Hey there! If you're in the midst of a move and wondering about insurance coverage, you're not alone. Many people find themselves navigating the complexities of relocation insurance and want to ensure everything is properly covered. In this article, we'll break down what you need to know about confirmation of insurance relocation coverage and how it can protect your belongings during the transition. So, let's dive in and discover the essentials together!

Policyholder Information

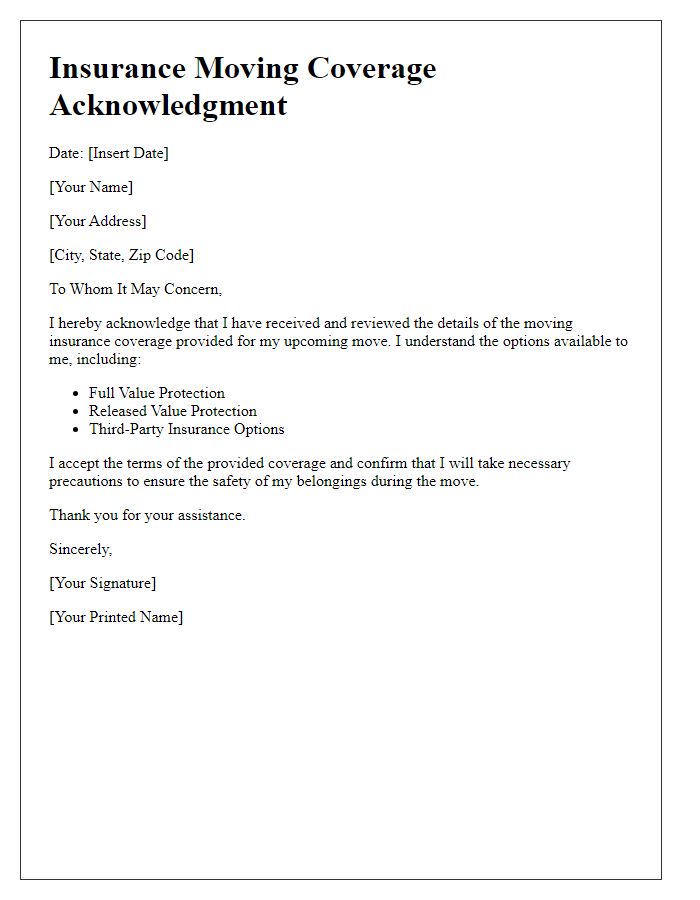

Insurance relocation coverage offers essential financial support for individuals and families during the process of moving to a new residence, ensuring that policyholders receive compensation for eligible expenses related to the relocation. Coverage often includes costs such as transportation of personal belongings, temporary storage fees, and potentially even expenses associated with travel to the new location, often calculated on a per-mile basis if the distance exceeds 50 miles. Documentation of all expenses, such as invoices or receipts, is typically required to validate claims. Policyholders should review their specific insurance policy details, as exclusions may apply, and limits on maximum coverage can vary based on the insurance provider and specific policy terms. Establishing clear communication with the insurance company can facilitate a smoother claims process and ensure timely reimbursement during what can often be a stressful period of transition.

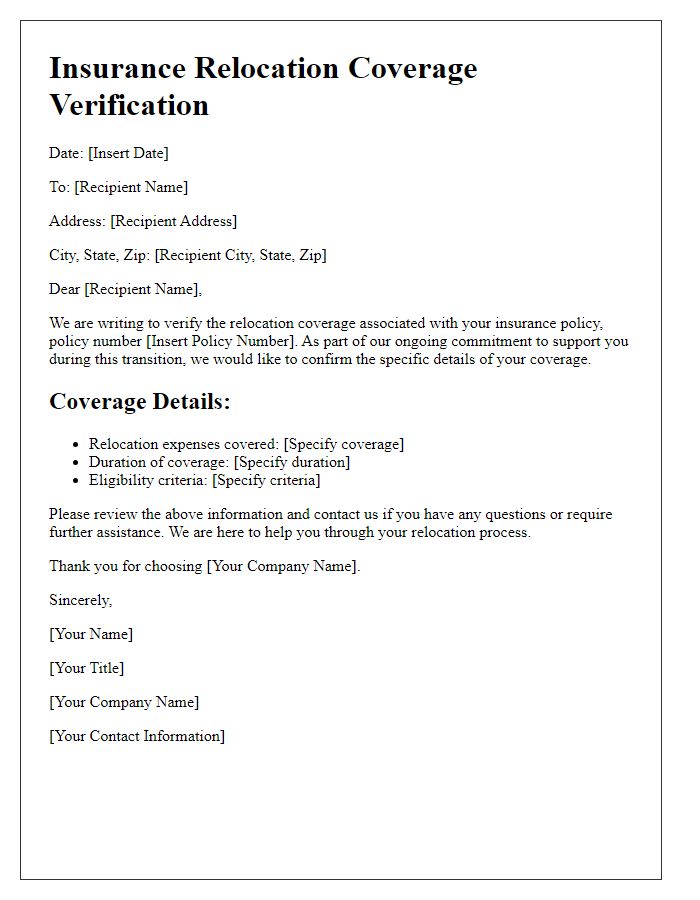

Coverage Details

Insurance relocation coverage can provide essential financial support during moves, particularly when individuals or families transition to new residences. Coverage typically includes expenses related to transporting personal belongings, ensuring that items such as furniture, appliances, or valuable possessions are protected during transit. Reimbursement might also extend to costs for temporary housing, storage solutions, or travel expenses for those relocating across state lines or internationally, often exceeding thousands of dollars in potential expenses. Policies commonly require pre-approval and documentation to validate costs incurred during the relocation process, ensuring that claim submissions are processed efficiently. Understanding specific coverage terms, limits, and exclusions is crucial for individuals securing their relocation insurance.

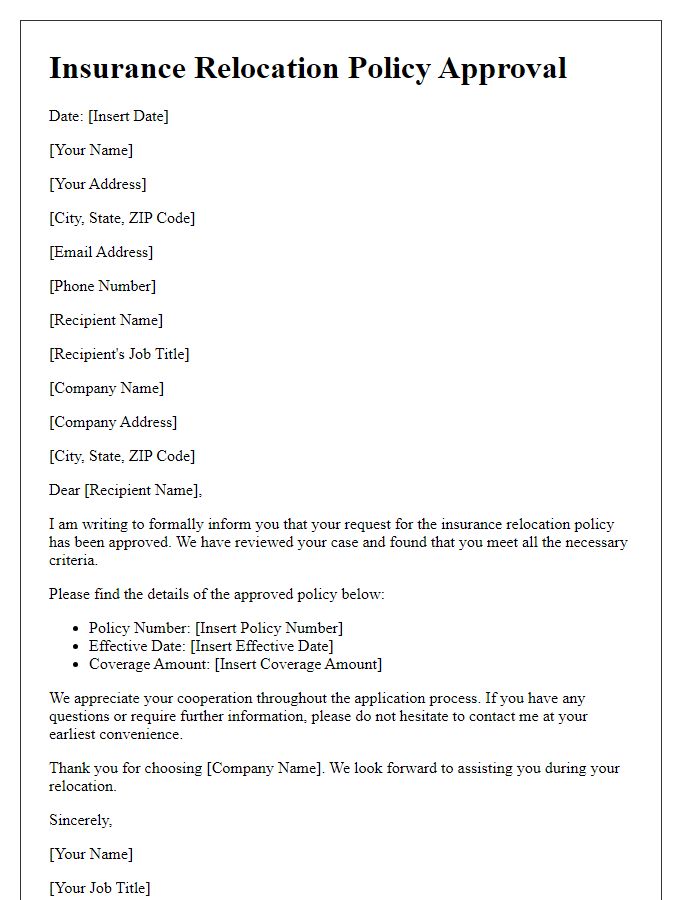

Effective Dates

Insurance relocation coverage confirmation is crucial for ensuring adequate protection during moving processes. This coverage typically begins on the date of relocation, with policies activated for the duration of transport of belongings. Coverage can include items such as furniture, appliances, and personal effects, with a maximum insured amount varying by policy, often ranging from $20,000 to $100,000. Additionally, supplemental coverage options may apply during international moves, reflecting the increased costs associated with customs and tariffs. Understanding effective dates is essential for policyholders to avoid lapses in coverage, ensuring that all items are protected from potential loss or damage throughout the relocation journey.

Contact Information

Insurance relocation coverage confirmation should include essential details such as the insured party's name, policy number, and contact information. This may include a postal address, email address, and phone number for efficient communication. Moreover, inclusion of relocation dates, coverage limits, and policy specificities is crucial for clarity. The confirmation should also mention the name of the insurance provider and any representative involved in the process. Such organized information facilitates a seamless verification process for both the insured and the insurance company during the relocation phase.

Terms and Conditions

Relocation insurance coverage provides essential protection during the moving process, ensuring financial reimbursement for unforeseen events. Key components include coverage limits defined in terms of monetary values (often between $1,000 to $250,000 depending on the policy), loss or damage of personal property during transit, and coverage for additional living expenses incurred (ranging from hotel stays to meals) if the move experiences delays. The policy typically specifies the geographical boundaries (such as interstate vs. intrastate moves), as well as requirements such as inventory lists and timeframes for filing claims (often within 30 days of the incident). Certain exclusions may apply, such as damage caused by natural disasters in high-risk areas or negligence. Carefully reviewing each provision ensures adequate understanding of the terms and conditions that govern the relocation coverage.

Comments