Navigating the world of collision insurance claims can feel daunting, but you're not alone in this process! Many people find themselves unsure about how to start their claim, what information to include, and how to communicate effectively with their insurance provider. Understanding the essential elements of a well-crafted claim letter can make a significant difference in speeding up your process and maximizing your benefits. If you're ready to take the next step and learn how to draft a compelling claim request, keep reading for helpful tips and a handy template!

Policyholder details

A collision insurance claim request begins with essential policyholder details, including the full name (e.g., John Smith), address (e.g., 123 Elm Street, Springfield, IL 62701), contact number (e.g., (555) 123-4567), policy number (e.g., ABCD123456), and the vehicle identification number (VIN) (e.g., 1HGBH41JXMN109186). These details ensure identification within the insurance company's records. Following the personal information, provide the date and time of the accident (e.g., October 5, 2023, at 3 PM), location of the incident (e.g., intersection of Main Street and 2nd Avenue in Springfield), and brief descriptions of the vehicles involved (e.g., 2019 Honda Accord versus 2020 Ford Escape). Collecting all relevant information is essential for a prompt and effective claims process.

Claim reference number

A collision insurance claim request involves providing detailed information related to an incident for a claim reference number issued by the insurance company. The request should include specifics such as the date of the accident (e.g., September 15, 2023), details about the vehicle involved (including make, model, year, and VIN), the location of the incident (e.g., Main Street, downtown area of Springfield), and a summary of damages sustained (like dented bumper, broken taillight). Additionally, it should mention the estimated repair costs, potentially including estimates from certified auto-repair shops, as well as any relevant police report numbers if a report was filed. This detailed contextual information assists in expediting claim processing and ensures all necessary factors are taken into account.

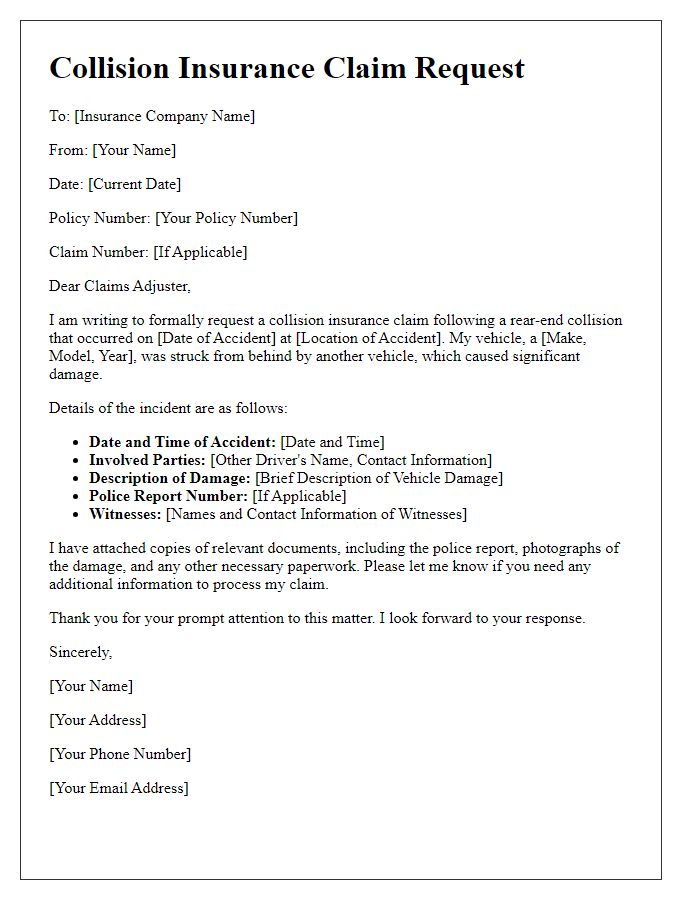

Incident description

On October 15, 2023, a significant collision occurred at the intersection of Elm Street and Maple Avenue in Springfield, resulting in substantial damage to my vehicle, a 2020 Honda Accord. The incident transpired around 3:00 PM when another driver failed to stop at the red light, ultimately colliding with my car on the driver's side. The impact led to extensive damage, including the deformation of the door, broken window glass, and widespread scrapes along the body of the vehicle. Thankfully, I was wearing a seatbelt, which prevented severe injuries. Police arrived promptly on the scene and documented the event, providing a copy of the police report detailing the circumstances. Subsequently, my vehicle was towed to Joe's Auto Body Repairs for an assessment of the damages and an estimate for repairs. This collision has caused significant inconvenience and financial distress, prompting my claim for collision coverage under my insurance policy.

Supporting documentation

Collision insurance claims can require numerous types of supporting documentation to expedite the review process. Essential items include a detailed accident report from local authorities, which typically outlines the circumstances surrounding the incident, including time, date, and involved parties' information. Photographic evidence of vehicle damage is crucial, showcasing specific areas of impact and interior damage if applicable. Estimates from certified body shops provide insights into repair costs, often necessary for accurately evaluating the claim. Witness statements can bolster the claim by corroborating events leading up to the collision. Lastly, a copy of the insurance policy, illustrating coverage details, is fundamental in ensuring that the claim meets policy requirements. Gathering all these materials in an organized manner aids in a smoother processing of the collision insurance claim.

Contact information

In the aftermath of a vehicular accident, it's crucial to submit a comprehensive insurance claim. The claim should include your personal contact details, such as your full name, email address, and telephone number, ensuring prompt communication with the insurance provider. Additionally, list the policy number associated with your collision coverage, as well as the vehicle identification number (VIN) of the damaged car, which is usually found on the dashboard or door frame. Including the date, time, and location of the incident, along with any witness contact numbers or police report references, will further substantiate your request and expedite the claims process.

Letter Template For Collision Insurance Claim Request Samples

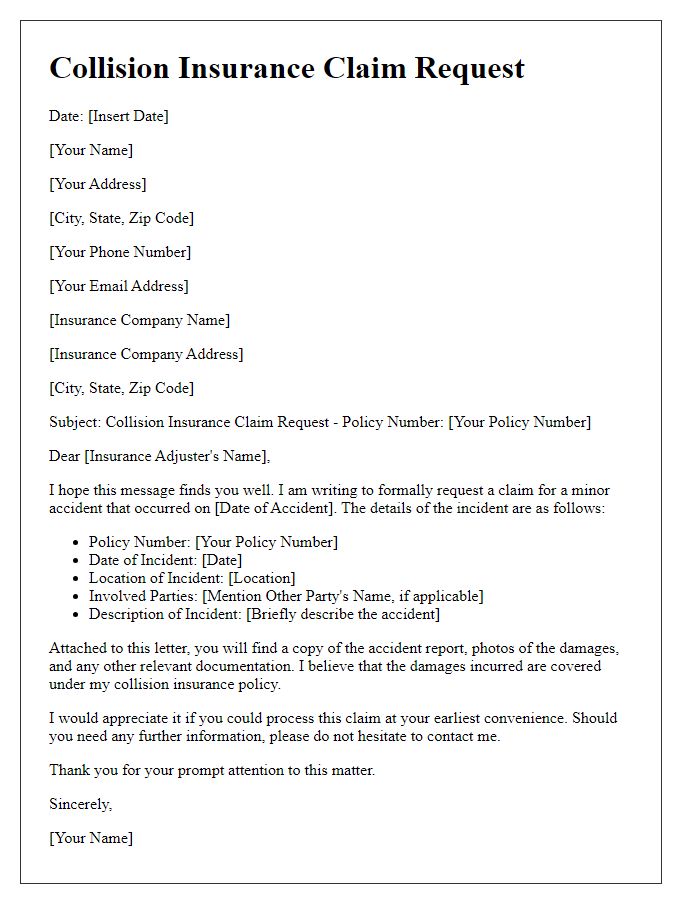

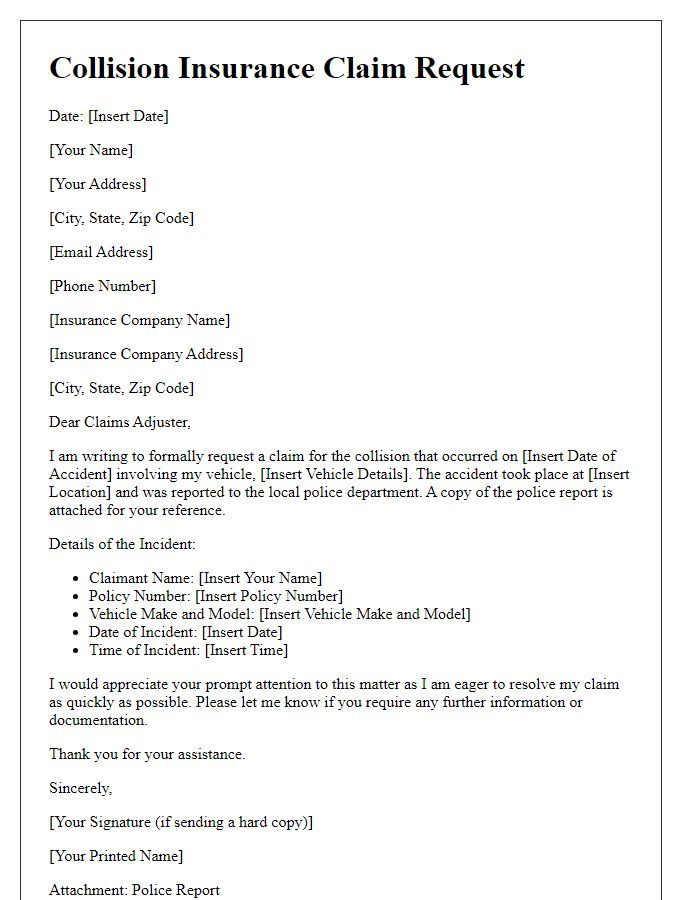

Letter template of collision insurance claim request for minor accidents.

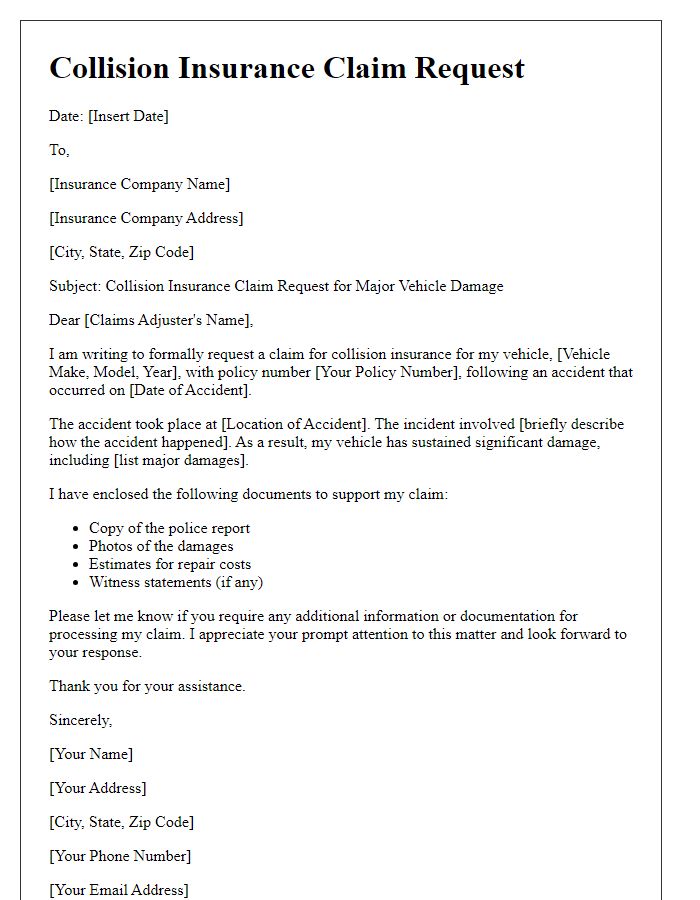

Letter template of collision insurance claim request for major vehicle damage.

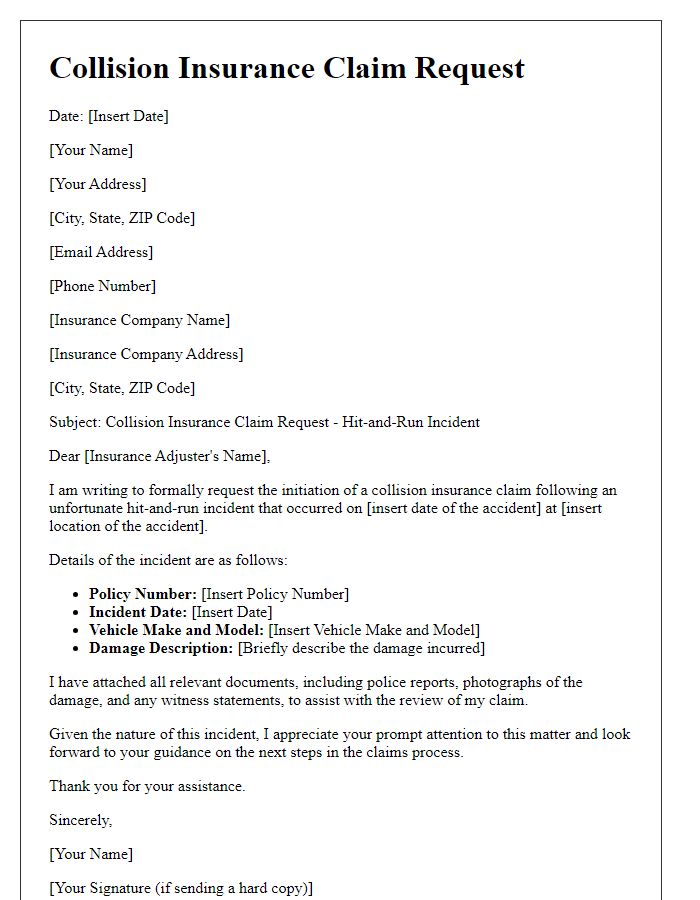

Letter template of collision insurance claim request for hit-and-run incidents.

Letter template of collision insurance claim request for leased vehicles.

Letter template of collision insurance claim request for uninsured motorist coverage.

Letter template of collision insurance claim request including eyewitness statements.

Letter template of collision insurance claim request for multiple vehicle collisions.

Letter template of collision insurance claim request with police report attachment.

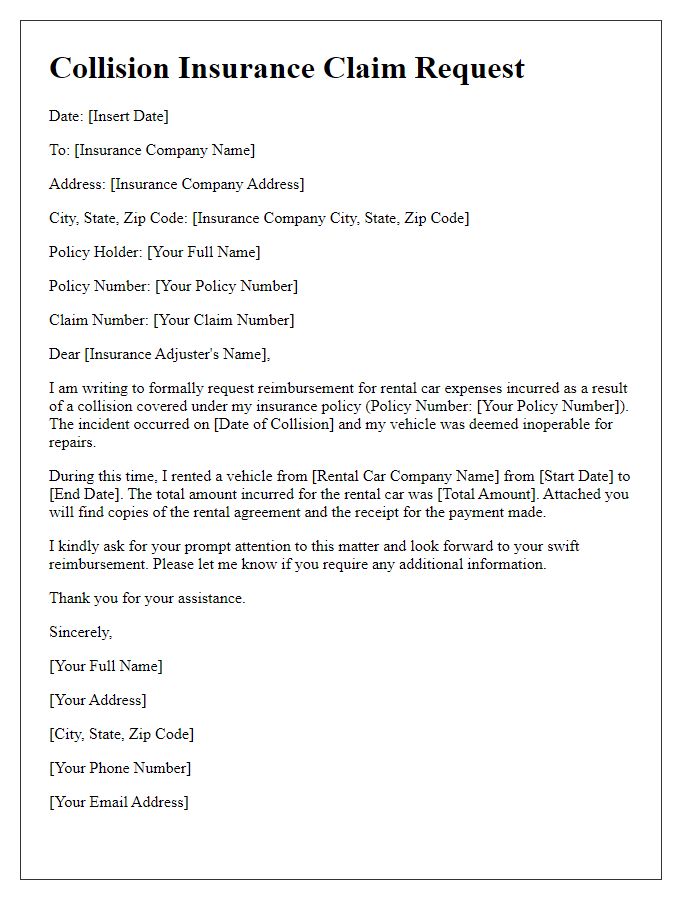

Letter template of collision insurance claim request for rental car reimbursement.

Comments