When it comes to dealing with insurance claims, it's not uncommon to find yourself in a frustrating position, especially if you feel that your settlement is unfair. Navigating the complexities of insurance terms and conditions can be daunting, but you have the right to dispute any decision that doesn't meet your expectations. In this article, we'll provide you with a comprehensive letter template to clearly communicate your concerns and advocate for a fair reassessment of your claim. So, if you're ready to take the next step in your insurance journey, let's dive in!

Clear Policy Reference

In a recent insurance settlement case, the importance of referencing a clear policy document (like Policy Number 12345) cannot be overstated. An insurance policy outlines coverage details, claim processes, and dispute resolution procedures. Accurate identification of specific clauses, such as Section 3.2 regarding "Loss of Property" or Subsection 2.5 concerning "Premium Payment Schedules," strengthens claims for better response from insurers. Additionally, citing relevant dates like the incident on January 15, 2023, promotes clarity. It allows for a structured argument concerning delays (like the 30-day response requirement) from the insurer's side, which can support the dispute against the settlement offered. Clear documentation, including photographs, repair quotes, and prior correspondence, must accompany the dispute to reinforce credibility.

Detailed Explanation of Dispute

Disputing an insurance claim settlement can be critical in securing fair compensation. Insurers often base their offers on extensive evaluations that may overlook key elements. A common issue arises from undervaluation of damages reported during the incident, particularly in cases involving property or vehicle damages where repair estimates fail to cover costs (discrepancies of up to 30 percent in some assessments). In instances like storm damage, factors such as location (e.g., coastal areas with higher repair expenses) and type of materials (specific building codes that mandate advanced materials) may influence the overall cost. Insurers may also use generalized depreciation methods that do not accurately reflect the true condition of the property or vehicle. Furthermore, convoluted policy terms can lead to misinterpretations regarding coverage limits (sometimes as low as $10,000 or as high as $100,000), resulting in inadequate settlement offers. Detailed documentation, including invoices and expert evaluations, alongside photographs of damages can fortify the dispute. Engaging a legal expert familiar with insurance law in your state can greatly enhance the chances of a fair reevaluation of the claim.

Supporting Documentation

Disputing an insurance claim settlement often requires substantial supporting documentation to establish a strong case. Essential documents include the initial claim form detailing the incident, copies of correspondence with the insurance company, and any denial letters received. Photographs of damages or losses provide visual evidence, while repair estimates from licensed contractors bolster claims of monetary amounts involved. Relevant medical records or bills are crucial for health-related claims, particularly following accidents or medical conditions. Additionally, any affidavits or witness statements from individuals present during the incident can significantly enhance the credibility of the dispute. Collecting these documents meticulously can expedite the review process by the insurance adjuster and increase the likelihood of a favorable resolution.

Request for Reassessment

A formal request for reassessment of an insurance claim settlement is crucial for ensuring fair evaluation of your case. The insurance policy (reference number) covers specific circumstances, such as unintentional damage or loss. Stakeholders often involve insurance adjusters who analyze claims based on policy terms, local regulations, and applicable laws (e.g., the Fair Claims Settlement Practices Act). Documentation such as police reports, photographs of damage, and repair estimates are essential to your case. Additionally, referencing similar claims that resulted in favorable outcomes can strengthen the argument for reassessment. Engaging legal counsel may also streamline the process in disputes involving significant amounts.

Contact Information and Professional Tone

Disputing an insurance claim settlement requires clarity and professionalism. Essential details include your name, address, claim number, and contact information prominently displayed at the beginning. Mention specific incidents, such as the date of the loss and the nature of the claim, to provide context. Clearly articulate the reasons for the dispute, referencing policy numbers and coverage limits to substantiate your position. Use a formal tone throughout, expressing your expectations for a review of the settlement decision. Additionally, include relevant documentation, such as receipts and previous correspondence, to bolster your case. Aim for a respectful but assertive approach, emphasizing the importance of a timely response to resolve the matter efficiently.

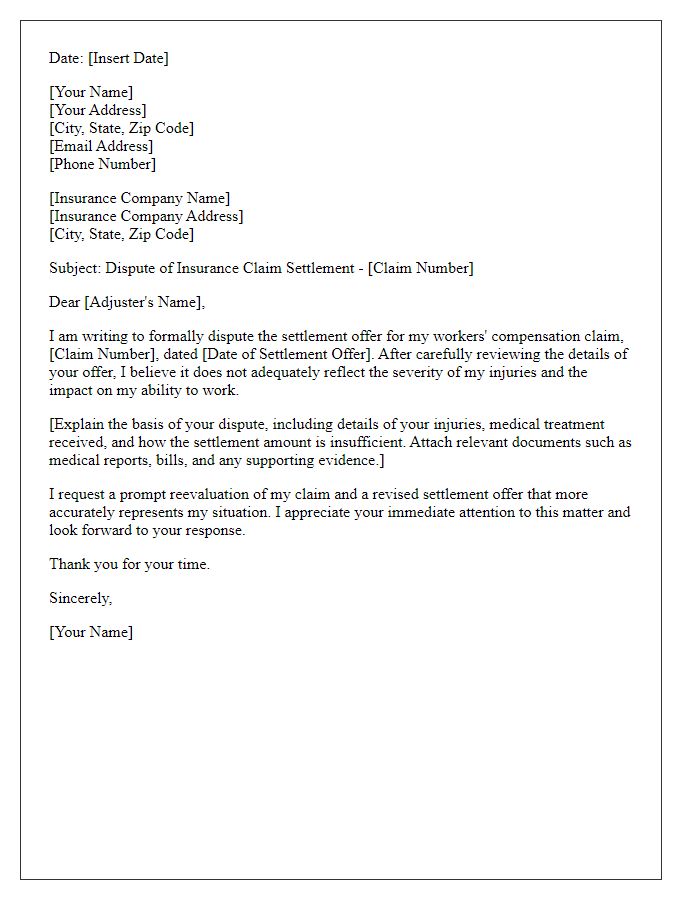

Letter Template For Disputing Insurance Claim Settlement Samples

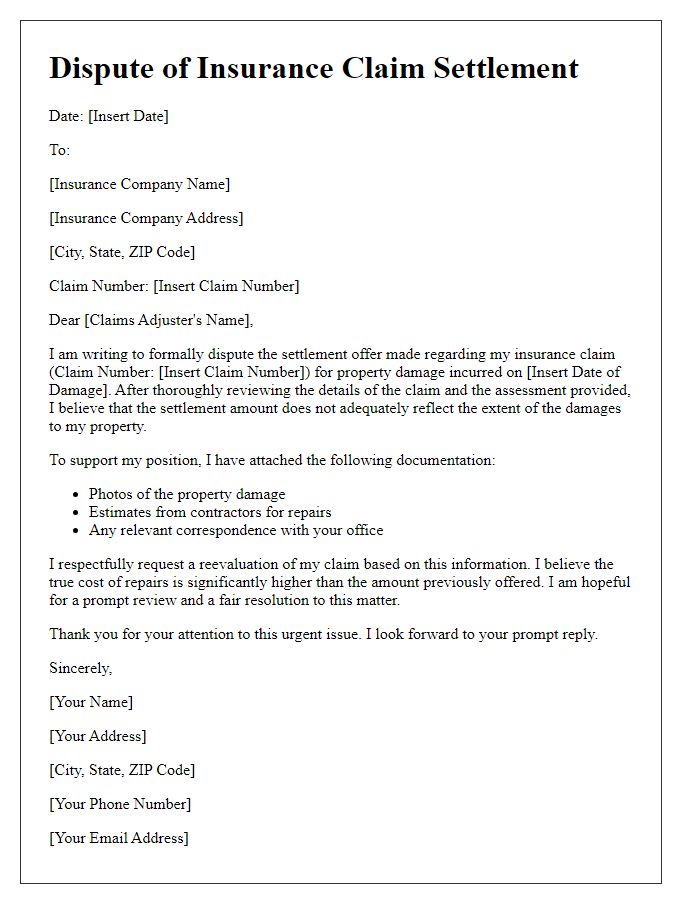

Letter template of disputing insurance claim settlement for property damage.

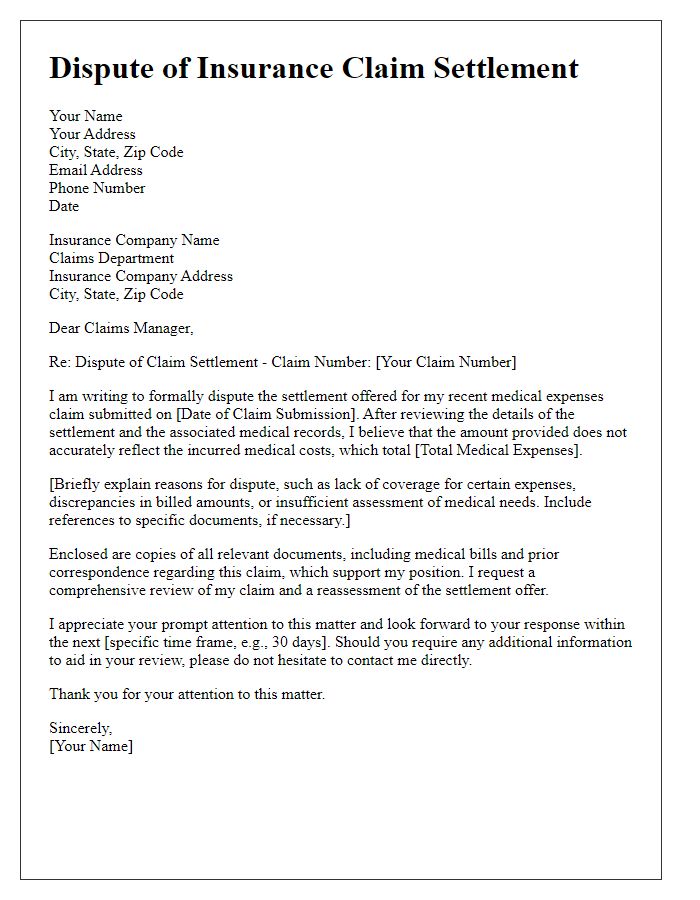

Letter template of disputing insurance claim settlement for medical expenses.

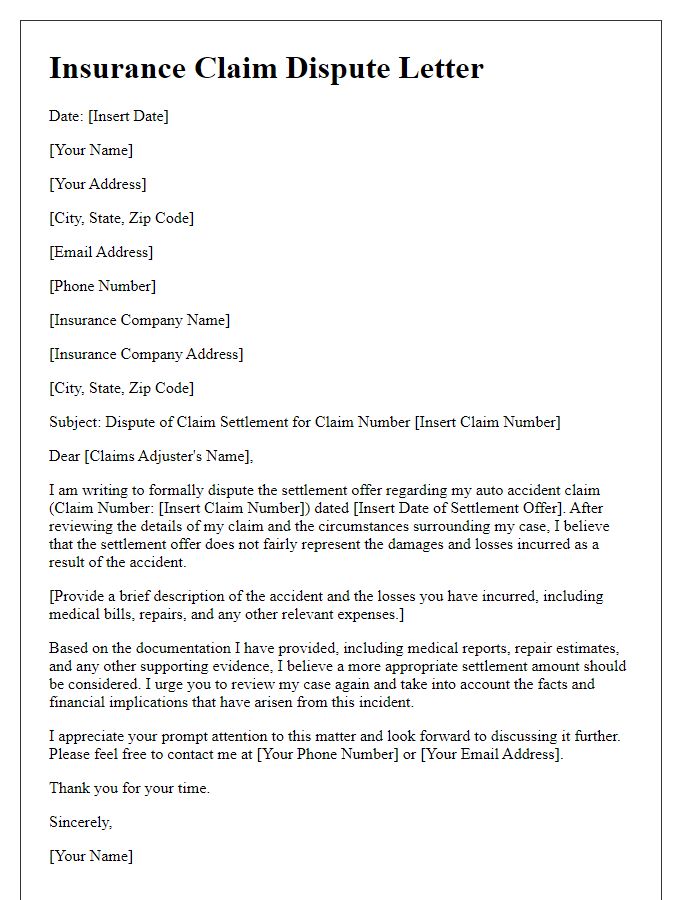

Letter template of disputing insurance claim settlement for auto accident.

Letter template of disputing insurance claim settlement for life insurance policy.

Letter template of disputing insurance claim settlement for business interruption.

Letter template of disputing insurance claim settlement for home insurance.

Letter template of disputing insurance claim settlement for flood damage.

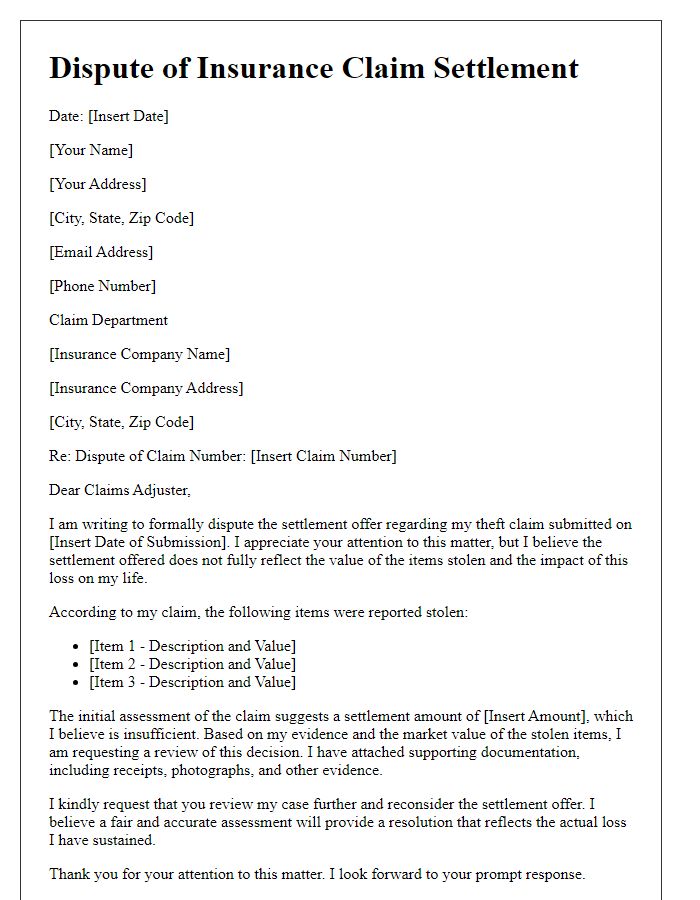

Letter template of disputing insurance claim settlement for theft claims.

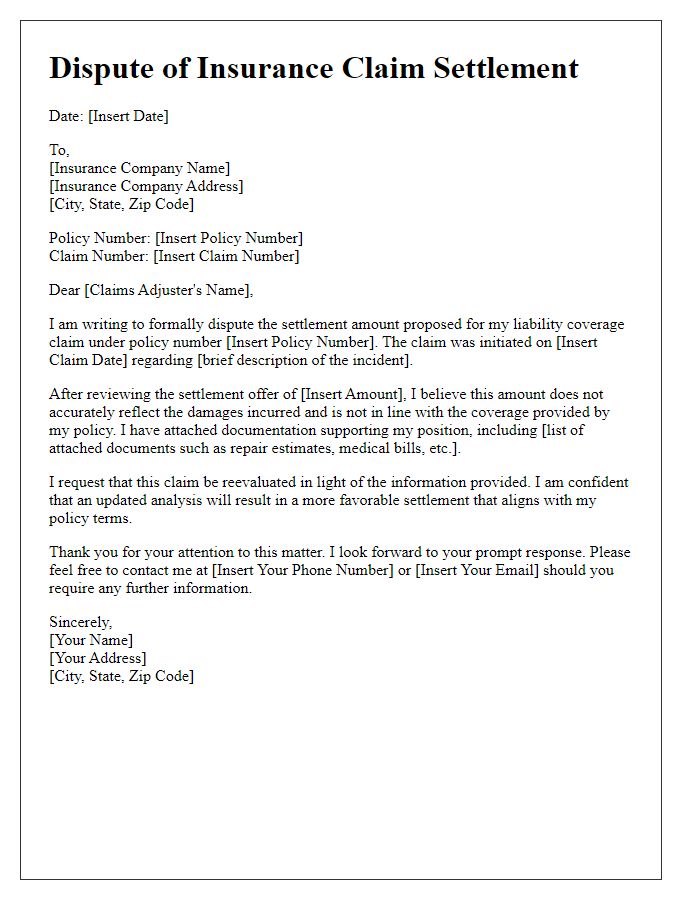

Letter template of disputing insurance claim settlement for liability coverage.

Comments