Are you worried about the potential lapse of your insurance policy? It's a common concern, but understanding how to prevent it can save you time, money, and stress in the long run. By staying informed about your payment schedules and communicating with your insurance provider, you can ensure your coverage remains intact. Let's dive deeper into effective strategies for preventing policy lapses and keeping your peace of mindâread on to learn more!

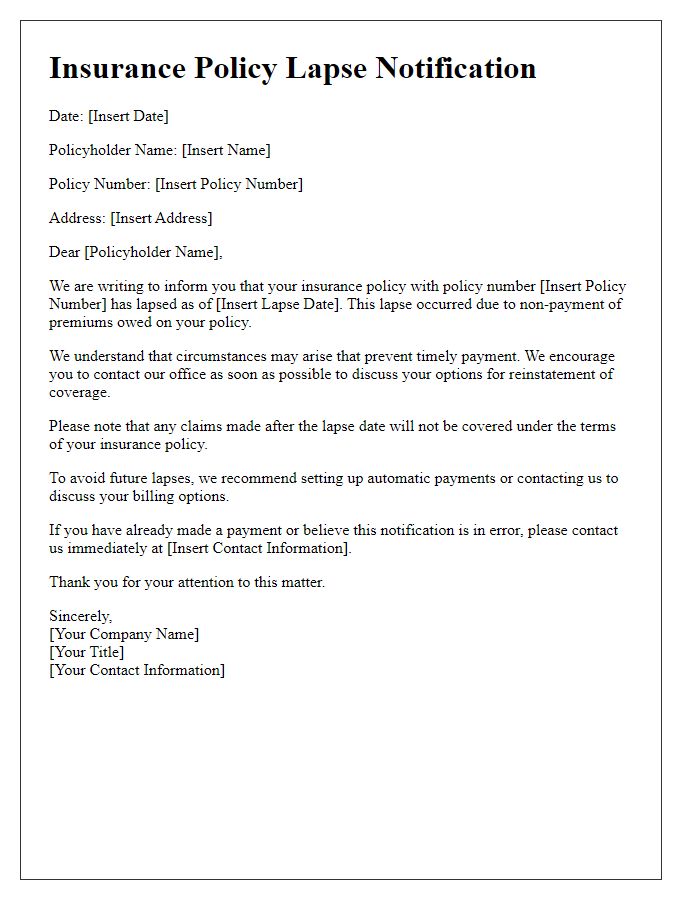

Policyholder Information

Insurance policy lapses can create significant gaps in coverage for policyholders, leaving them vulnerable to unexpected financial burdens. Policyholders (individuals who hold an insurance policy) are typically notified by their insurance company (the entity providing the coverage) when payments are missed, which may lead to cancellation and loss of benefits. The lapse often occurs after a grace period (usually 30 days), during which premium payments must be made to maintain active status. Effective communication strategies (including emails, phone calls, or mail) are essential for insurance providers to remind policyholders of upcoming payment deadlines. Identifying key dates (like renewal dates or premium due dates) and utilizing automated reminders can help prevent lapses, ensuring continuous coverage for events such as accidents or natural disasters.

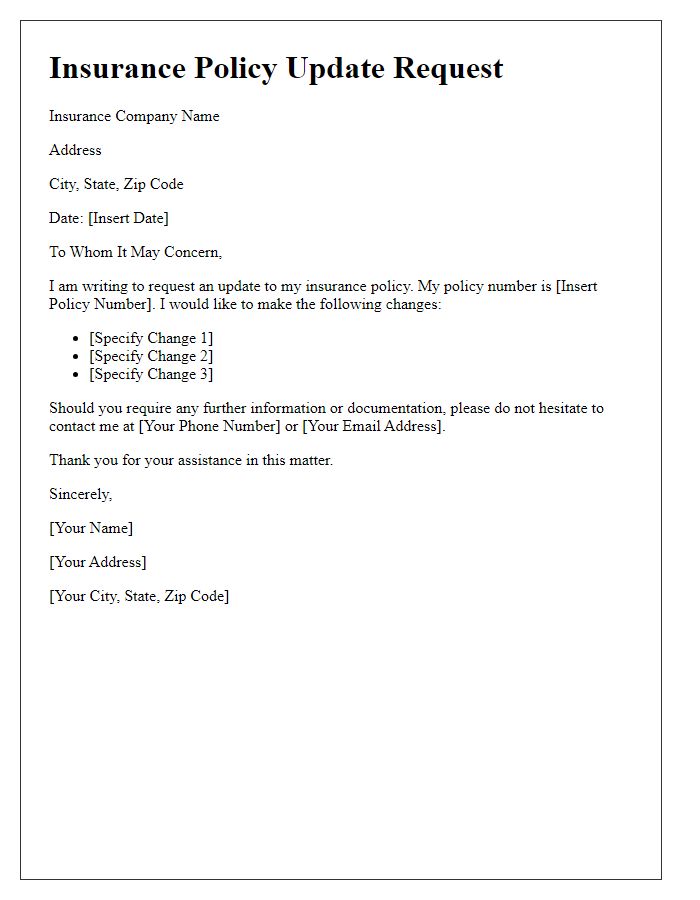

Policy Details

Regular monitoring of insurance policy details is essential for maintaining coverage and avoiding policy lapses. Many insurance companies, such as State Farm and Allstate, operate in multiple states, providing various plans, including home, auto, and health insurance. Policyholders must be aware of critical dates, such as premium due dates, typically occurring monthly, quarterly, or annually, depending on the plan. Failure to make timely payments within a grace period of 10 to 30 days may lead to coverage termination. Additionally, changes in personal circumstances, such as address changes or marital status, should be communicated promptly to ensure policy accuracy. Regular reviews of policy limits and deductibles can provide necessary adjustments, ensuring adequate protection in events like accidents or natural disasters.

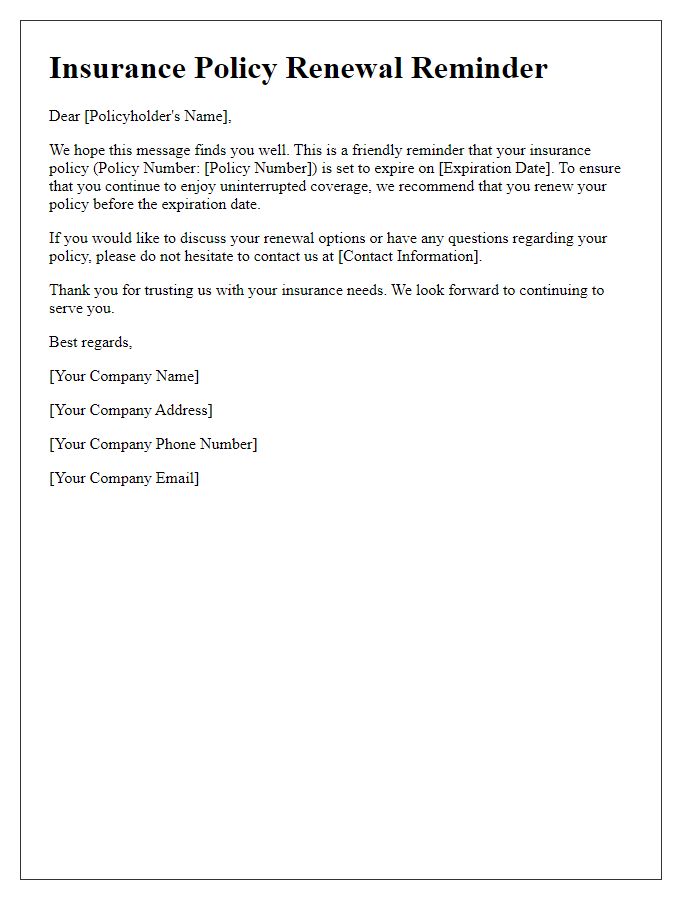

Payment Options

Insurance policy lapse prevention requires proactive communication regarding payment options available to policyholders. Various payment methods exist, including monthly electronic funds transfer (EFT) from banks, one-time online payments via credit cards, annual lump-sum payments by check, or automatic renewals through debit authorization. Insurance companies may offer grace periods (typically 30 days) allowing policyholders to settle outstanding premiums without losing coverage. Policyholders might also consider autopay programs (automatic payment systems) which help in ensuring timely payments. Communication channels often include notifications through email, mobile apps, or phone reminders on upcoming due dates. Accessible customer service representatives are available to assist with setting up payment plans tailored to individual financial situations.

Consequences of Lapse

Failure to maintain an active insurance policy can lead to significant consequences, affecting financial security and legal obligations. Policyholders may face lapses in coverage, resulting in a lack of protection against unforeseen events such as accidents or natural disasters. For instance, a homeowner's insurance lapse may leave the property exposed to risks like fire (over $1.6 billion in damages annually) and theft, potentially leading to expensive out-of-pocket expenses. In case of an accident, drivers without valid auto insurance can incur legal penalties, including fines up to $5,000 and license suspension. Additionally, reinstatement of a lapsed policy may lead to higher premium rates, with insurers often increasing rates by an average of 25% for those with prior lapse in coverage. Maintaining continuous insurance coverage is crucial for ensuring financial protection and peace of mind.

Contact for Assistance

Insurance policy lapses can lead to significant financial risks for policyholders, including the loss of coverage in critical situations. Timely intervention is crucial. Contact your insurance provider immediately to discuss potential options for policy renewal, including grace periods, premium payments, or adjustments in coverage. Documented communication through customer service channels is advisable. Many companies offer online assistance platforms that expedite resolution processes. Additionally, inquire about automatic payment settings or reminders, which can prevent unforeseen lapses. Familiarize yourself with your policy's terms and conditions, especially regarding lapsing consequences, to ensure informed decisions. Regularly reviewing your policy details can help safeguard your coverage in the future.

Comments