When it comes time to renew your insurance policy, it's essential to have a clear and concise letter in hand to streamline the process. A well-crafted request can make all the difference in ensuring your coverage continues without a hitch. In this article, we'll explore the key elements to include in your renewal request letter to make it effective and professional. So, let's dive in and discover how to draft the perfect letter for your insurance policy renewal!

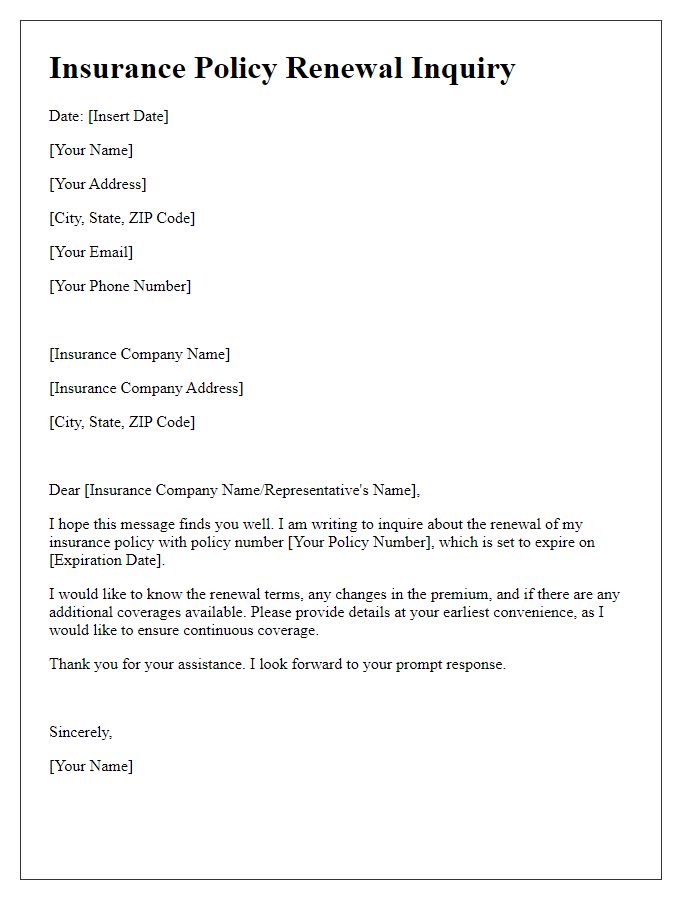

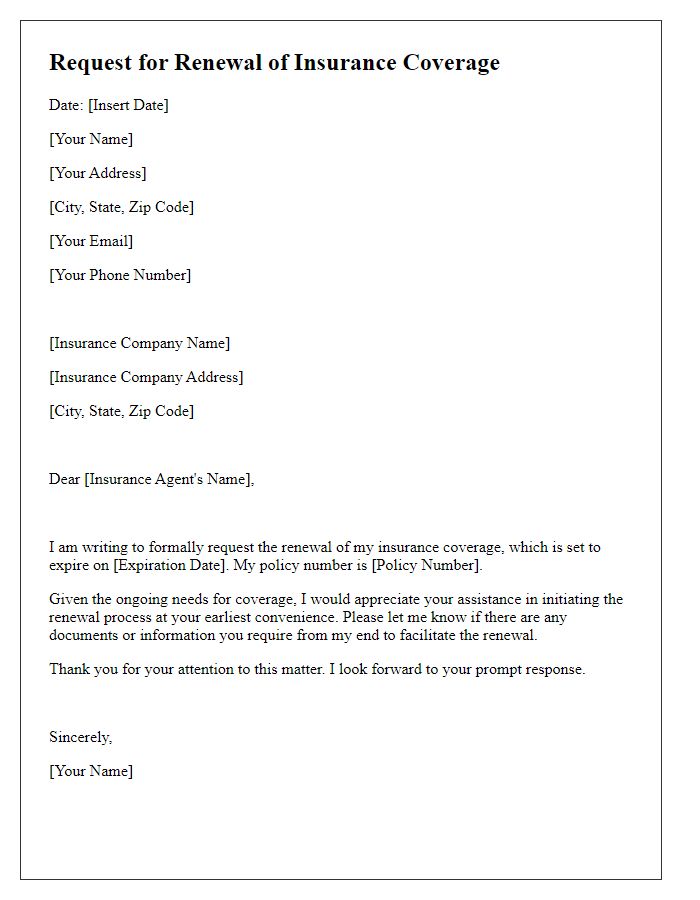

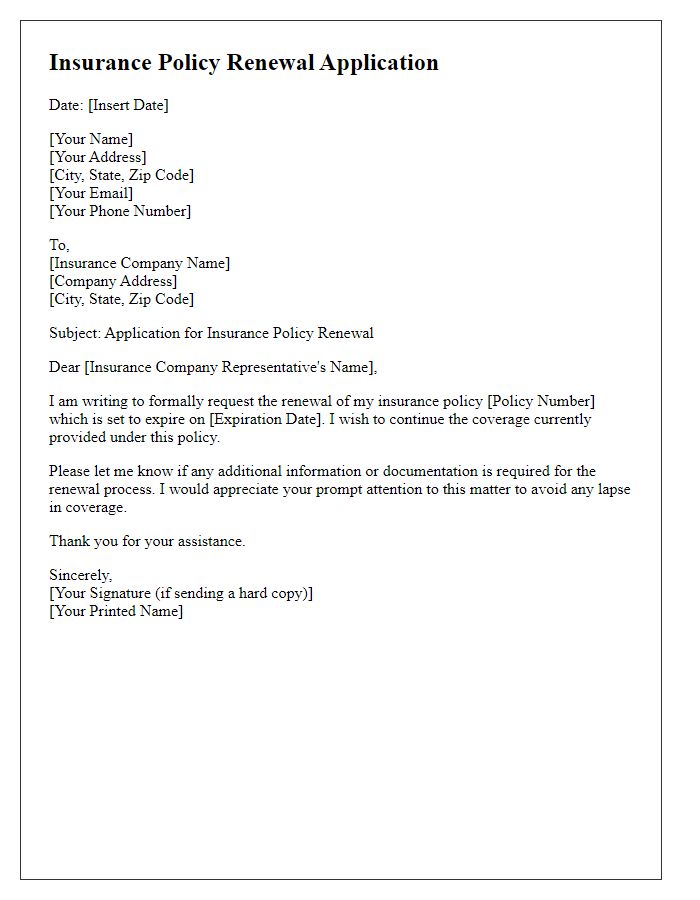

Policyholder information (name, address, policy number)

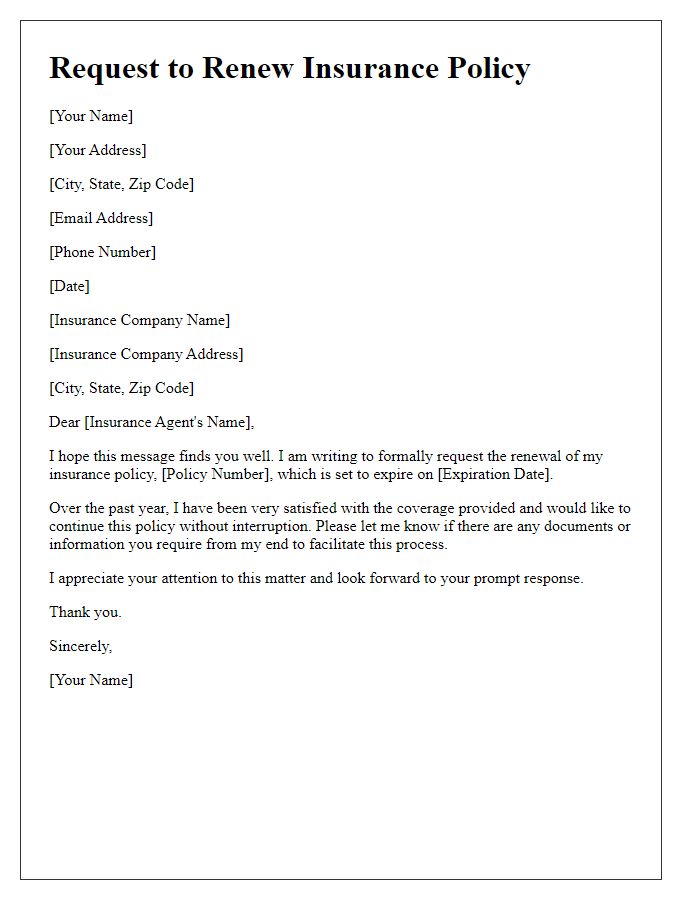

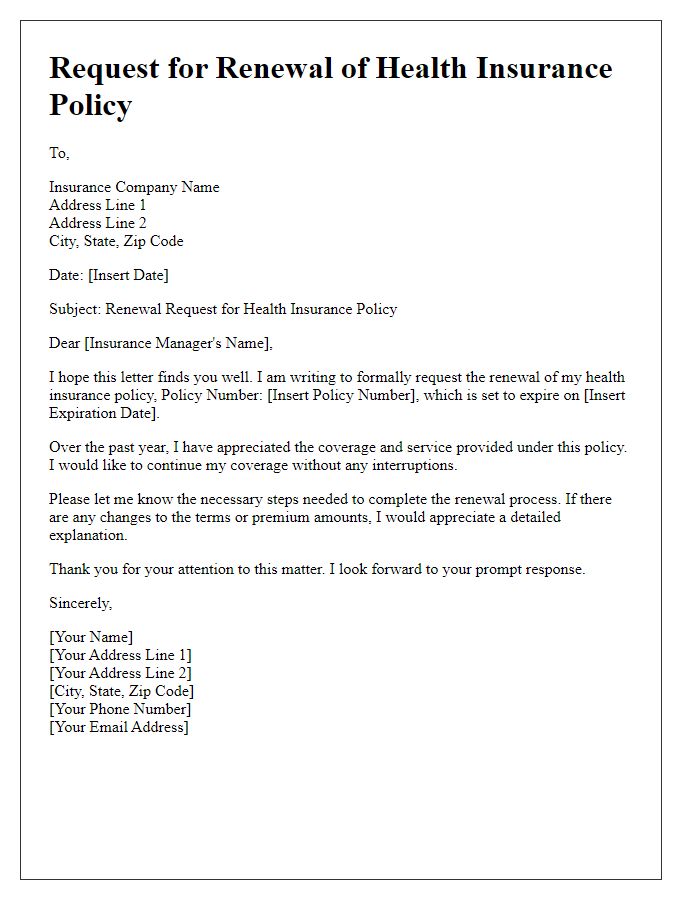

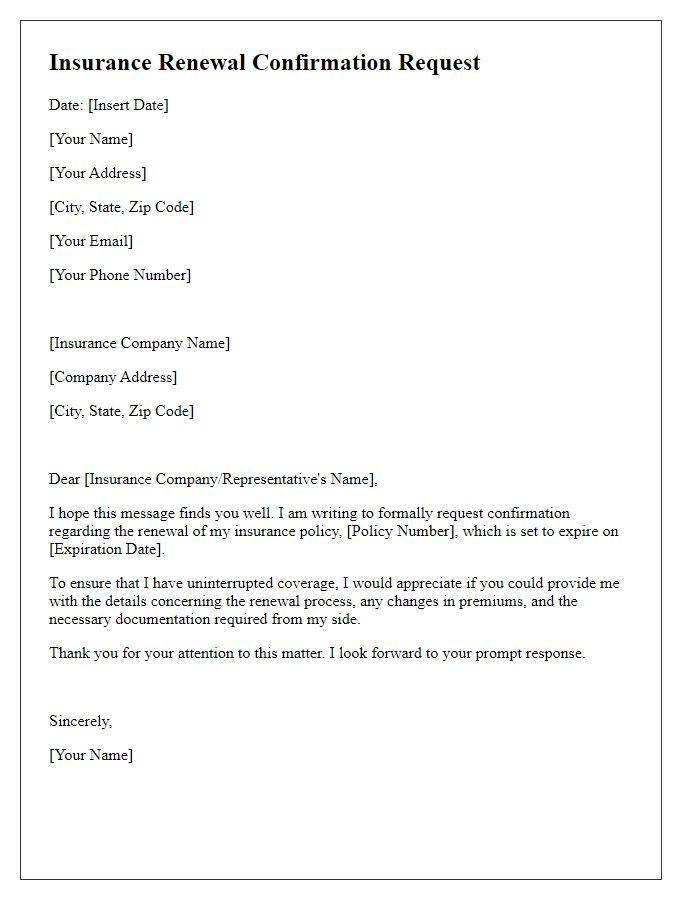

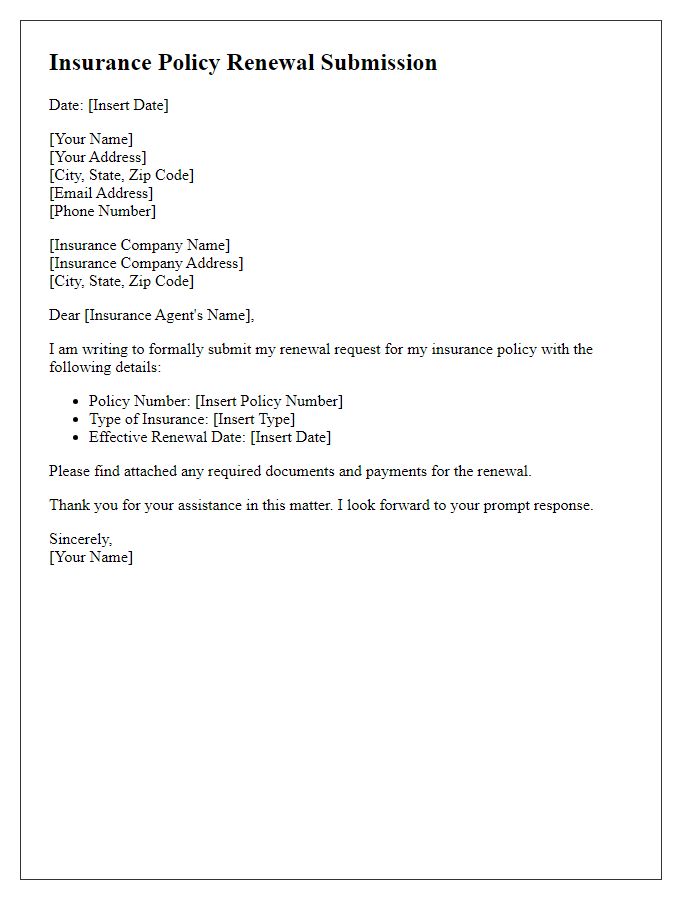

Insurance policy renewal requests require clear and accurate documentation to ensure continuity of coverage. The policyholder's name, often including the full legal name, should be clearly stated. The address must include street number, street name, city, state, and zip code to facilitate correspondence and verification. The policy number, a unique identifier assigned by the insurance company, is critical for locating the specific policy in question. Additionally, mentioning the desired renewal period, any changes in coverage limits, or additional riders requested can streamline the renewal process. A respectful closing and a clear request for confirmation of renewal are essential for effective communication.

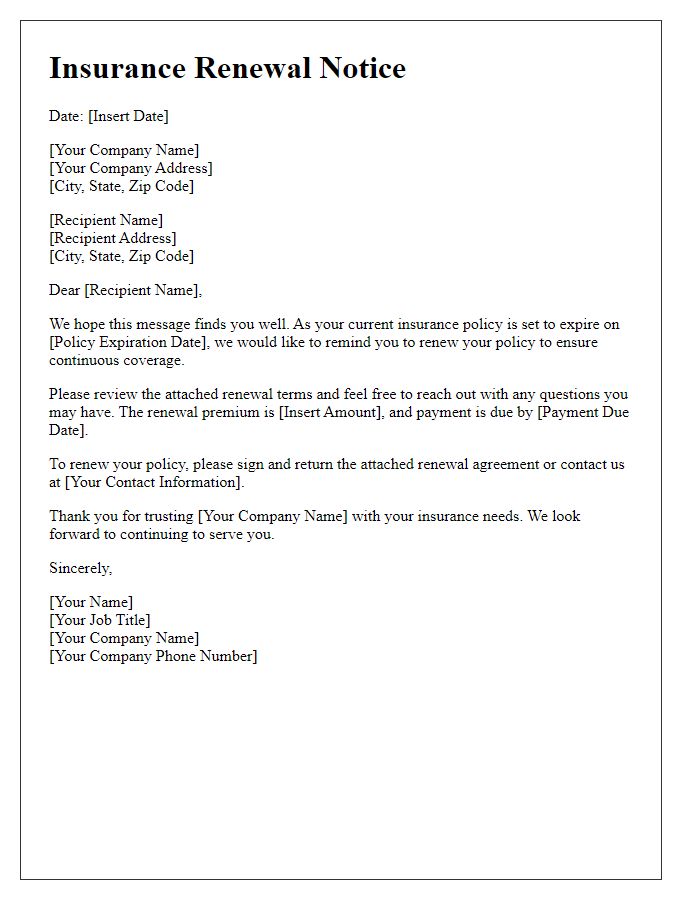

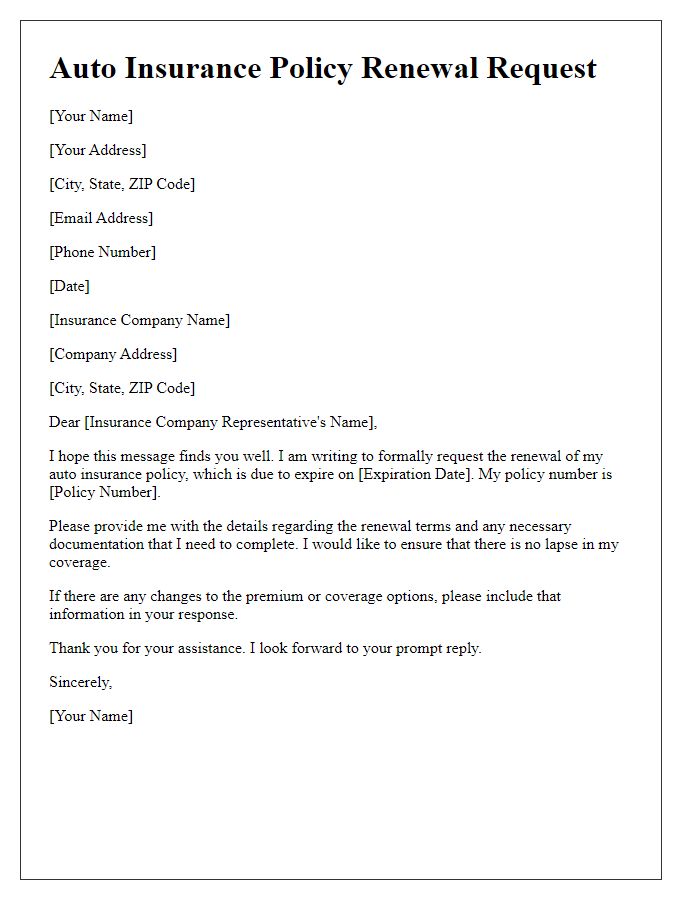

Request for renewal (clear intention to renew the policy)

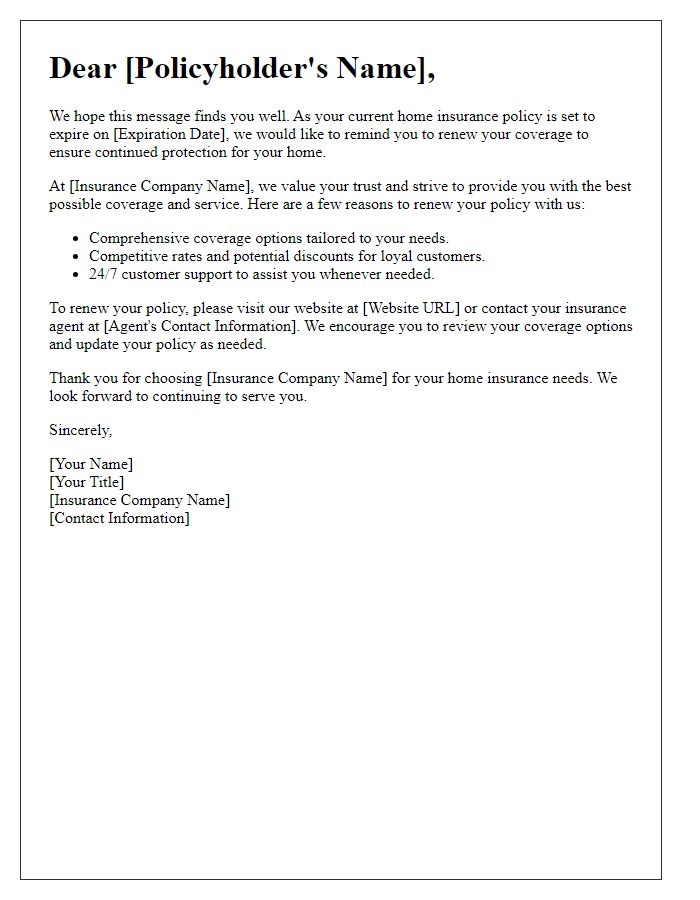

Insurance policy renewal is a crucial step for maintaining continuous coverage and benefits. A timely request ensures the policyholder, such as an individual or business, avoids any gaps in protection against unforeseen events. For instance, a homeowner seeking to renew a property insurance policy should highlight key details like the policy number, date of renewal, and any relevant changes in circumstances, such as updated property value or modifications to coverage limits. Additionally, it's beneficial to express a clear intention to continue the existing terms and discuss any adjustments needed for the upcoming term. This proactive approach can facilitate a smoother transition into the new policy year and ensure uninterrupted risk management.

Updated coverage needs or changes

Renewing an insurance policy requires careful consideration of updated coverage needs and changes in personal or business circumstances. Policyholders should review the current policy provisions to identify any gaps in coverage that may arise due to life events such as marriage, the birth of a child, or purchasing a new home in locations like Los Angeles. Furthermore, changes in financial status, such as income fluctuations or increased asset values, may necessitate higher liability limits or additional coverage options. Adjustments to property values, such as renovations or acquisitions, can also impact the required insurance levels. Comprehensive communication of these changes to the insurance provider ensures that the renewed policy aligns with the policyholder's current risk profile and coverage expectations.

Contact information for follow-up

Insurance policy renewal requests are essential for maintaining coverage. Clear communication facilitates the process. Affected parties should include comprehensive contact information such as full name, address (including city, state, and zip code), phone number (with area code, preferably a mobile number for immediate responses), and email address. Ensuring this information is accurate allows the insurance company to efficiently follow up regarding policy details and renewal confirmation. Keeping records of the communication will assist in tracking the progress of the request.

Gratitude and professionalism in tone

A policyholder with an active insurance policy may submit a renewal request communication to their insurance provider at least 30 days prior to the expiration date. Expressing gratitude while maintaining a professional tone enhances the request's effectiveness. The policyholder's name, policy number, and contact details should be clearly included. Acknowledging past services received and highlighting the importance of continued coverage demonstrates the value placed on the insurer's support. Additionally, reiterating any specific needs or coverage adjustments desired, while requesting the renewal documents promptly, reflects preparedness for seamless continuation. This approach nurtures a positive relationship with the insurance provider, paving the way for efficient processing.

Comments