Are you feeling a bit overwhelmed trying to navigate the complexities of retroactive insurance coverage? You're not alone! Many individuals find themselves in situations where they need to request coverage for past incidents, but knowing how to structure that request can be tricky. In this article, we'll explore a comprehensive letter template that simplifies the process and provides tips to ensure your request stands outâso stick around to learn how to effectively advocate for your coverage!

Policyholder Information

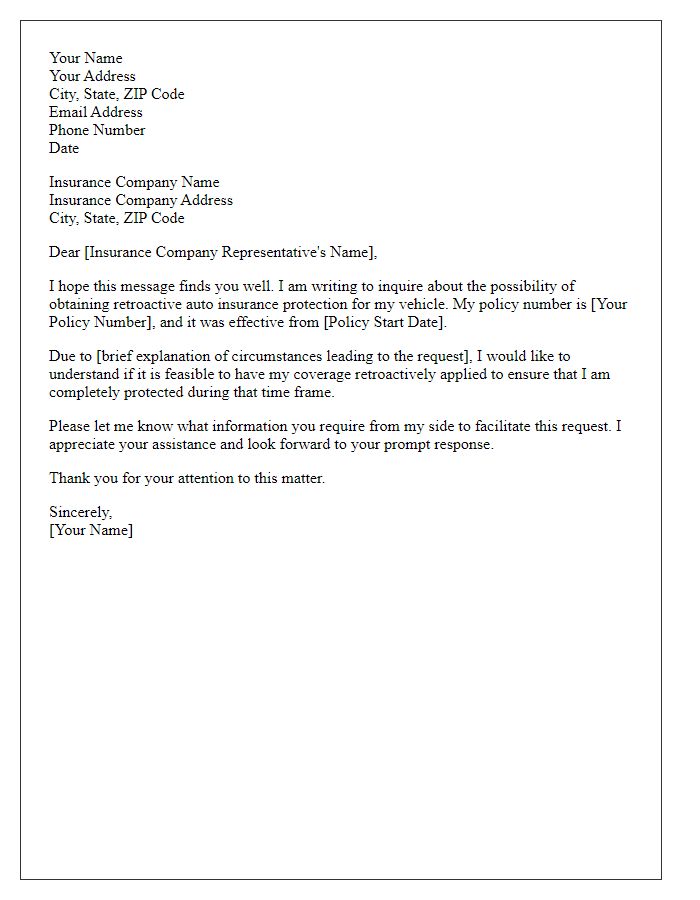

Requesting retroactive insurance coverage involves communicating specific details regarding the policyholder and the relevant circumstances. The policyholder, often an individual or business, seeks to amend coverage dates for a specific event. This request typically includes the policy number for identification, the specific dates for which coverage is sought, and any pertinent claims or incidents that occurred during that time. Additionally, the request should clarify the reasons for seeking retroactive coverage, such as unforeseen circumstances, administrative errors, or urgent needs that arose unexpectedly. Documenting any previous communication with the insurance provider regarding this matter can also strengthen the case for retroactive consideration.

Policy Details

Retroactive insurance coverage requests often involve specific policy details and reasons for the request. Policyholders, like a family or business, may seek coverage due to unforeseen circumstances, such as medical expenses caused by an accident. Providing policy details like the policy number, effective dates, and the types of coverage can strengthen the request. Important dates such as the incident date (e.g., March 15, 2023) should be highlighted to establish the context for coverage necessity. Additionally, citing relevant case laws or insurance regulations can substantiate the appeal for retroactive coverage. Accurate documentation, including medical bills or incident reports, supports the claim ensuring a thorough consideration by the insurance provider.

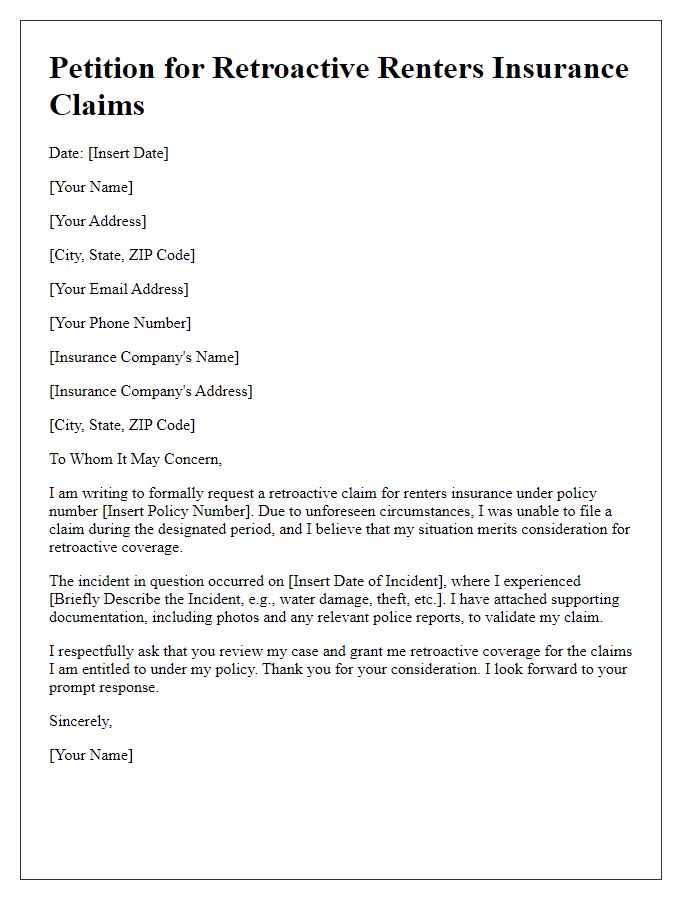

Explanation of Delay

Delays in retroactive insurance coverage can often stem from administrative errors or miscommunications with insurance providers. For instance, a policyholder may encounter issues if documentation regarding previous claims or eligibility requirements is incomplete or incorrectly filed, potentially resulting in a lapse of coverage that affects critical medical expenses. In some cases, a change in employment or policy terms may lead to misunderstandings about effective dates, leaving individuals without necessary protection. Furthermore, insurers may also experience processing delays, further complicating requests for retroactive coverage during critical health events, leaving policyholders to navigate complex healthcare costs without the financial support intended by their policies.

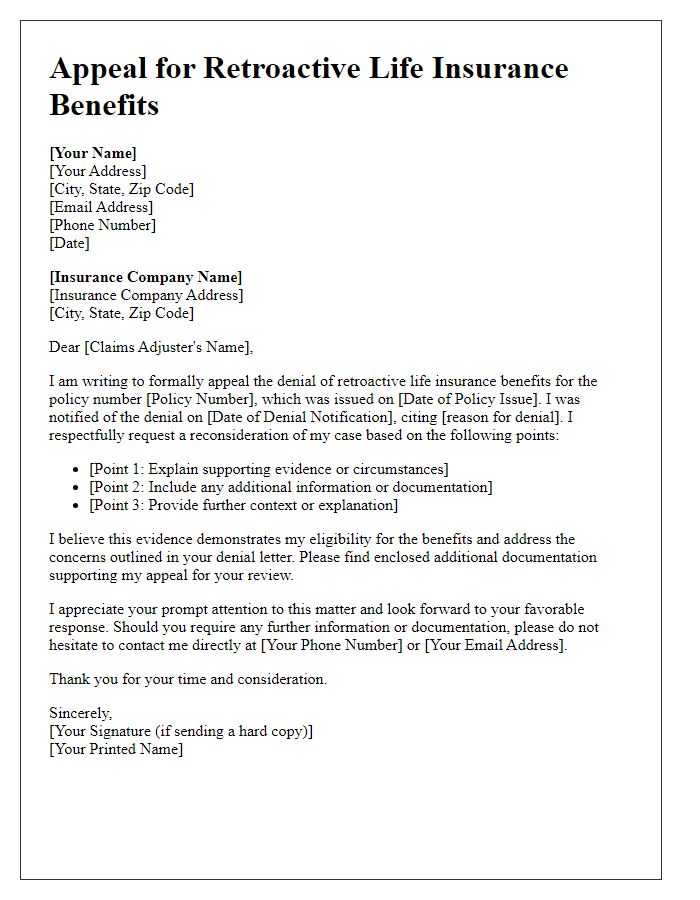

Justification for Retroactive Coverage

A retroactive insurance coverage request often arises when a policyholder seeks to obtain benefits for claims made after a certain event, such as a medical procedure or an accident. This coverage permits financial restitution for already incurred expenses, which can include hospital bills, rehabilitation costs, or loss of property in particular scenarios. To justify this request, it is essential to present a detailed account of the circumstances surrounding the event, including specific dates (such as the date of the occurrence and the date the policy was established), pertinent medical documents, or legal notifications. Clear communication with the insurance provider regarding policy terms, applicable statutes, and procedural guidelines also plays a crucial role in successfully acquiring retroactive coverage.

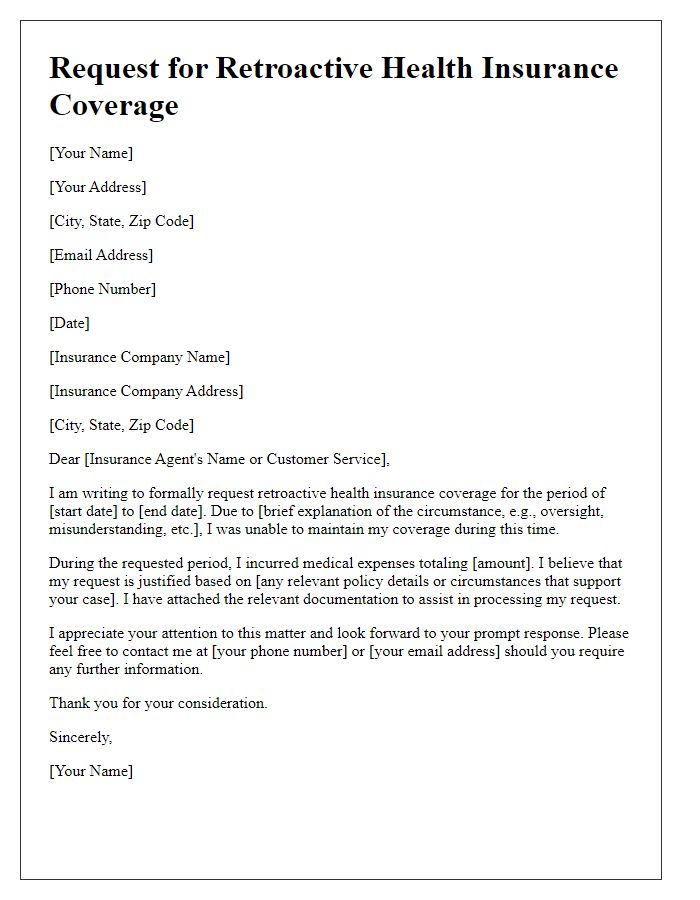

Formal Request Statement

Retrospective insurance coverage refers to the process of seeking insurance benefits for events or medical expenses that occurred prior to the formal approval of an insurance policy. Situations like this arise when individuals experience delays in policy activation, potentially due to administrative processes or unforeseen circumstances, resulting in significant medical expenses incurred on dates (such as October 2022 or January 2023) prior to the policy's effective date (e.g., February 2023). The request for such coverage often involves detailing the specific medical procedures or incidents (like surgeries, hospital visits, or urgent care) that happened during that time. Documentation such as invoices, healthcare provider statements, and proof of insurance enrollment should be included to support the request. Policyholders typically address their submissions to the insurance company's claims department or customer service team, highlighting the urgency of their situation and asking for a reconsideration of their case based on compassionate grounds or discrepancies in communication.

Letter Template For Requesting Retroactive Insurance Coverage Samples

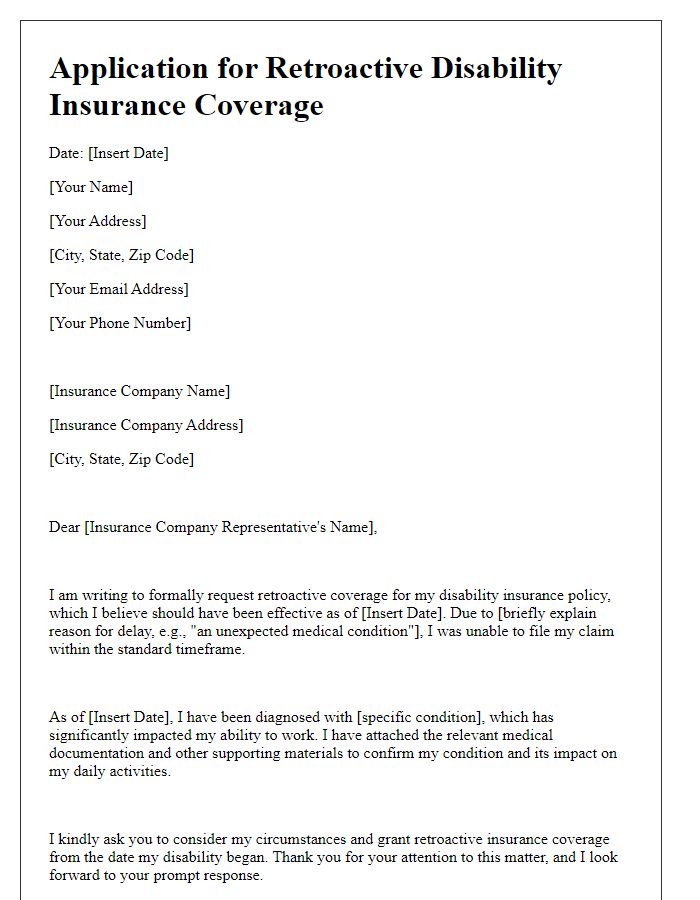

Letter template of application for retroactive disability insurance coverage

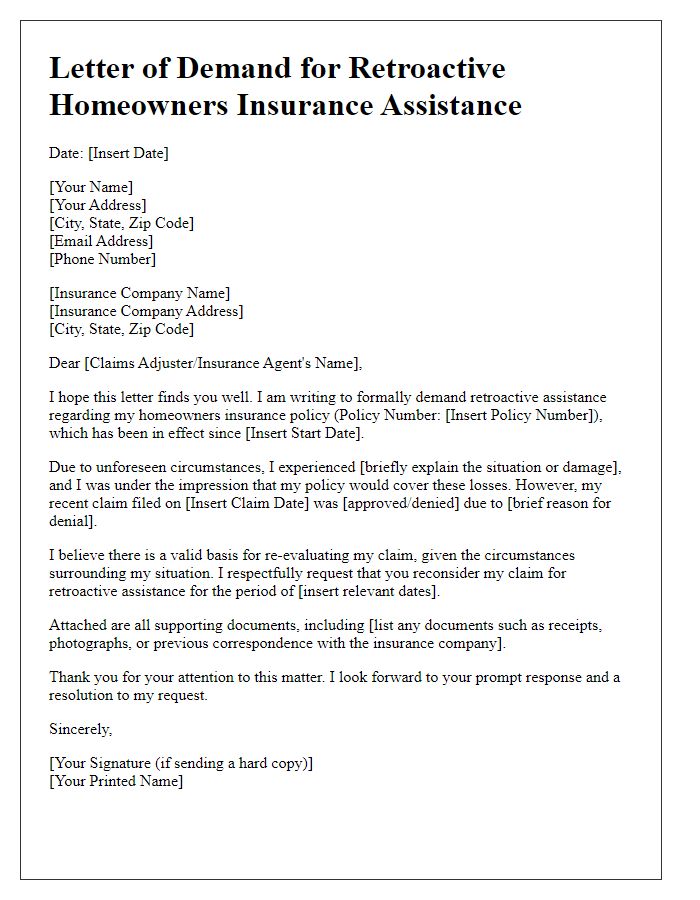

Letter template of demand for retroactive homeowners insurance assistance

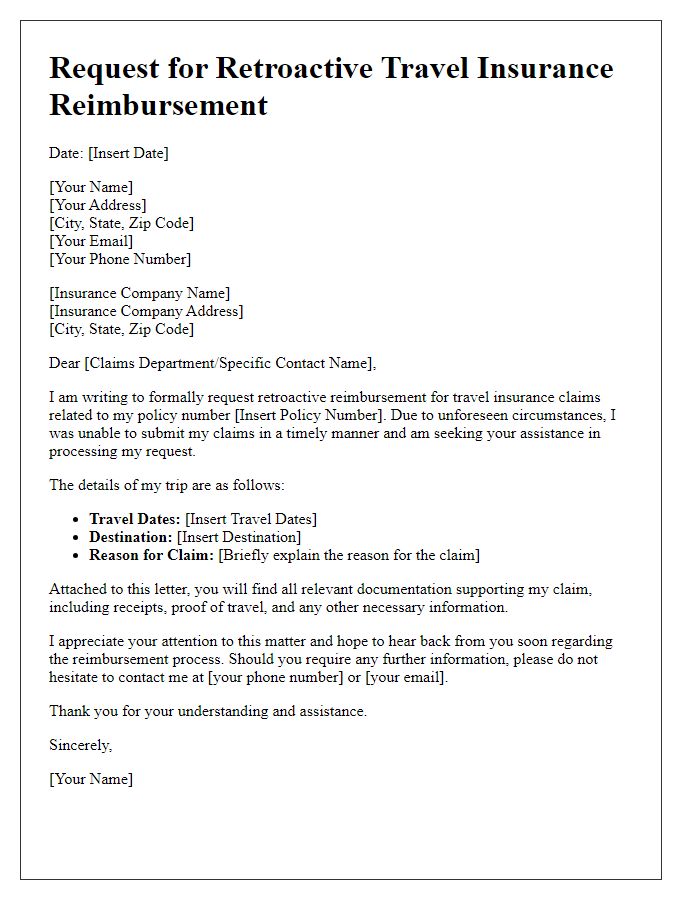

Letter template of solicitation for retroactive travel insurance reimbursement

Comments