Are you looking to file a recreational vehicle insurance claim but not sure where to start? Navigating the claims process can seem overwhelming, but with the right guidance and a clear template, it can be much simpler than you think. In this article, we'll walk you through everything you need to know to craft the perfect letter for your RV insurance claim, ensuring you provide all necessary details to get the compensation you deserve. Let's dive in and get you one step closer to smooth sailing on your next adventure!

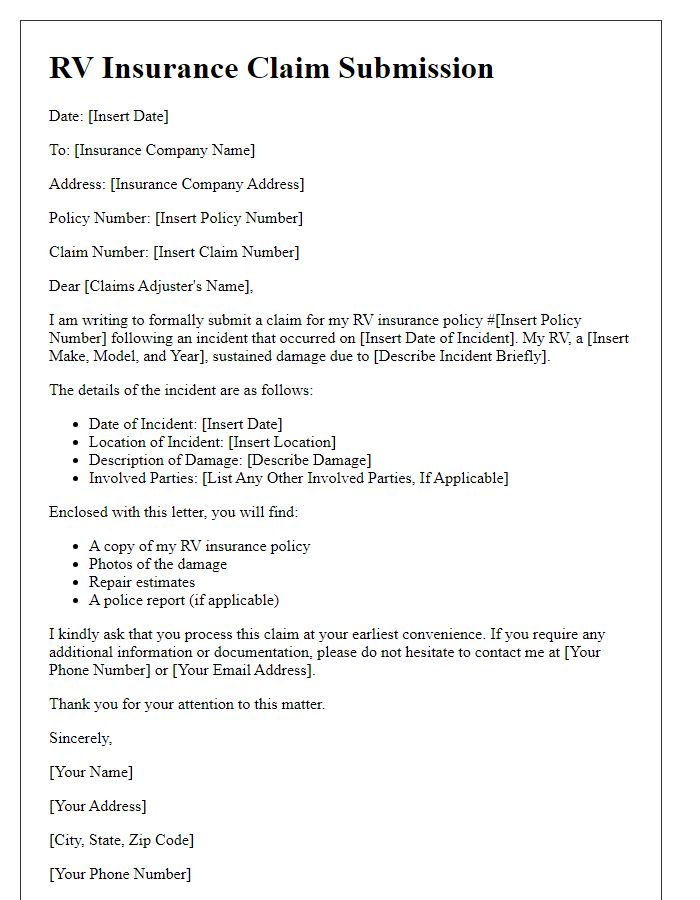

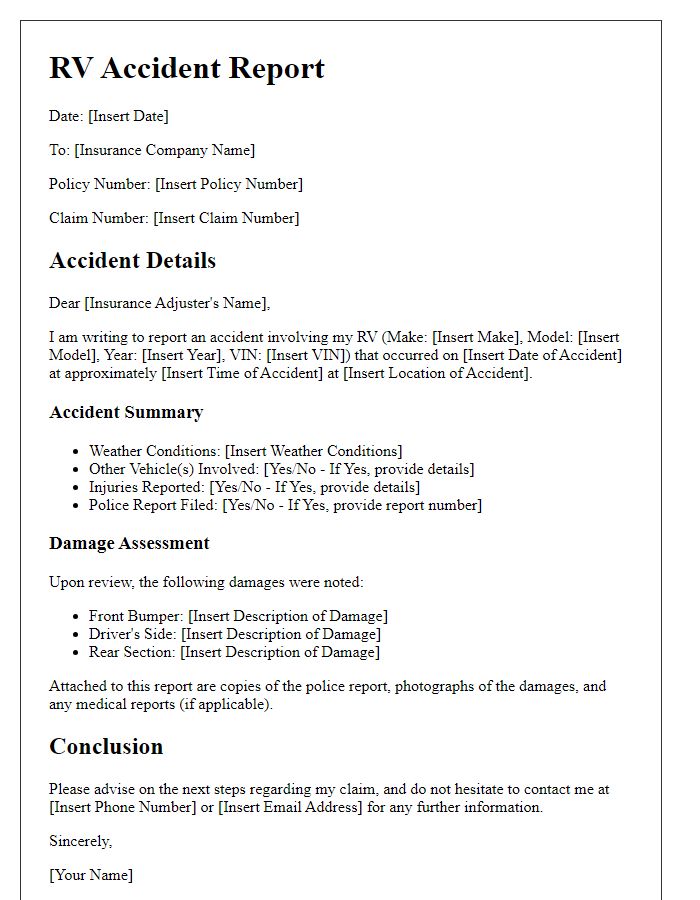

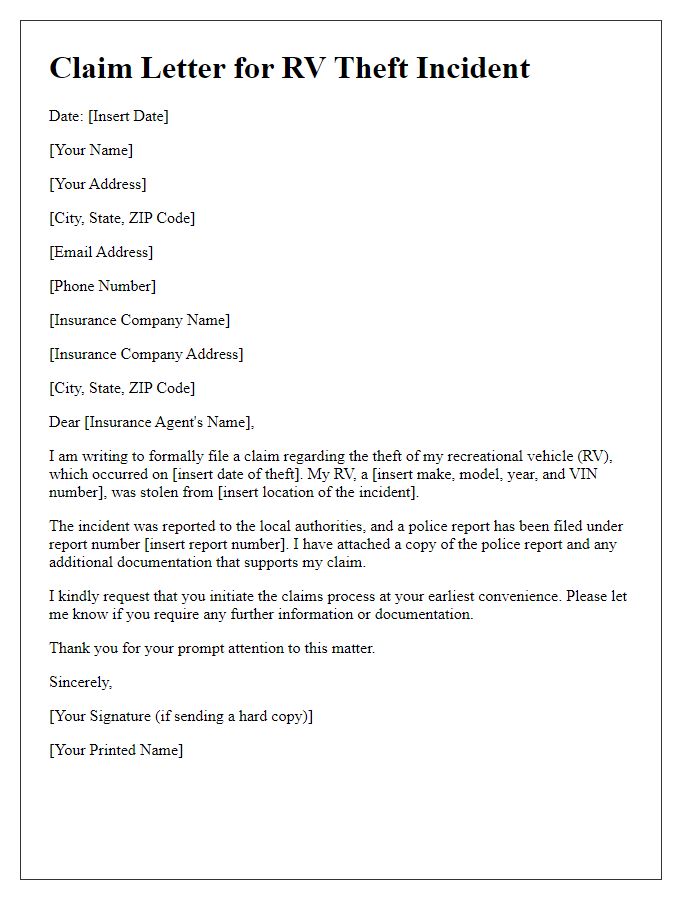

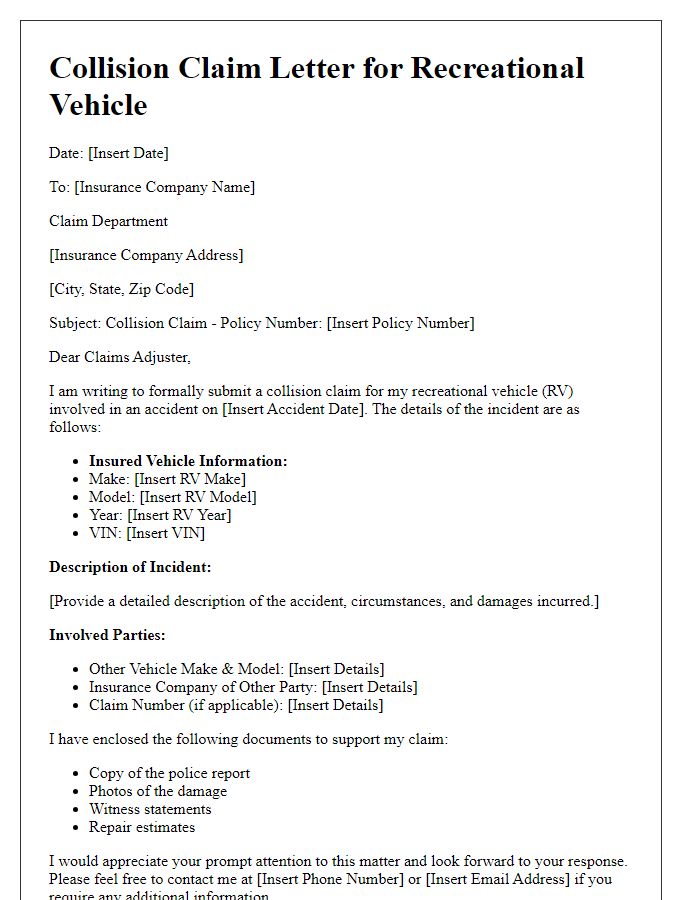

Clear identification of policyholder and policy details

Recreational vehicle (RV) insurance claims require precise identification of the policyholder along with relevant policy details to facilitate processing. The policyholder's name, usually a legal designation appearing on the insurance documentation, must be clearly stated. An associated unique policy number acts as a reference for specific coverage terms, which may include collision, comprehensive, and liability. Additionally, the make, model, and year of the RV, as well as the vehicle identification number (VIN), are crucial details that help verify the insured item. Include the date of the incident and a detailed description of the circumstances leading to the claim, supplementing with photographs and any law enforcement reports if applicable, to enhance the credibility of the claim submission.

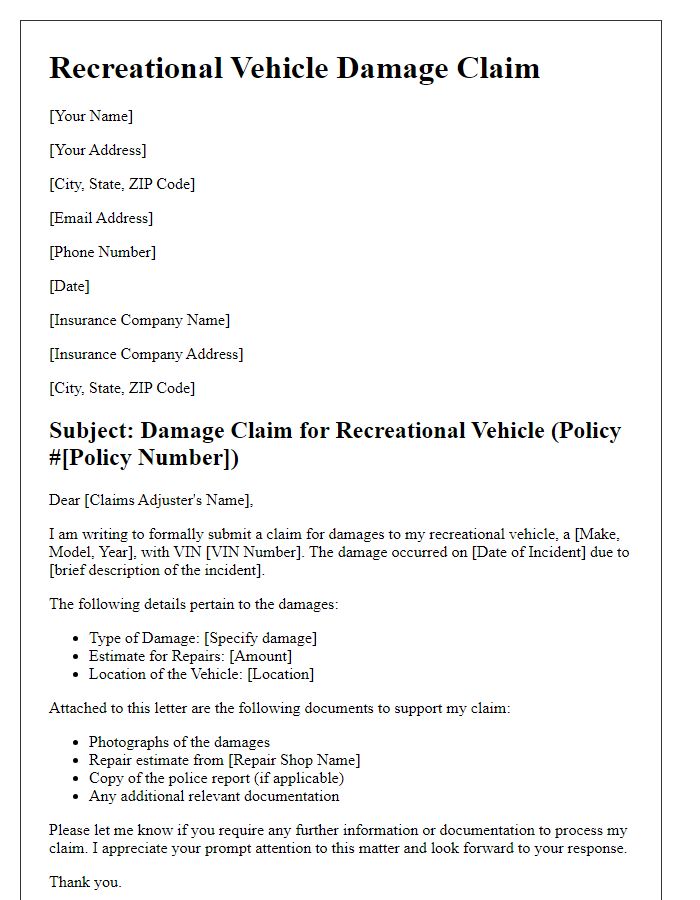

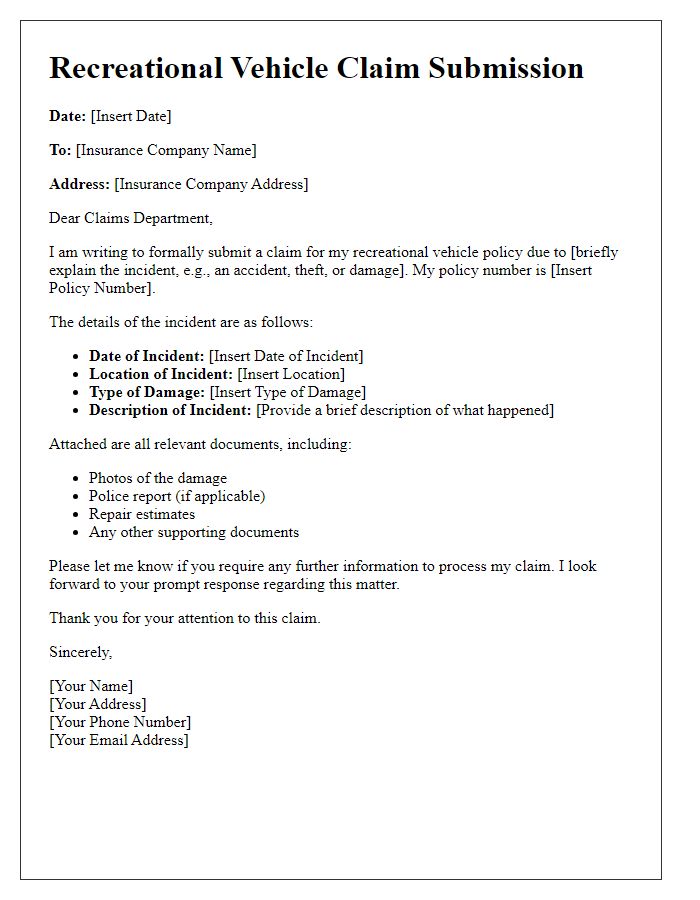

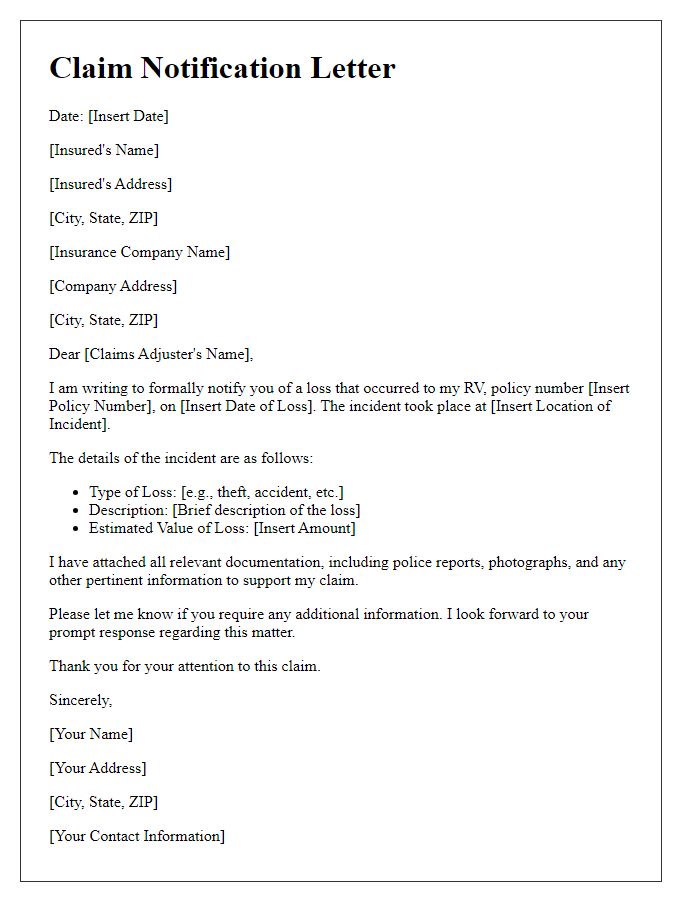

Detailed description of the incident or damage

A recreational vehicle (RV), specifically a 2021 Winnebago Adventurer, sustained significant damage due to a collision with a fallen tree branch during a severe thunderstorm on July 15, 2023. The incident occurred at Lake Tahoe, Nevada, where winds exceeded 60 miles per hour. The 14-foot long, 3-foot diameter branch struck the driver's side, causing dents and paint scratches along the side panel. Additionally, the impact compromised the window frame, resulting in a crack in the double-pane glass, which poses a risk of water leakage during future storms. The RV's roof, designed to provide ventilation, also suffered damage, with the impact bending the edge and creating concerns for future weather resistance. Immediate repairs are necessary for proper functionality and safety.

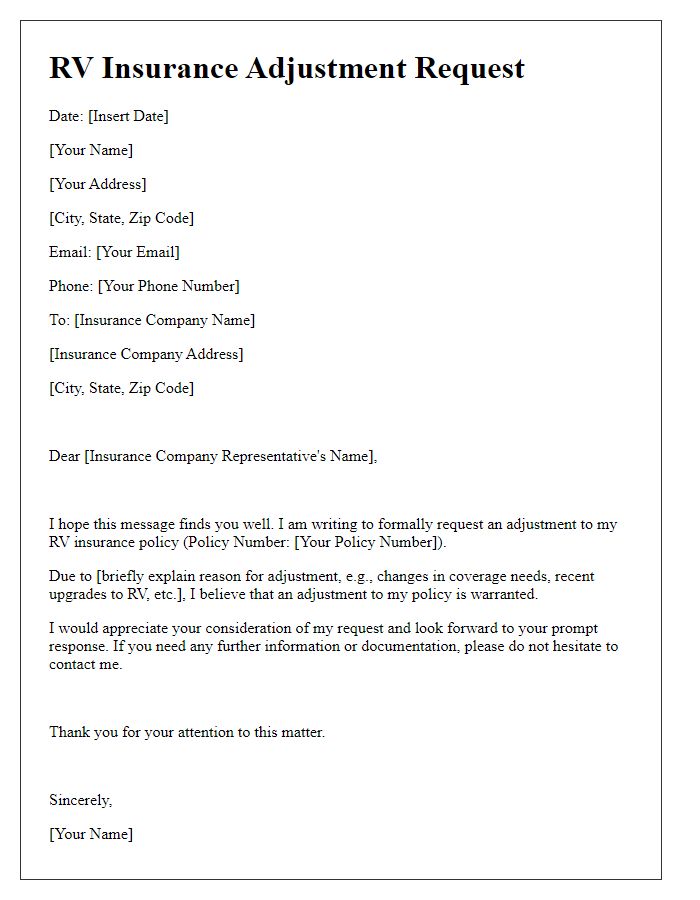

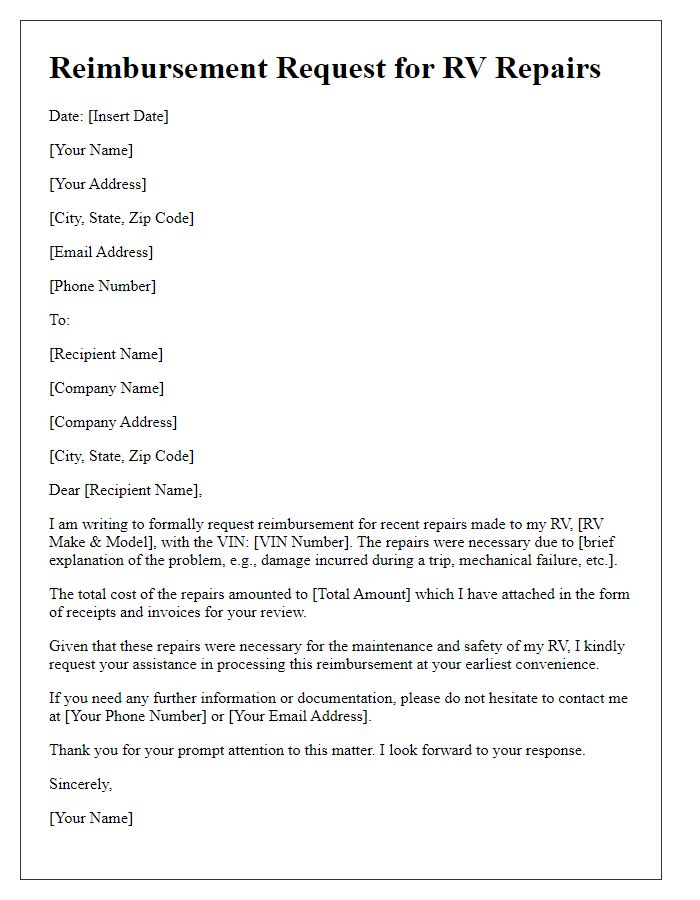

Comprehensive list of damages or losses incurred

Severe weather events, particularly hurricanes or hailstorms, can result in extensive damage to recreational vehicles (RVs) like motorhomes and travel trailers. Common damages include shattered windows from hail (usually ranging from 1 to 4 inches in diameter), punctured roofs caused by fallen debris, and water intrusion leading to interior mold growth. Additionally, collisions or accidents may cause structural damages such as bent frames or damaged axles, requiring costly repairs. Theft incidents could involve stolen valuable items like portable electronics or custom equipment, estimated to cost thousands of dollars. Comprehensive assessments often report estimated losses totaling up to $30,000, depending on the severity of incidents and the specific RV model's value.

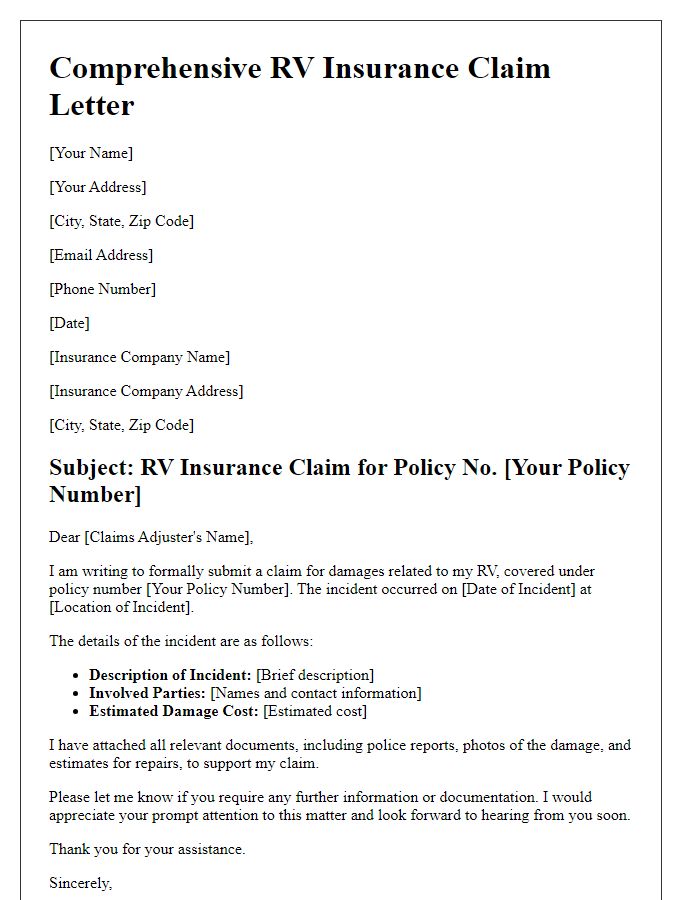

Supporting documentation and evidence (photos, police reports)

Recreational vehicle insurance claims require comprehensive supporting documentation to facilitate the claims process efficiently. Essential items include high-resolution photographs capturing the damage to the RV (recreational vehicle), ideally taken from multiple angles (front, sides, rear) to provide a thorough visual assessment. Police reports, particularly relevant in instances of theft or accidents involving other vehicles, must be included to validate the incident's details and establish timelines. Additional documentation may consist of repair estimates from certified mechanics, ownership proof (such as the title or registration), and any previous maintenance records. Detailed descriptions of the incident, including the date (e.g., March 15, 2023) and location (specific street address or highway name), enhance the clarity of the claim. Compiling this evidence systematically ensures a smooth and prompt review process, aiding in swift claim resolution.

Contact information for further communication

Filing a recreational vehicle (RV) insurance claim requires clear contact information to facilitate further communication. Ensure accurate details of your primary contact number (e.g., mobile or landline), email address (professional or personal), and physical address (including city, state, and zip code) are provided. The insurance provider, such as Geico or Progressive, often requests these details to expedite the claim process. Consider adding a secondary contact person's information if necessary, and specify preferred communication method with the insurer for efficient updates regarding the status of the claim. Always keep records of communication for future reference.

Comments