Are you looking to update your insurance policy details, but aren't quite sure where to start? Making changes to your policy can seem overwhelming, but it's essential to ensure that your coverage reflects your current life situation. Whether it's updating your address, adding a new beneficiary, or changing coverage limits, this process doesn't have to be daunting. Join us as we explore a simple letter template that will help you navigate the amendment process with ease!

Policyholder's Full Name and Contact Information

The insurance policy details require careful amendments to ensure accurate coverage and communication. Policyholder's full name, John Doe, should be clearly stated on the document for reference. Furthermore, contact information, including the mobile number (555-123-4567) and email address (johndoe@email.com), must be updated to reflect any changes to ensure timely correspondence from the insurance provider, XYZ Insurance Company, based in New York City. Accurate policy details are crucial for processing claims effectively and ensuring the policyholder maintains adequate protection.

Policy Number and Type of Insurance

An insurance policy amendment request requires clear communication to ensure accurate updates. Policy number refers to the unique identifier assigned to individual insurance contracts, which allows insurance companies to track and manage coverage details efficiently. The type of insurance represents the specific coverage being requested for amendment, such as health, auto, or home insurance. When composing a request, it is essential to include the policy number prominently, alongside precise details regarding the desired changes. This includes the effective date for changes and any pertinent personal information like name and address to facilitate processing by the insurance provider. Clarity and specificity in these details help avoid processing delays and ensure that the amendments reflect the policyholder's current situation accurately.

Specific Details to be Amended or Updated

Amending an insurance policy requires careful attention to detail and clarity. Accurate documentation ensures that the policyholder's needs are clearly understood and processed efficiently. Policyholder information, such as name, address, and contact details, must be updated. Additionally, changes to coverage options, such as increasing or decreasing liability limits, or adding riders for specific events like natural disasters, must be clearly specified. Specific details surrounding the insured items, including their descriptions, values, and any changes in ownership or use, are paramount. This type of communication often necessitates referencing the policy number, effective date, and any prior amendments to maintain a clear record for both the insurer and the policyholder.

Reason for Amendment Request

When requesting an amendment to an insurance policy, a specific detail that frequently necessitates modification is the coverage limit amount. For example, after evaluating personal assets and liability risks more comprehensively, a policyholder may realize the need to increase their home insurance coverage from $300,000 to $500,000. This adjustment is crucial, especially in areas prone to natural disasters, like hurricanes in Florida, where property values may escalate rapidly. Another common reason for amendment requests involves changes in personal circumstances, such as adding a new driver to an auto insurance policy, which could lead to a recalibration of premiums based on age and driving history. Accurately reflecting these changes in the policy ensures adequate protection and aligns coverage with current needs and potential risks.

Preferred Effective Date for Changes

Amending insurance policy details requires careful attention to specific dates, such as the preferred effective date for changes. This date, often specified in policy documentation, represents the moment when requested amendments will take effect. For example, if a policyholder requests an increase in coverage limits or an adjustment in deductible amounts, the preferred effective date should align with the premium payment schedule. Insurance companies, such as Allstate or State Farm, typically process these updates within a designated timeframe, often prompting policyholders to submit requests at least 30 days in advance to avoid any lapses in coverage. Notifying the insurer about desired changes ensures clarity and ensures that the policyholder's financial protection aligns with their current needs.

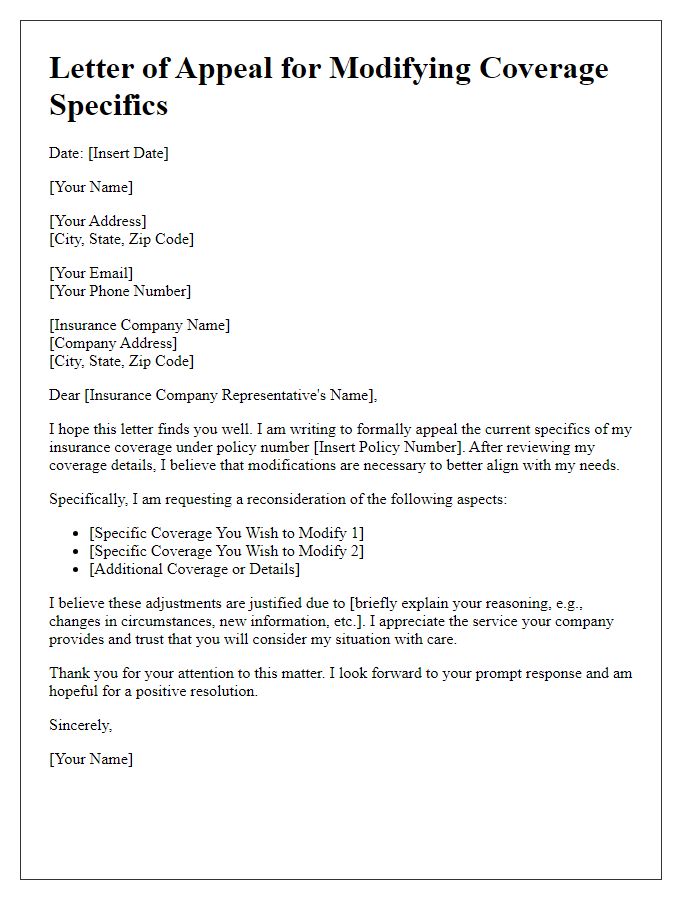

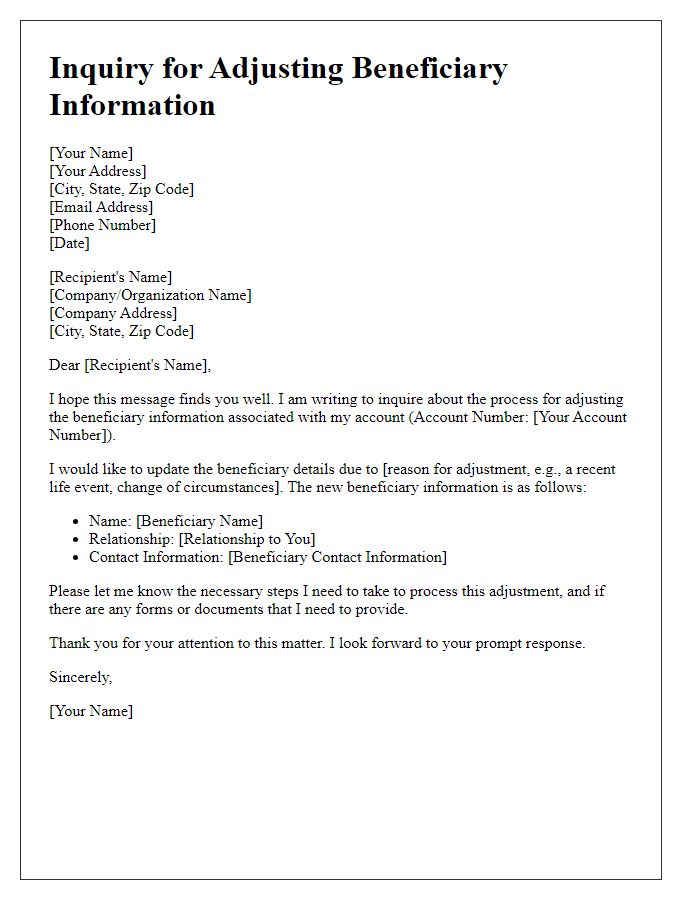

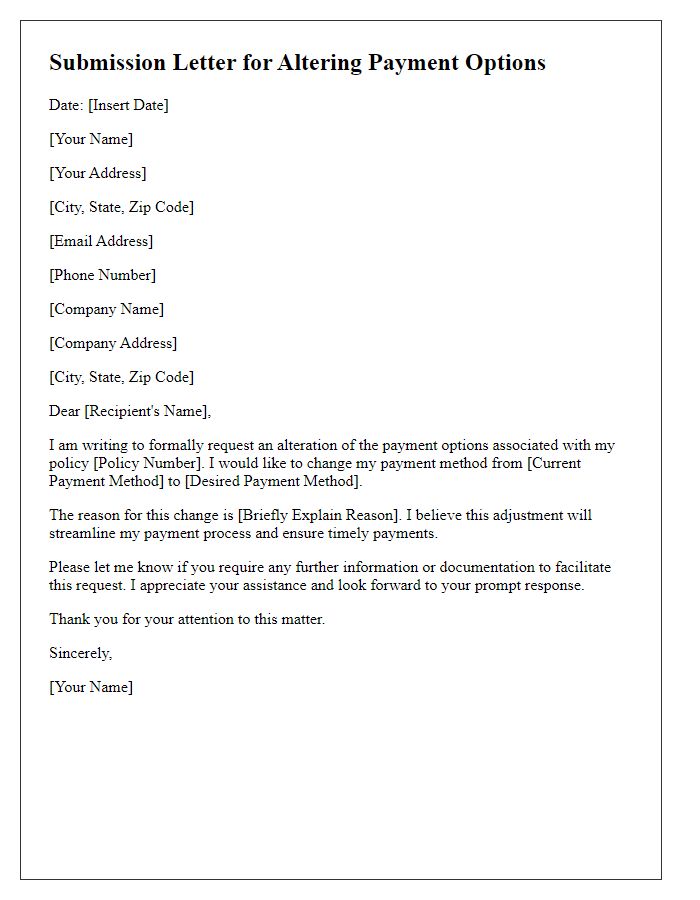

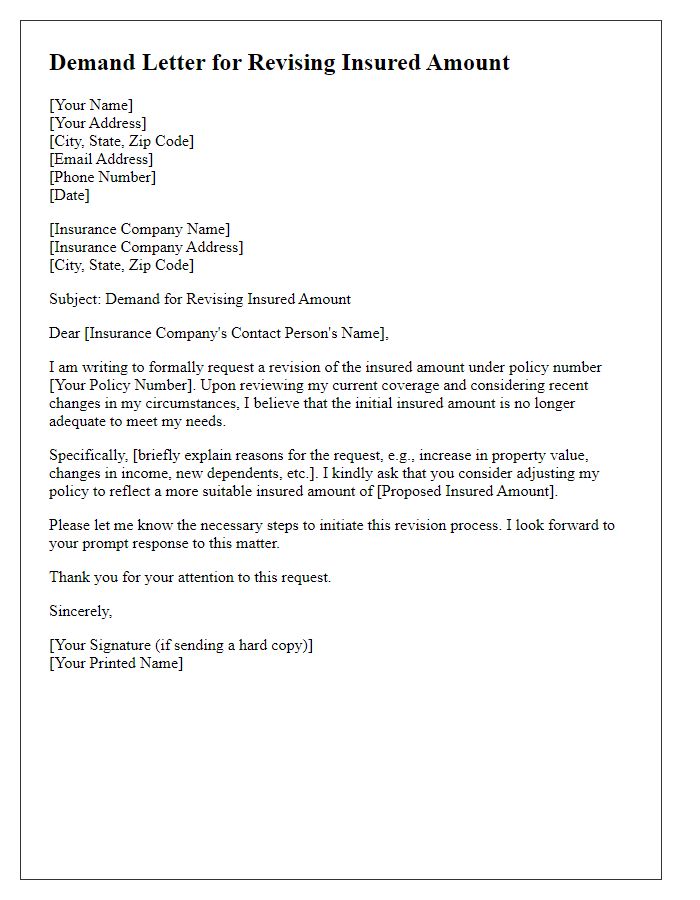

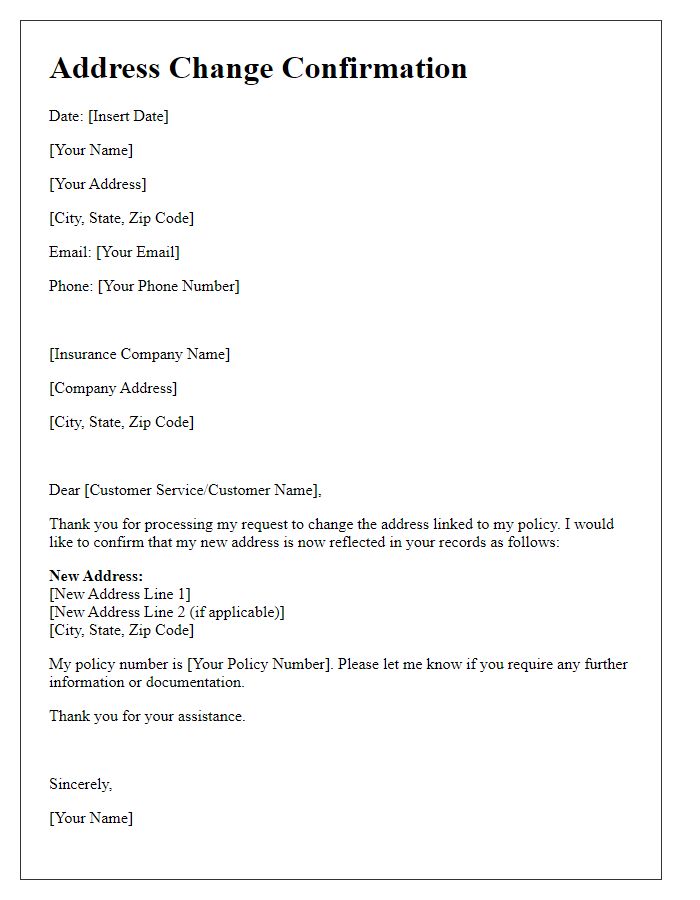

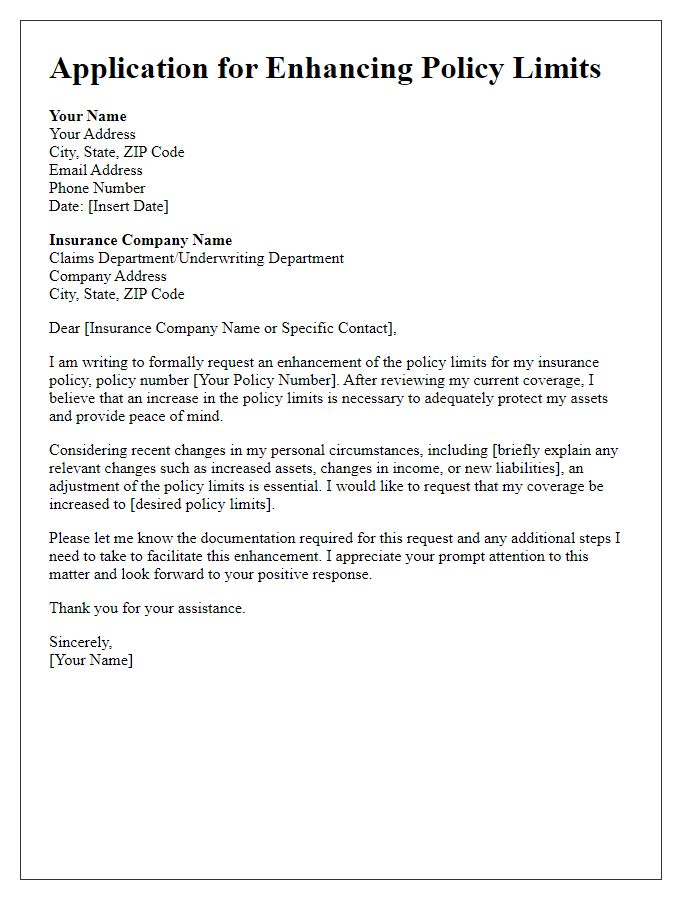

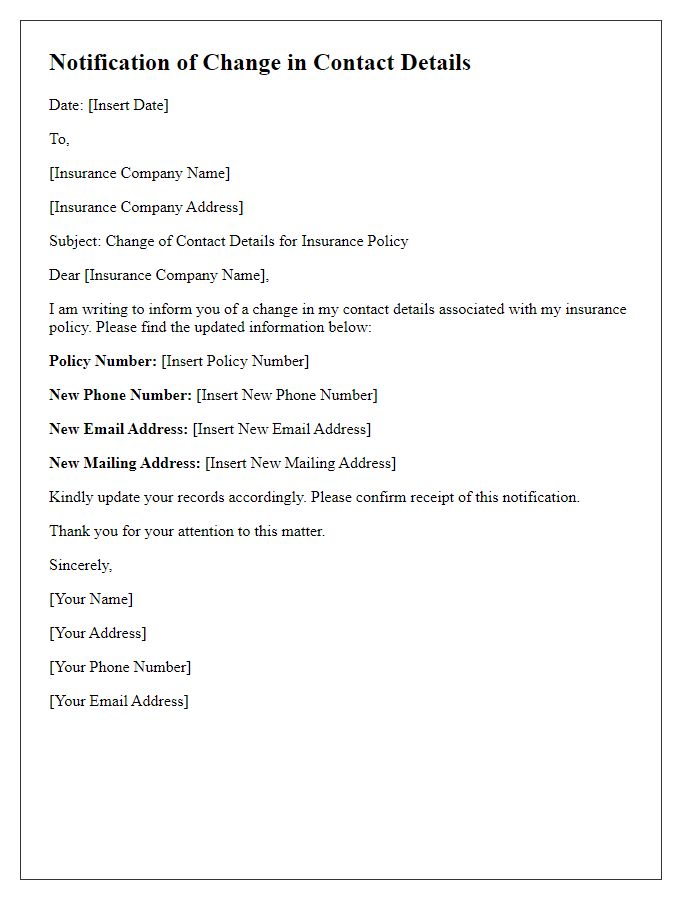

Letter Template For Amending Insurance Policy Details Samples

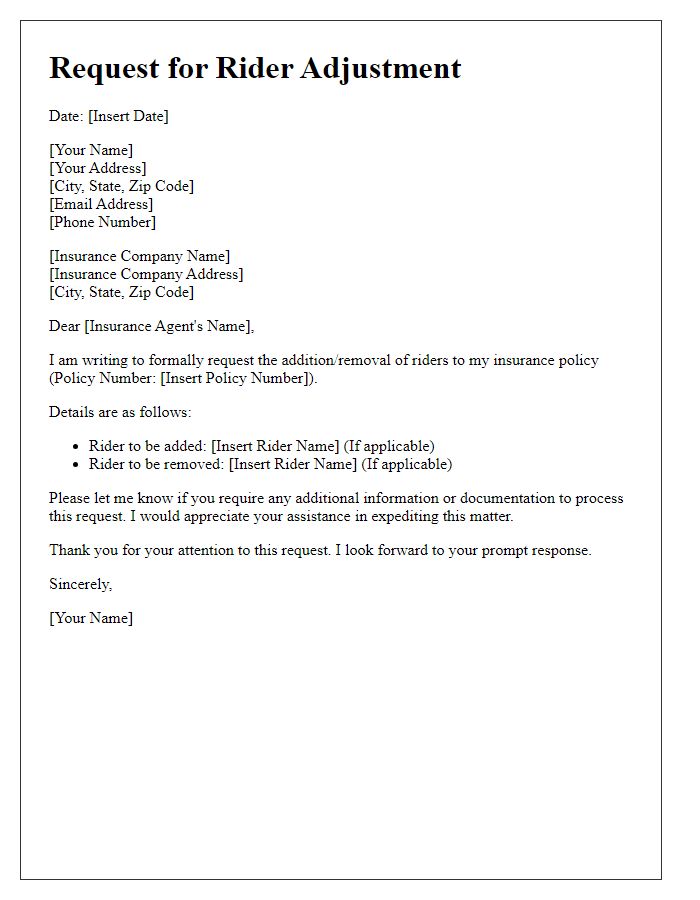

Letter template of correspondence for removing or adding riders to policy

Comments