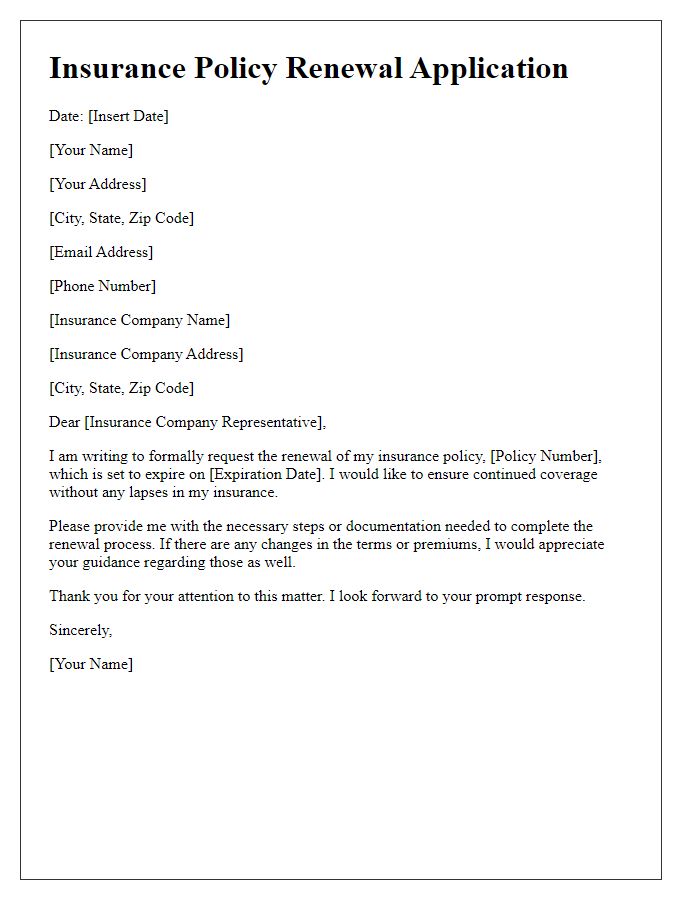

Renewing your insurance policy might seem like a daunting task, but it's simpler than you think! Whether you have questions about coverage, premium rates, or any changes in your personal circumstances, this letter template will help you confidently communicate your intentions to your insurance provider. Keeping your policy up to date is essential for peace of mind and protecting what matters most. Let's dive into the details so you can breeze through your renewal process!

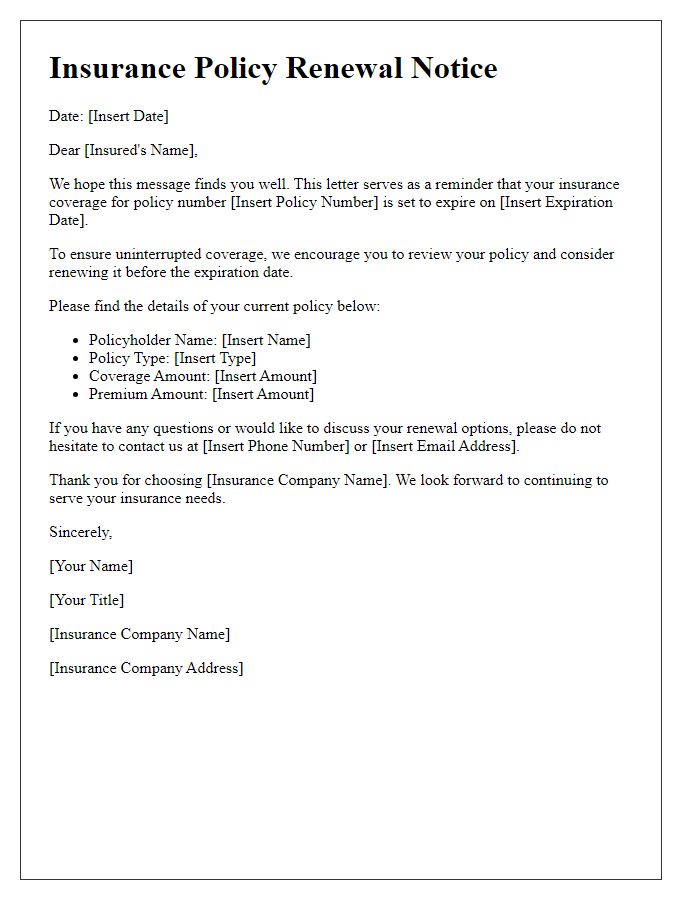

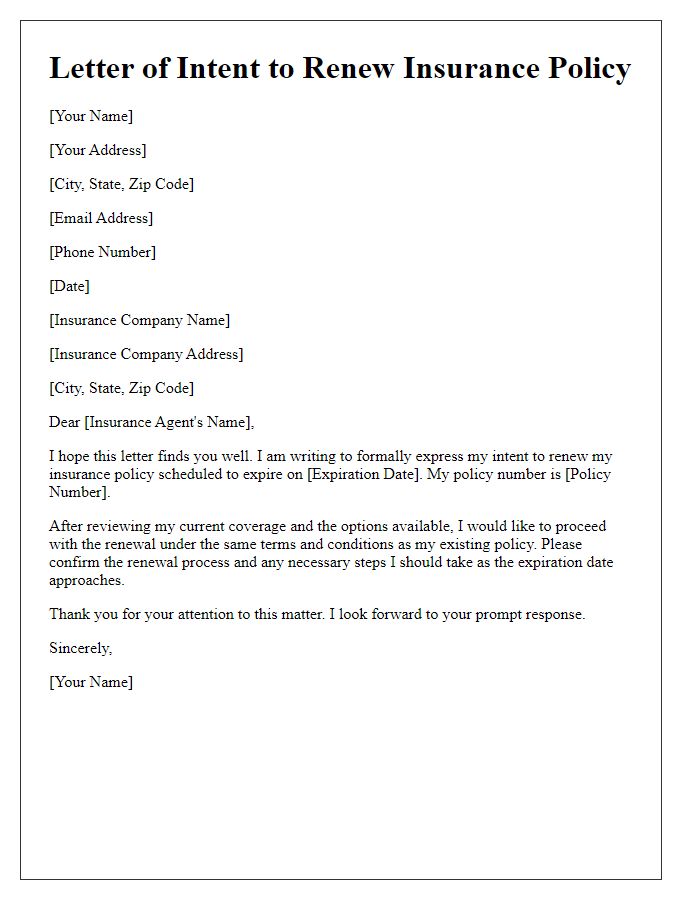

Policyholder's details and contact information.

Renewing an insurance policy requires attention to vital details such as the policyholder's full name, contact number, and address. The policyholder's name (e.g., John Smith), must match the identity on file. Contact information includes a direct phone number (e.g., +1-202-555-0198) for prompt communication and an email address (e.g., john.smith@email.com) for digital correspondence. Address details should reflect the current residence (e.g., 1234 Elm Street, Springfield, IL 62701), ensuring that any correspondence reaches the policyholder without delay. Accurate and updated information is crucial for uninterrupted coverage and efficient service during the renewal process.

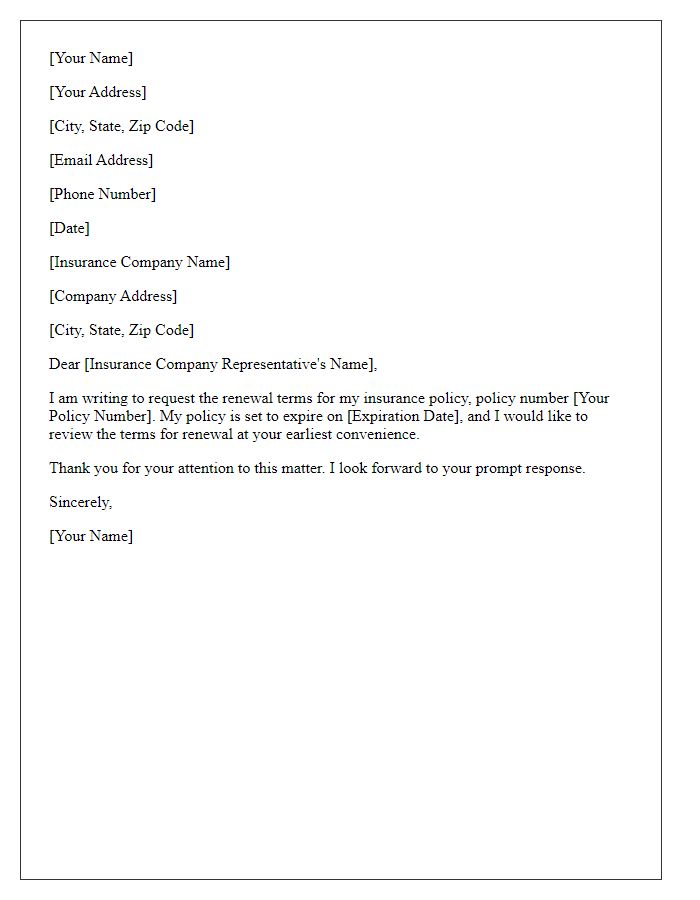

Policy number and renewal date.

Insurance policy renewal notifications typically detail the policy number, which uniquely identifies the specific coverage plan (such as auto, home, or health insurance), along with the renewal date, signaling the end of the current term and the start of the new coverage period. Timely renewal--often within a 30-day window before the expiration date--ensures uninterrupted coverage and helps avoid potential lapses in insurance protection. In addition, any changes in premiums or terms should be highlighted, allowing policyholders to review adjustments before the renewal takes effect. It is essential for policyholders to verify their coverage limits and any new conditions that may impact their risk assessments based on recent claims or changes in personal circumstances.

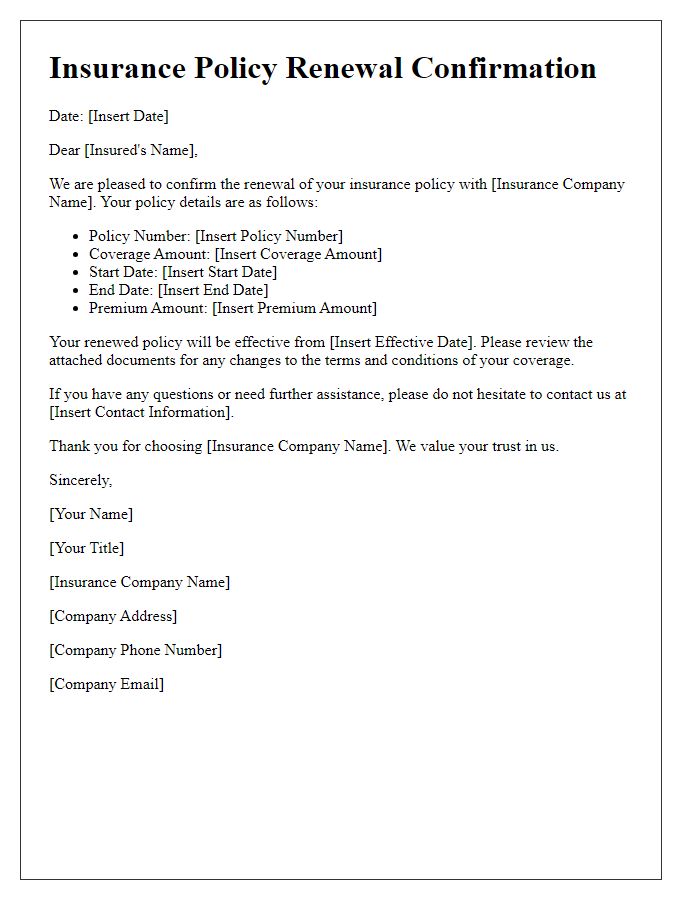

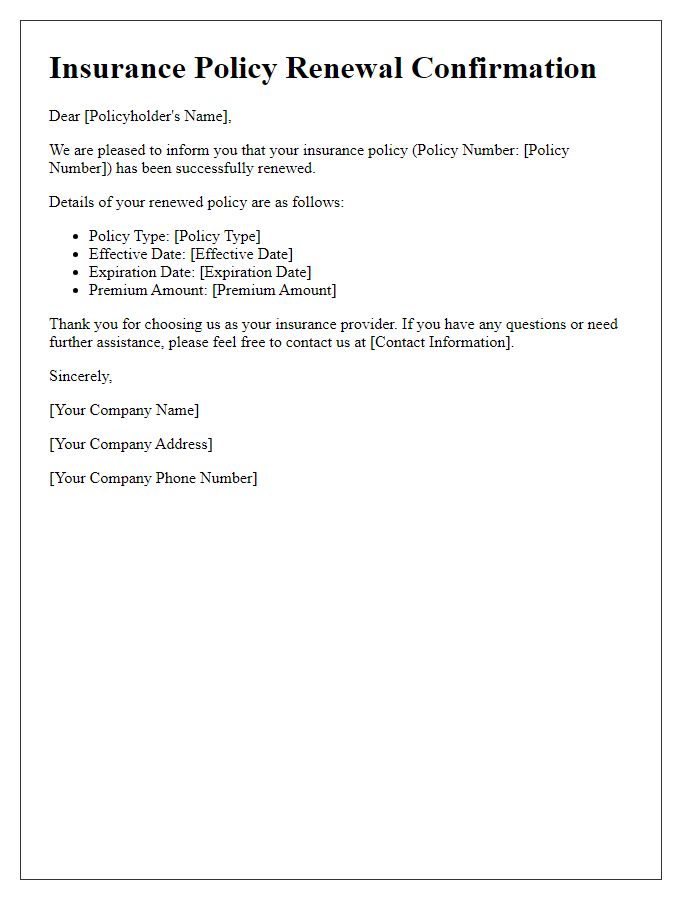

Benefits and coverage summary.

When renewing an insurance policy, it's essential to highlight key benefits and coverage details that provide assurance and peace of mind to policyholders. Comprehensive coverage plans can encompass various aspects such as general liability insurance, which typically includes protection against bodily injury and property damage claims, often up to one million dollars per incident. Additionally, property coverage safeguards assets against losses due to theft or natural disasters, ensuring financial security for homeowners. Supplementary benefits may feature no-claims discounts, which can reduce premiums for policyholders with a clean record over a specified period, often resulting in savings of up to 20%. Furthermore, the addition of optional riders, such as personal injury coverage, can provide extended protection against specific risks, enhancing overall policy robustness. The renewal process usually includes a review of updated terms, often within a timeframe of 30 days before expiration, to ensure that policyholders remain informed and appropriately covered.

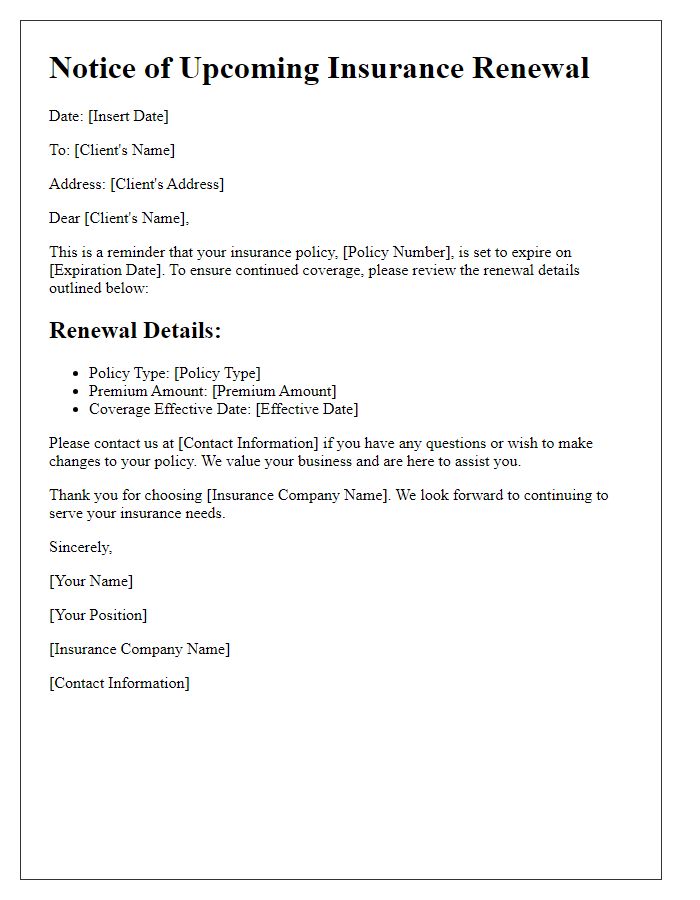

Premium payment options and due date.

Insurance policy renewal involves understanding premium payment options and due dates. Most policies offer flexible payment methods, including annual, semi-annual, quarterly, or monthly options, allowing policyholders to select what fits their budget best. The due date for premium payment typically falls on the same day as the policy's original inception date, providing a consistent schedule. Delays in payment can lead to a lapse in coverage, which could result in significant financial risks and exposure to potential claims. It is vital to check for any changes in premium amounts or coverage details and to communicate any updates from the insurance provider, ensuring policyholders maintain adequate protection.

Contact for inquiries or assistance.

Renewing an insurance policy requires careful attention to the details involved in maintaining coverage. This process typically involves reviewing the existing terms such as premiums and coverage limits, which often vary by provider. Policyholders may contact their insurance agent or customer service department directly for inquiries or assistance, ensuring they understand any changes in benefits or conditions. Many insurance companies now utilize online portals, allowing for convenient access to policy details, claims history, and renewal options. Review deadlines are crucial; failing to renew before the expiration date could lead to lapses in coverage.

Comments