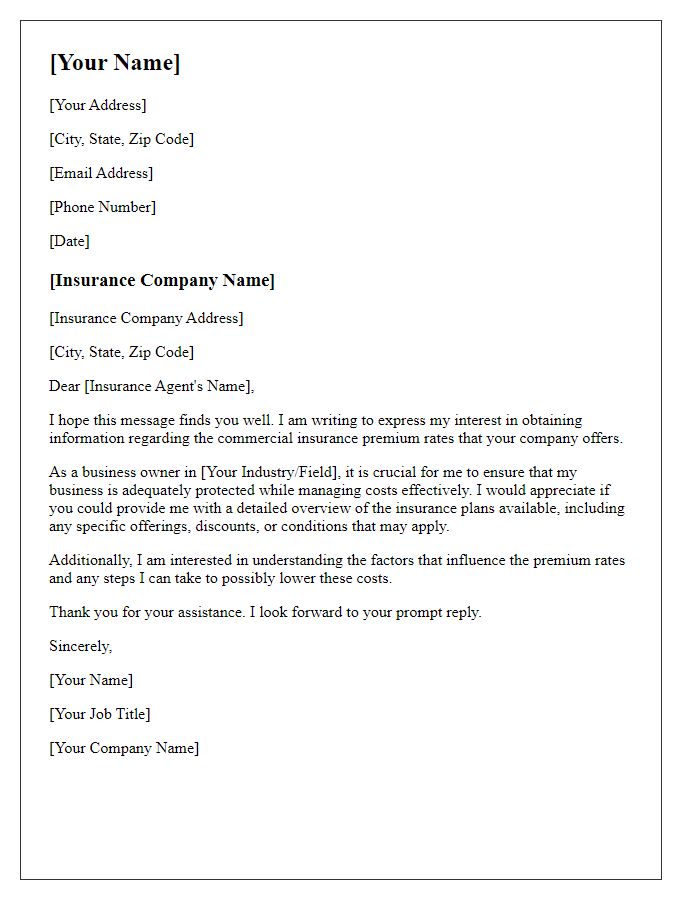

Premium Rates and Payment Options

Commercial insurance policies cover various types of businesses, including small retail shops and large manufacturing plants, providing protection against risks such as property damage, liability claims, and employee injuries. Premium rates typically depend on multiple factors, including business size, revenue (for example, a small business earning $500,000 annually versus a corporation with $10 million in revenue), location (urban versus rural settings), and the industry risk classification. Payment options may include annual, semi-annual, or monthly payment plans, allowing businesses to choose a schedule that aligns with their cash flow needs. Additionally, bundling multiple policies can sometimes yield discounts. Understanding these factors helps businesses make informed decisions regarding their commercial insurance coverage.

Claims Process and Assistance

Inquiring about the claims process for a commercial insurance policy is essential for businesses to understand their rights and responsibilities after an incident. Commercial insurance policies often cover various events, including property damage, liability claims, and business interruptions. Key elements of the claims process typically include notification timelines, required documentation, and response times from insurers. Additionally, assistance from dedicated claims representatives can facilitate communication, ensuring claims are processed efficiently and without unnecessary delays. Each insurance provider may have specific protocols that vary based on policy terms and conditions, which businesses must consider when filing a claim to achieve timely restitution for their losses.

Risk Assessment Requirements

Commercial insurance policies require thorough risk assessment to determine coverage needs and premium rates. Risk assessment evaluates various factors such as the industry type, operational activities, and location (e.g., California, New York). Specific requirements may include building safety inspections, employee training records, and analysis of equipment risks. Documentation like loss history and safety protocols also plays a crucial role. Insurers often utilize data from audits and onsite evaluations to gauge risks effectively. Understanding these requirements helps businesses align their insurance coverage with potential liabilities.

Additional Endorsements and Discounts

Many commercial insurance policies offer additional endorsements (policy additions) to enhance coverage based on business needs and risks. Endorsements such as Business Interruption Insurance, Cyber Liability Insurance, and Equipment Breakdown Coverage can be vital for safeguarding assets in event of unforeseen circumstances. Discounts, like bundling policies, implementing safety program discounts, or loyalty discounts for long-standing clients, can lower premiums significantly. Understanding these options can ensure comprehensive protection and financial savings for small to medium-sized enterprises across various industries.

Comments