Are you facing a transition in your insurance agency and unsure how to communicate it effectively? It can be tricky to navigate the process of notifying clients and partners about changes, whether you're moving to a new agency or stepping into a different role. Crafting a clear and professional transition notice is essential to maintaining trust and transparency with those you serve. We've put together a helpful guide on how to create a seamless transition letter that not only informs but also reassures clients about their ongoing coverageâread on to find out more!

Client Information and Personalization

Transitioning to a new insurance agent can significantly impact clients, particularly in terms of service continuity and personalized care. Clients should be promptly informed about the change to ensure they feel secure in their insurance coverage. Detailed communication includes essential information such as the new agent's name, contact details, and a brief description of their experience and approach to client service. Providing reassurances regarding the uninterrupted handling of existing policies and claims is crucial for maintaining trust. Additionally, an invitation for clients to reach out with questions or concerns fosters an open line of communication, enhancing client-agent relationships during this transition period.

Clear Explanation of Transition

Transitioning insurance agents can create uncertainty for clients in managing their policies and claims. A clear explanation should highlight the reason behind the transition, such as a new career opportunity or a change in agency structure. It's essential to provide a detailed overview of the new agent's qualifications, ensuring clients feel confident in their capabilities. Outline any changes in communication methods, including the new agent's contact information. Emphasizing continuity in service and commitment to supporting clients throughout the transition period can help alleviate concerns. Reassuring clients about the seamless transfer of their policies and that no action is needed on their part will enhance trust during this change.

Contact Details of New Agent

Transitioning to a new insurance agent can enhance client support and streamline service. New agent contact details are crucial for maintaining seamless communication. Typically, clients should receive the new agent's name, phone number (including area code), and email address for direct inquiries. Additionally, the new agent's office address may be provided for any required in-person meetings or document submissions. Clear identification of the new agent's expertise and services can reassure clients during the transition process, ensuring they feel confident in the continuity of their insurance needs.

Continuity of Service Assurance

Transitioning to a new insurance agent can significantly impact ongoing policy management and client support. A notification highlighting continuity of service is vital for reassuring clients during this process. Emphasizing the new agent's qualifications, experience, and understanding of specific policies--such as homeowners insurance or auto insurance--can instill confidence. Clients should be informed about any changes in communication methods, such as email or phone contacts. Additionally, outlining timelines for the transition, including important dates for policy renewals or claims processing, is crucial for maintaining trust. Addressing potential concerns about coverage gaps or claims management during the transition ensures clients feel prioritized and supported amidst changes.

Expression of Gratitude and Support

Transitioning between insurance agents can be a significant event for clients, signaling a change in representation for their policies and coverage. It's an opportunity to express gratitude for the services provided by the current agent while ensuring clients feel supported during the transition. The farewell may emphasize the positive experiences shared, such as personalized guidance received in navigating complex claims or coverage options. Furthermore, it's vital to reassure clients about the new agent's qualifications, emphasizing their dedication to client satisfaction and continuity of service, creating a smooth handover for policy management. Clients should feel encouraged to reach out with questions while fostering a sense of trust in their ongoing insurance journey.

Letter Template For Insurance Agent Transition Notice Samples

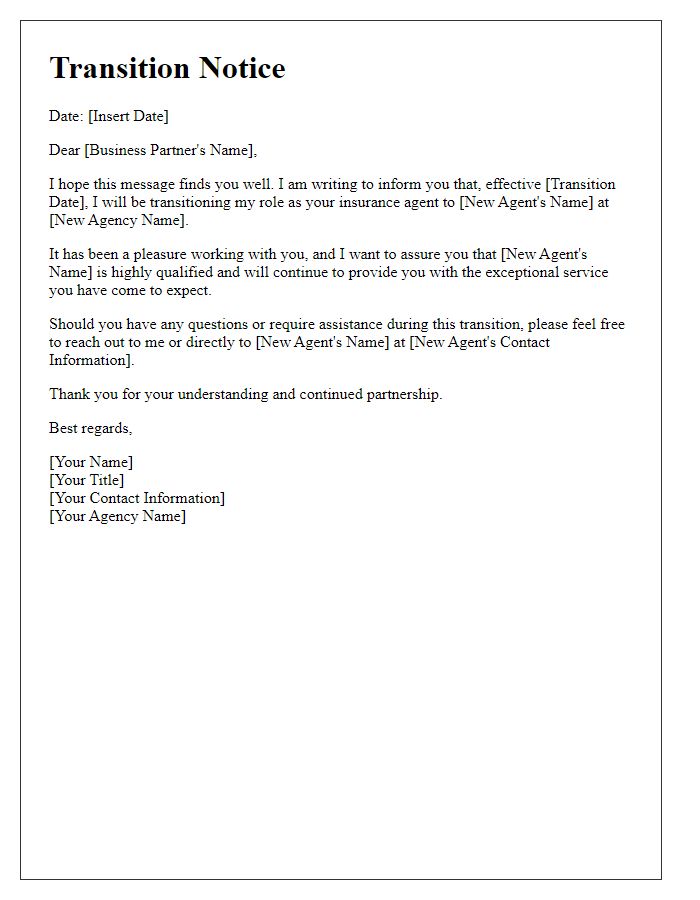

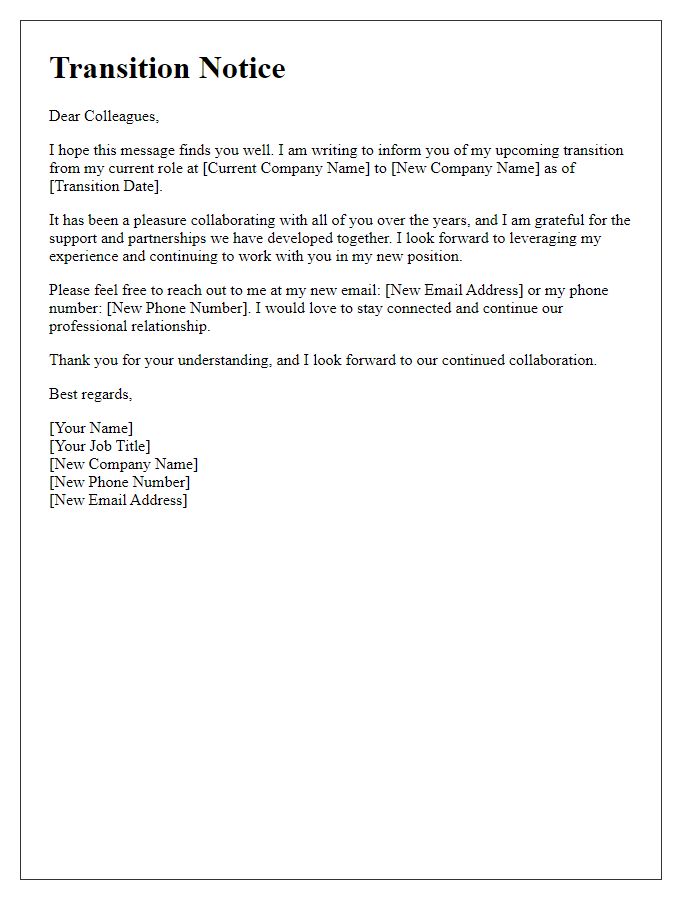

Letter template of insurance agent transition notice for business partners

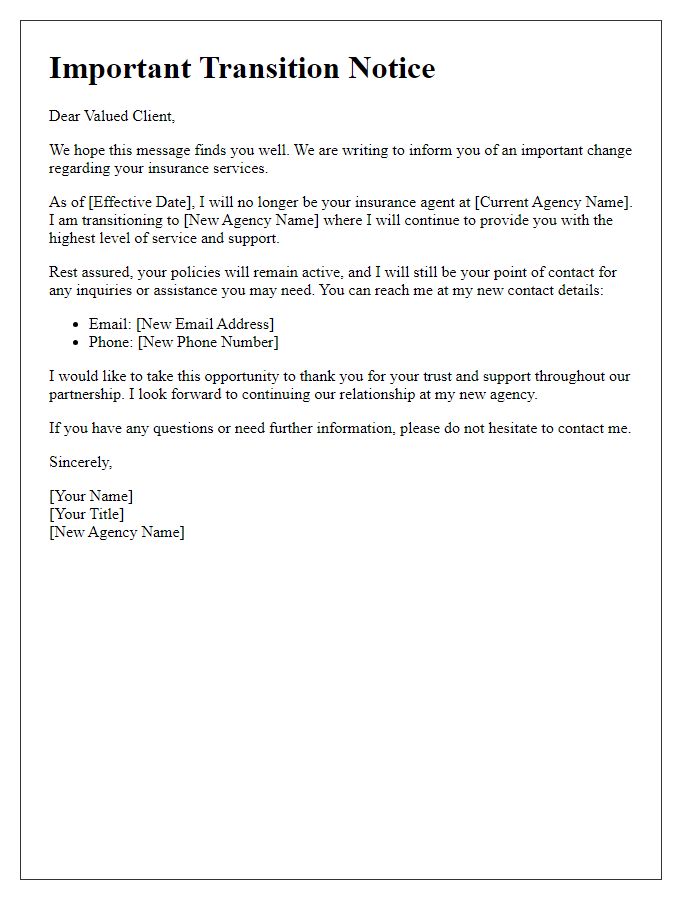

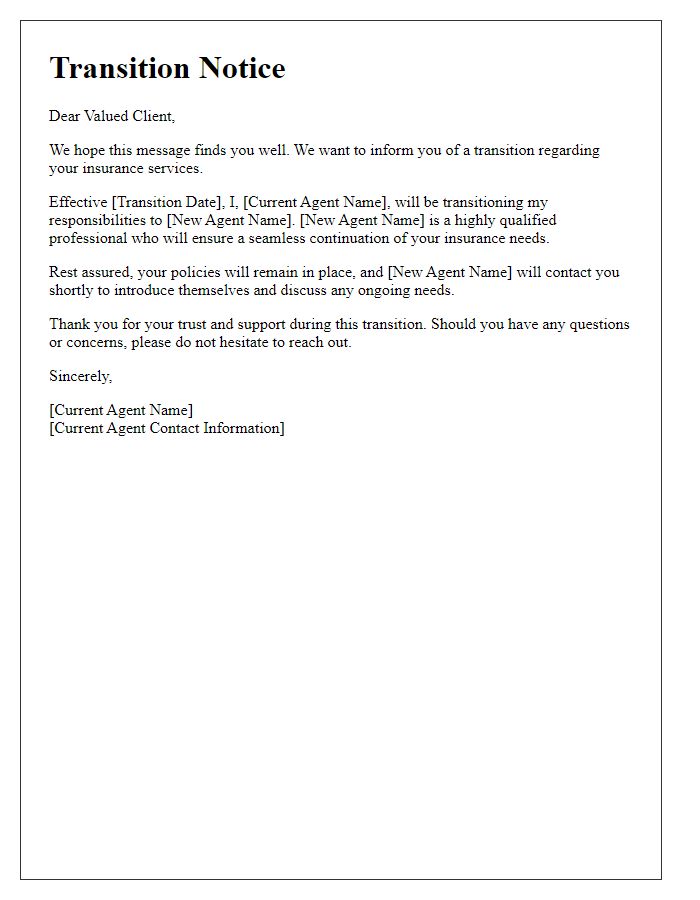

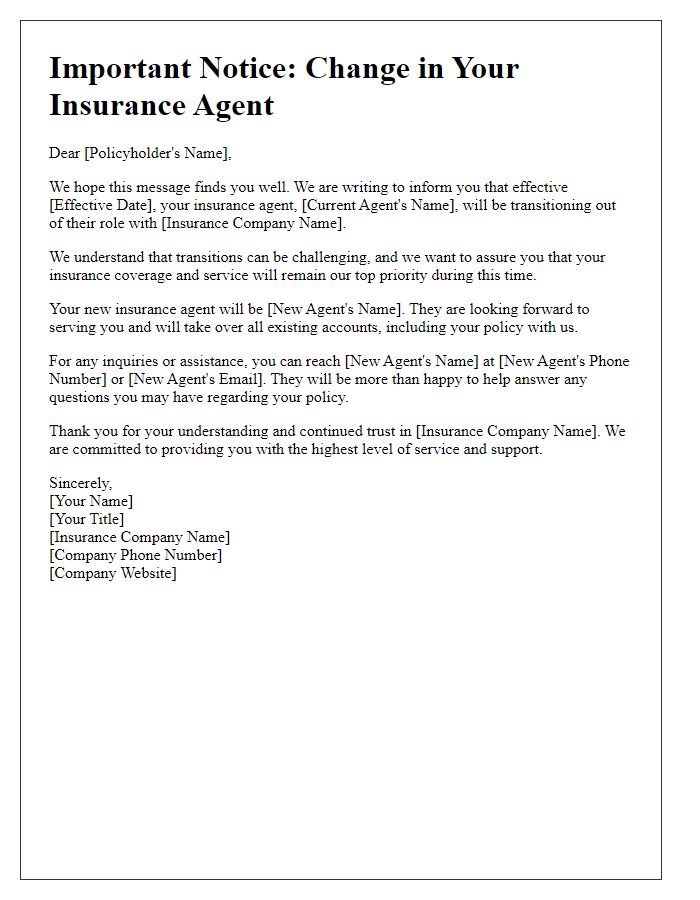

Letter template of insurance agent transition notice for personal clients

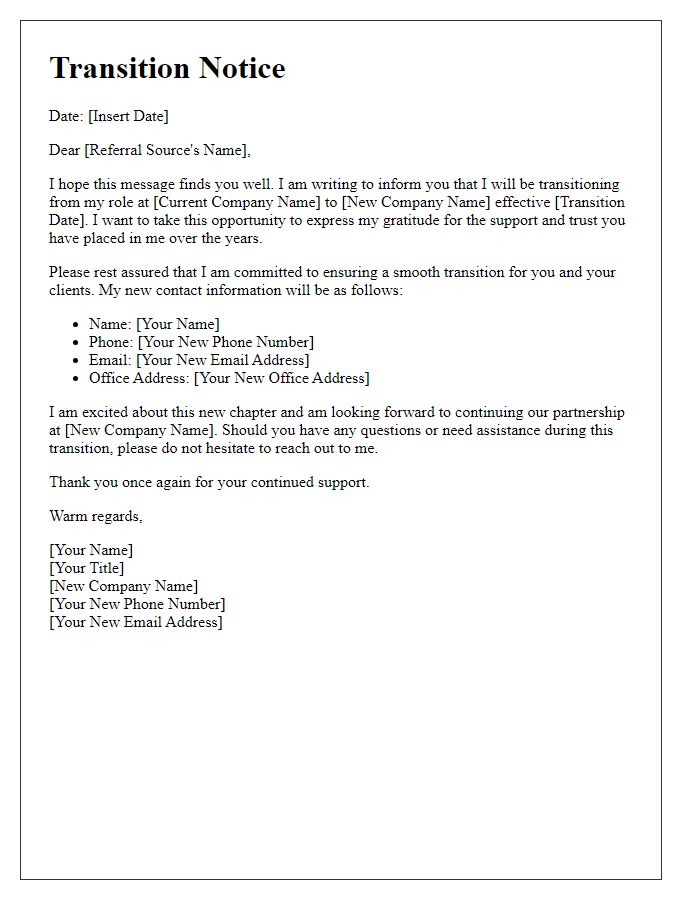

Letter template of insurance agent transition notice for referral sources

Letter template of insurance agent transition notice for industry colleagues

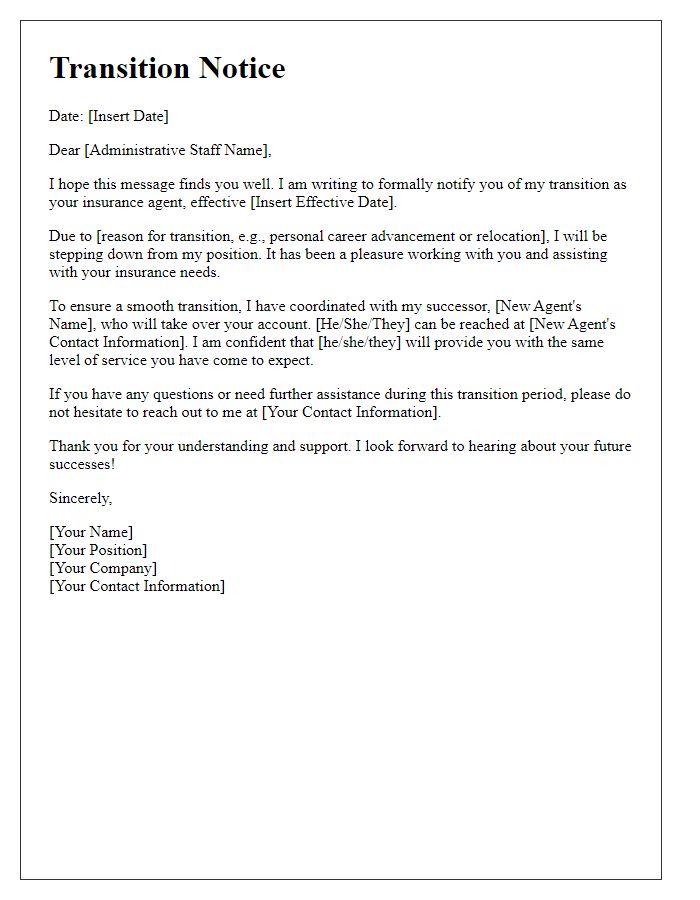

Letter template of insurance agent transition notice for administrative staff

Comments