Are you looking to streamline your communication with clients and make a lasting impression as an insurance agent? Crafting a well-structured letter for assignment requests is key to showcasing your professionalism. It not only clarifies your intentions but helps in fostering trust and understanding with potential clients. If you're ready to enhance your skills in this area, dive into the article for some valuable insights and tips!

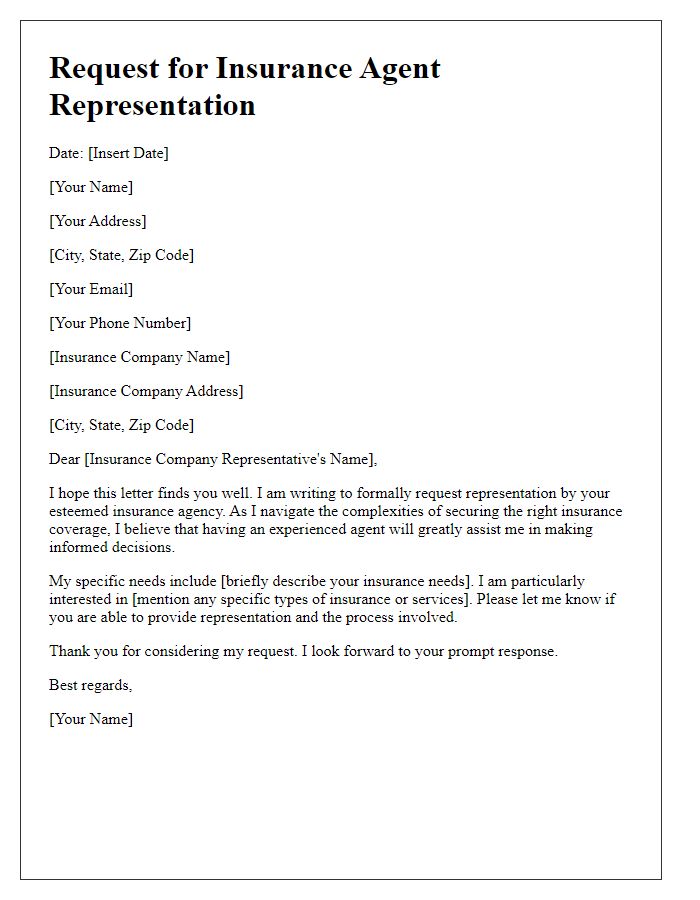

Comprehensive Client Information

Comprehensive client information plays a vital role in insurance agent assignment requests. Accurate data such as client names, contact details, and policy types ensures seamless communication and efficient client service. Essential elements include comprehensive risk assessments, which involve thorough evaluations of client assets, liabilities, and coverage requirements. Detailed notes on claims history provide insight into previous incidents, minimizing potential risks during the underwriting process. Geographic location influences risk factors significantly, requiring zip codes and property information for accurate premium calculations. Understanding client demographics, including occupation and income levels, allows agents to tailor policies to meet specific needs effectively. Overall, maintaining detailed client information supports better policy customization and enhances the client-agent relationship in the insurance industry.

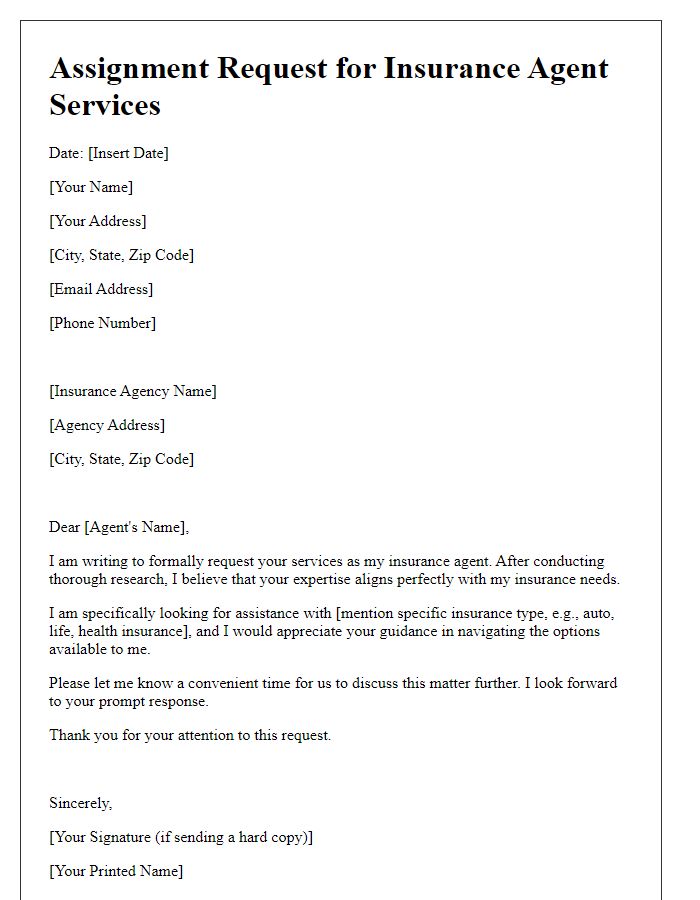

Direct and Formal Language

Please provide details regarding your insurance assignment request. Specific information about the type of insurance (e.g., life, auto, health), preferred coverage amounts, and any particular concerns will help tailor the response. Include your contact information for further follow-up. Thank you.

Clear Assignment Intent

Insurance agents must provide clear assignment intent to ensure proper processing of insurance policy transfers. An assignment reference number should be included for tracking purposes. Policyholders need to specify details such as policy number, effective date of assignment, and the name of the assignee or new policyholder. Documentation may require notarization for legal verification. Communication methods can include written correspondence, email, or secure online submission portals provided by insurance companies. Timely submission of assignments to the appropriate department, often labeled Policy Administration, ensures that all rights and benefits are allocated correctly to the new party involved.

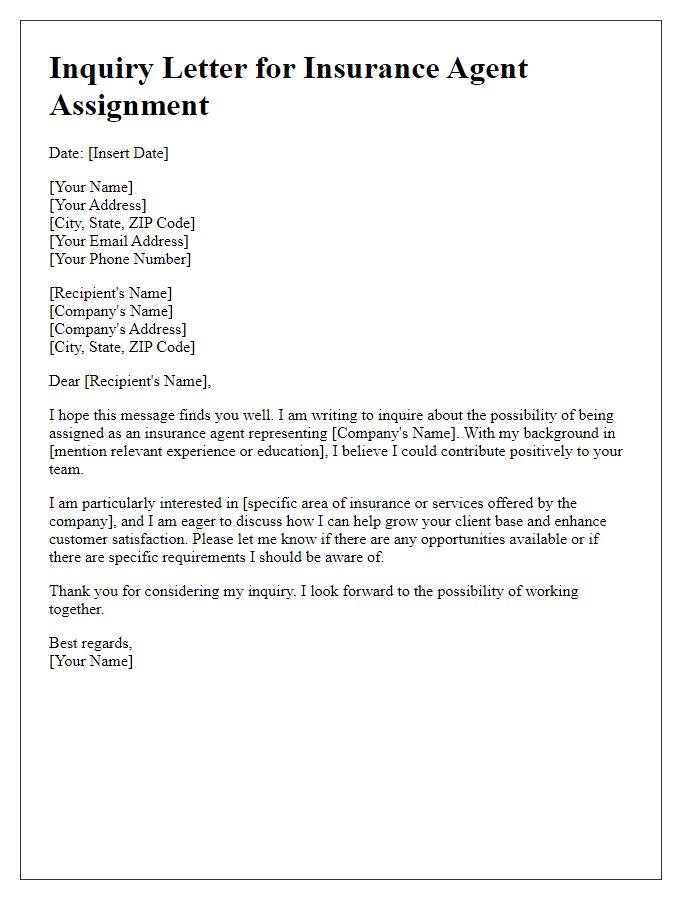

Specific Policy Details

Insurance assignment requests often require specific details to ensure accurate processing. Key elements may include the policyholder's name (such as John Doe), policy number (e.g., 123456789), insurance type (such as auto, health, or home insurance), coverage limits (e.g., $100,000 liability coverage), effective dates (from January 1, 2023, to December 31, 2023), and any special riders or endorsements attached to the policy. Providing a clear objective for the assignment, such as filing a claim for water damage in a residence located in Miami (ZIP code 33101), is crucial. Contact information for both the agent and the policyholder should be included to facilitate communication, as well as relevant documentation, like the police report number or estimates for repairs, if applicable.

Contact Information for Follow-up

Efficient communication is crucial for the smooth processing of insurance claims and assignments. Having accurate contact information, such as phone numbers and email addresses, allows the insurance agent to follow up promptly with clients for necessary documentation and updates. In the case of inquiries regarding policies, the agent needs to reach out directly to clients (usually within 24 to 48 hours) to clarify any issues. Furthermore, maintaining a comprehensive database with updated contact information ensures that the agent can carry out their duties effectively, reducing the chances of miscommunication and delays in service delivery. Ensuring follow-up protocols are in place can significantly enhance client satisfaction.

Comments