If you're facing the tough situation of needing to send a non-payment insurance cancellation notice, you're not alone. Many people find themselves grappling with timely payments, and it's essential to communicate effectively with your insurance provider. Crafting a clear and concise letter can help ensure that both parties understand the circumstances surrounding the cancellation. Ready to learn how to put together an effective template? Keep reading for all the tips you need!

Policyholder Information

A cancellation notice for non-payment of insurance often includes critical information about the policyholder's financial obligations, the insurance policy (often denoted by its unique policy number), and the terms stated in the insurance document. This notice outlines the essential steps required for maintaining coverage, including the payment deadline, typically set at 30 days from the notice issue date. Furthermore, it specifies potential penalties for continued non-payment, including lapse of coverage, meaning loss of protection in the event of a claim. The notice serves to inform the policyholder, who resides in a specific region, about their financial responsibilities and the implications of failure to meet payment schedules.

Policy Details

Non-payment of insurance premiums can lead to cancellation notices, impacting financial security. Affected policyholders should be aware of critical details, such as policy numbers, coverage types, and expiration dates. For example, a standard auto insurance policy (e.g., Comprehensive Coverage) with a premium of $1,200 annually may face cancellation if payments are not made by the due date. Insurers typically provide a grace period, often 30 days, allowing policyholders to make overdue payments before cancellation becomes effective. Moreover, any notifications should include relevant contact information, such as the claims department phone number and website, to facilitate communication regarding reinstatement or resolution of payment issues. Understanding state regulations surrounding non-payment can also influence the cancellation process.

Non-Payment Notice

Insurance policies can face cancellation due to non-payment, particularly in life insurance, health plans, or auto insurance. Upon missing payment deadlines, typically around 30 days from the due date, policyholders receive notification letters. These letters detail the outstanding amount, cancellation date, and reinstatement options, often emphasizing the serious consequences of policy loss, including coverage termination. Additionally, insurance providers may reference specific state regulations or company policies governing the cancellation process. Clear instructions for completing necessary payments or appealing decisions may also accompany this notice, aimed at guiding policyholders back into good standing.

Cancellation Date

Non-payment of insurance premiums can lead to the cessation of coverage, with cancellation date usually set at 30 days after the final grace period. Insurance providers, adhering to regulatory guidelines, typically notify policyholders about missed payments. Specifics such as policy number and coverage type play a crucial role in the communication process. The cancellation notice should clearly articulate the consequences of non-payment, including loss of financial protection against unforeseen events such as accidents or natural disasters. Additionally, the notice often includes options for reinstatement, contingent on payment of owed premiums, emphasizing the importance of timely payments to maintain continuous coverage.

Contact Information for Queries

A non-payment insurance cancellation notice must include essential details for effective communication. Policyholders should have clear contact information, including a dedicated phone number (such as 1-800-555-0182 for customer service inquiries) and email address (for instance, support@insurancecompany.com) monitored by representatives during business hours (Monday to Friday, 9 AM to 5 PM). Including the physical address of the insurance company (such as 1234 Insurance Blvd, Suite 100, City, State, ZIP Code) enhances accessibility. Clarity in contact protocols ensures that policyholders can promptly resolve their inquiries regarding the cancellation process, outstanding premiums, and any potential reinstatement options prior to policy termination.

Letter Template For Non-Payment Insurance Cancellation Notice Samples

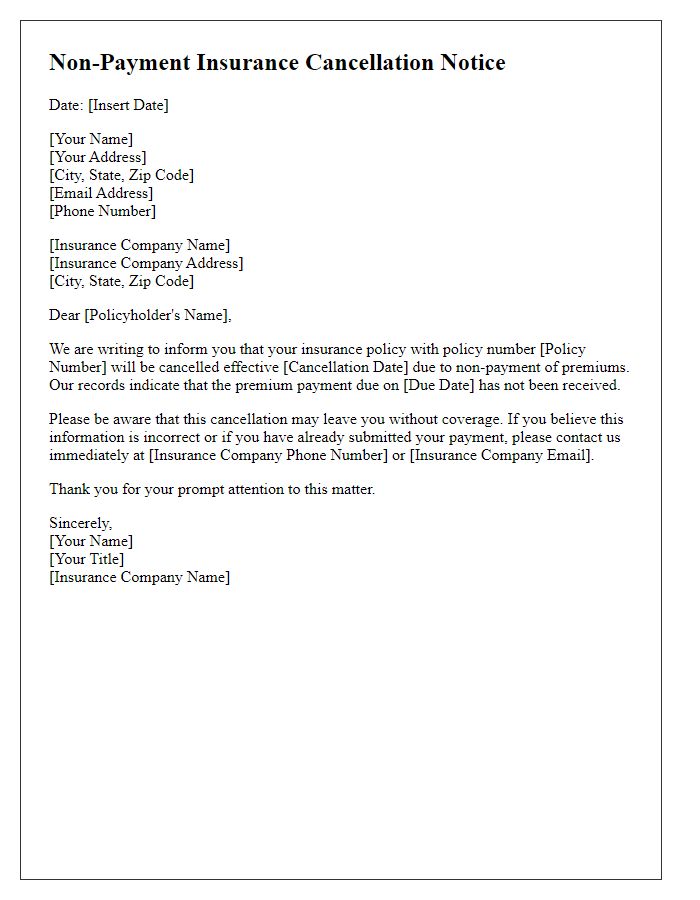

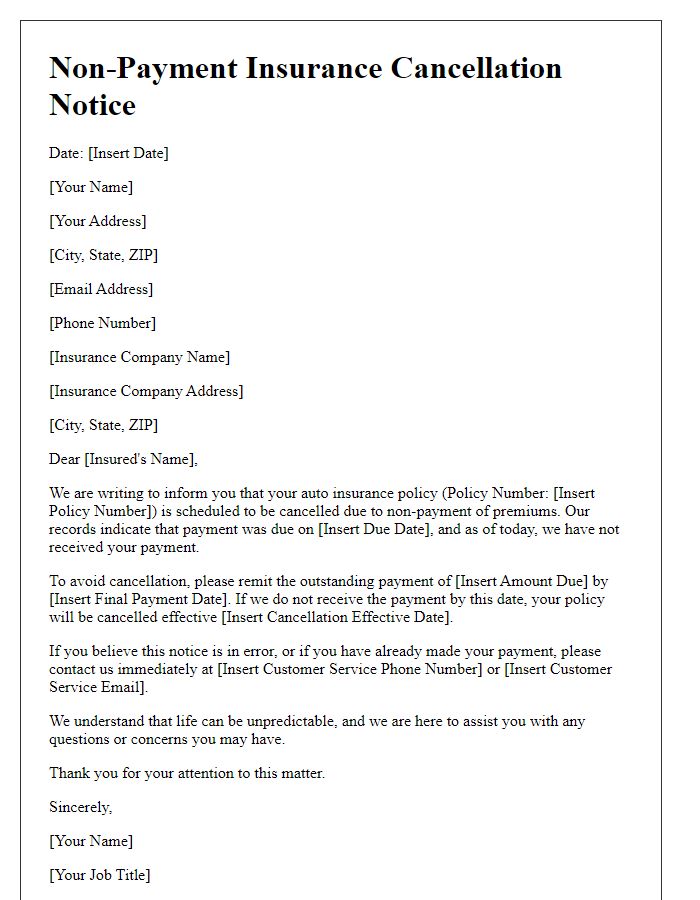

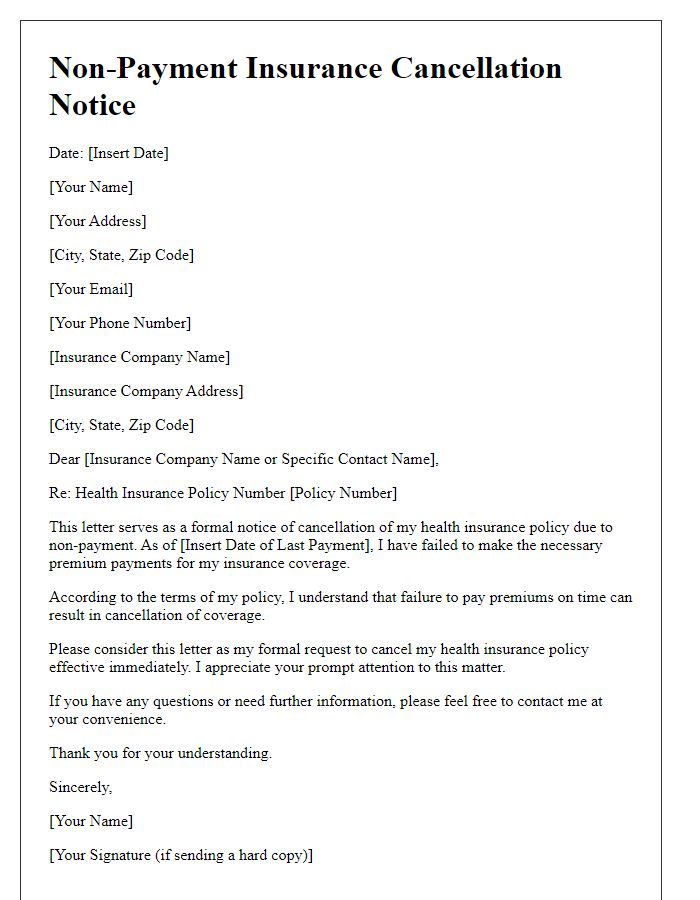

Letter template of Non-Payment Insurance Cancellation Notice for Individuals

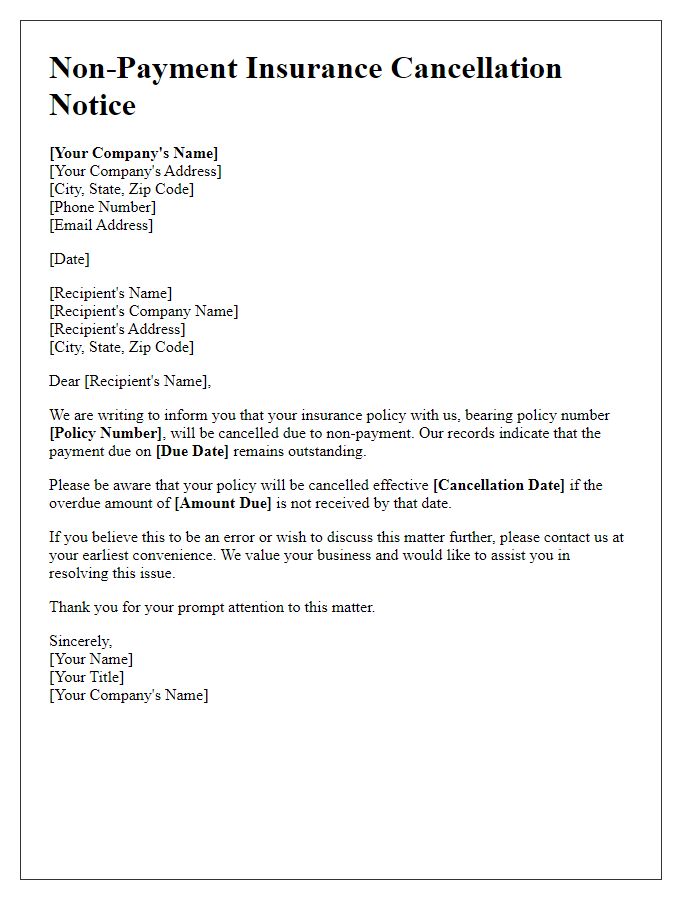

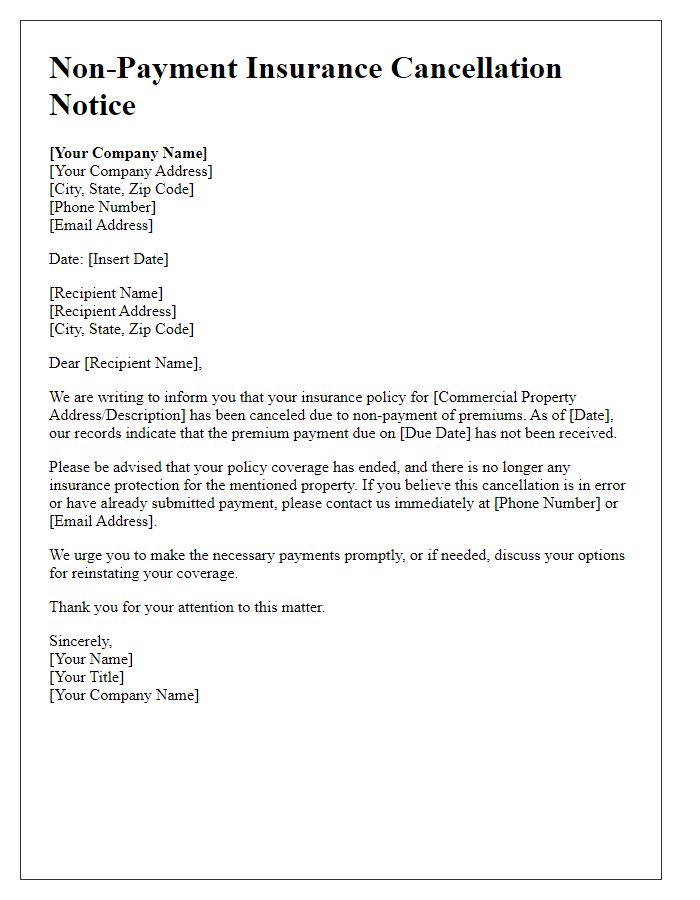

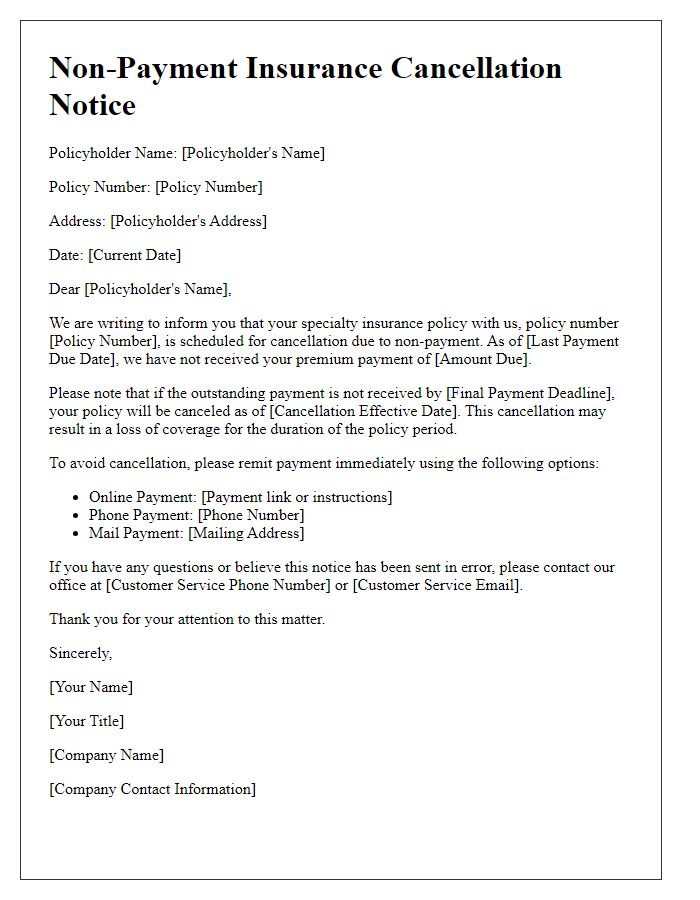

Letter template of Non-Payment Insurance Cancellation Notice for Businesses

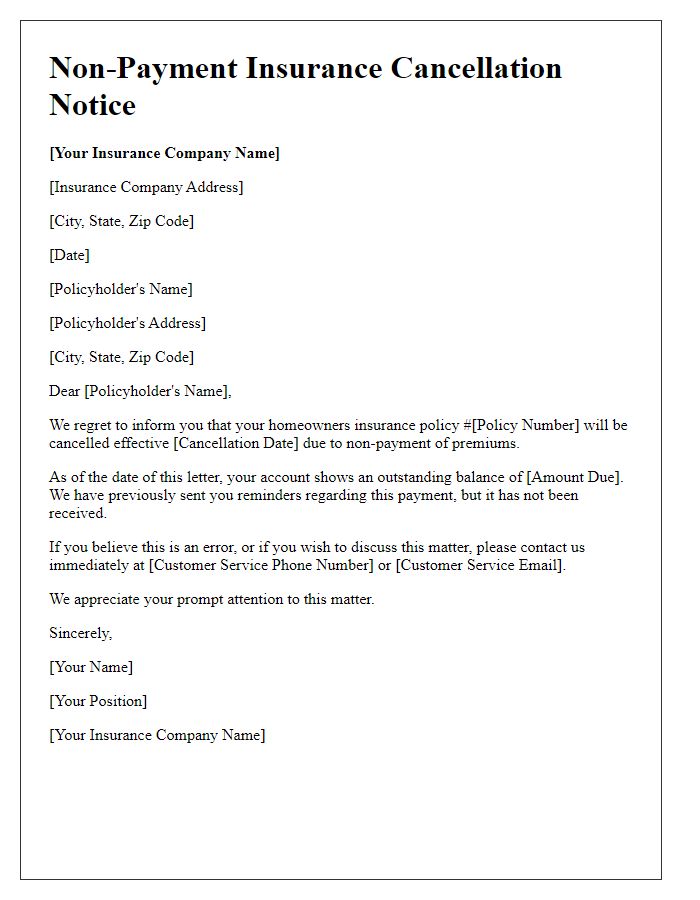

Letter template of Non-Payment Insurance Cancellation Notice for Homeowners

Letter template of Non-Payment Insurance Cancellation Notice for Auto Insurance

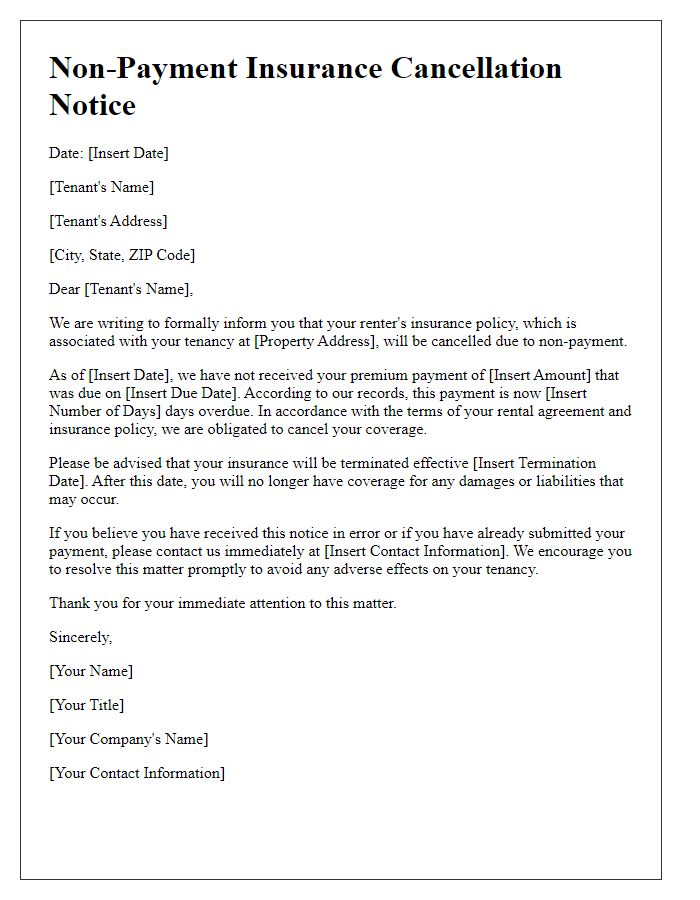

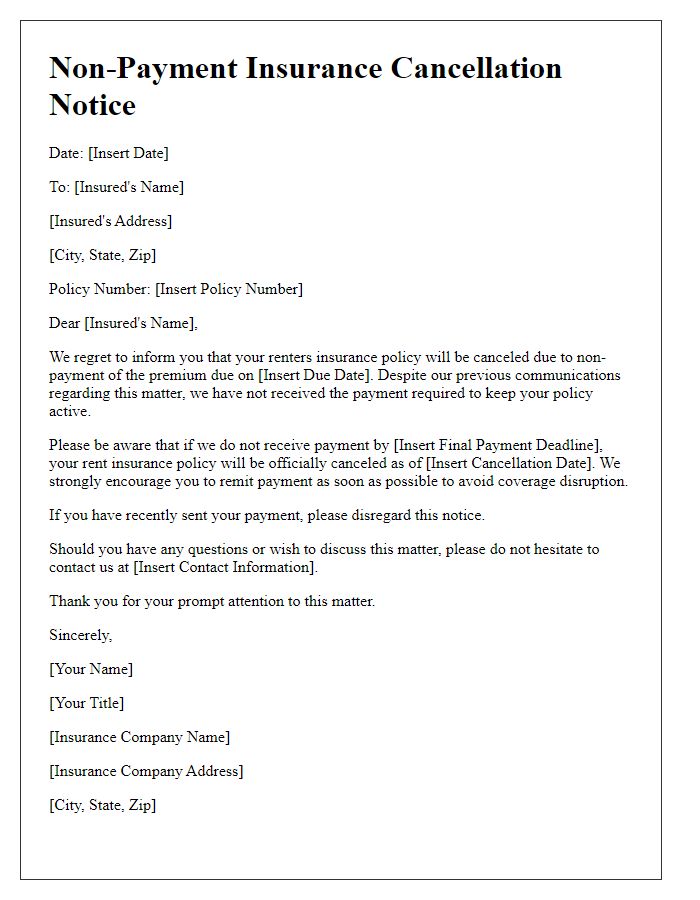

Letter template of Non-Payment Insurance Cancellation Notice for Tenants

Letter template of Non-Payment Insurance Cancellation Notice for Commercial Properties

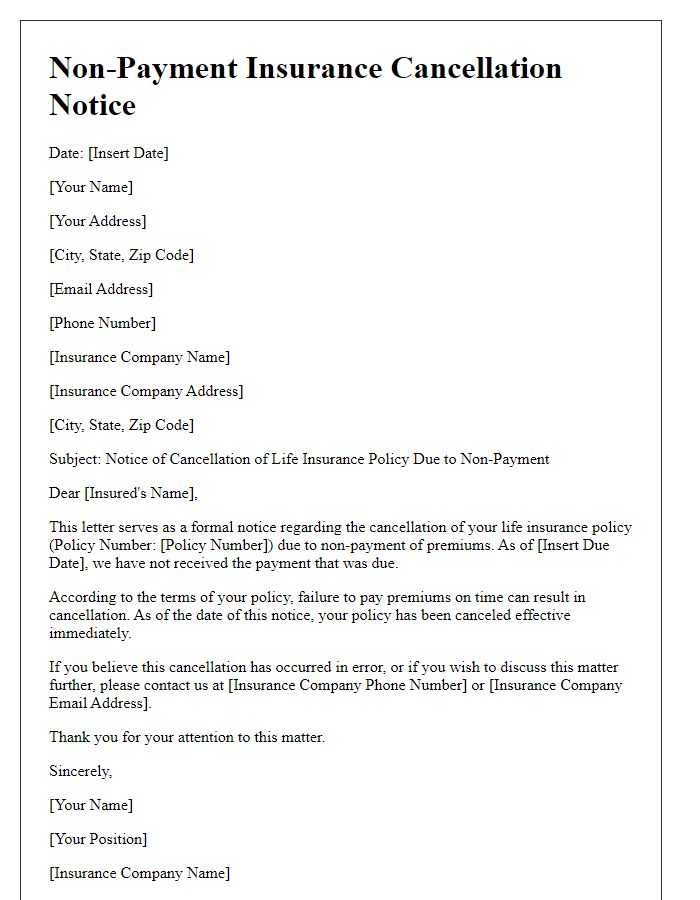

Letter template of Non-Payment Insurance Cancellation Notice for Life Insurance Policies

Letter template of Non-Payment Insurance Cancellation Notice for Health Insurance

Letter template of Non-Payment Insurance Cancellation Notice for Renters Insurance

Comments