Are you navigating the complex world of breach insurance claims? It can be overwhelming, especially when you're trying to ensure every detail is covered. In this article, we'll delve into essential tips for crafting a follow-up letter that keeps your insurance claim on track and improves your chances of a swift resolution. So, grab a cup of coffee and let's explore how you can effectively communicate with your insurer!

Policyholder's information

Following up on a breach insurance claim requires clear communication regarding policyholder details. The policyholder's name should be provided, typically in full, including any middle initials or suffixes. Essential contact information is necessary: phone number and email address, allowing for timely updates on the claim status. Documentation related to the policy such as policy number should be included for quick identification. The date of the breach incident must also be noted, as it helps in assessing the timeline and urgency of the claim. Additionally, providing details regarding the type of breach and the specific losses incurred can assist in the review process.

Insurance policy details

Insurance policy details are crucial for processing a breach insurance claim efficiently. Policy number (123456789) outlines the specific coverage terms, including data breach response services offered by the insurer, such as legal consultation and credit monitoring for affected individuals. Coverage limits specify the maximum financial restitution available, which can reach up to $1 million depending on the severity of the breach. Additionally, policy effective dates (January 1, 2022, to December 31, 2023) indicate the duration of coverage applicable during the incident. The insured entity, a tech startup located in San Francisco, California, must provide incident details, including date of breach (October 5, 2023) and nature of data compromised (customer personal information), to ensure a swift resolution of the claim process.

Description of the breach incident

A data breach incident resulting from a sophisticated cyber attack can compromise sensitive information, affecting individuals and organizations. The breach, which occurred on July 15, 2023, targeted customer databases within the systems of the multinational corporation XYZ Corp, headquartered in New York City. Attackers exploited vulnerabilities in outdated software, allowing unauthorized access to personal data of approximately 500,000 customers, including social security numbers, credit card information, and addresses. The incident was discovered on July 20, 2023, leading to an immediate security audit and deployment of advanced cybersecurity measures to mitigate further risks. As a result, both the reputation of XYZ Corp and the trust of their customer base have been jeopardized, necessitating a comprehensive insurance claim to cover potential liabilities and recovery costs.

Documentation and evidence attached

Following the submission of a breach insurance claim, timely follow-up is crucial for effective resolution. Comprehensive documentation should be provided, including reports outlining the circumstances of the incident, such as date (specific date of the breach) and location (specific servers or data centers affected). Supporting evidence should encompass logs detailing fraudulent activity, communications with affected parties, and expert testimonies if available. Relevant policies pertaining to data protection (e.g., GDPR compliance) must be referenced to substantiate the claim. All attached documents should be clearly labeled and organized for efficient review, ensuring that the claims adjuster can easily verify submitted materials for a thorough examination.

Request for response or resolution timeline

In a situation where breach insurance claims are involved, policyholders often face challenges in securing timely responses from their insurance providers. Insurance claims related to cybersecurity breaches can encompass a multitude of factors, including data loss incidents, regulatory fines, and costs associated with recovery efforts. These claims are critical for businesses, especially small and medium enterprises, as the average cost of a data breach in 2023 reached approximately $4.35 million, according to IBM's Cost of a Data Breach Report. A prompt response and clear communication from the insurance provider, such as an expected resolution timeline, can significantly affect the policyholder's recovery strategy and financial stability. Establishing clear expectations helps businesses manage their resources effectively while navigating the complexities of remediation and potential legal repercussions following a cybersecurity incident.

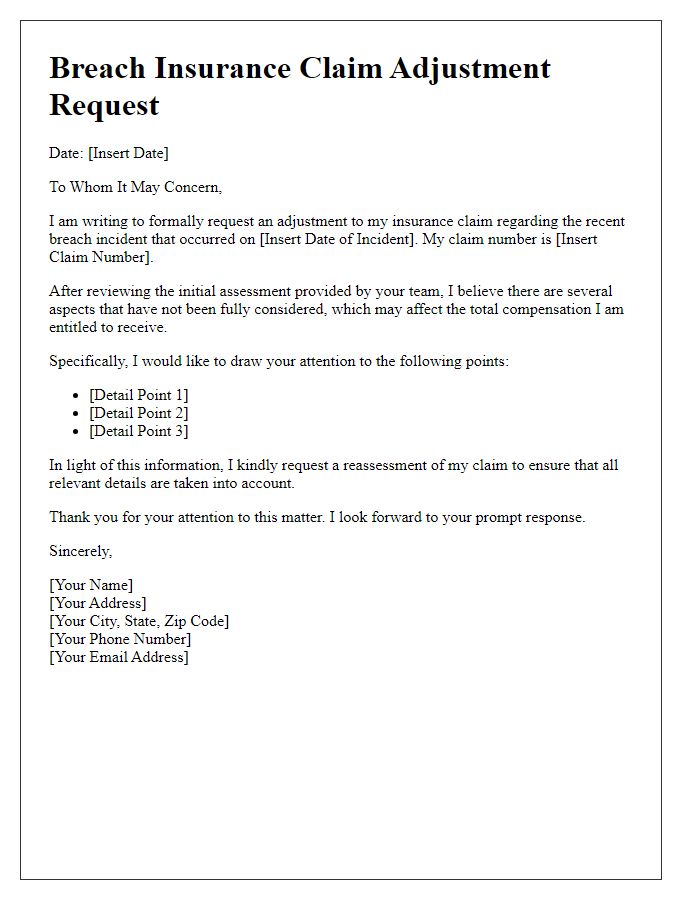

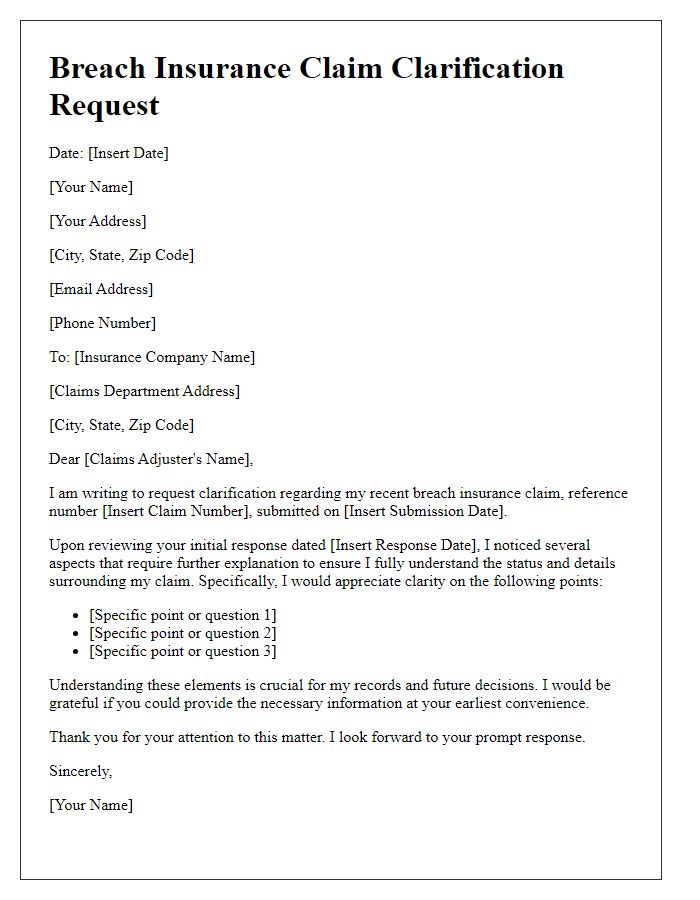

Letter Template For Breach Insurance Claim Follow-Up Samples

Letter template of breach insurance claim additional documentation request

Comments