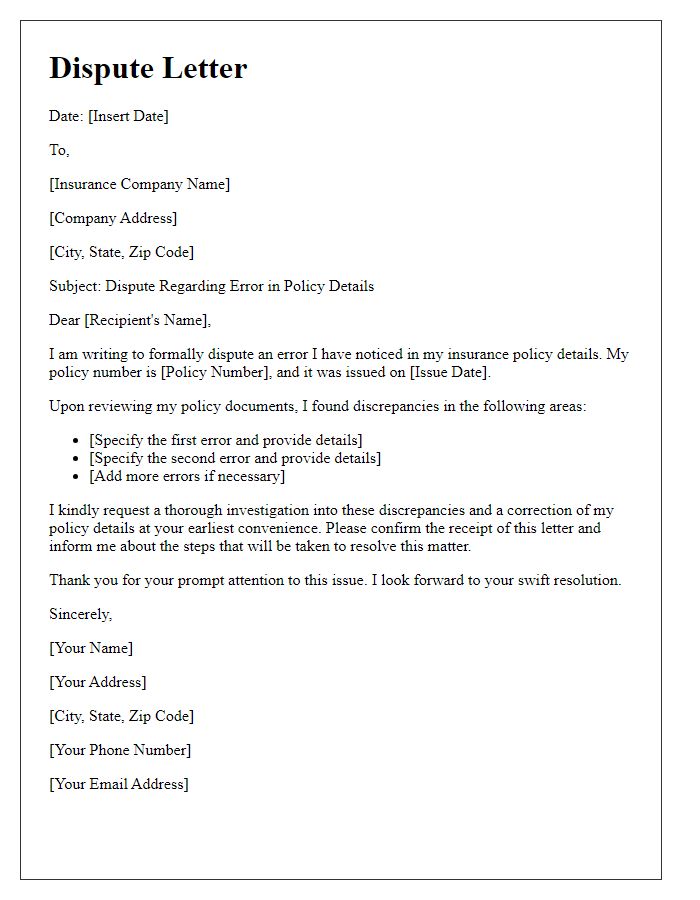

Are you feeling frustrated about the terms of your insurance policy? You're not alone; many people find themselves tangled in confusing clauses and restrictions that don't seem fair. It's essential to know your rights and how to effectively dispute any terms you believe are unjust. Stick around as we outline a powerful letter template to help you communicate your concerns clearly and assertively.

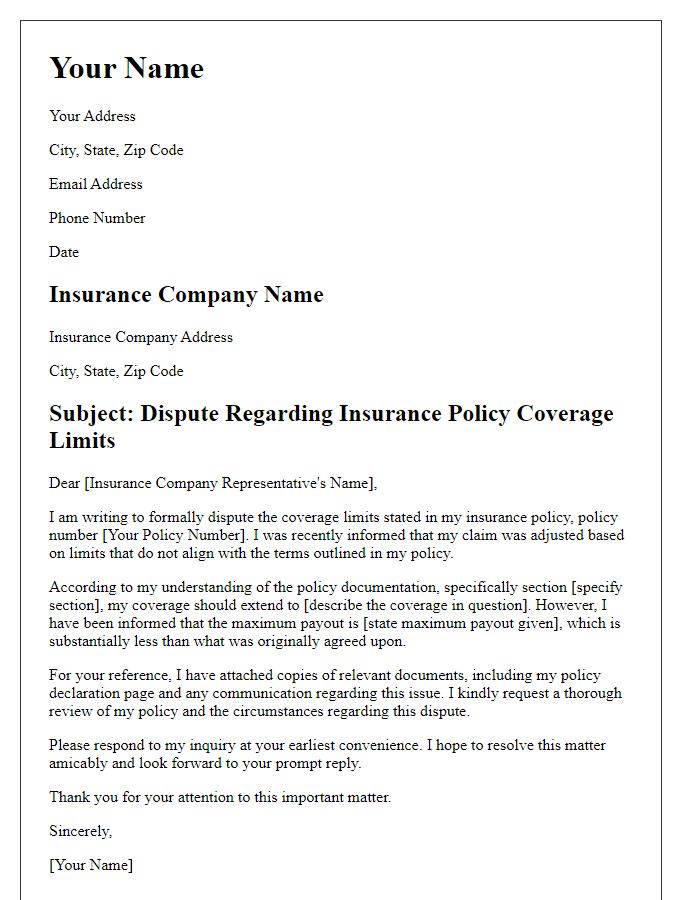

Clear Policy Reference

Disputes regarding insurance policy terms often arise from unclear language or misinterpretations within the policy document. For instance, the policy reference number might entail specific coverage details that are critical to evaluating claims. According to standard insurance practices, key clauses (like limitations and exclusions) should be explicitly defined to prevent misunderstandings. Trigger events, such as accidents or natural disasters, require precise definitions to determine coverage applicability (e.g., flood vs. water damage). Furthermore, states like California have regulatory frameworks that mandate transparency in policy terms, enhancing consumer protection. Clarity in these documents is essential, as vague language can lead to significant financial implications for policyholders.

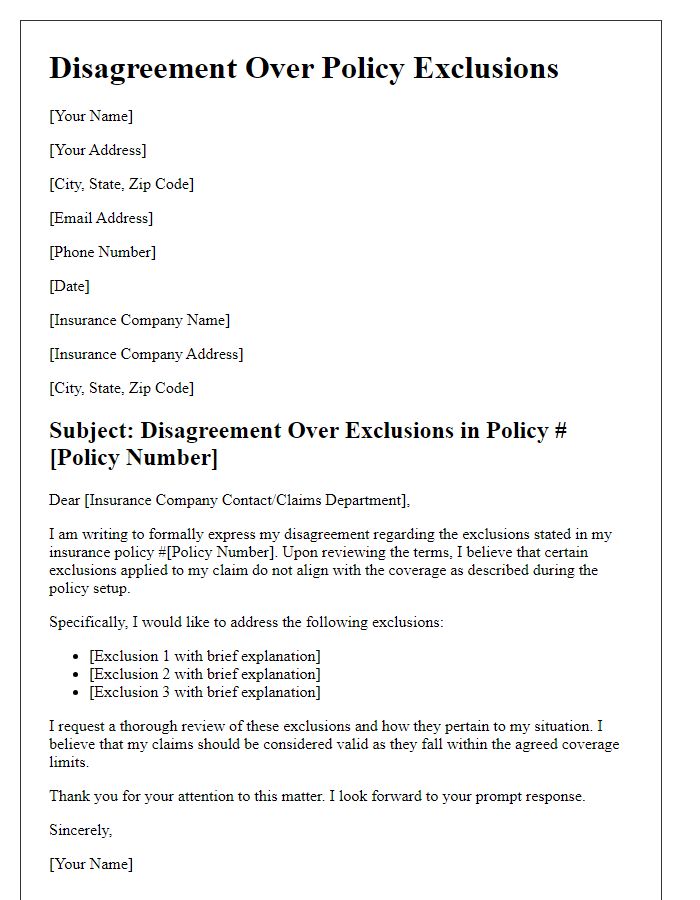

Specific Dispute Explanation

Disputes regarding insurance policy terms often arise due to misunderstandings or unclear clauses. An example of this can be seen in homeowner's insurance policies, which typically cover damages but may exclude specific natural disasters like floods or earthquakes. For instance, a policy issued by Acme Insurance Company in January 2021 might state that damages due to water intrusion from a leaky roof are covered, while damages resulting from flooding are not. A homeowner in Hurricane-prone Florida, purchasing a policy for $1,200 annually, might find themselves facing denial of claims following a storm if their policy explicitly excludes flood-related damages. Such exclusions can lead to significant financial repercussions, prompting disputes that require clear clarification of terms and coverage limits.

Relevant Documentation

Disputing insurance policy terms requires a comprehensive understanding of the specific provisions within the policy document, often referred to as the Declarations Page, and supporting evidence such as communication records, premium payment receipts, and documentation of the claims process. Policyholders must reference specific clauses (such as coverage limits or exclusions) that are being contested or misunderstood. Key dates, including the policy inception date and the dates of any claims filed, provide essential context for the dispute. Additionally, evidence illustrating compliance with policy requirements (like repair documentation or loss assessments) strengthens the case against any unfavorable interpretations from the insurer. Furthermore, correspondence with the insurance company, including dated letters or emails that outline previous discussions related to the disputed terms, can serve as critical corroborative documents that reinforce the policyholder's position.

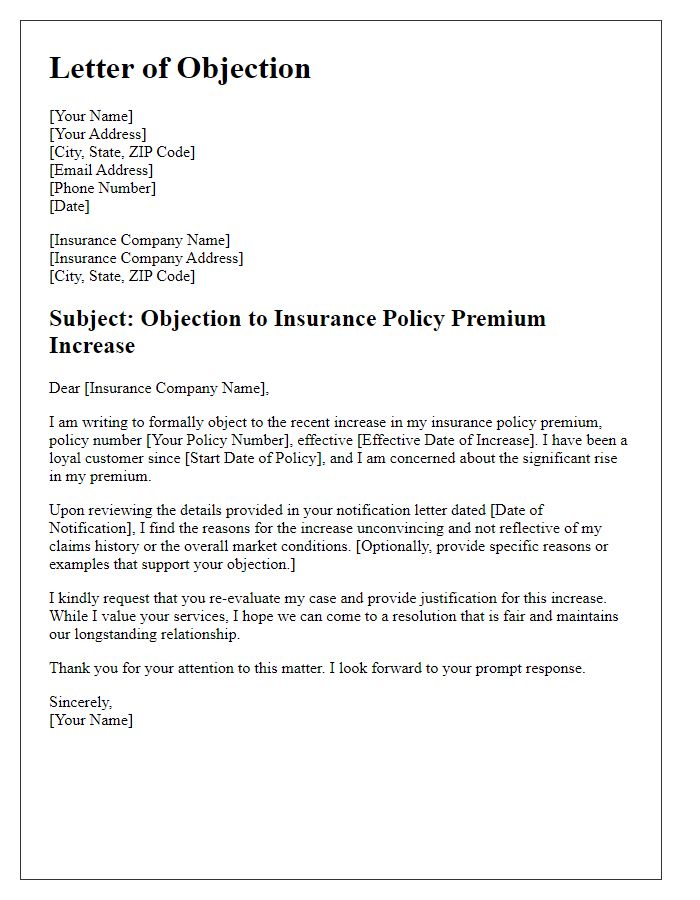

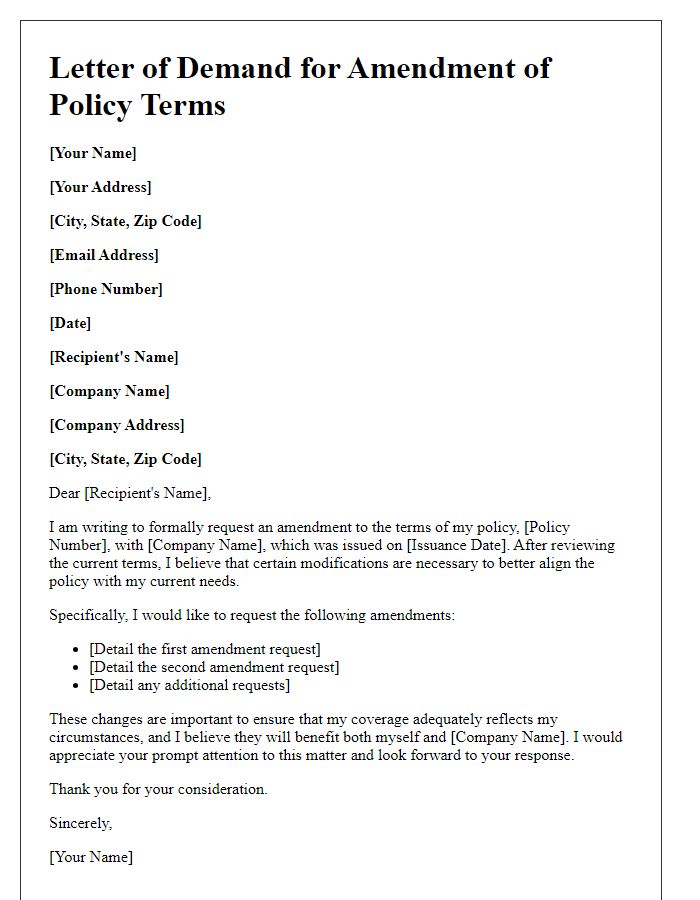

Requested Resolution

Disputing insurance policy terms can often lead to a complex situation involving numerous details, and understanding the specifics is essential for a successful resolution. Insurance policies, such as those governed by state regulations in the United States, often contain clauses detailing coverage limits, deductibles, and exclusions. When disputing such terms, policyholders should reference specific sections of the policy document dated January 2023, which may outline coverage definitions. Examples of disputed terms might include limitations for specific events, such as theft or natural disasters like hurricanes, where the policy limit may significantly affect the payout amount. The resolution sought could involve clarifying ambiguous language or seeking amendments to benefit from a comprehensive coverage plan. In these cases, contacting the insurance provider, often based in locations like Hartford, Connecticut, may be necessary to facilitate further discussion or escalate the issue. Documenting all communication, along with evidence supporting the dispute, strengthens the case for revisiting the terms.

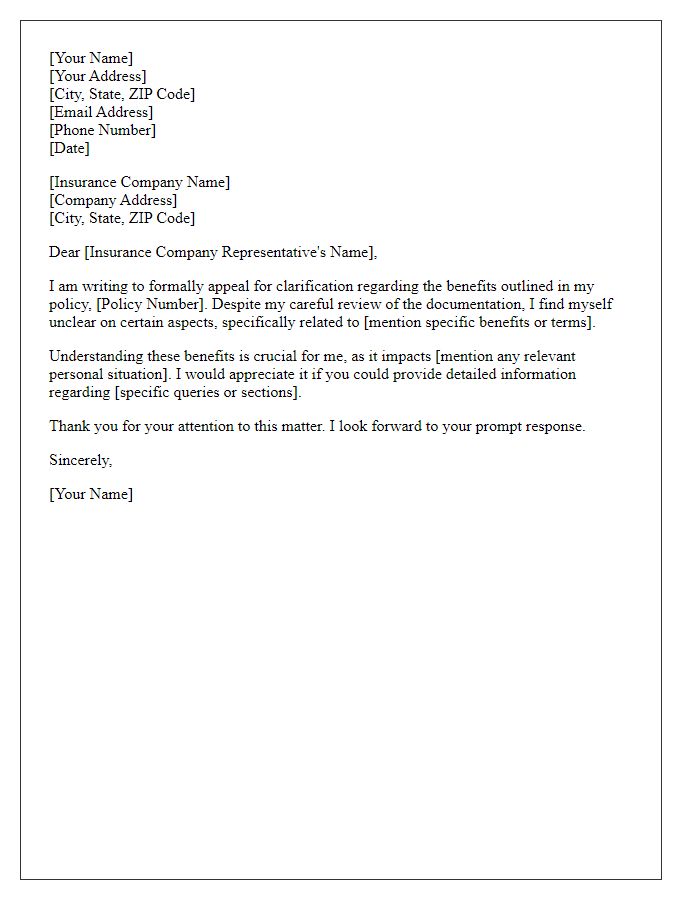

Contact Information and Timeline

Disputing insurance policy terms requires careful documentation and clarity. It is essential to gather relevant contact information, including policy numbers and customer service representatives' contacts. Establish a clear timeline detailing events, such as the initial policy signing date, any amendments made, and key communications with the insurance provider. Highlight specific incidents that triggered the dispute, like claim denials or policy interpretations. Necessary documentation may include the original policy agreements, correspondence with agents, and any evidence supporting the claim. Keep all information organized to facilitate the dispute process effectively.

Comments