As the aviation industry continues to soar, ensuring the safety and security of your aircraft is more important than ever. One essential aspect of this process is obtaining a comprehensive aviation insurance certificate, which provides the peace of mind you need while navigating the skies. Whether you're a pilot, aircraft owner, or operator, knowing how to request this vital document can save you time and ensure you meet all regulatory requirements. Ready to learn how to craft the perfect request for your aviation insurance certificate? Let's dive in!

Clear identification of the aircraft and owner details.

Aviation insurance certificates are essential documents for aircraft owners, ensuring protection against liability and damage. Essential elements include specific details of the aircraft, such as Aircraft Registration Number (N12345), Manufacturer (Cessna), Model (C172), and Year of Manufacture (2020). Furthermore, owner details must be included, encompassing the Owner's Full Name (John Doe), Address (123 Aviation Lane, Springfield, IL), Contact Number (555-123-4567), and Email (johndoe@example.com). Providing a clear description of any existing insurance policies is also crucial, such as coverage types (liability, hull damage) and effective dates (from January 1, 2023, to January 1, 2024). Accurate information ensures prompt processing of the request for the aviation insurance certificate.

Specific coverage and liability limits requested.

Aviation insurance coverage encompasses various aspects of flight operations, including general liability, hull insurance, and passenger liability. Specific coverage can include liability limits, often ranging from $1 million to over $100 million, depending on the type of aircraft and operations. Geographic constraints, such as coverage during international flights or operations in conflict zones, can further define the policy parameters. Important factors include aircraft type (e.g., single-engine, multi-engine), use (private, commercial), and any specific endorsements necessary for unique operational risks. Each aspect of the coverage should reflect the intended use and regulatory compliance outlined by the Federal Aviation Administration (FAA) and international aviation standards.

Effective date and duration of the insurance coverage.

Aviation insurance coverage, specifically covering aircraft liability and hull damage, typically requires precise documentation. The effective date, which marks the beginning of coverage, is often set at midnight of the specified date, such as January 1, 2023. Duration commonly spans one year, with policies renewable annually. Important details include the policy number, the name of the insured (such as a flight school or charter company), and the aircraft type (e.g., Cessna 172). Any additional clauses for coverage, such as for flight training or non-commercial use, significantly impact overall protection and risk assessment. Accurate information ensures compliance with aviation regulations and protects against potential financial liabilities.

Contact information for response and documentation delivery.

Aviation insurance certificates provide proof of coverage for aircraft, crucial for compliance with aviation regulations and safety standards. When requesting a certificate, include specific contact information for seamless communication. Essential details: name of the individual or organization (e.g., XYZ Aviation LLC), mailing address (e.g., 1234 Skyway Drive, Miami, FL 33101), email address (e.g., info@xyzaviation.com), and phone number (e.g., 555-0123). Specify preferred method for receiving documentation, whether by postal mail or digital format. Ensure clarity and accuracy in these details to expedite the processing of the certificate request from the insurance provider.

Request for additional insured or loss payee endorsements.

Aviation insurance certificates provide essential coverage details for aircraft operation. When requesting additional insured endorsements, specify key entities like lenders, partners, or lessors needing protection. Include the policy number associated with the coverage, premium details, and limits of liability essential for compliance with contractual stipulations. Loss payee endorsements are crucial for safeguarding interests in cases of damage or loss, particularly for aircraft valued at millions of dollars, like a Cessna Citation. Submit requests through formal channels, ensuring clarity regarding the insured aircraft's registration number and the operational scope outlined in the insurance policy. Timeliness is critical, as aviation operations often require up-to-date documentation prior to flight activities or contract signings.

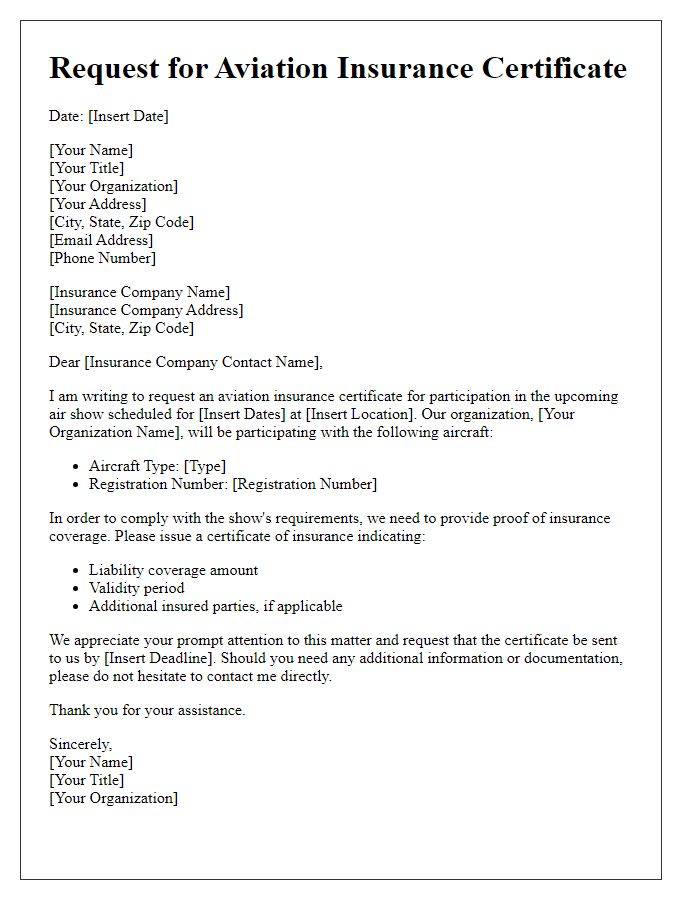

Letter Template For Aviation Insurance Certificate Request Samples

Letter template of aviation insurance certificate request for commercial aircraft.

Letter template of aviation insurance certificate request for private pilot.

Letter template of aviation insurance certificate request for flight school coverage.

Letter template of aviation insurance certificate request for drone operations.

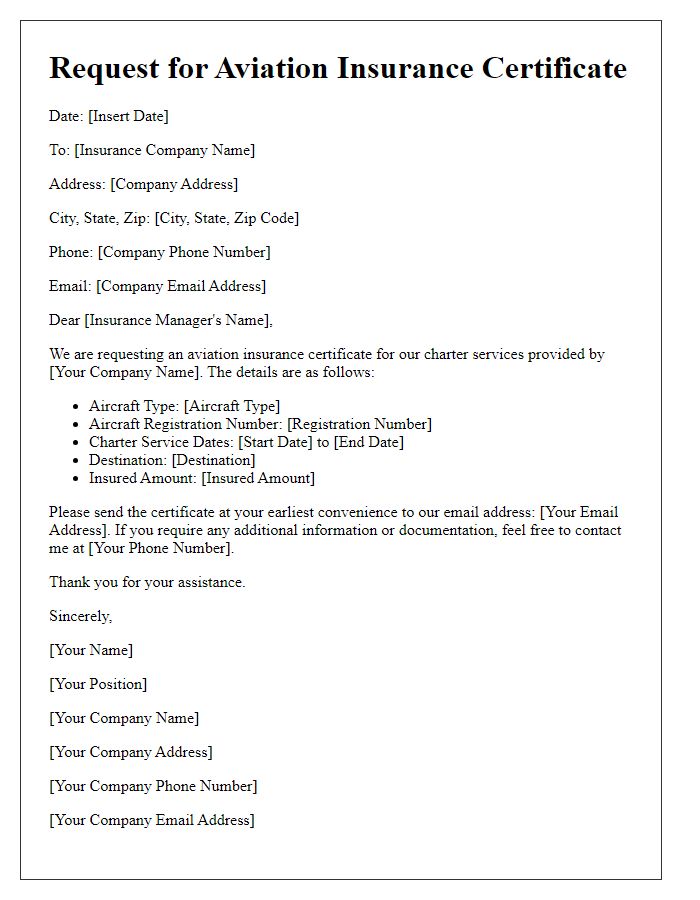

Letter template of aviation insurance certificate request for charter services.

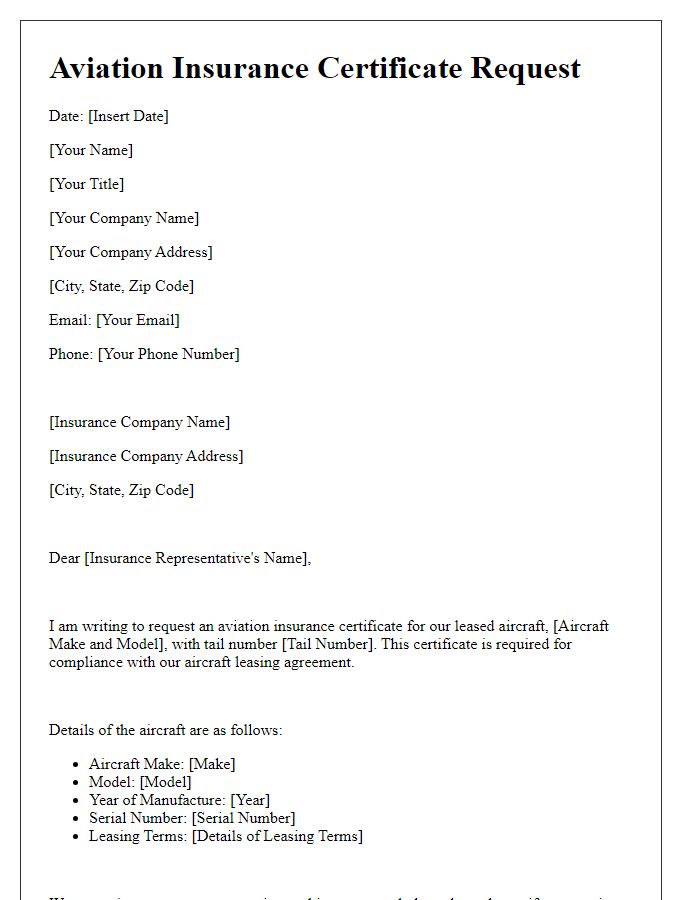

Letter template of aviation insurance certificate request for aircraft leasing.

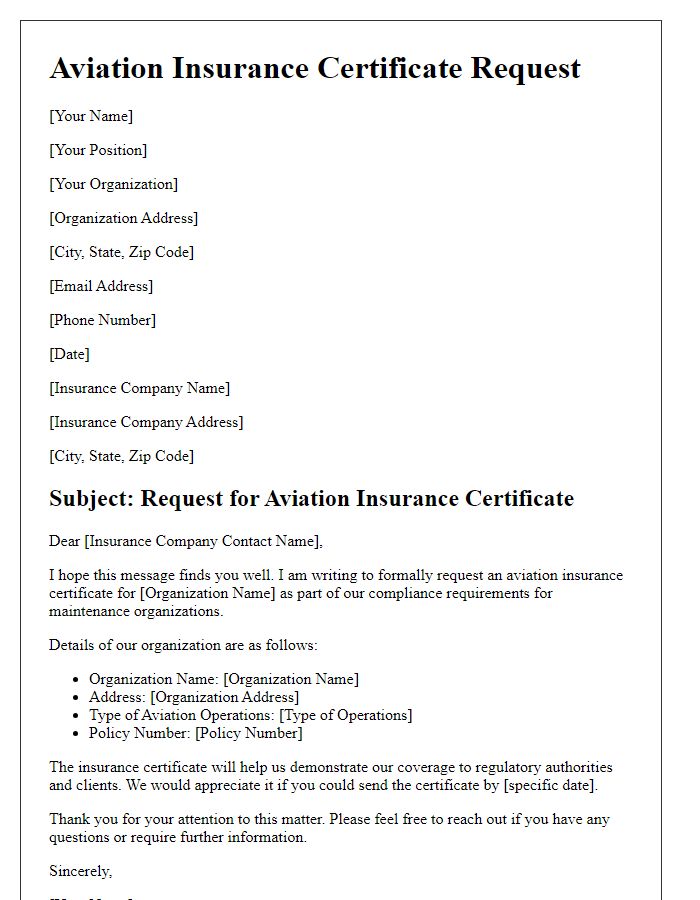

Letter template of aviation insurance certificate request for maintenance organizations.

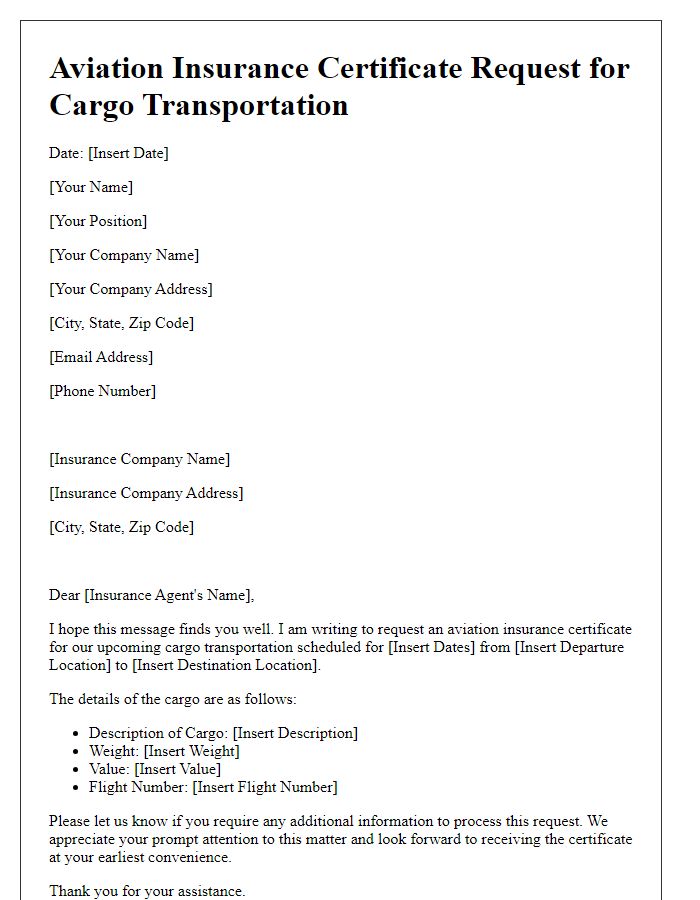

Letter template of aviation insurance certificate request for cargo transportation.

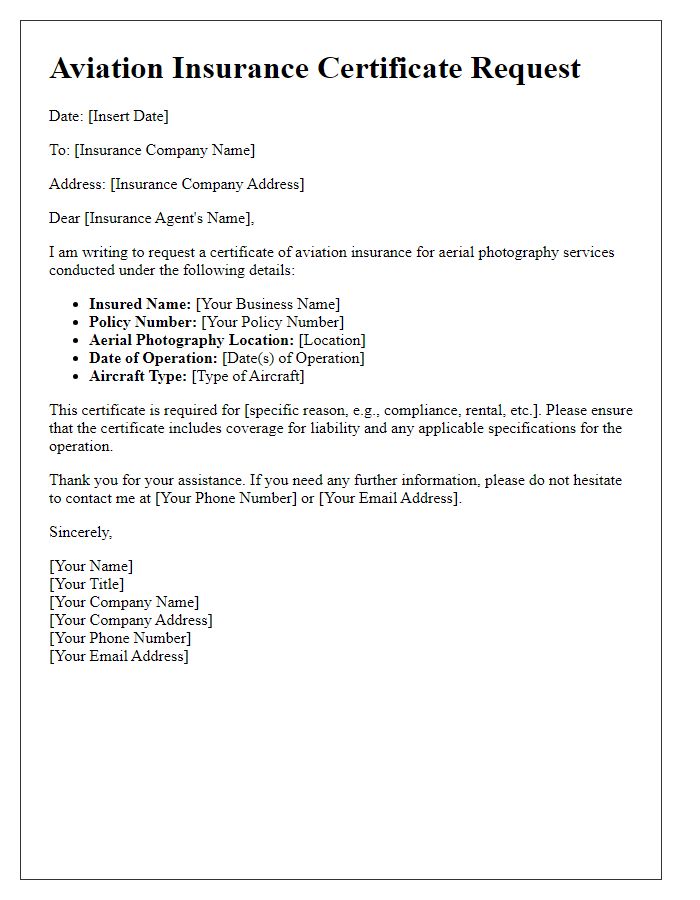

Letter template of aviation insurance certificate request for aerial photography.

Comments