Are you in the process of applying for temporary insurance coverage and feeling a bit overwhelmed? You're not aloneâmany people find the paperwork and requirements a little daunting! Fortunately, having the right letter template can simplify your application and ensure you include all necessary details. So, if you're ready to navigate the world of temporary insurance with confidence, read on for our comprehensive guide!

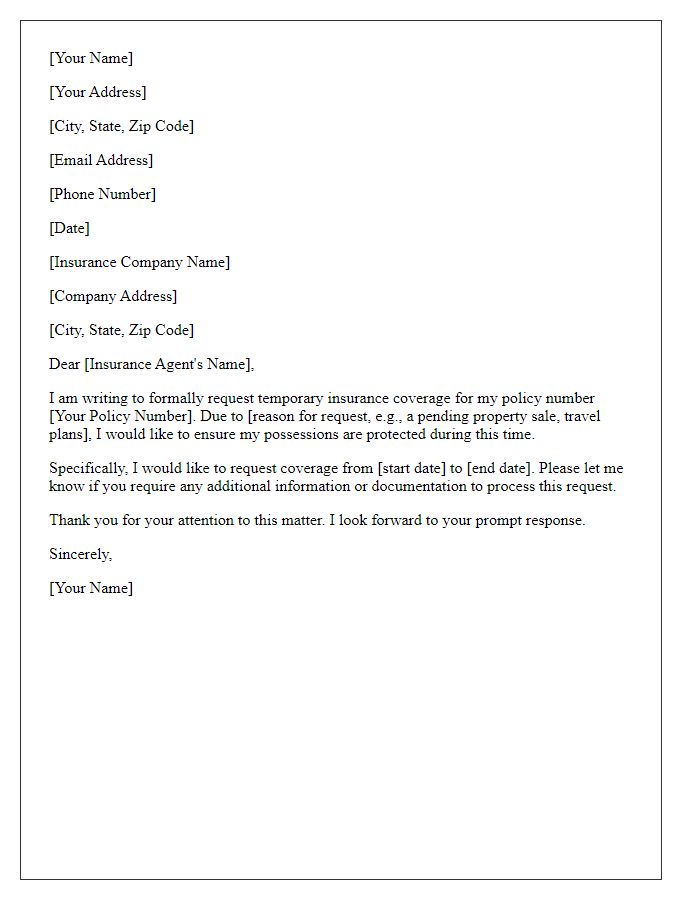

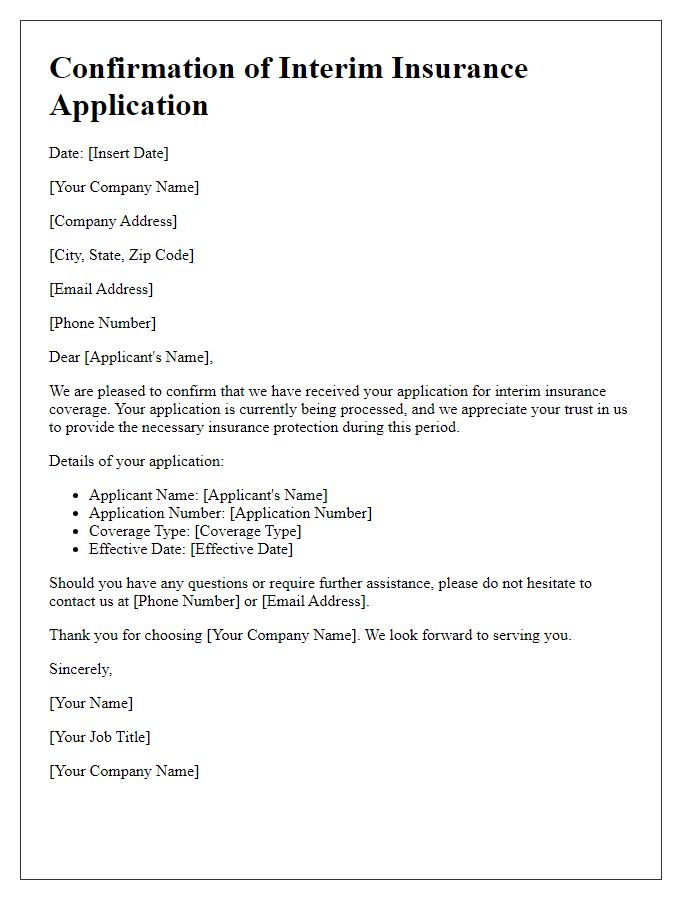

Applicant Information

The temporary insurance coverage application requires comprehensive applicant information for processing. Essential details include full name (first, middle, last), date of birth (format: MM/DD/YYYY), and residential address (city, state, ZIP code). Contact information, such as a valid phone number and email address, must be provided for communication purposes. Additionally, specific identification numbers (like Social Security Number) and current employment details (employer name, job title, length of employment) are often necessary to verify eligibility for coverage options. It is crucial for applicants to accurately complete this section to expedite the review and approval process for their temporary insurance requests.

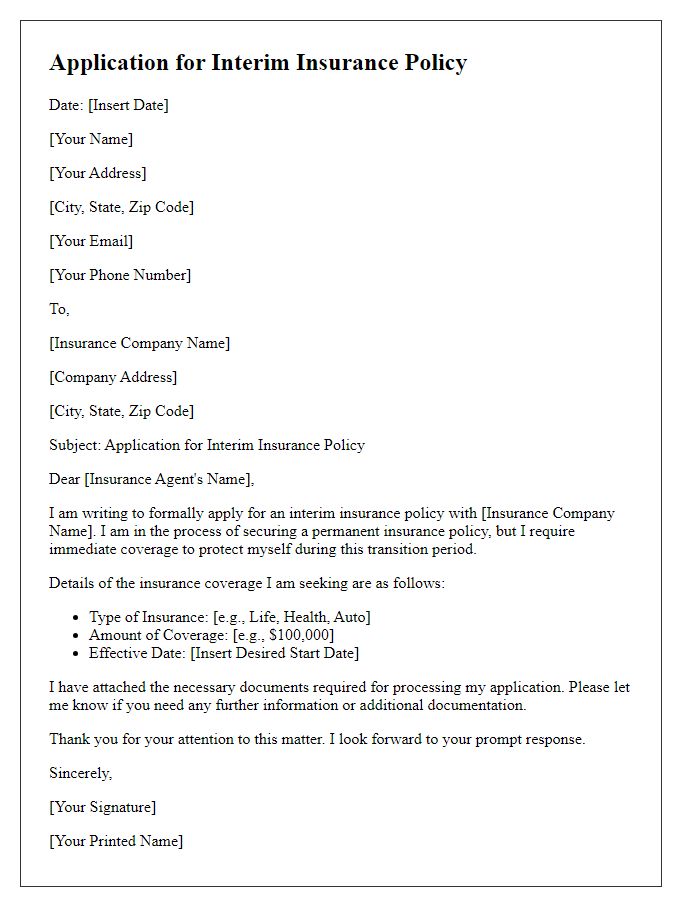

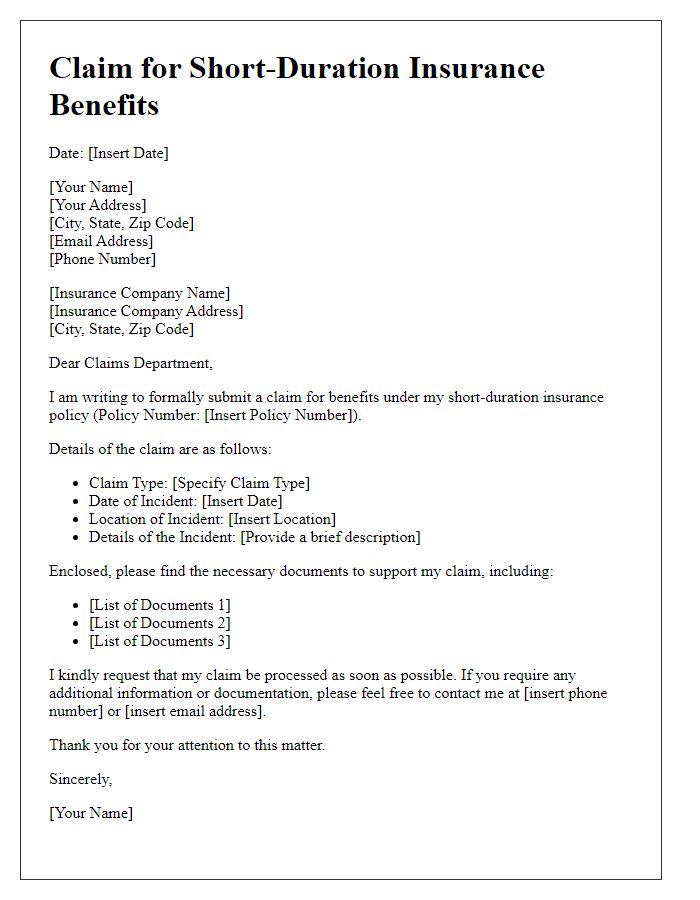

Coverage Details

Temporary insurance coverage provides essential protection for individuals or entities during transitional periods, such as while purchasing a new vehicle or awaiting the effective date of a more comprehensive plan. Specifics of this coverage may include a short-term duration, typically ranging from one to three months, and a maximum coverage limit based on the insured item's value or risk factors. In instances of vehicle insurance, typical limits might range from $30,000 to $100,000, contingent on the vehicle's make and model. Furthermore, potential deductibles may apply, often between $500 and $1,000 for claims. Coverage generally encompasses liability, collision, and comprehensive aspects, ensuring that unexpected events such as accidents or theft do not lead to significant financial burdens. It is crucial for applicants to provide accurate information regarding factors such as location, driving history, and the intended use of the vehicle or property to determine premium costs and specific terms of coverage effectively.

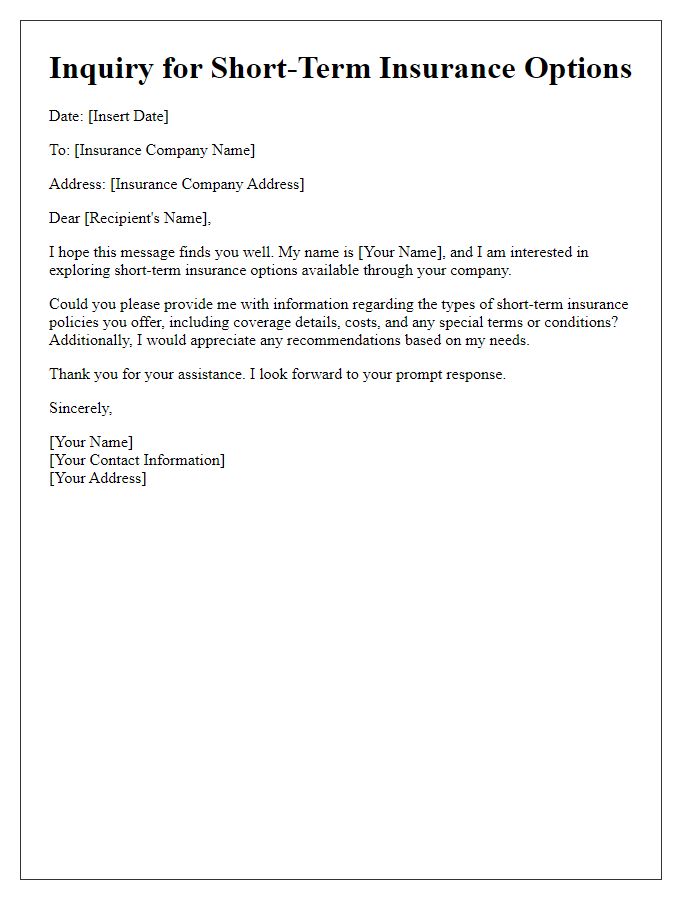

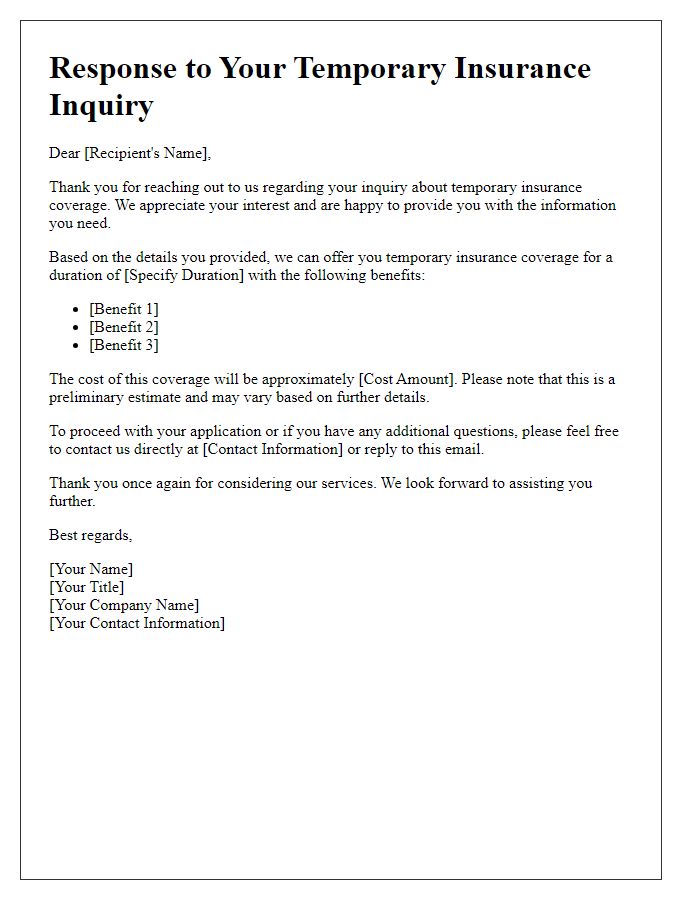

Purpose of Temporary Coverage

Temporary insurance coverage serves as a safety net during transitional periods, such as when a policyholder is in between jobs or awaiting a new insurance policy to take effect. This type of coverage offers protection against unforeseen incidents, including accidents and health emergencies. The duration of temporary coverage typically ranges from a few days to several months, depending on the insurance provider's offerings. For individuals traveling abroad or relocating to a new area, obtaining temporary coverage ensures peace of mind against medical costs or property damage. Its flexibility allows policyholders to bridge gaps in their insurance needs while ensuring compliance with state or federal regulations.

Effective Dates

Temporary insurance coverage applications often specify effective dates to determine the period of protection provided. Typically, these dates range from 30 to 90 days, depending on the policy type and insurer's terms. The start date, commonly denoted as the effective date, marks when the coverage begins, potentially impacting events such as accidents or damages. The end date concludes the temporary coverage, after which, clients must transition to a permanent policy or risk being uninsured. Accuracy in these dates is crucial, as any discrepancies can result in gaps in coverage, leading to financial exposure during unforeseen incidents.

Contact Information

Temporary insurance coverage provides short-term protection for specific events or periods. This type of coverage often includes key details such as policy duration, coverage limits, and specific exclusions. For instance, travelers may seek temporary insurance for international trips spanning 14 to 30 days, typically covering medical emergencies and trip cancellations. Key stakeholders include individuals, families, and businesses seeking to mitigate risks. Companies like World Nomads and InsureMyTrip offer tailored solutions with online applications, ensuring quick processing of requests. Understanding the terms and conditions, along with the premium rates, is crucial for adequate risk management during the coverage period.

Comments