Are you finding it difficult to manage your insurance premiums in these challenging times? You're not alone, as many individuals are seeking ways to ease their financial burdens. A premium waiver can provide the relief you need, allowing you to keep your coverage without added stress. Let's dive into the details of how to approach this process and explore the steps you should take to submit your request effectively.

Policyholder information

A letter requesting an insurance premium waiver should include key details such as the policyholder's name, policy number, premium amount, and reasons for the waiver request. Clearly stated, the policyholder may demonstrate any relevant financial hardship, such as job loss or medical expenses, to strengthen the case. Essential dates should also be specified, including when the policy was initiated (e.g., policy start date) and the due date for the premium payment. Including contact information ensures easy follow-up from the insurance company regarding the request. Overall, clarity and detail in the letter enhance the likelihood of a favorable response.

Policy details

Insurance premium waivers can facilitate financial relief under specific circumstances. Certain policies, like term life or health insurance, may offer premium waivers in cases of disability or critical illness. For example, a policyholder diagnosed with cancer may be eligible for a waiver on premiums for the duration of treatment. Generally, an application process is required, often including documentation such as medical reports or proof of disability. Important terms include "waiver period," which indicates the duration of the premium exemption and "policy number," crucial for identifying the contract in question. Conditions for waiver eligibility typically emphasize the significance of immediate notification to the insurer (usually within 30 days) and clear evidence of the qualifying situation.

Reason for waiver request

Financial hardship due to unforeseen medical expenses can create significant challenges for individuals. In 2023, reports indicate that unexpected health-related costs have led to 62% of bankruptcies in the United States. Many policyholders, facing barriers such as unemployment or reduced income, struggle to maintain insurance premium payments. Additionally, specific life events, like the loss of a primary income source or the onset of a serious illness, can adversely impact financial stability. In such cases, requesting a premium waiver can provide essential relief, allowing individuals to maintain necessary coverage without the burden of immediate financial strain.

Financial hardship explanation

Financial hardship can significantly impact an individual's ability to maintain insurance premiums. Situations such as job loss (a decrease in income by 30% or more), unexpected medical expenses (averaging $1,500 to $5,000 depending on treatment), or temporary disability can lead to an inability to fulfill financial obligations. Additionally, economic downturns, such as the recession experiences in 2008 or the recent pandemic-related job cuts, further exacerbate this issue. In such cases, reaching out to the insurance provider with a detailed explanation of circumstances is crucial. This may include specific events like layoffs from major corporations in the industry or personal health crises that required extensive medical coverage. Providing documentation, such as unemployment letters or medical bills, can strengthen the case for a premium waiver and demonstrate genuine financial need.

Supporting documentation

Submitting supporting documentation for an insurance premium waiver involves providing various key components to ensure a thorough review. Essential documents may include a completed application form, indicating the specific type of waiver requested, such as for financial hardship or disability. Supporting medical records, including detailed physician statements and diagnoses, strengthen the case for physical or mental incapacity waivers. Financial documents such as recent bank statements, pay stubs, and tax returns can illustrate economic struggles, providing a financial snapshot for hardship waivers. Additionally, a copy of the insurance policy, which outlines coverage and terms, is crucial for the insurer's evaluation process. The entire submission should be organized meticulously to facilitate a smooth review by the insurance company, ensuring all relevant details are easily accessible for decision-making.

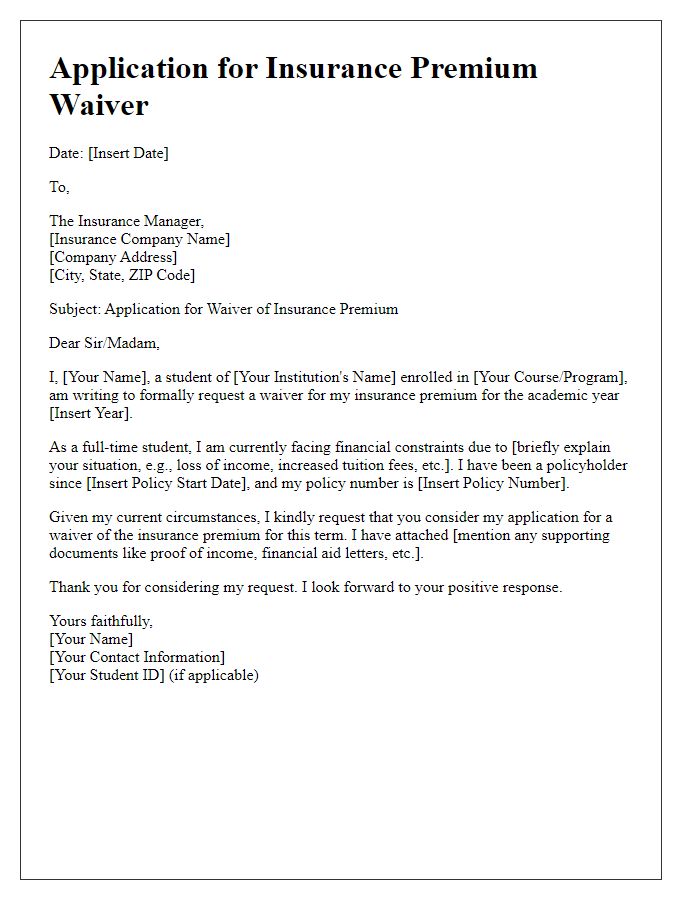

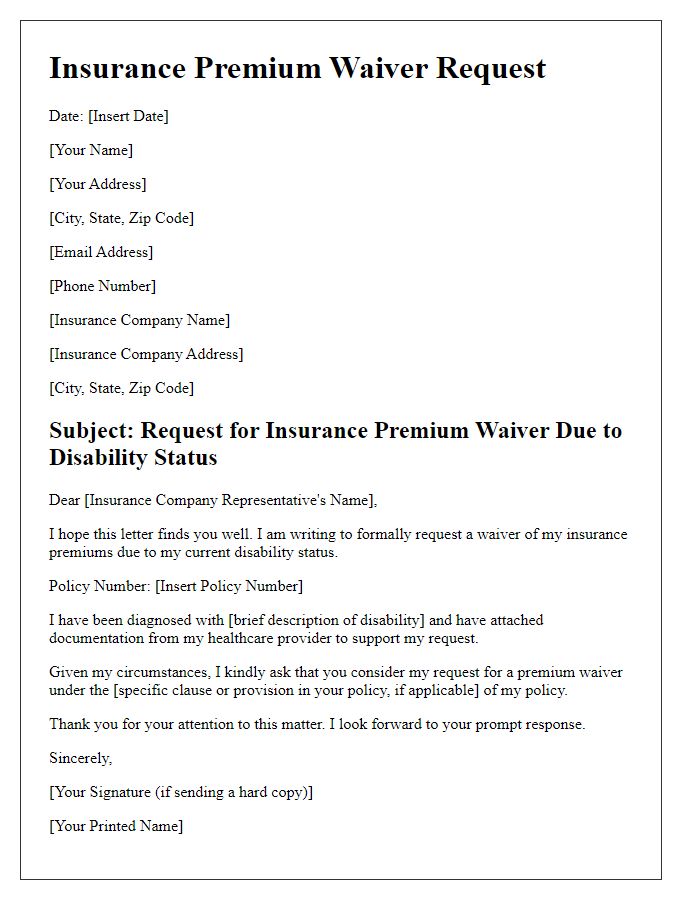

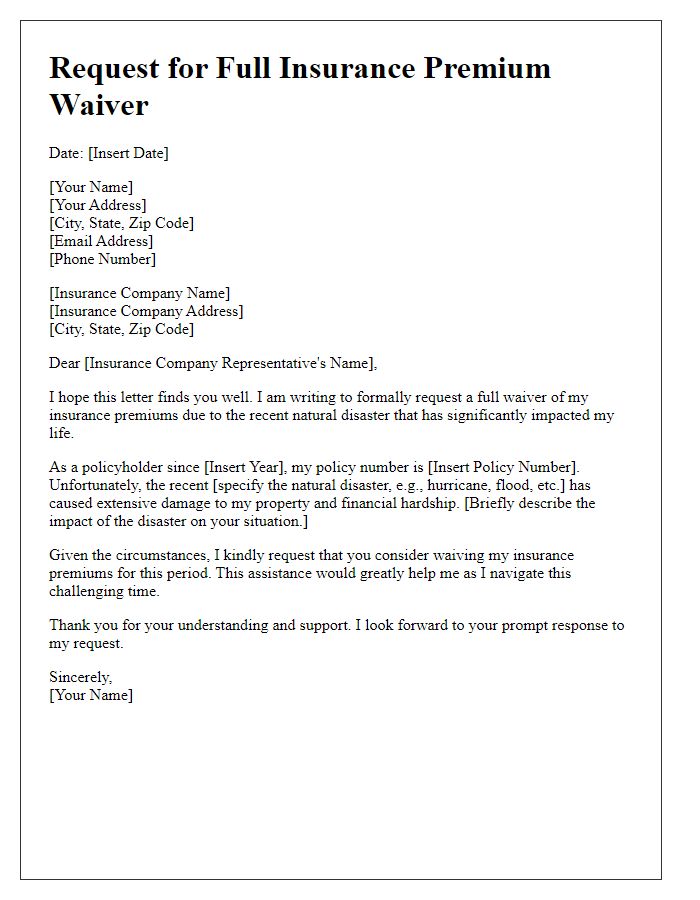

Letter Template For Insurance Premium Waiver Samples

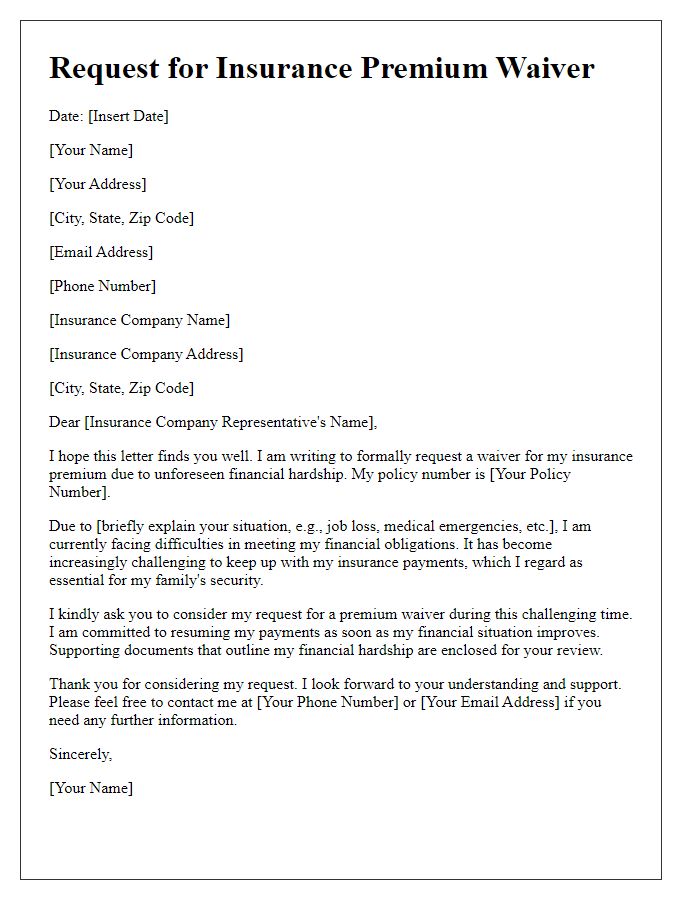

Letter template of request for insurance premium waiver due to financial hardship.

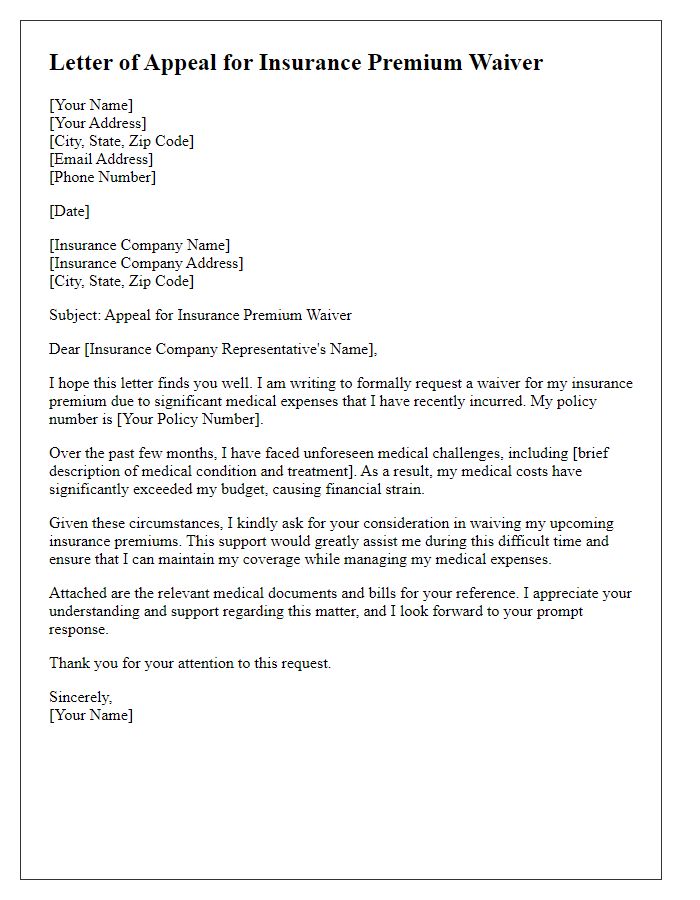

Letter template of appeal for insurance premium waiver due to medical expenses.

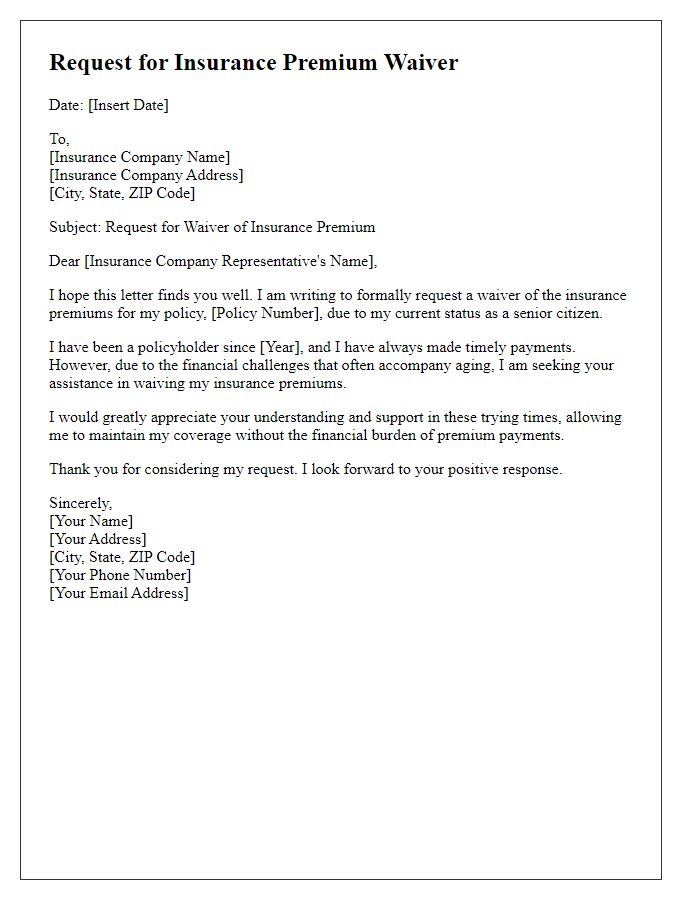

Letter template of insurance premium waiver request for senior citizens.

Letter template of request for temporary insurance premium waiver during pandemic.

Letter template of appeal for life insurance premium waiver for critical illness.

Letter template of insurance premium waiver request for military service members.

Comments