Are you navigating the complexities of naming additional insureds in your insurance policies? Understanding how to effectively implement a naming policy can save you time, money, and potential legal troubles in the long run. With the right letter template, you can streamline the process and ensure that all parties involved are protected and informed. Ready to learn more about creating a foolproof naming policy?

Clear identification of involved parties

In a naming policy for additional insured status, clear identification of involved parties is crucial. Naming policies typically include the primary policyholder, which may be a business or individual with the liability insurance, and the additional insured entities, which could be subcontractors, clients, or partners requiring protection under the primary policy. This identification should include complete legal names, physical addresses, and specific roles in the relationship, such as project contractor, lessee, or property owner. Accurate identification minimizes ambiguity and ensures that all parties understand their coverage limits and obligations. Including the policy number and effective dates also strengthens clarity and accountability.

Detailed description of coverage scope

The additional insured endorsement expands the existing liability coverage of an insurance policy, specifically designed to protect third parties in numerous scenarios, such as subcontractors working on construction projects or landlords requiring coverage for tenants. This added provision typically covers general liability exposures, including bodily injury, property damage, and personal injury, ensuring financial protection against claims resulting from operations performed by the additional insured. For instance, under a commercial general liability policy, the additional insured may benefit from coverage limits of $1 million per occurrence and $2 million in the aggregate. Specific situations that may trigger coverage include premises liability, ongoing operations, and completed operations exposures. Such endorsements often require written notification of claims and adherence to the policy's terms, ensuring that all parties understand the breadth and limitations of the coverage.

Specific policy numbers and terms

A naming policy for additional insured status typically includes specific insurance policy numbers, terms of coverage, and acknowledgment of parties involved. A standard liability insurance policy (usually General Liability) may number such as GL12345678 could be stipulated for the primary insured's coverage. Furthermore, terms of coverage would specify protection against liability claims, which may arise from accidents occurring during the policy period from January 1, 2023 to December 31, 2023. The policy would also dictate the nature of relationships between the parties, such as subcontractors or vendors, establishing the additional insured's right to coverage under the primary policy in the event of a claim.

Effective dates and policy duration

Effective dates are critical in the context of naming additional insured parties on liability policies. The inception date signifies when coverage begins, often specified to align with contract requirements, such as construction agreements or service contracts, typically spanning one year. Policy duration determines how long the additional insured status remains active, commonly reflecting the primary policy term. For ongoing projects or events, renewal notices should be sent before the policy reaches expiration, maintaining uninterrupted coverage for named entities. Accurate documentation of these terms is essential for compliance with contractual obligations and risk management practices.

Compliance with legal and regulatory standards

Compliance with legal and regulatory standards is crucial for businesses that seek to mitigate liability and protect their interests effectively. The additional insured endorsement, often required in policies such as general liability coverage, helps safeguard organizations against legal claims. This is particularly significant in high-risk industries, such as construction or events management, where numerous stakeholders, including subcontractors and vendors, can be involved. Ensuring adherence to state specific regulations, such as California's Civil Code Section 2782, mandates that contracts explicitly state the additional insured provision. Documentation of this compliance is essential for risk management and can influence insurance premiums and claims processes. Properly naming an additional insured in policy documents, combined with routine audits, can enhance legal protections and ensure alignment with industry standards, fostering comprehensive risk mitigation strategies.

Letter Template For Naming Policy Additional Insured Samples

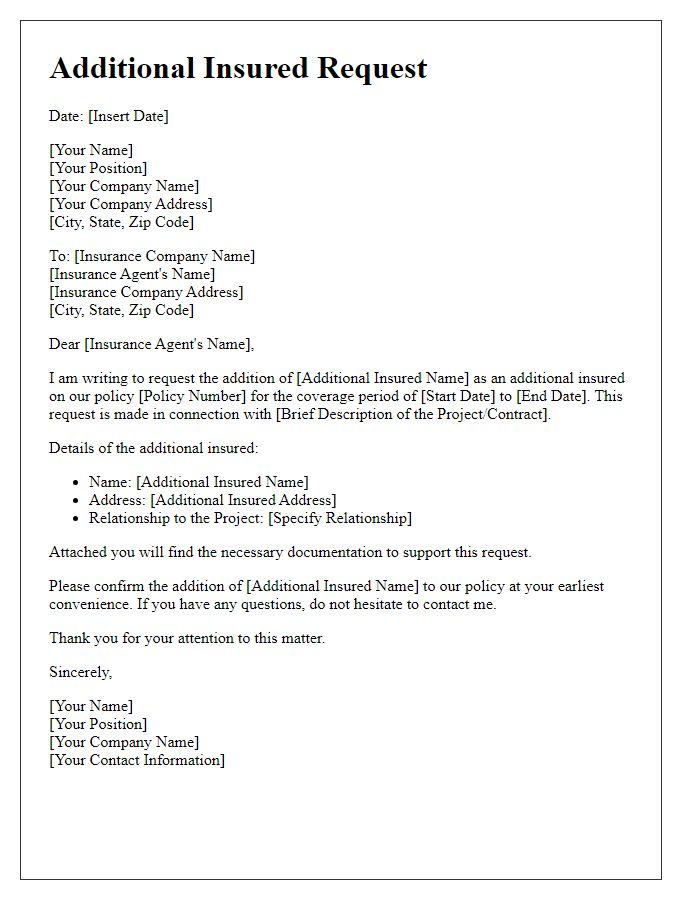

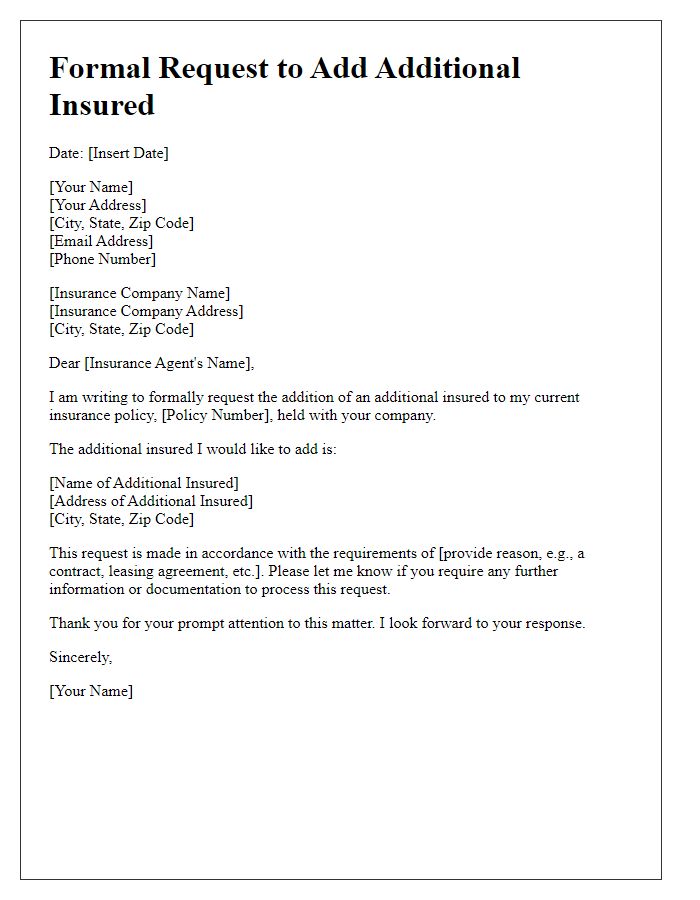

Letter template of additional insured request for naming policy endorsement.

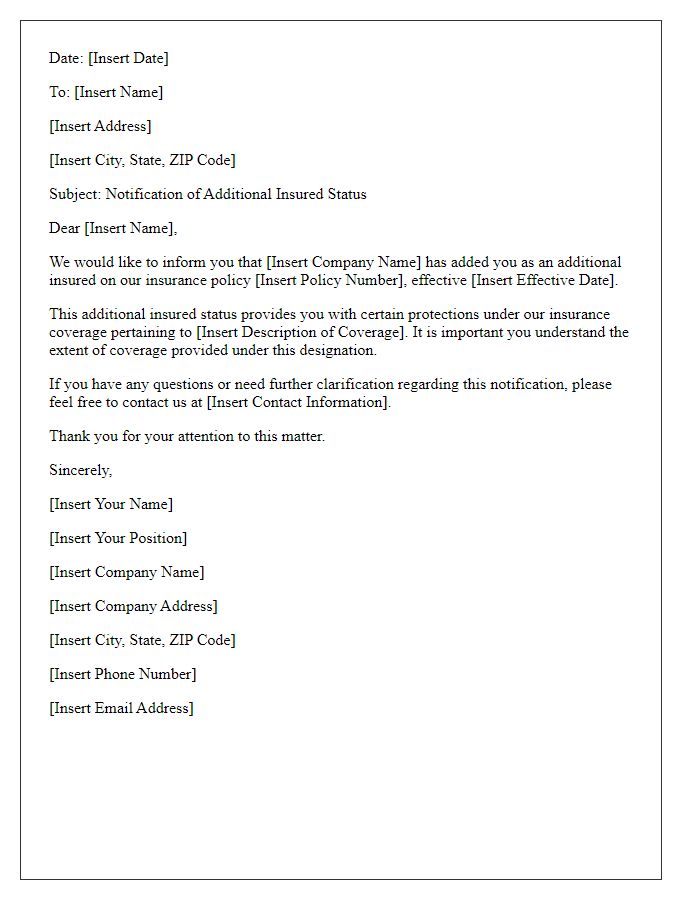

Letter template of notification for additional insured status on insurance policy.

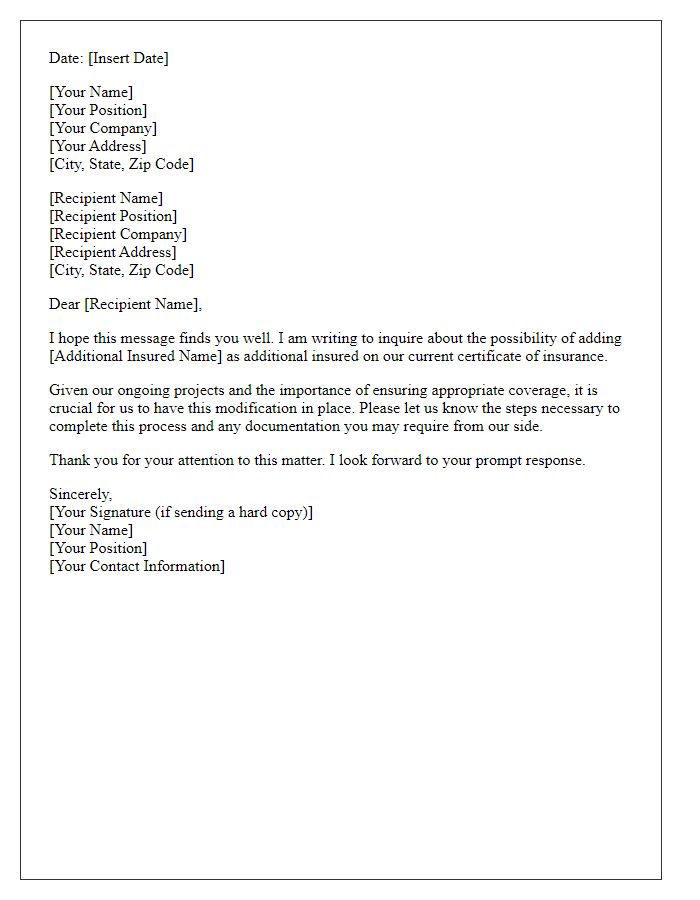

Letter template of inquiry regarding naming additional insured on certificate.

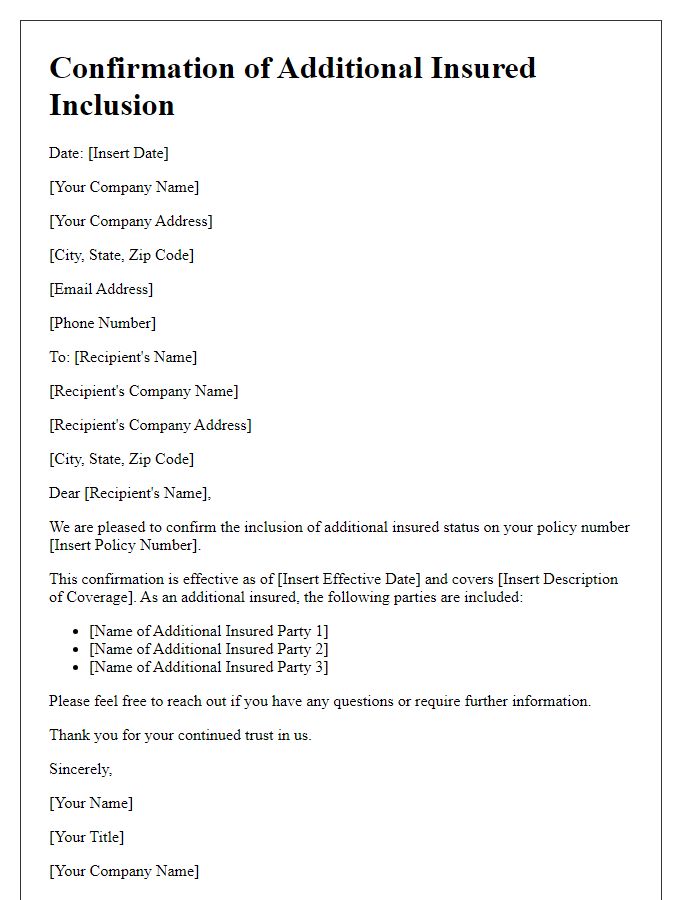

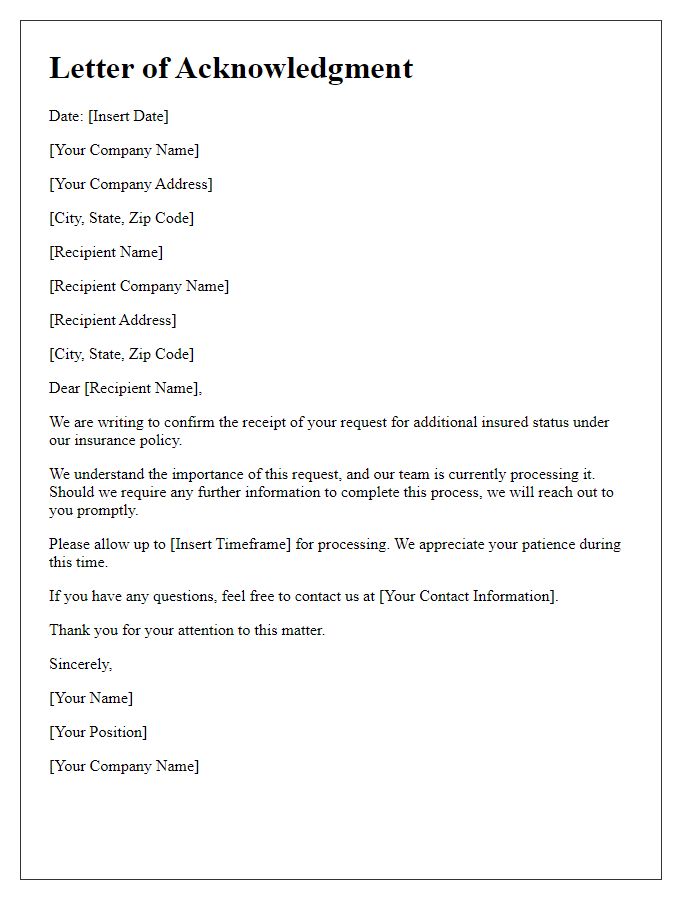

Letter template of confirmation for additional insured inclusion in policy.

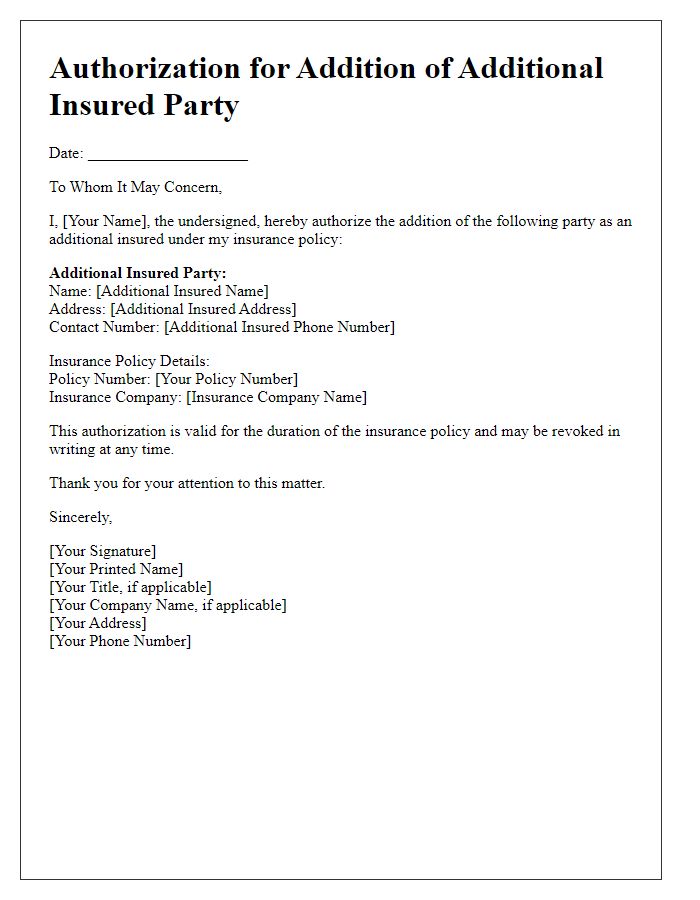

Letter template of Authorization for addition of additional insured party.

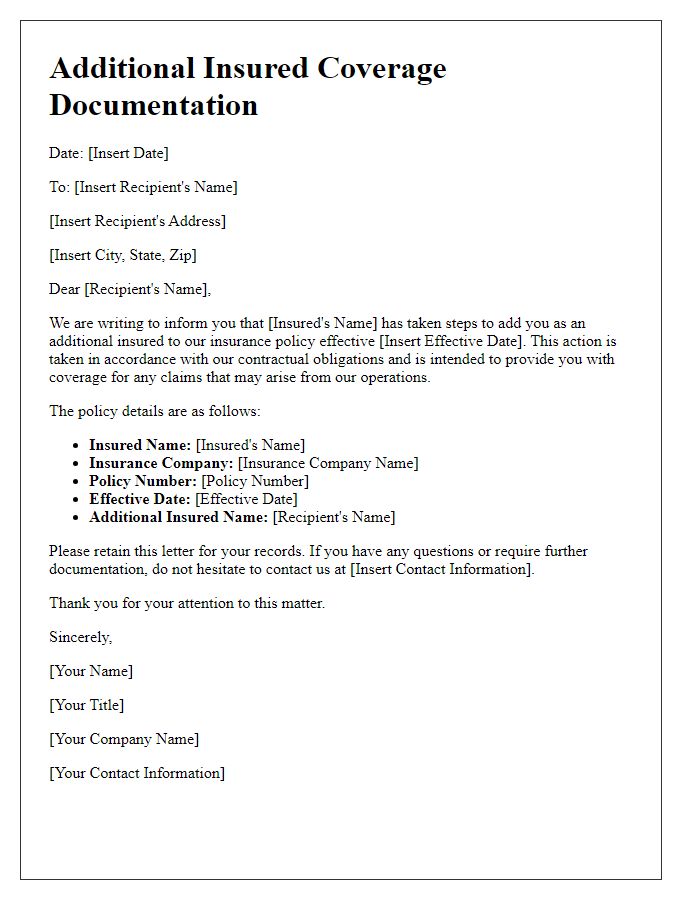

Letter template of documentation for adding additional insured to coverage.

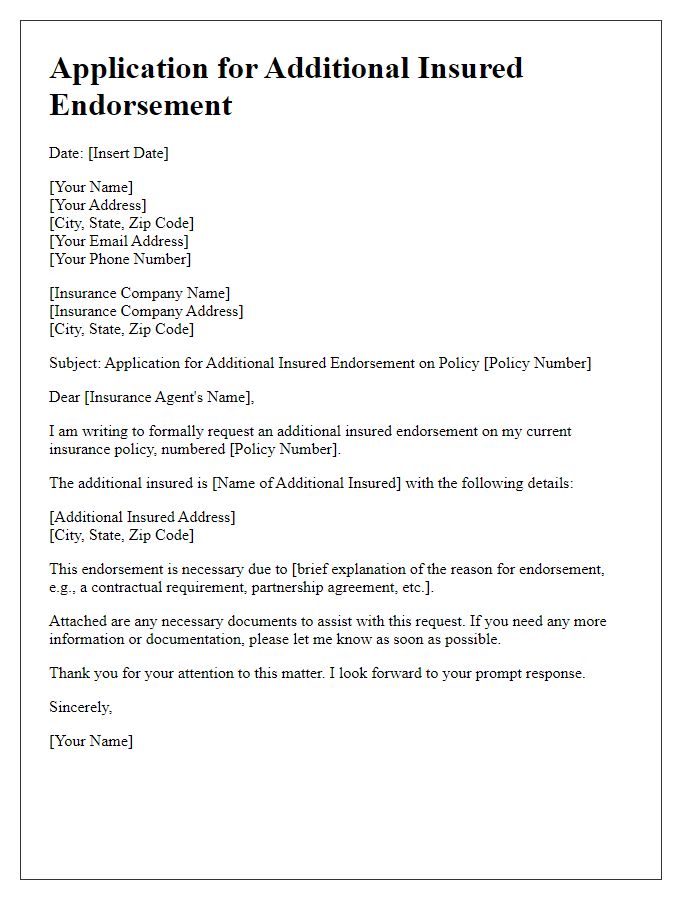

Letter template of application for additional insured endorsement on policy.

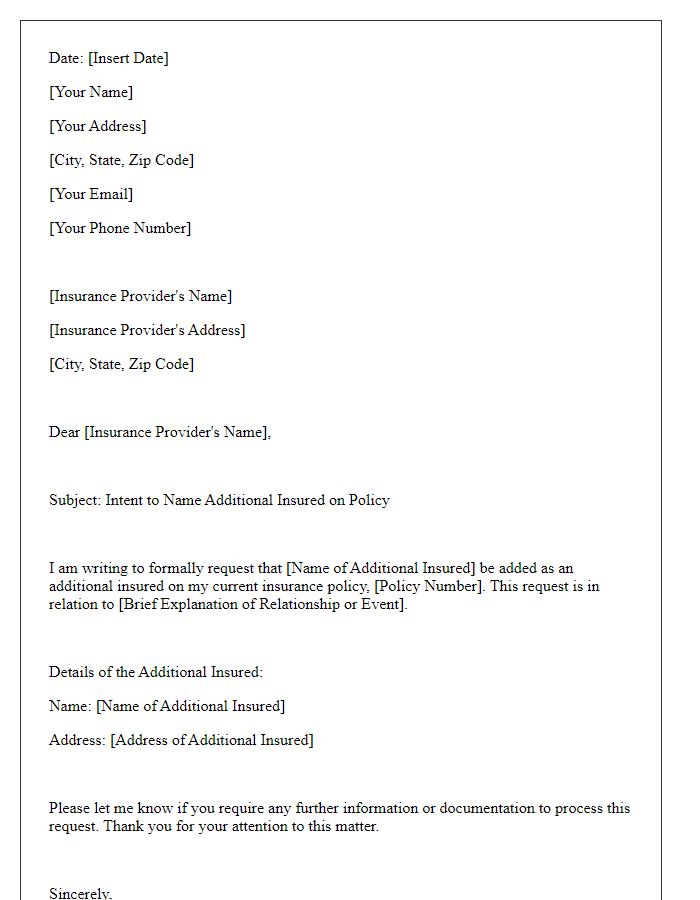

Letter template of intent to name additional insured on an insurance policy.

Comments