If you've ever felt frustrated after receiving a negative review from your insurance provider, you're not alone. Many individuals encounter situations where their claims are not processed to their satisfaction, leading to feelings of disappointment and confusion. Writing an appeal letter can be a powerful way to express your concerns and seek a resolution. So, let's dive into how to craft an effective appeal letter that can help you regain the confidence and support you deserveâread on for tips and templates!

Precise Policy Information

Insurance appeals often require clarity and specific details to ensure successful resolution. Policy numbers (usually a combination of letters and numbers unique to each customer) play a crucial role in identifying the account. Claim dates, such as the submission date (formatted as MM/DD/YYYY), must be included for accurate tracking of processing timelines. The reasons for appeal should be clearly articulated, referencing specific policy terms such as coverage limits and exclusions. Clear communication of the nature and circumstances of the claim can help contextualize the request. It is vital to include the contact information for customer service representatives at the insurance company, facilitating follow-up and resolution. Additionally, citing relevant case numbers from previous communications can streamline processing.

Claim Details and Reasons

Submitting an insurance appeal following an unfavorable review often revolves around specific claim details and underlying reasons. Claim numbers serve as unique identifiers for efficient tracking, while dates of the incident and subsequent communications provide crucial context. Detailed descriptions of the events leading to the claim highlight the circumstances behind the request for compensation. Key reasons for the appeal may include perceived inconsistencies in the initial assessment, overlooked documentation, or a lack of clear justification for the decision made. Additionally, policy number and coverage limits play significant roles in outlining the entitlement to claims. Supporting documents, such as photographs, witness statements, or repair estimates, enhance credibility and strengthen the appeal's foundation.

Supporting Documentation

In the process of appealing an insurance decision, thorough supporting documentation is essential for bolstering your argument. Collect relevant records such as policy documents outlining coverage terms, medical reports detailing treatment received, and correspondence logs with your insurance company, marking dates and discussions relating to your claim. Include evidence of expenses incurred, like receipts for medical fees or repair costs, to substantiate your financial impact. Mistakes in claims handling should be documented; for example, note the date of any insufficient explanations given for claim denials. Additionally, testimonials from medical professionals or industry experts could strengthen your case by providing insight into the necessity of the treatments or services rendered. Organizing this information neatly into a comprehensive package will help clarify your perspective and reinforce your appeal.

Appeal Argument and Rationale

A well-documented insurance appeal can increase the chances of a successful review response. The claim denial often stems from specific criteria within the insurer's policy, making it essential to highlight relevant policy details. Gather supporting documents, including medical reports or photographs, to substantiate your case. Clearly outline the reasons for disagreement with the denial, referencing the policy language that supports your argument. Provide evidence of prior claims accepted under similar circumstances, demonstrating consistency in the insurer's previous decisions. Use a professional tone throughout the appeal while maintaining clarity. Specify the desired outcome, whether it be coverage reinstatement or further investigation into the claim. Promptly submit the appeal within the designated timeframe to comply with policy requirements and maintain the validity of your request.

Contact Information and Follow-up Plan

A comprehensive insurance appeal letter should include clear contact information for the policyholder and the insurance company, alongside a detailed follow-up plan for addressing the previous negative review. Essential details such as the policy number, the date of the incident, and the nature of the claim should be included to provide context. The policyholder's contact information should consist of the full name, address, phone number, and email address. The insurance company's contact details must feature the name of the representative handling the case, the company's address, and a direct phone number for efficient communication. The follow-up plan should outline specific dates for follow-up calls or emails to ensure the appeal's progress, emphasizing the importance of timely communication and resolution.

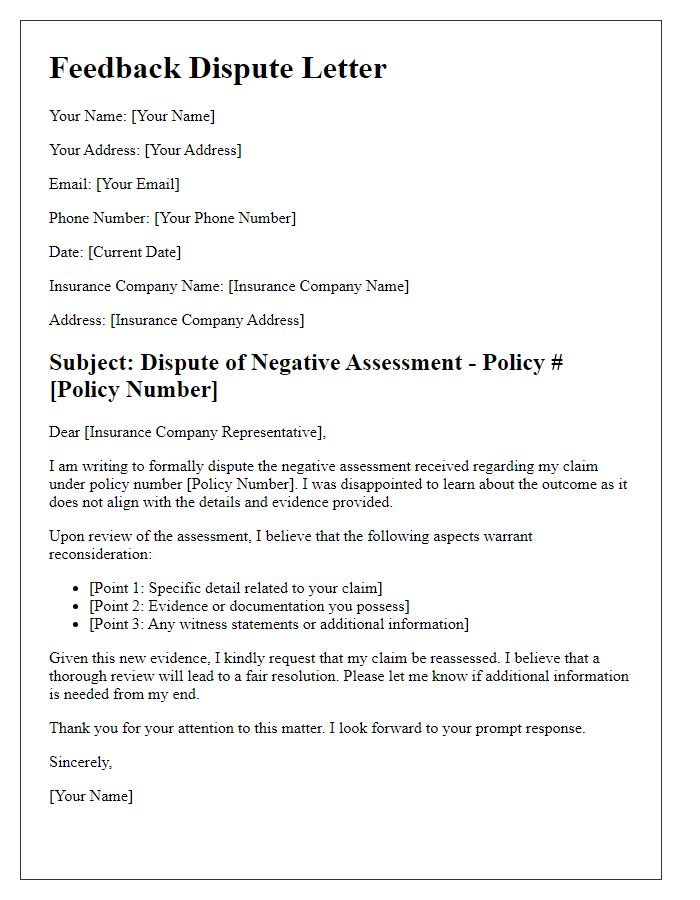

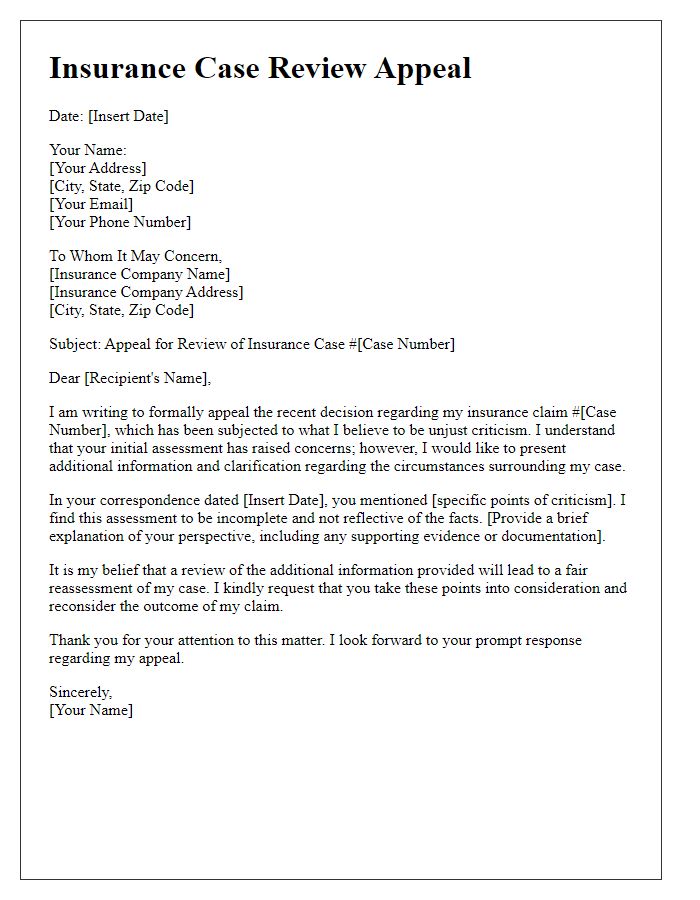

Letter Template For Insurance Appeal After Bad Review Samples

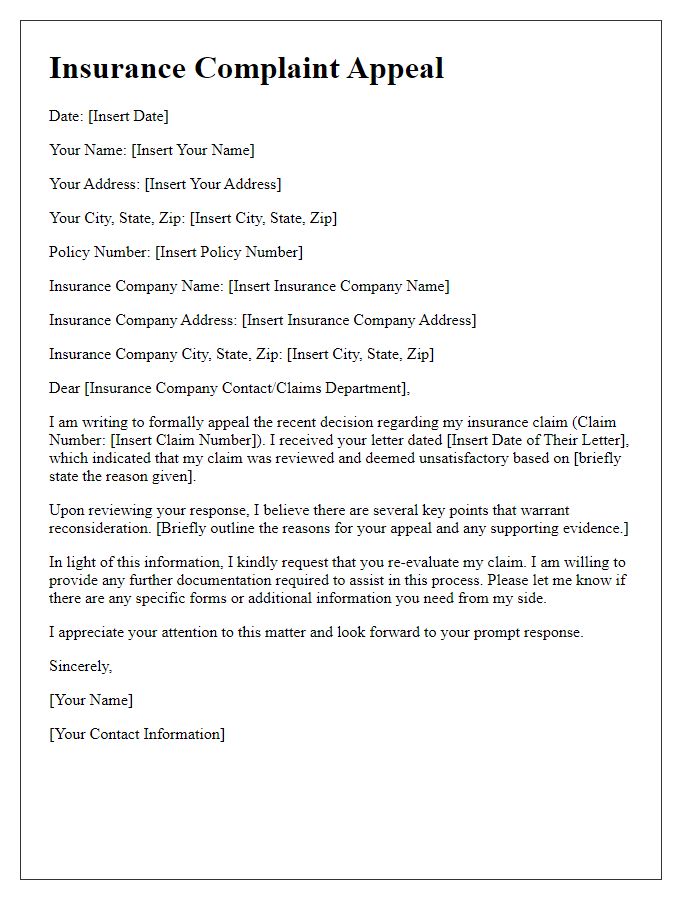

Letter template of insurance complaints appeal following unsatisfactory review

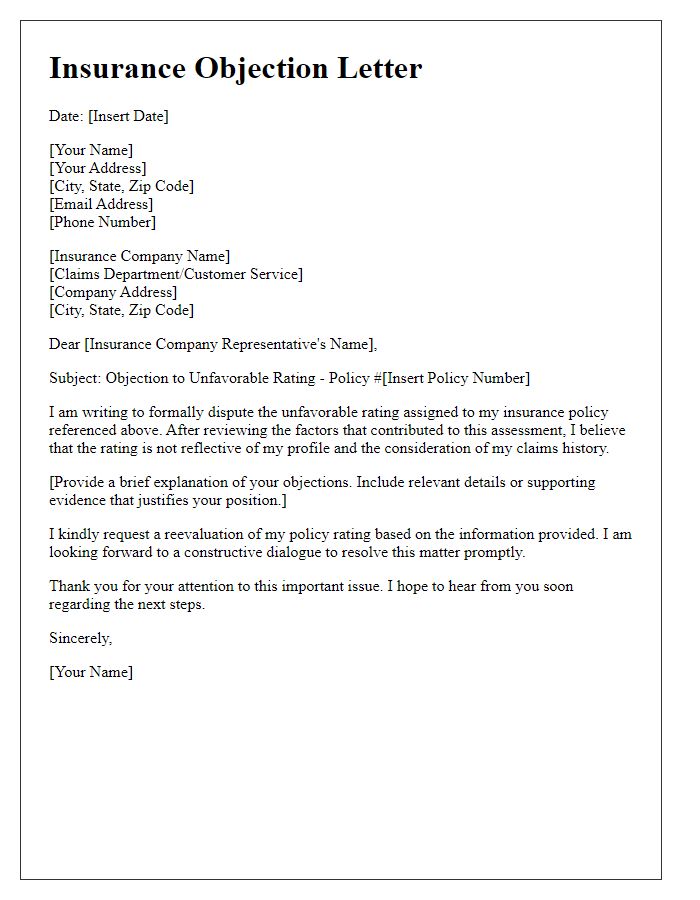

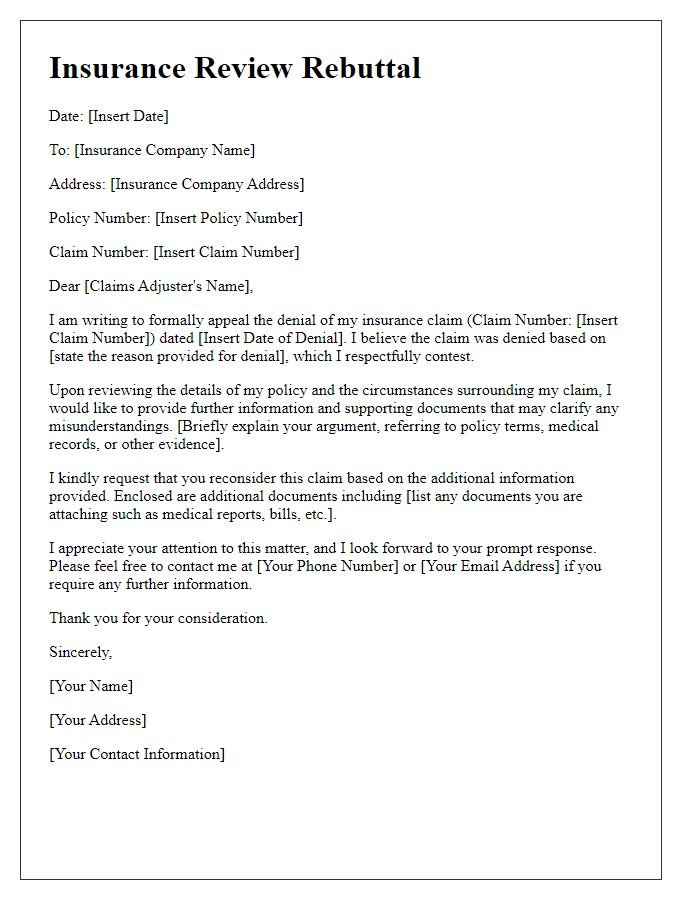

Letter template of insurance objection letter in response to unfavorable rating

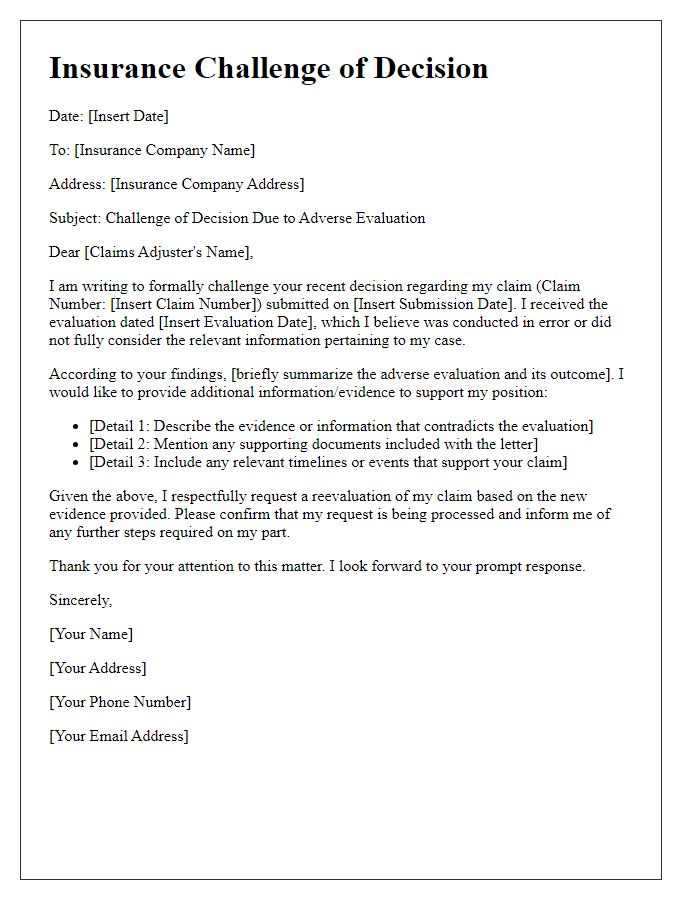

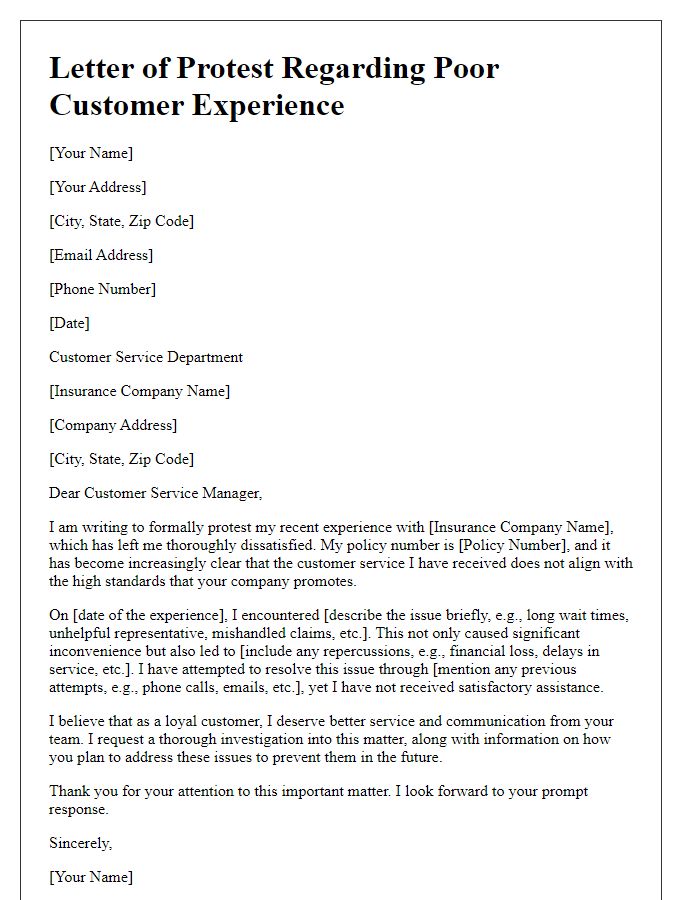

Letter template of insurance challenge of decision due to adverse evaluation

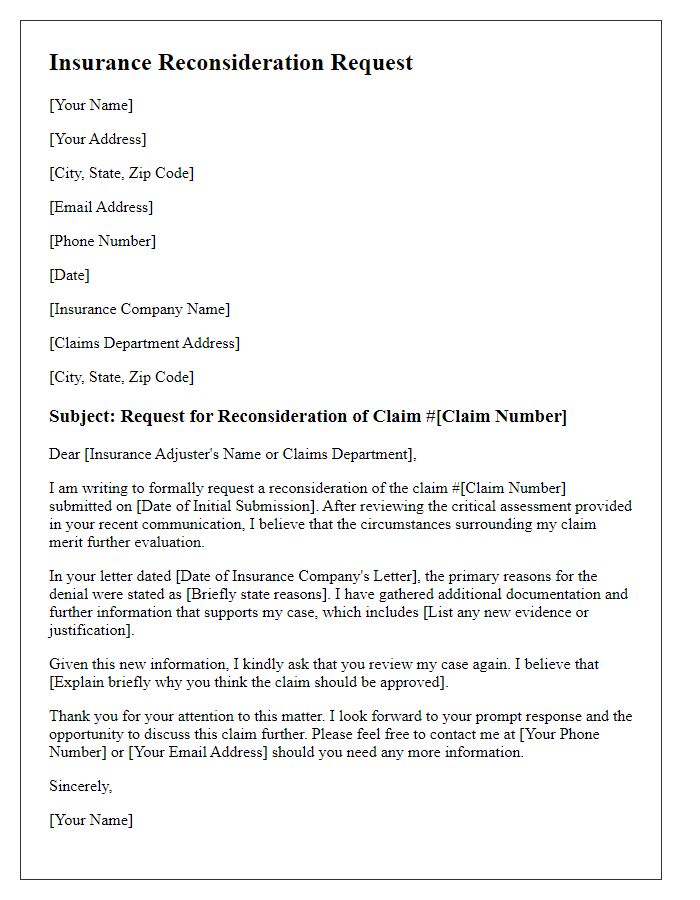

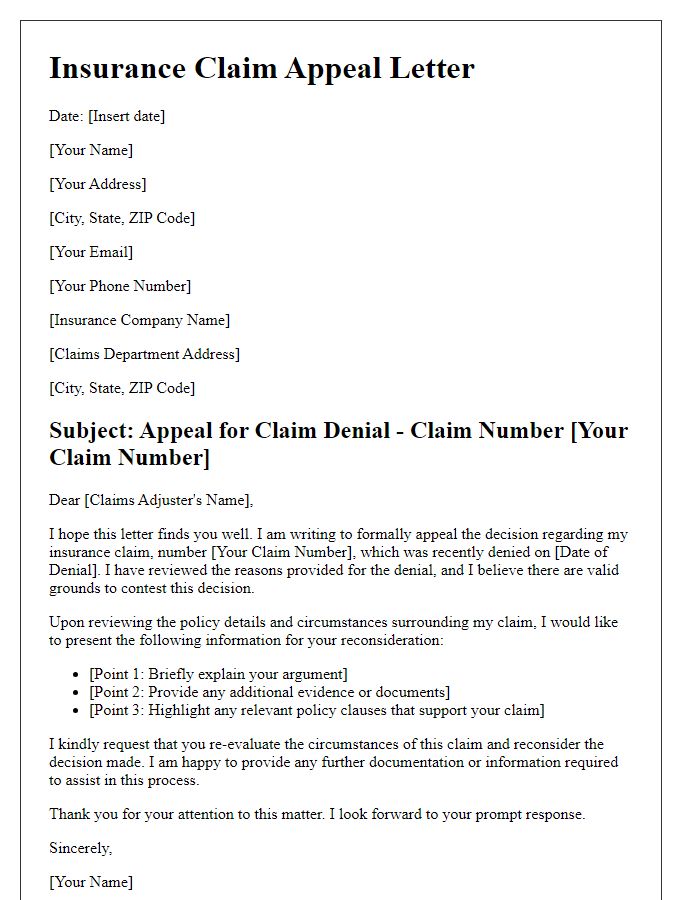

Letter template of insurance reconsideration request after critical review

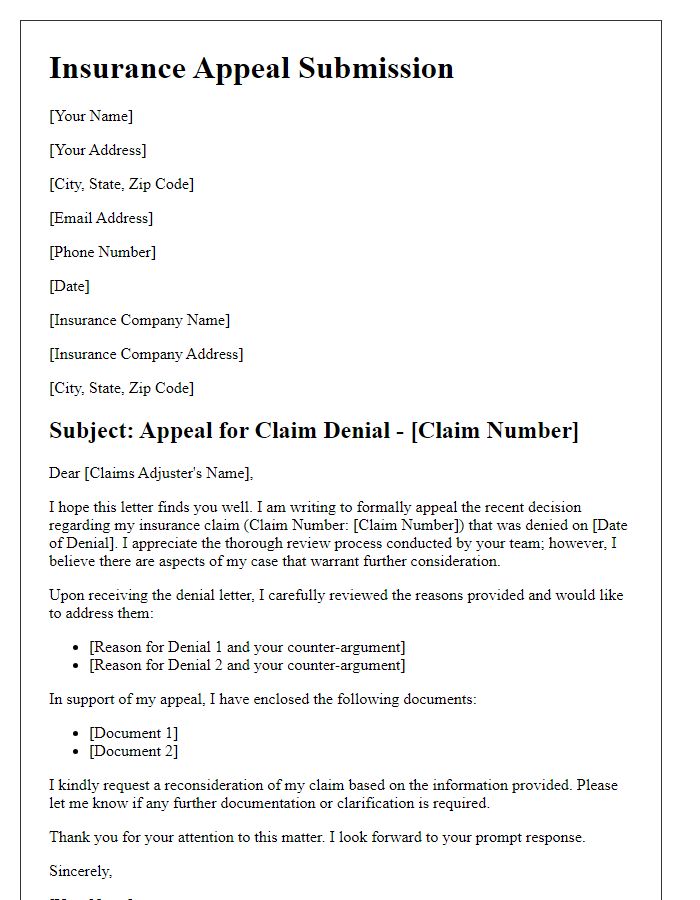

Letter template of insurance appeal submission after receiving bad remarks

Comments