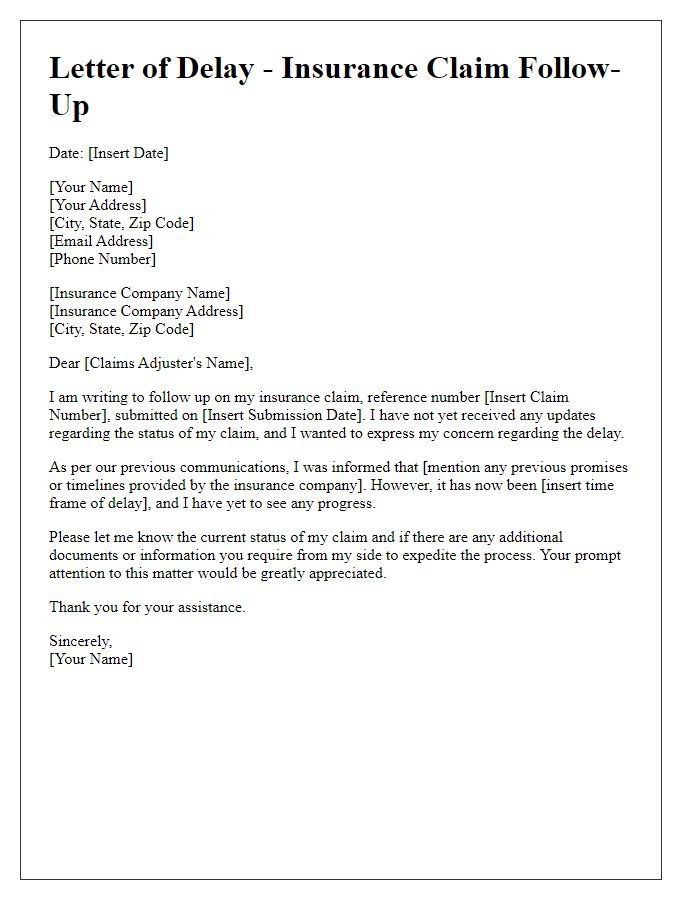

Dealing with insurance claims can often feel like navigating a maze, especially when delays occur. We understand how frustrating it is to be left waiting for a response when you're eager to get things moving. This letter template is designed to help you express your concerns about the hold-up in your insurance claim process while keeping the tone polite yet assertive. Ready to learn the best way to communicate effectively with your insurance provider? Let's dive in!

Policyholder Information

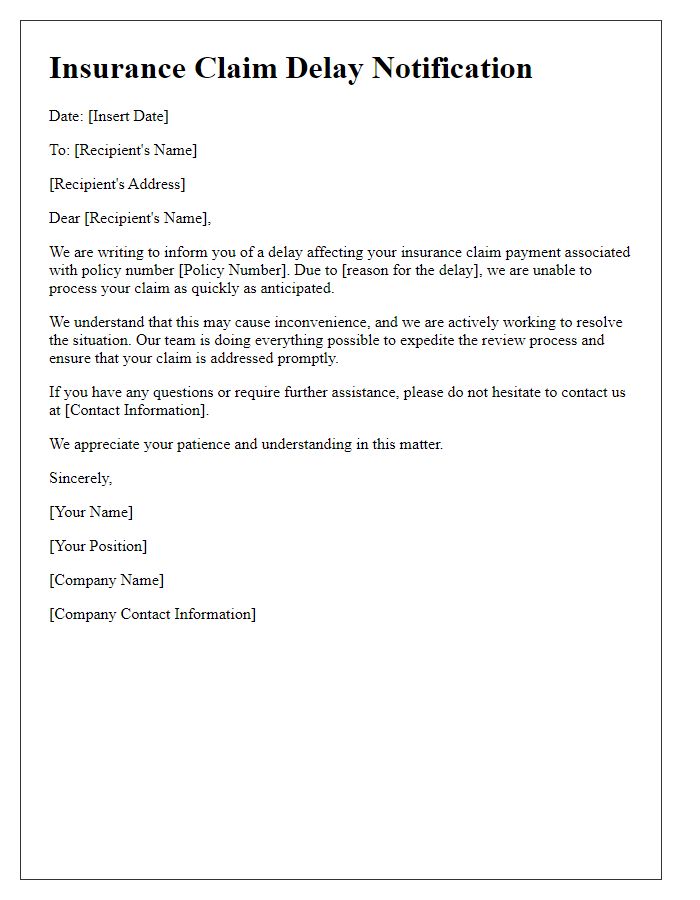

The delay in insurance claim responses can significantly impact individuals seeking assistance, especially in critical situations requiring financial support. For policyholders, such as those affected by natural disasters like Hurricane Katrina in 2005, the urgency for timely claim processing becomes paramount. High-value claims, often ranging in thousands of dollars, can get stalled due to incomplete documentation or excessive verification processes. Insurance companies, influenced by regulatory standards set by organizations like the National Association of Insurance Commissioners, must balance thorough investigations with the necessity of prompt service. This situation can lead to heightened anxiety for policyholders waiting for relief during emergencies or accidents. The response time usually outlined in policies can vary significantly, with maximum periods sometimes exceeding 30 days, leading to frustration for those impacted, including families facing medical or financial crises.

Claim Reference Number

Insurance claims can often take longer than anticipated, leading to frustration among policyholders. A delay in response for claims, such as Claim Reference Number 123456, may occur due to complex investigations or high claim volumes, particularly after natural disasters or significant events, like Hurricane Ian in 2022. Claim filing paperwork needs careful review for accuracy, while documentation, including police reports or medical records, may require additional time to acquire. As a result, insurance companies, such as State Farm or Allstate, strive to provide timely updates. Understanding the claims adjuster's workload can help alleviate concerns during extended waiting periods. Regular follow-ups via phone calls can keep the policyholder informed about progress and expected timelines for resolution.

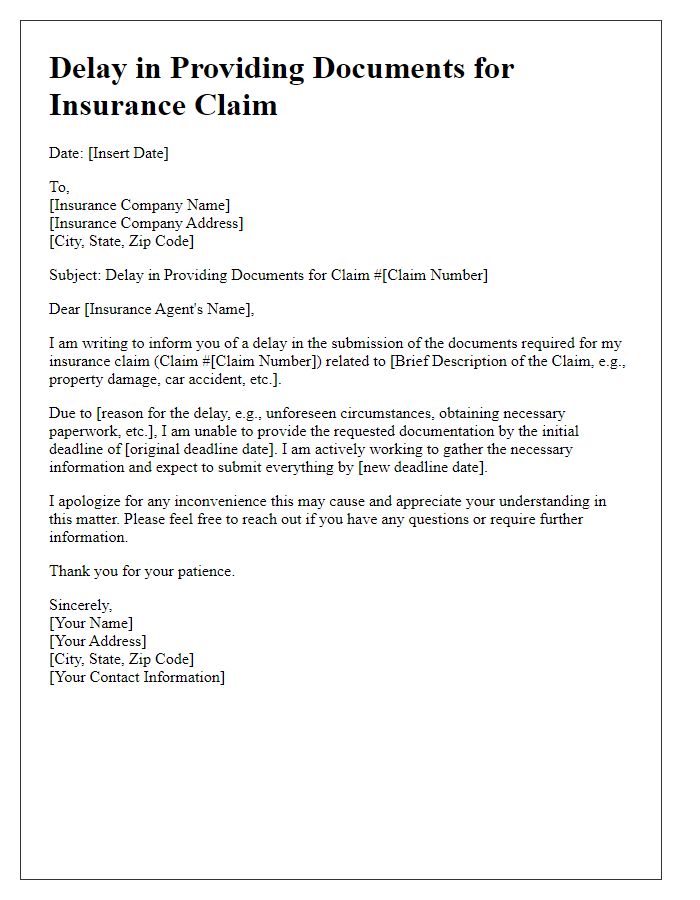

Reason for Delay

Delays in insurance claim responses can significantly impact policyholders. Common reasons for these delays often include incomplete documentation, where essential papers such as medical records or accident reports are missing. High claim volumes, particularly after natural disasters like hurricanes or wildfires, can overwhelm processing teams, causing backlogs. Additionally, fraud investigations may arise from suspicious claims, extending the review period. Complex claims involving multiple parties can also complicate and prolong the approval process. Policyholders may face financial strain as they await settlements for damaged properties or medical expenses, underscoring the need for timely communication from insurance companies.

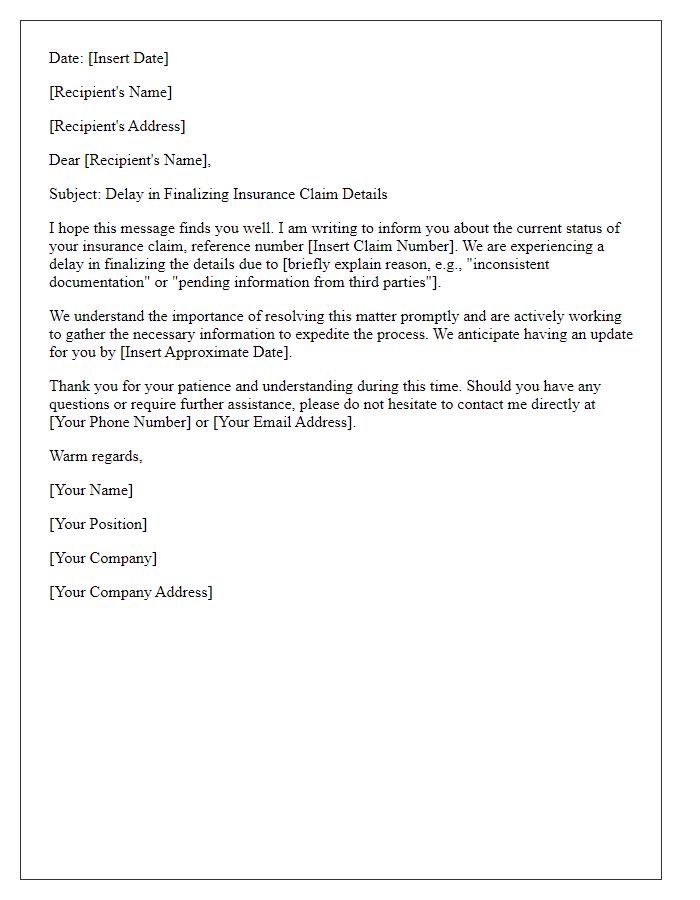

Apology Statement

Insurance claims processing can face delays due to a variety of factors, leading to frustration among policyholders. Such delays often arise from increased claim volumes, especially following catastrophic events like hurricanes or wildfires, or from complex claims requiring additional documentation. Insurers may also experience staffing shortages or technological issues that hinder timely responses. Customers are informed that while the average processing time typically ranges from 15 to 30 days, certain claims may take longer depending on specific circumstances. Acknowledging the inconvenience caused by an unexpected delay is crucial, as is reassessing the claims process to improve efficiency and communication moving forward.

Resolution Timeline

Delayed insurance claim responses can significantly impact policyholders, particularly during stressful situations such as accidents or natural disasters. Typically, insurance companies have a resolution timeline established by state regulations, often around 30 days for initial responses. Events like catastrophic incidents prompts increased claim volumes, resulting in extended processing times. Places with high insurance activity, such as California after wildfires or Florida post-hurricane, frequently face these delays. Effective communication is crucial; this can include status updates and estimated timelines for resolution. Maintaining transparency builds trust and helps policyholders manage their expectations during the claims process.

Comments