Are you considering updating your jewelry insurance valuation? It's essential to ensure that your precious pieces are adequately covered, reflecting their current worth in today's market. With fluctuations in the jewelry industry, a regular assessment can provide peace of mind and protect your cherished items. Let's dive into the important steps for updating your jewelry insurance valuation and why it matters â read on to find out more!

Accurate Description of the Jewelry

Updating jewelry insurance valuation requires pinpoint accuracy in describing each piece. Detailed descriptions should include the type of jewelry, materials used, and significant characteristics. For instance, a 14-karat yellow gold engagement ring featuring a 2-carat round brilliant cut diamond should specify the diamond's clarity grade (like VS1) and color grade (such as G). Additional details such as gemstone quality, any unique craftsmanship (like hand engravings), and overall dimensions (such as ring size 7) contribute to a comprehensive valuation report. Accurate photographs showcasing multiple angles enhance the report, providing visual verification for insurers. This meticulous approach ensures precise coverage reflecting current market values for jewelry assets.

Current Market Value Assessment

Current market value assessments for jewelry insurance, specifically diamonds (certified by GIA with specific cut grades), gold (measured in karats, particularly 14k and 18k), and unique designer pieces (from brands like Tiffany & Co. or Cartier), reflect fluctuations in the jewelry market due to trends and economic conditions. For example, diamond prices have seen a notable increase of approximately 5% between 2022 and 2023, driven by supply chain challenges and increasing consumer demand. Artisanal jewelry has also gained popularity, prompting significant valuation adjustments for handcrafted items. Accurate assessments consider historical auction results, market data, and condition reports to ensure proper coverage. Insurers rely on these evaluations to provide adequate replacement costs, minimizing the risk of underinsurance in cases of theft or damage. Regular updates (recommended every 1-2 years) ensure policies align with the evolving market dynamics and maintain adequate protection for valuable collections.

Detailed Gemstone and Metal Specifications

Jewelry insurance valuation updates require meticulous documentation of gemstone and metal specifications. Precious gemstones like diamonds, graded by carat weight (e.g., 1.5 carats), clarity (e.g., VS1), color (e.g., G), and cut (e.g., Round Brilliant), should include certification from institutes like the Gemological Institute of America (GIA). Other gemstones, such as sapphires and emeralds, also need details regarding origin (e.g., Burmese for rubies or Colombian for emeralds), treatment status (whether heat-treated), and any inclusions visible under magnification. Metal specifications require information on purity levels, such as 18K gold (75% gold content) or platinum (95% purity), alongside any additional markings or hallmarks indicating the manufacturer or artisan. Documenting these specifications not only enhances valuation accuracy but also assists in claims processing, ensuring full protection for valuable jewelry pieces.

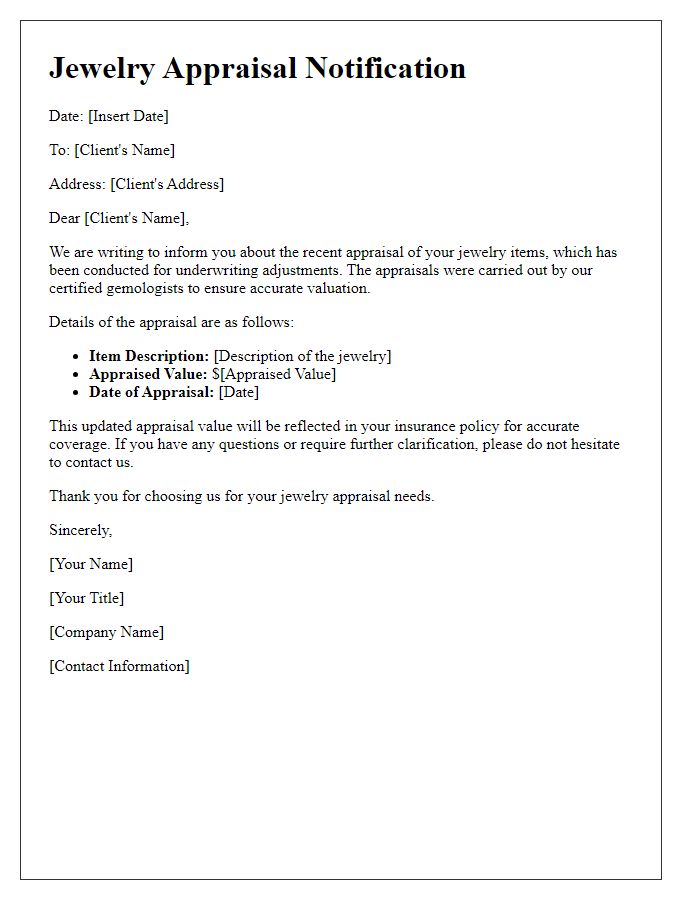

Appraiser Credentials and Contact Information

Jewelry appraisal documents provide essential information regarding the value and authenticity of high-value items. Credentials of appraisers, such as certifications from organizations like the American Society of Appraisers or the National Association of Jewelry Appraisers, play a crucial role in establishing credibility. Appraisers often include contact information, including phone numbers and email addresses, ensuring clients can reach them for follow-ups or consultations. Accurate valuations are essential for insurance purposes, with updates often required to reflect market conditions or significant changes in item condition, typically every three to five years. Providing comprehensive details helps insurance companies determine appropriate coverage levels for specific jewels, whether diamond engagement rings or vintage heirlooms.

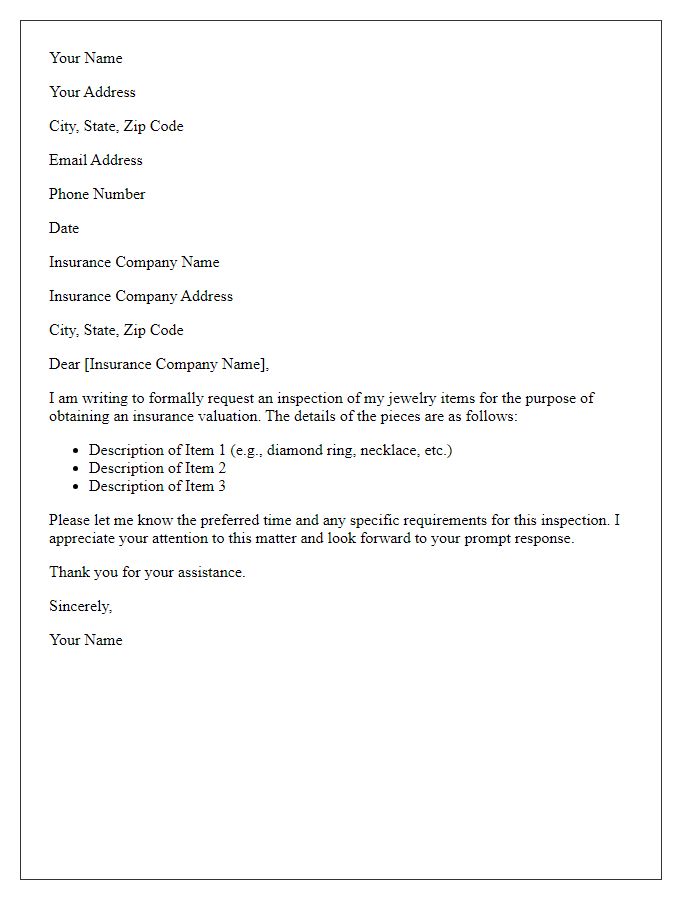

Policyholder's Personal and Policy Information

Jewelry insurance valuation updates are essential for maintaining accurate coverage for valuable items, such as diamonds, pearls, and vintage pieces. Policyholders should provide personal information, including full name, contact details, and mailing address, along with policy information such as policy number and effective dates. Accurate valuation is critical; appraisers should consider various factors including market conditions, materials, craftsmanship, and historical significance of each item. Regular updates help ensure that coverage reflects current market values, protecting against potential financial loss in the event of theft, damage, or loss. Keeping records organized and up-to-date aids in precise assessments and efficient claims processing.

Comments