Are you curious about how to save some money on your insurance premiums? Many people overlook the potential discounts available to them, which can add up to significant savings over time. In this article, we'll explore the key steps for crafting an effective letter to inquire about insurance discounts, ensuring you maximize your benefits. So, if you're ready to unlock those savings, keep reading!

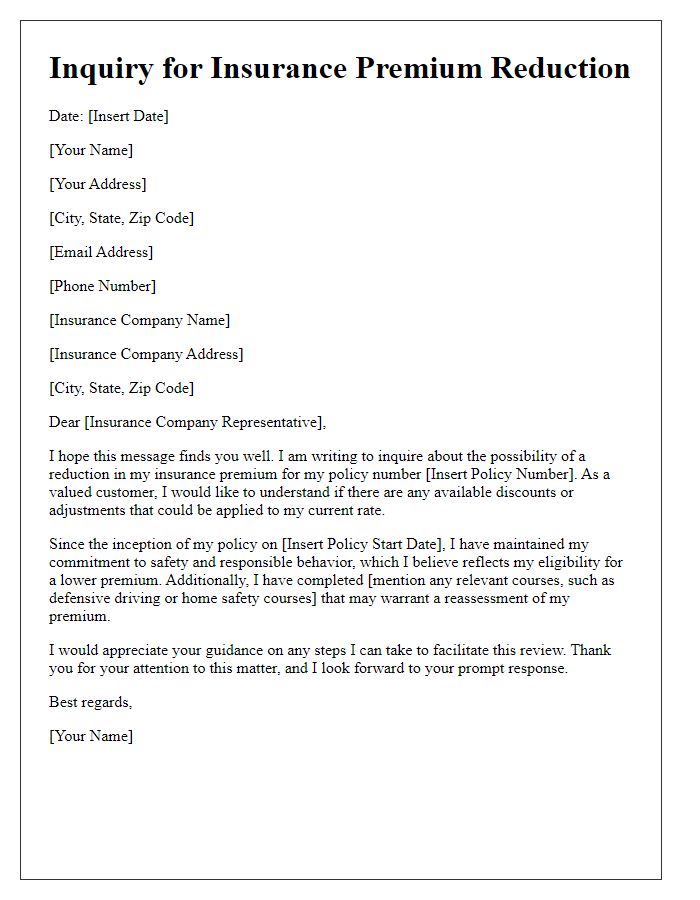

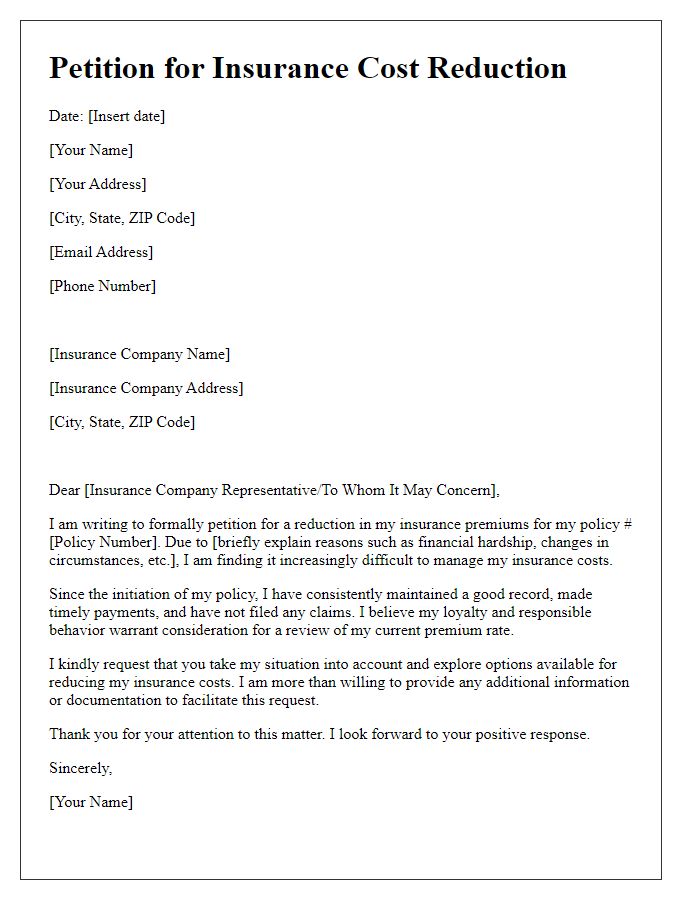

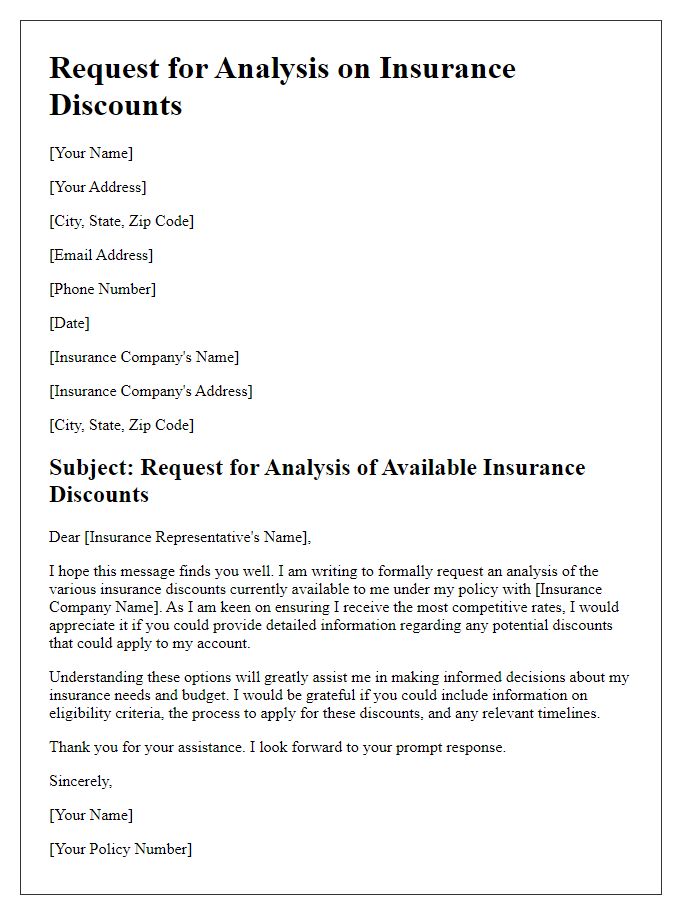

Policyholder Information

Insurance discounts can vary significantly based on multiple factors including policyholder status, claims history, and loyalty period. Policyholder information such as name, address, and policy number play a crucial role in determining eligibility for discounts. Insurance companies may offer discounts for various reasons, including good driving records, bundling policies, and safety features in vehicles. Additionally, location (like urban versus rural areas) can influence available discounts. It's important for policyholders to inquire about specific discounts and their requirements during policy renewal, ensuring they optimize costs associated with their insurance premiums.

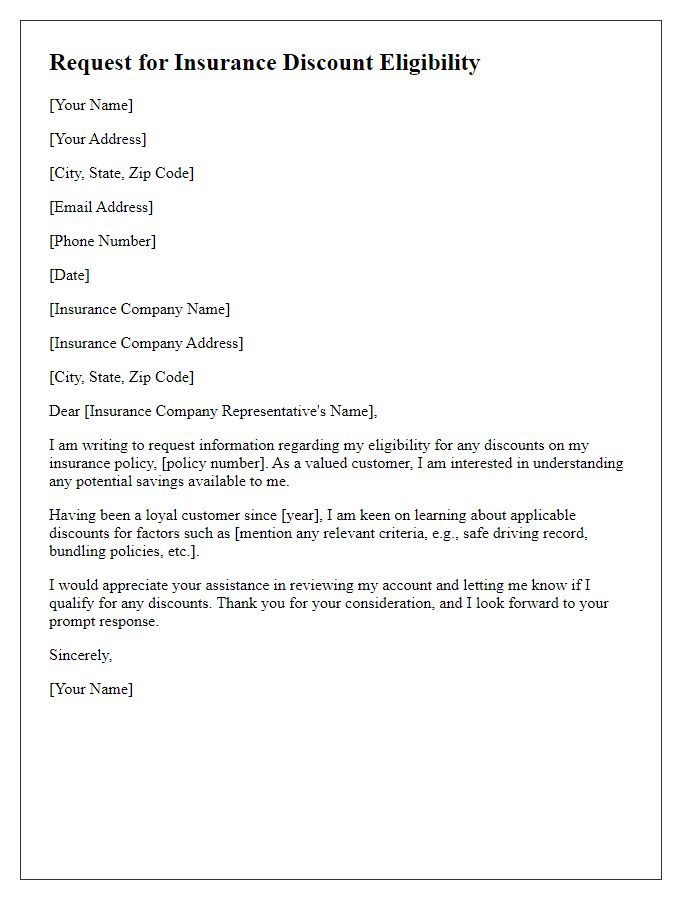

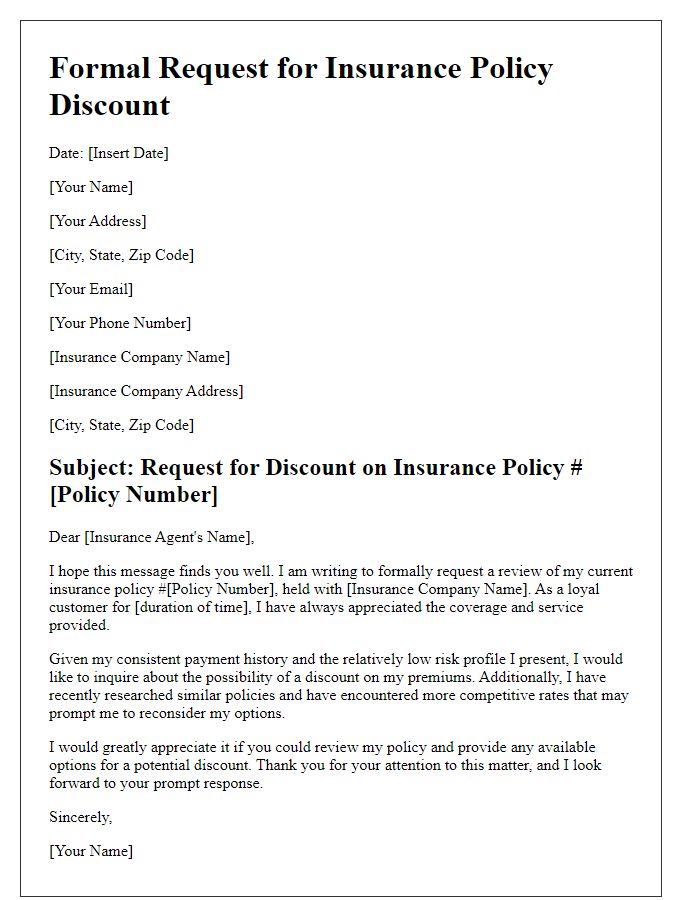

Policy Details

Insurance discounts can significantly reduce premiums for policyholders. Homeowner's insurance policies, for instance, often contain provisions that allow discounts based on certain criteria, such as having security systems or smoke detectors installed. For auto insurance, safe driving records and completion of defensive driving courses can lead to substantial reductions. It's crucial to review specific policy details, including terms and conditions, to identify eligibility for discounts. Contacting the insurance provider directly ensures accurate assessment of applicable discounts based on individual circumstances. Keeping all relevant documentation ready, including policy numbers and any compliance certificates, will facilitate a smoother inquiry process.

Reason for Discount Inquiry

Many insurance companies offer discounts to policyholders based on various factors that can potentially reduce risk. For example, discounts may be granted for maintaining a clean driving record (no accidents in the past five years), completing defensive driving courses (approved by the National Safety Council), or bundling multiple policies (such as auto and home insurance) under one provider. Additionally, participating in vehicle safety programs or using certain safety features in a car (like anti-lock brakes or electronic stability control) can qualify for premium reductions. Homeowners can seek discounts for having security systems installed (validated by companies like ADT or Vivint), or for making energy-efficient upgrades (such as installing solar panels or Energy Star appliances). These measures often lead to lower risk and costs, which insurance companies recognize by lowering premiums.

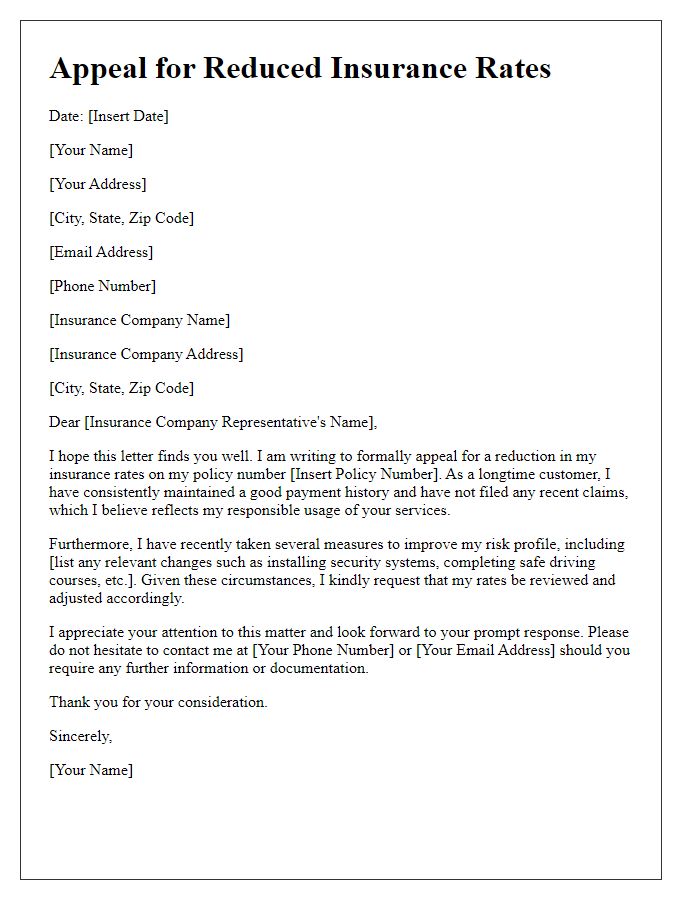

Supporting Documentation

Insurance policies often include discounts for various reasons, such as safe driving records, installation of security devices, or completion of approved safety courses. To support a request for an insurance discount, policyholders may need to provide specific documentation. Required documents might include a driving record from the Department of Motor Vehicles (DMV), proof of graduated licensing, completion certificates for safety courses from accredited institutions, or installation receipts for security systems. Each insurance provider typically has unique requirements, so it is essential to check specific guidelines for submitting supporting documentation. Requesting a discount can lead to substantial savings, potentially reducing premiums by up to 15% or more, enhancing financial security for policyholders.

Contact Information

To secure a potential insurance discount, individuals should prepare essential contact information including full name, address, phone number, and email address. Full name helps agents identify the policyholder. Address ensures accurate policy details, especially for homeowner's insurance. Phone number provides a direct line for quick communication regarding inquiries or updates. Email address facilitates correspondence for documentation or offer notifications. Ensure all information is current to streamline the discount application process.

Comments