Navigating the world of disability insurance can be challenging, but having the right information at your fingertips makes all the difference. When faced with a disability, understanding how to effectively file a claim for benefits is essential for securing the support you need during a difficult time. This article will guide you through the ins and outs of crafting a compelling letter to accompany your disability insurance claim, ensuring you have the best chance of approval. So, let's unpack the steps togetherâread on for expert tips and a helpful template to get you started!

Applicant's personal and contact information

In a disability insurance benefit claim, the applicant's personal information encompasses vital details such as full name, residential address including city, state, and ZIP code, date of birth, and Social Security number, which is crucial for identity verification. Contact information includes a primary phone number, secondary phone number for reliability, and email address, enabling efficient communication regarding the claim. Additionally, details about the employer, including the company's name, address, and contact information, may be required to verify employment status and eligibility for benefits. Comprehensive documentation ensures proper processing of the claim and expedites access to the necessary financial support during periods of disability.

Policy and claim details

Securing disability insurance benefits relies heavily on key details outlined within the policy. For instance, the policy number, a unique identifier assigned by the insurance company, enables efficient tracking and processing of claims. Important claim details include the date when the disability began, ensuring accurate assessment of eligibility based on the policy terms, typically requiring documentation from a healthcare professional detailing the nature and extent of the disability. The insurer often requests specific documentation, such as medical records and evidence of lost wages, to substantiate the claim. Timelines for submission can vary, often ranging from 30 to 90 days, making it essential for claimants to be aware of these deadlines to avoid potential delays or denials. Additionally, understanding the waiting period, which can span from 30 days to several months, is crucial as it determines when benefits will start.

Description of disability and impact

A severe spinal injury, classified as a herniated disc at L4-L5, can result in debilitating pain and limited mobility. This condition impedes daily activities, such as walking (requiring assistance after short distances), lifting objects (over 10 pounds may induce severe discomfort), and performing essential self-care tasks. The chronic pain levels, often rated between 7 and 9 on a scale of 1 to 10, severely restrict participation in social activities and employment responsibilities. Associated treatments, including physical therapy sessions (typically requiring two visits per week), medication regimens (such as opioids and anti-inflammatories), and frequent doctor consultations have become necessary to manage symptoms. The overall impact on quality of life is profound, leading to increased mental health concerns like anxiety and depression due to the continuous struggle with physical limitations and reduced independence.

Supporting medical documentation

Supporting medical documentation is essential for disability insurance benefit claims, as it provides evidence of a claimant's health status and functional limitations. Important documents may include detailed medical reports from healthcare providers, such as physicians, specialists, or therapists, who can verify the diagnosis and treatment history. A comprehensive report may consist of diagnostic imaging results, such as MRI or CT scans, which highlight the extent of injuries or chronic conditions. Treatment records should detail prescribed medications, therapy sessions, and rehabilitation efforts, indicating the duration of symptoms. Additionally, functional capacity evaluations performed by certified professionals can assess the impact of a disability on daily activities, providing clearer context on the claimant's ability to work. Accurate and thorough documentation, adhering to the insurance policy requirements, plays a crucial role in substantiating the claim and ensuring an appropriate review process by the insurance provider.

Signature and date

Disability insurance claims require specific documentation to ensure a smooth process. Essential components include precise identification details, such as claimant's full name, policy number, and contact information. Medical documentation must accompany the claim, detailing the nature of the disability, treatment received, and healthcare provider's contact information. Important dates, such as the onset of the disability and the date of the first medical visit, should be clearly stated. Additionally, signatures from both the claimant and the healthcare provider affirm the accuracy of the submitted information. Finally, including a date on the claim form is crucial for tracking the submission timeline and eligibility for benefits.

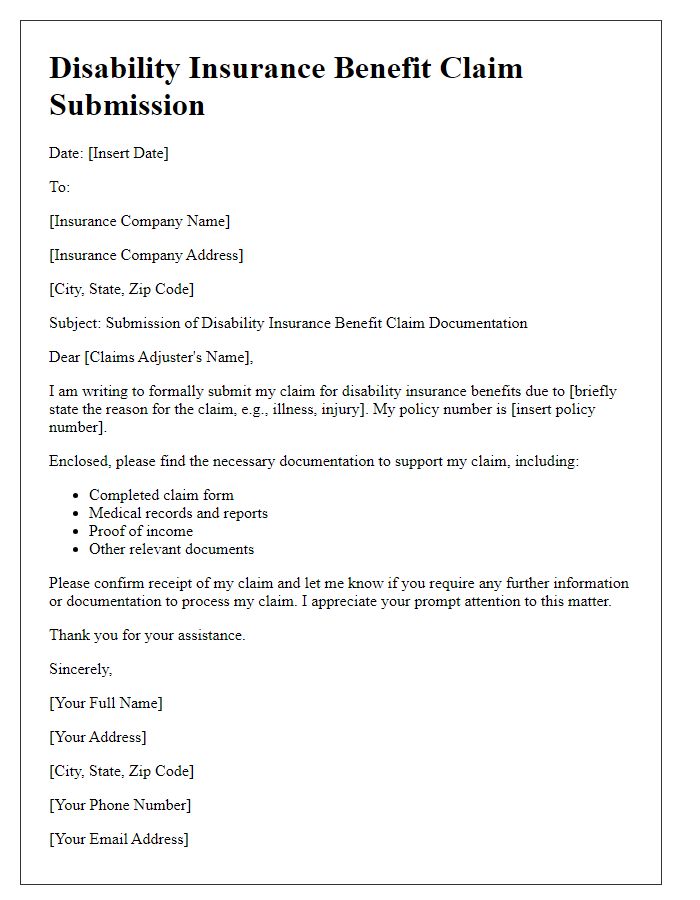

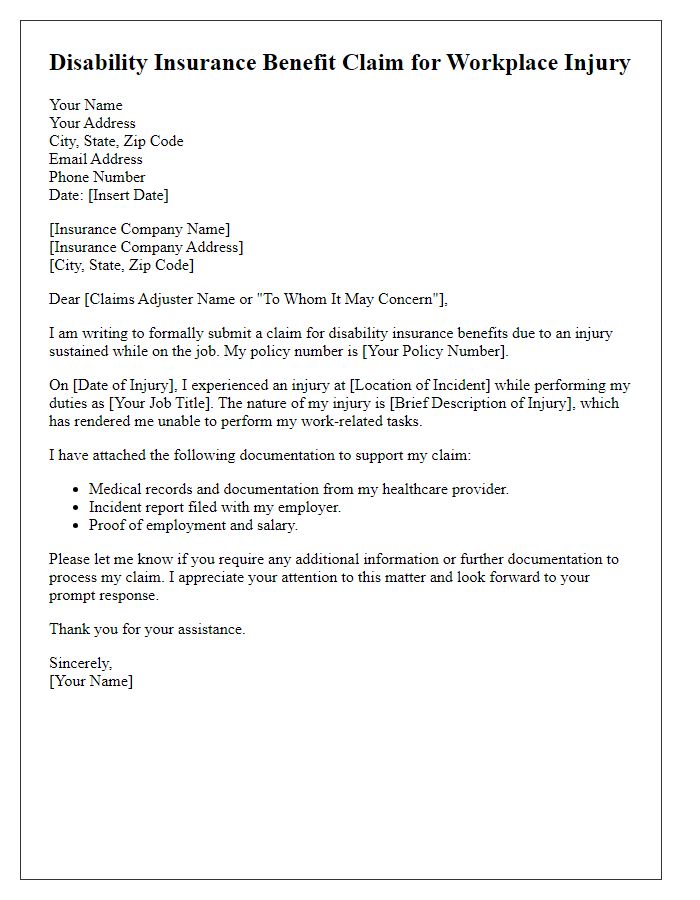

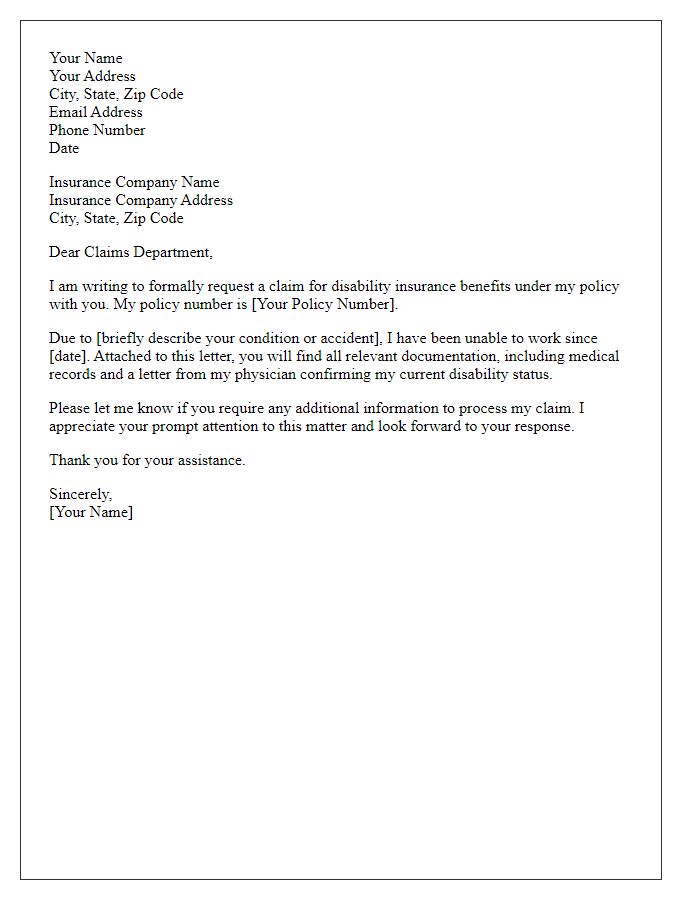

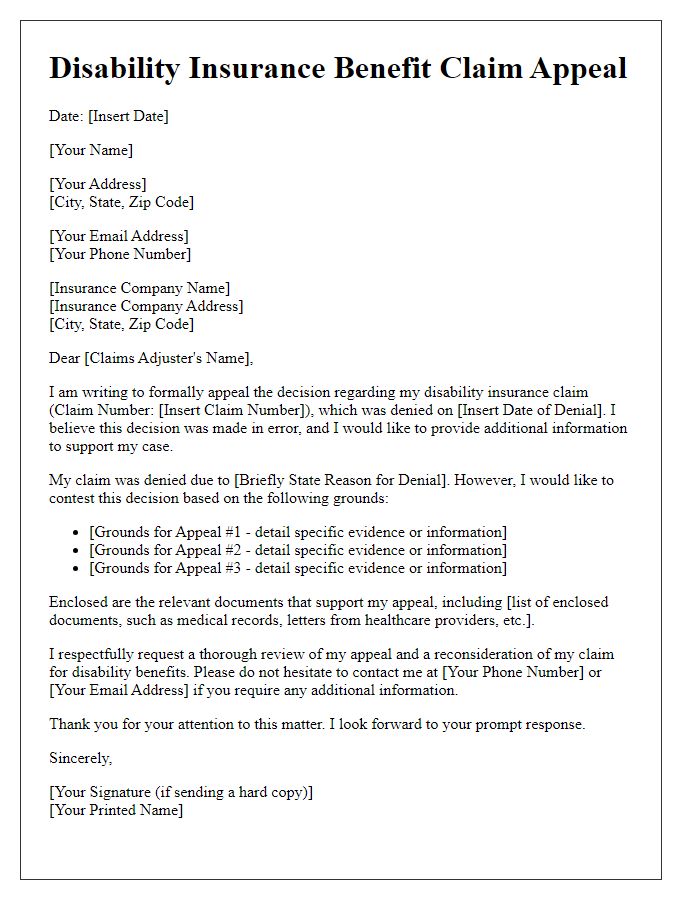

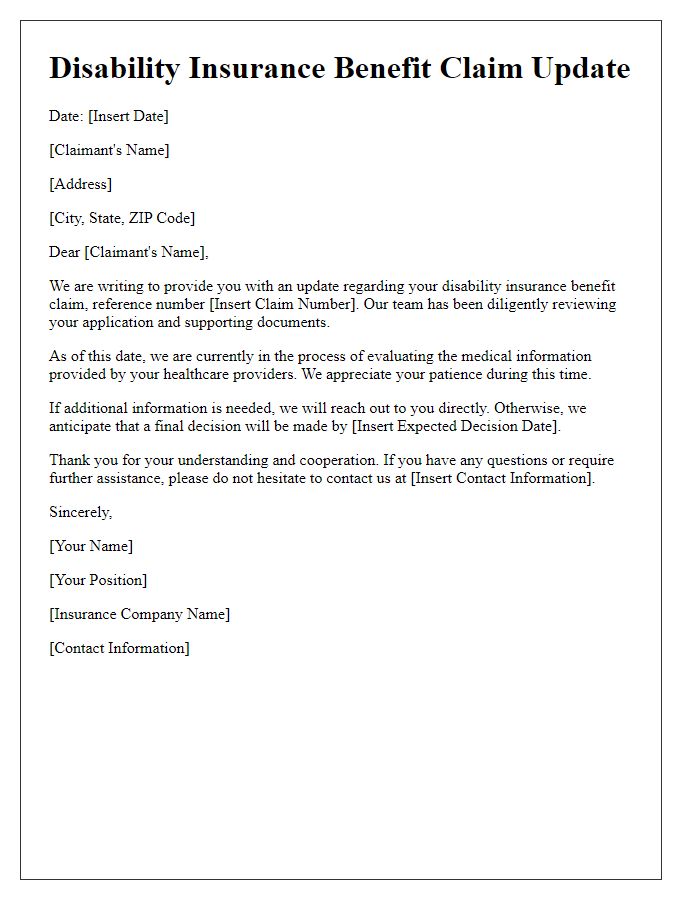

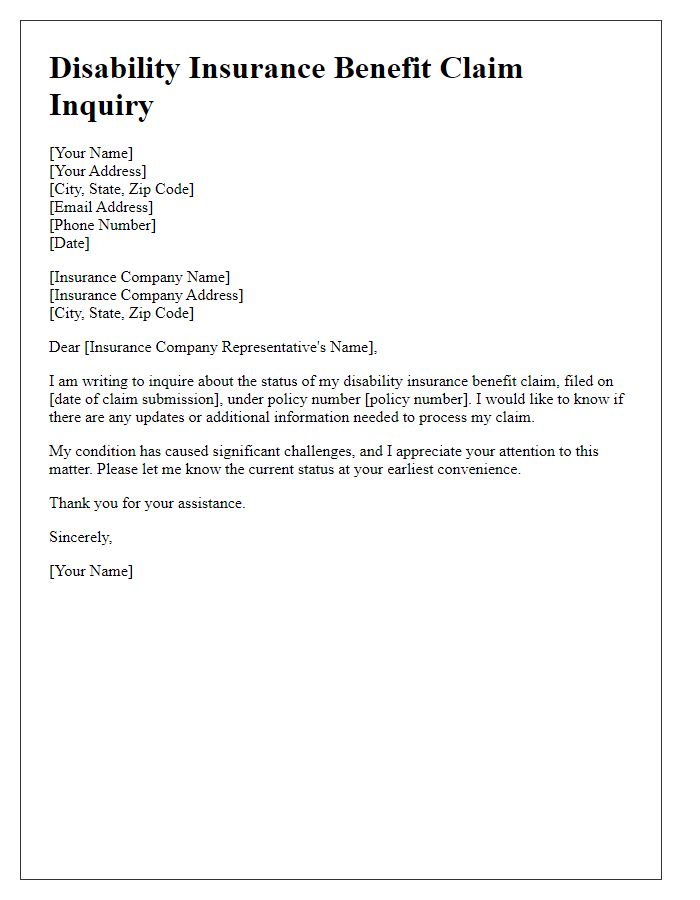

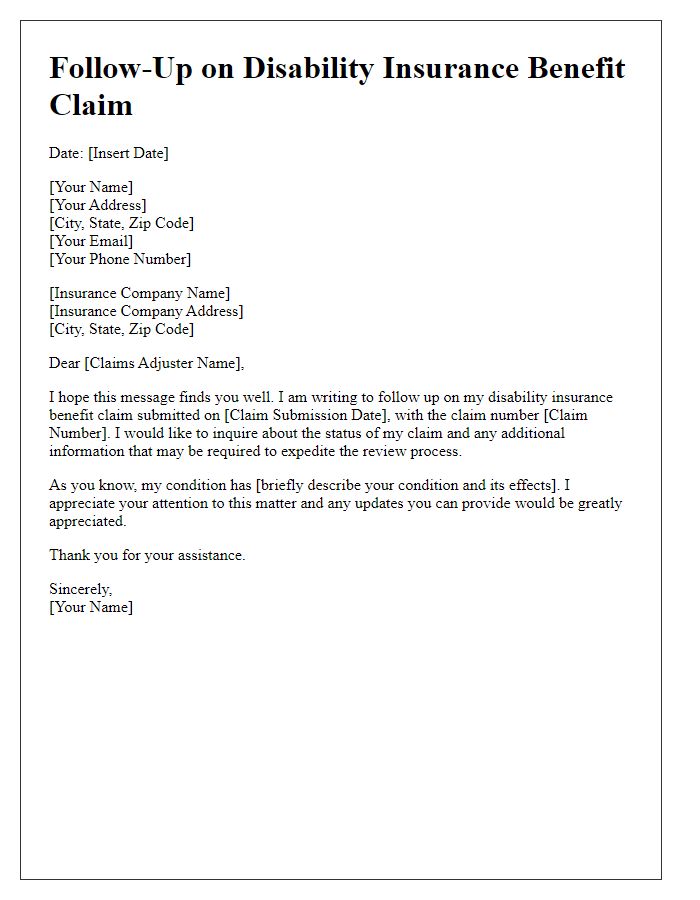

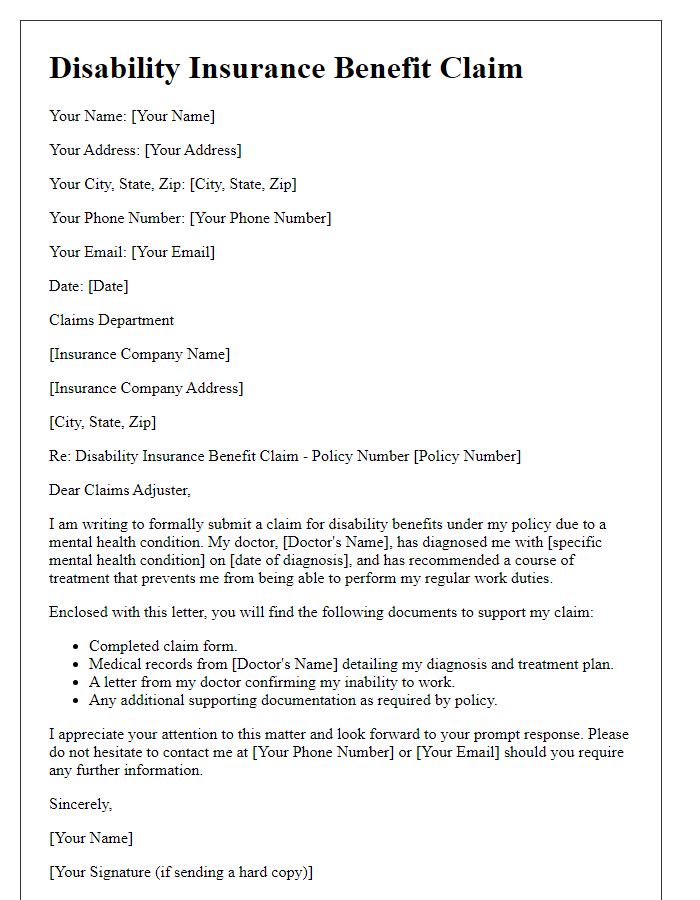

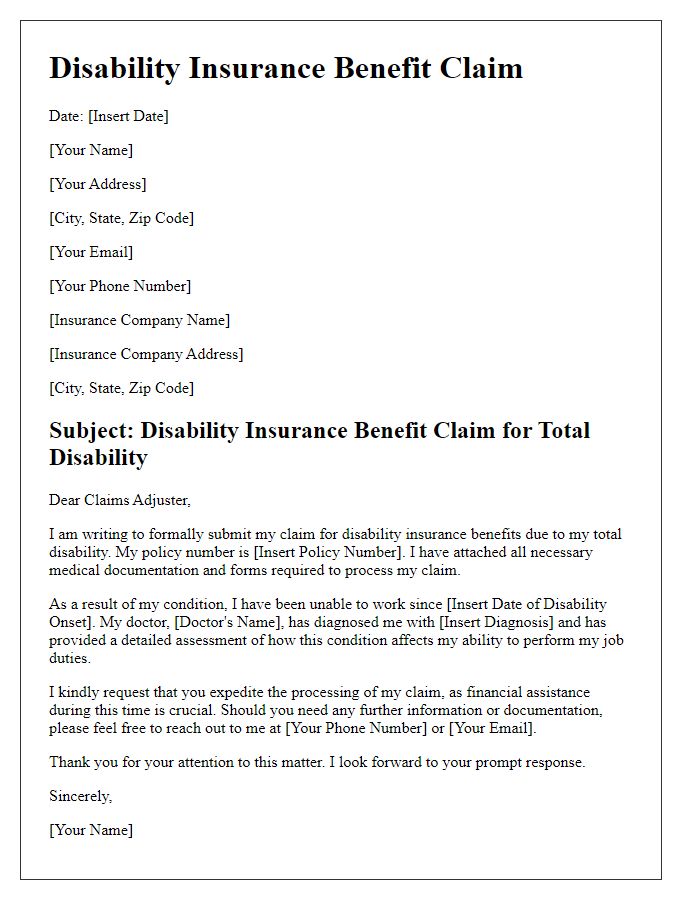

Letter Template For Disability Insurance Benefit Claim Samples

Letter template of disability insurance benefit claim documentation submission

Letter template of disability insurance benefit claim for chronic illness

Letter template of disability insurance benefit claim for workplace injury

Comments