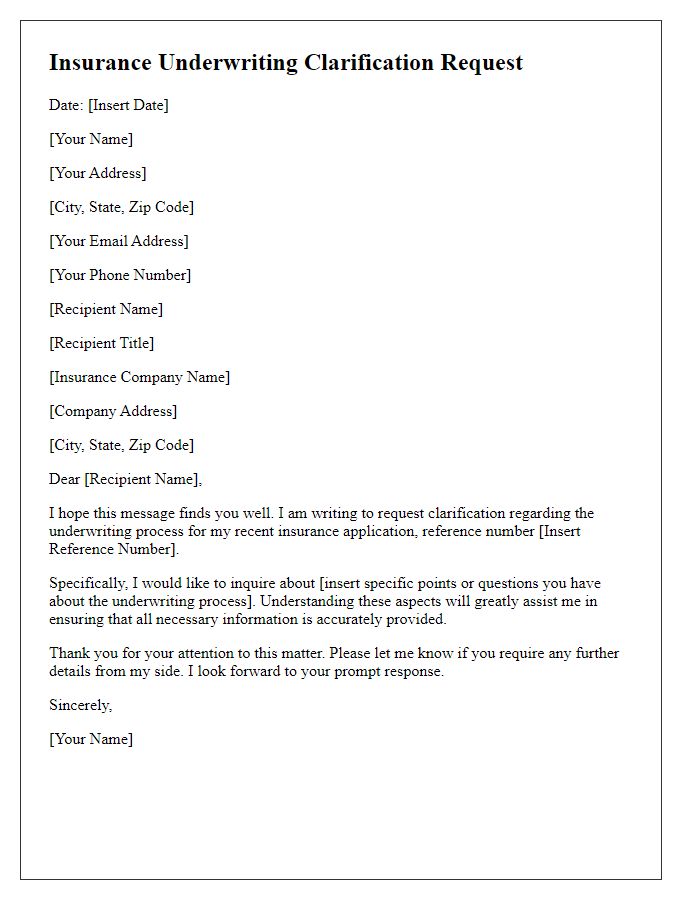

Are you ready to simplify your insurance underwriting requests? Crafting the perfect letter can be the key to ensuring a smooth and efficient process. In this article, we'll explore essential tips to help you structure your request clearly and effectively, making it easier for underwriters to understand your needs. So, grab a seat and join us as we delve into the art of writing an impactful insurance underwriting request!

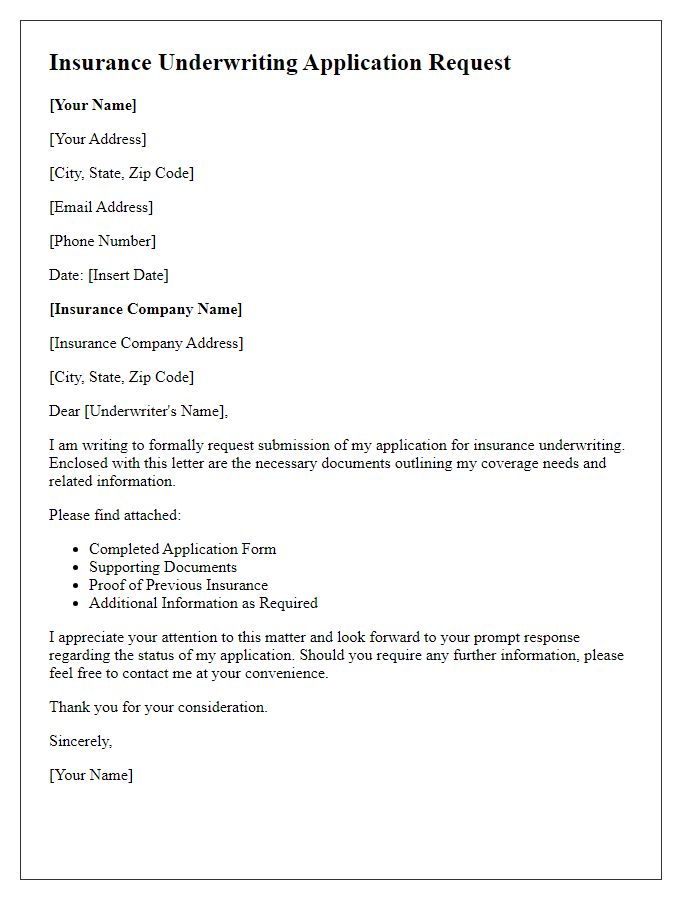

Applicant's Personal Information

When requesting insurance underwriting, the applicant's personal information is crucial in assessing risk and determining coverage options. The applicant's full name, such as John Smith, date of birth (e.g., January 15, 1985), and current address (including city, state, zip code) provide essential demographic details. Additionally, the applicant's occupation, for instance, software engineer, and employer name add context to their lifestyle and potential exposure to risk. Relevant information also includes marital status (single, married, divorced) and the number and ages of dependents (e.g., two children aged 8 and 10). Social Security number may be requested for identity verification. Lastly, financial details such as annual income and any existing insurance coverage should be noted to evaluate the applicant's overall risk profile effectively.

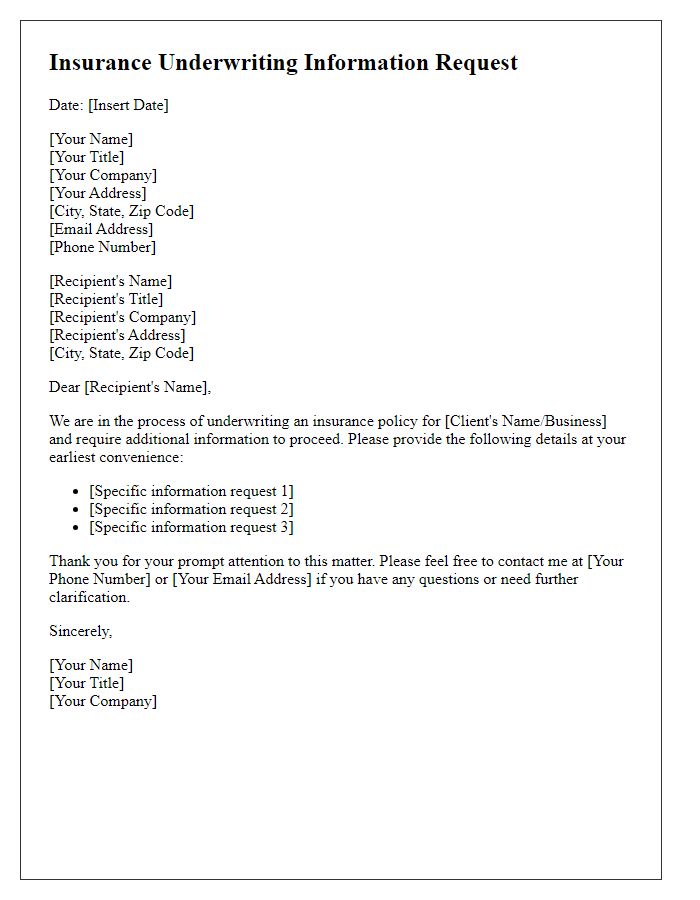

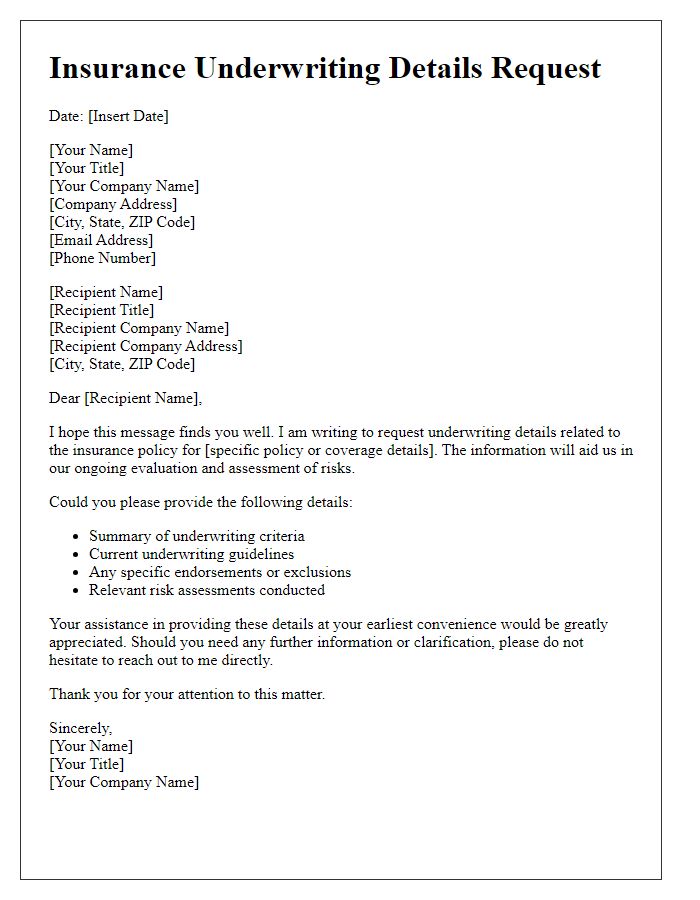

Detailed Description of the Insurance Coverage

The comprehensive insurance coverage for small businesses includes specific protections such as general liability insurance, which safeguards against third-party claims related to bodily injury or property damage occurring on commercial premises. This coverage often extends to business interruptions, protecting operational revenue during unforeseen events like natural disasters, theft, or pandemics, aligning with the parameters set forth by insurance underwriters. Professional liability insurance is crucial for service-oriented businesses, covering legal fees and damages from negligence claims. Additional components may include commercial property insurance, ensuring physical assets like office equipment, inventory, and real estate are protected from risks such as fire or vandalism. In 2023, an estimated 40% of small businesses reported experiencing a loss, underscoring the importance of a comprehensive insurance policy tailored to the unique risks associated with each industry.

Supporting Documentation/Attachments

The insurance underwriting process requires a comprehensive set of supporting documentation to assess risk and determine coverage eligibility. Essential documents may include a detailed financial statement outlining assets, liabilities, and recent income statements, along with tax returns from the past three years to verify the applicant's fiscal responsibility. Property appraisal reports, which provide current market values, serve as critical attachments, particularly for real estate insurance. Medical records or health evaluations are necessary for life or health insurance applications, ensuring accurate risk assessment. Furthermore, driving records hold importance for auto insurance underwriters, indicating the applicant's history of accidents or violations. Collectively, these documents create a robust profile that enables underwriters to make informed decisions regarding policy issuance and premium pricing.

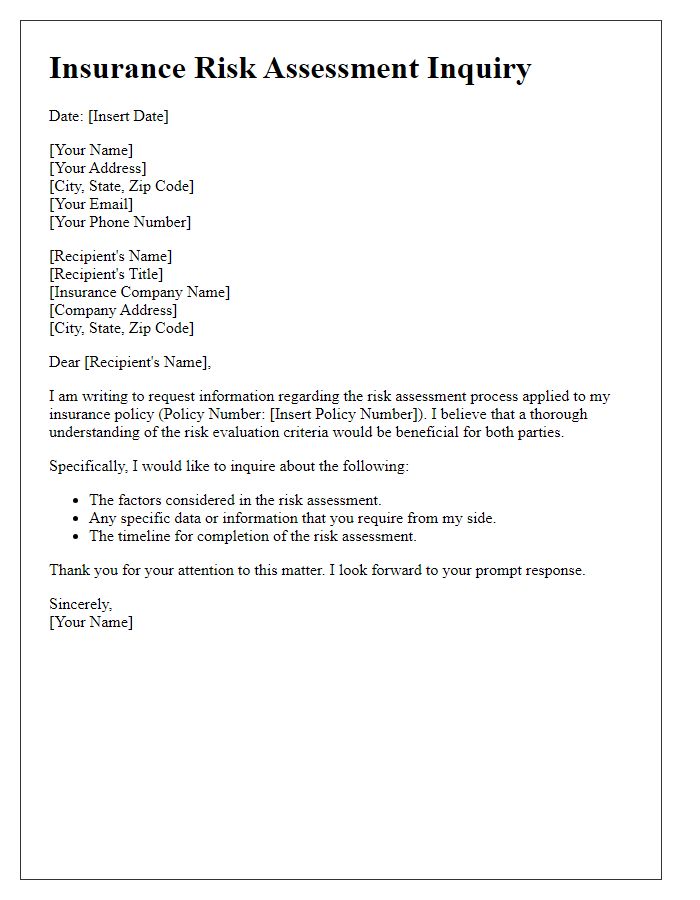

Risk Assessment and Evaluation Criteria

Insurance underwriting involves a thorough risk assessment process that evaluates multiple factors including policyholder information, property details, and risk management practices. Key elements such as the applicant's credit score, accident history, and previous claims will be scrutinized to determine overall risk levels. Specific criteria such as building age, location (for instance, flood zones or earthquake-prone areas), and safety features like smoke detectors or security systems will significantly impact the underwriting decision. Moreover, industry regulations and guidelines set forth by insurance bodies such as the National Association of Insurance Commissioners (NAIC) will be adhered to during the evaluation process to ensure compliance and fairness in premium estimation. Additionally, market trends and economic factors may influence risk perceptions, leading to adjustments in coverage options or policy limits.

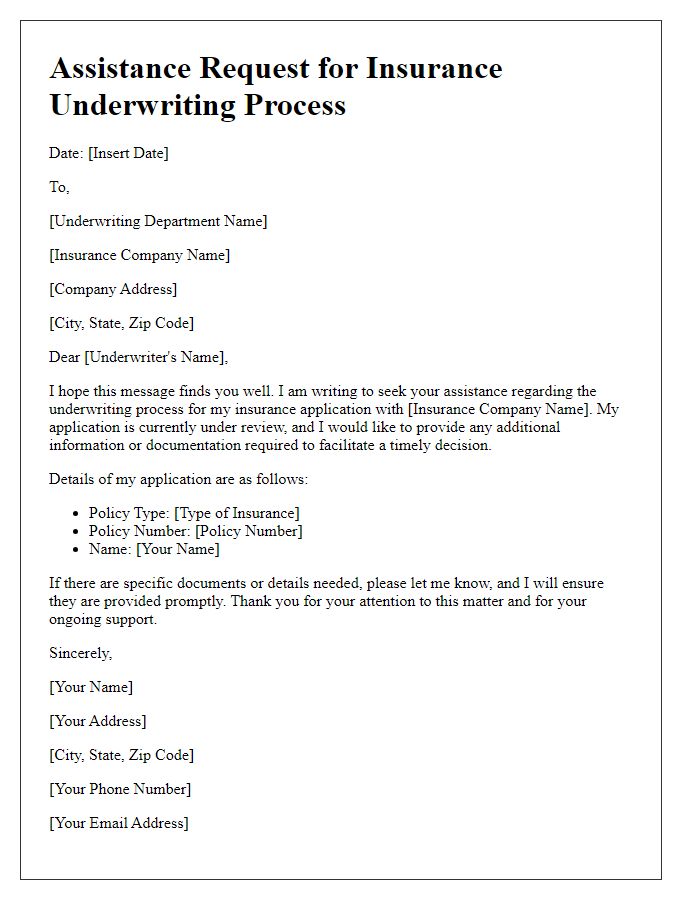

Contact Information for Follow-up

Insurance underwriting requests often require comprehensive details for follow-up communication. Presenting contact information clearly is crucial for efficient processing. Include your full name, including any professional titles, and a primary phone number for immediate inquiries. Additionally, provide a secondary contact number or email address for alternative communication. If affiliated with a specific organization, include the company name, address, and relevant department. Pivotal details, such as the best times for follow-up interactions, facilitate timely exchanges. Being precise in your contact details enhances clarity and expedites the underwriting process.

Comments