Are you feeling overwhelmed trying to navigate the complexities of reinstating your insurance policy? You're not alone, and we're here to simplify the process for you. In this article, we'll break down the essential steps, share valuable tips, and provide a sample letter template that you can use to effectively communicate with your insurance provider. So, grab a cup of coffee and let's dive in to help you get your coverage back on track!

Policy Details

Restoring an insurance policy after a lapse requires understanding key elements such as policy number, coverage amount, and terms of service. For instance, the policy number (e.g., policy number 12345678) uniquely identifies the insurance contract. The coverage amount, which could range from $100,000 to $1 million, defines the maximum amount the insurer will pay in case of a claim. Additionally, the terms of service incorporate specific conditions, like the policy period (12 months duration) and premium payment schedule (monthly or annually). Certain reinstatement conditions may apply, including submitting a reinstatement application form, providing valid identification (driver's license or government-issued ID), and making any overdue premium payments.

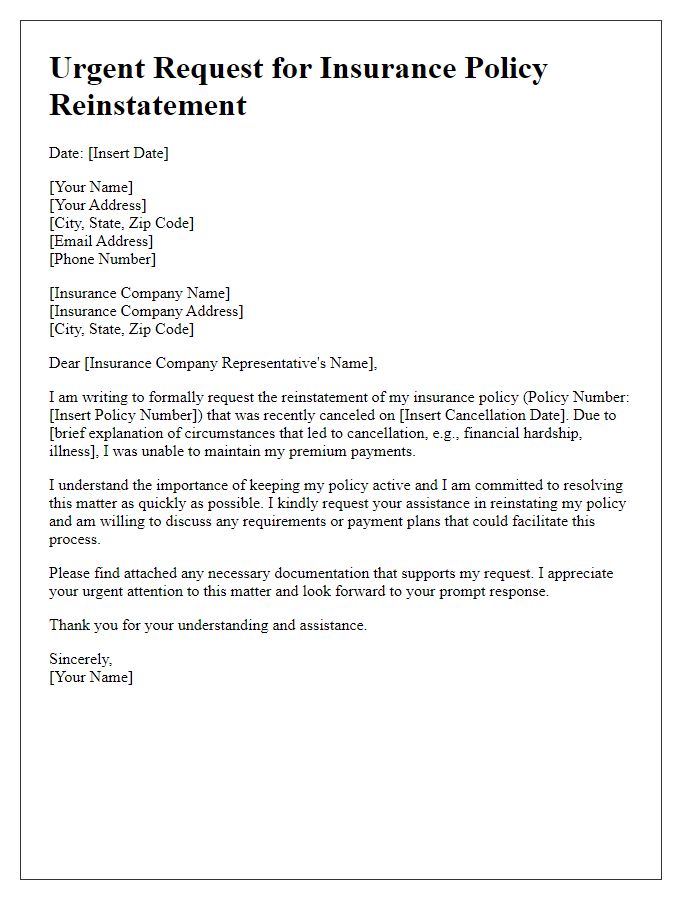

Reinstatement Request Reason

An insurance policy reinstatement request often involves a detailed explanation of the circumstances leading to the request. Commonly, individuals may face challenges such as financial hardship or unforeseen medical expenses that disrupt premium payments. In the United States, reinstatement can typically be pursued within a grace period of 30 days post non-payment. Policies frequently require evidence of insurability for reinstatement, depending on the insurer's guidelines. Documentation, such as proof of income or medical records, may be essential. Additionally, specific information about the policy, such as the policy number and type of insurance (e.g., life, health), should be clearly stated to facilitate processing. It's crucial to adhere to the insurer's protocol, as regulations can vary significantly by state, impacting eligibility and terms for reinstatement.

Payment Method and Schedule

For insurance policy reinstatement, the payment method typically involves options such as credit card, bank transfer, or e-check, allowing customers flexibility. The reinstatement schedule often specifies a timeline, such as 30 days after the request submission, ensuring policyholders resume coverage promptly. Notifications may be sent via email or physical mail (addressed to the policyholder's registered address) confirming payment receipt and reinstatement status, crucial for maintaining insurance benefits. The average premium amount can vary significantly based on coverage type, with specific guidelines outlined in the policy documentation to clarify procedures and obligations for the insured individuals.

Proof of Compliance

Insurance policy reinstatement requires proof of compliance with terms and conditions outlined by the insurer. Essential documents include a valid identification (such as a driver's license or passport), prior policy number for reference, and proof of premium payment (bank statement or payment receipt). Additionally, a completed reinstatement application form is necessary, alongside any requested medical exams or inspections, specific to the insurance type. Providers often seek documentation demonstrating ongoing eligibility, such as updated health records for life insurance or vehicle inspection reports for auto insurance. Timely submission of these documents post-lapse maximizes the chances for successful reinstatement.

Contact Information

Insurance policy reinstatement requires accurate contact information to ensure effective communication between the policyholder and the insurance provider. Relevant details include the policyholder's full name, address (including city, state, and zip code for precise location), phone number (preferably a mobile number for immediate reach), and email address for digital correspondence. Additionally, referencing the specific insurance policy number aids in identifying the account quickly, facilitating a smoother reinstatement process. This information plays a crucial role in expediting requests and resolving potential issues efficiently.

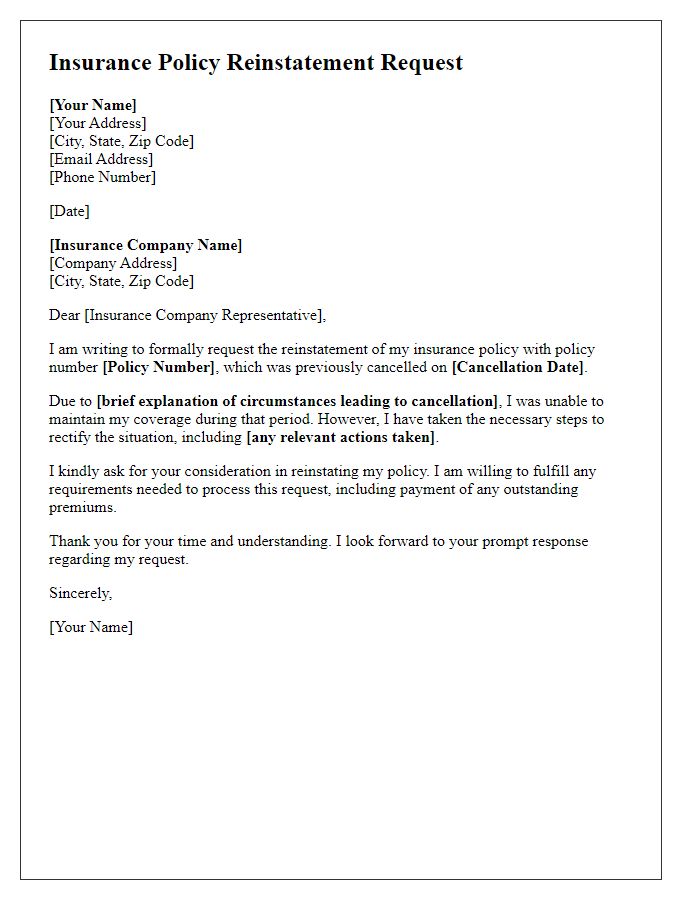

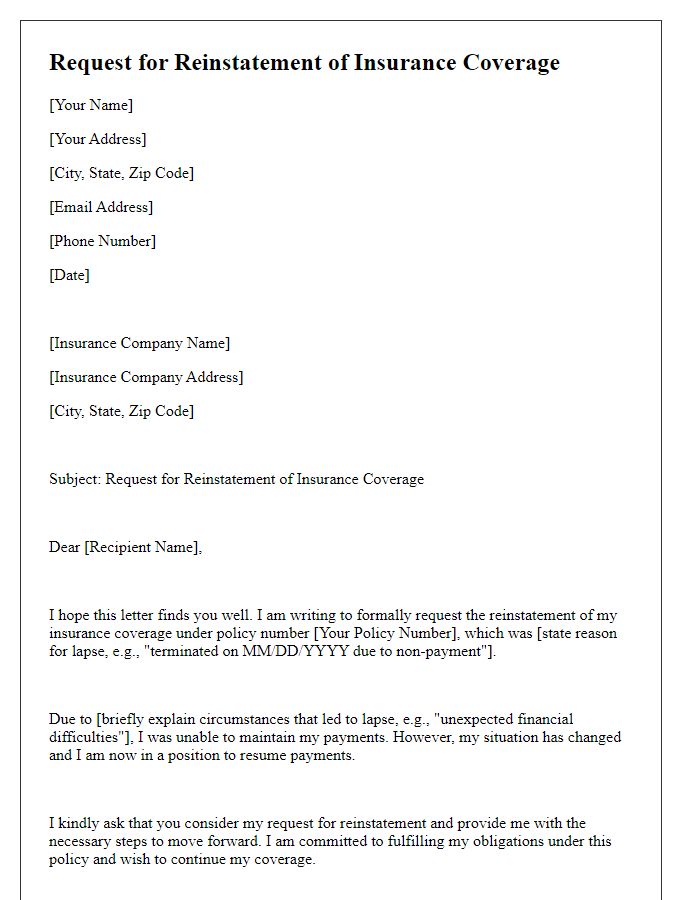

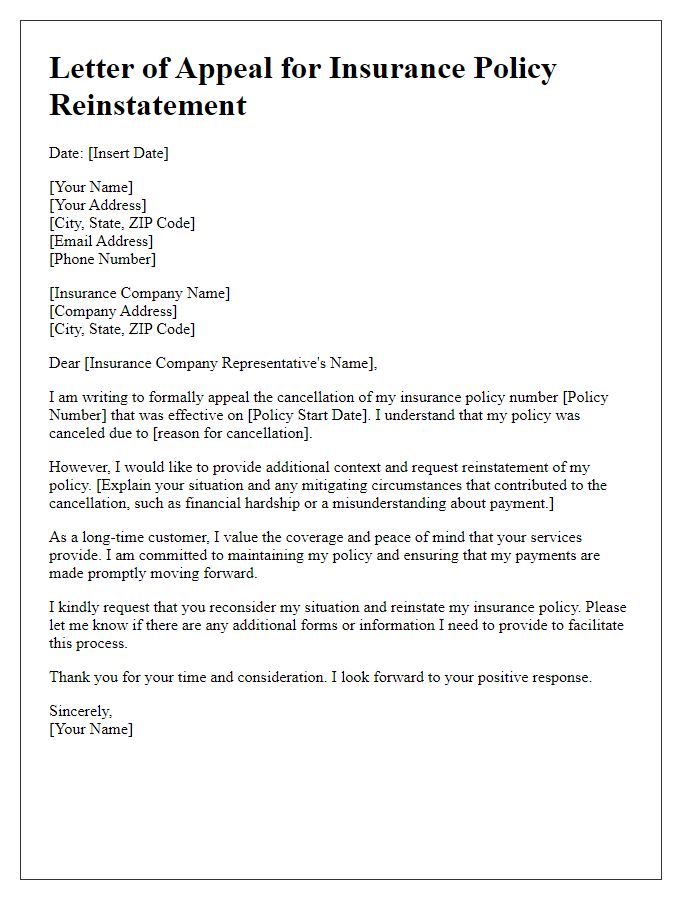

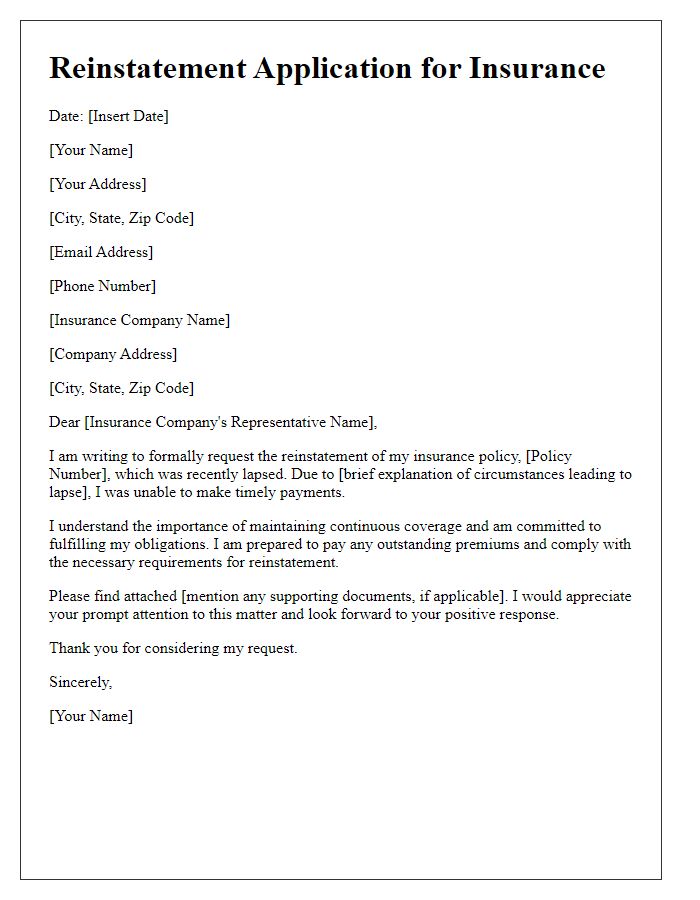

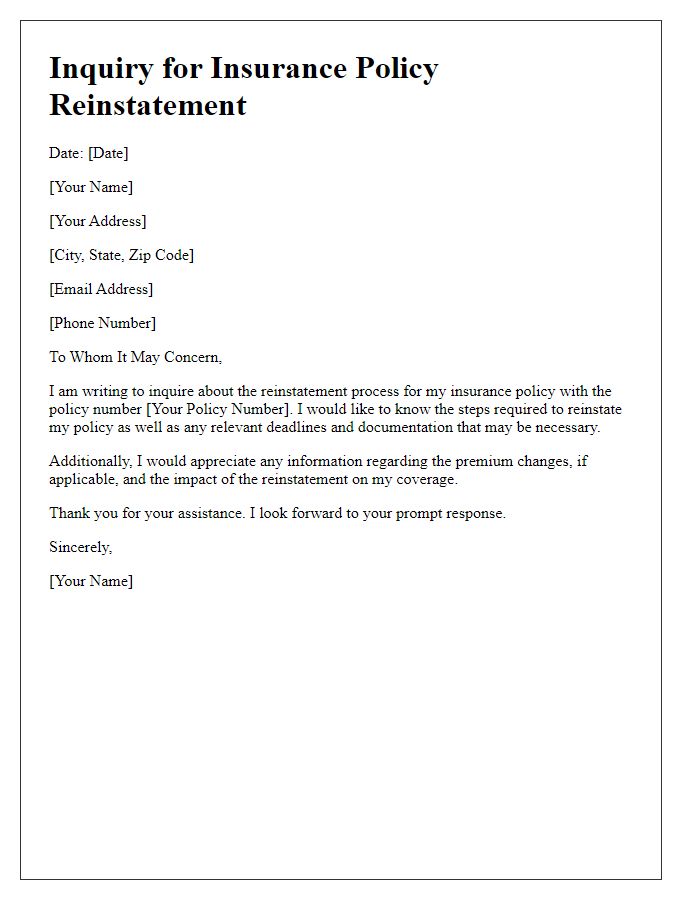

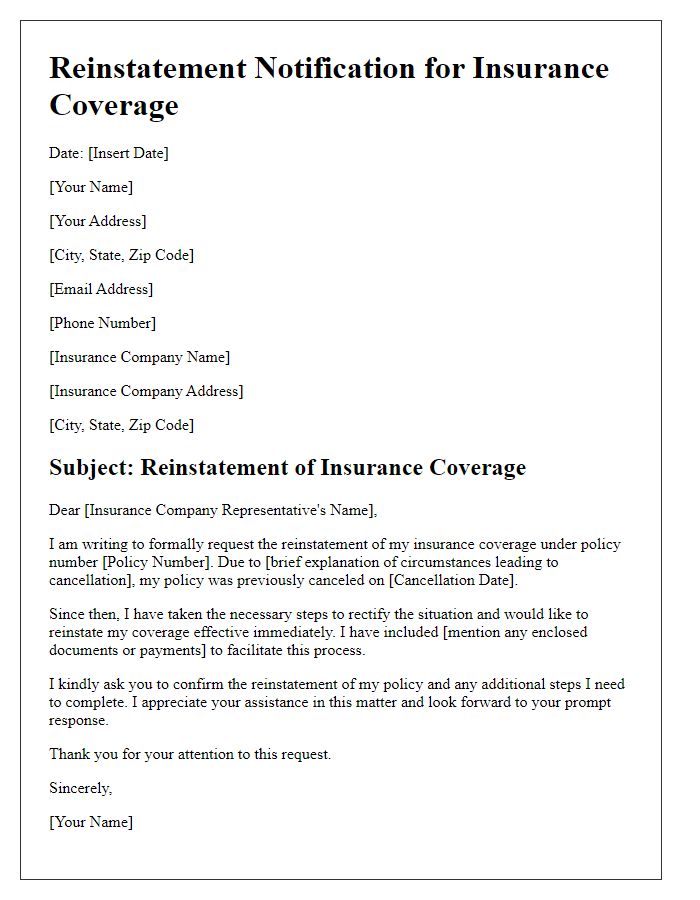

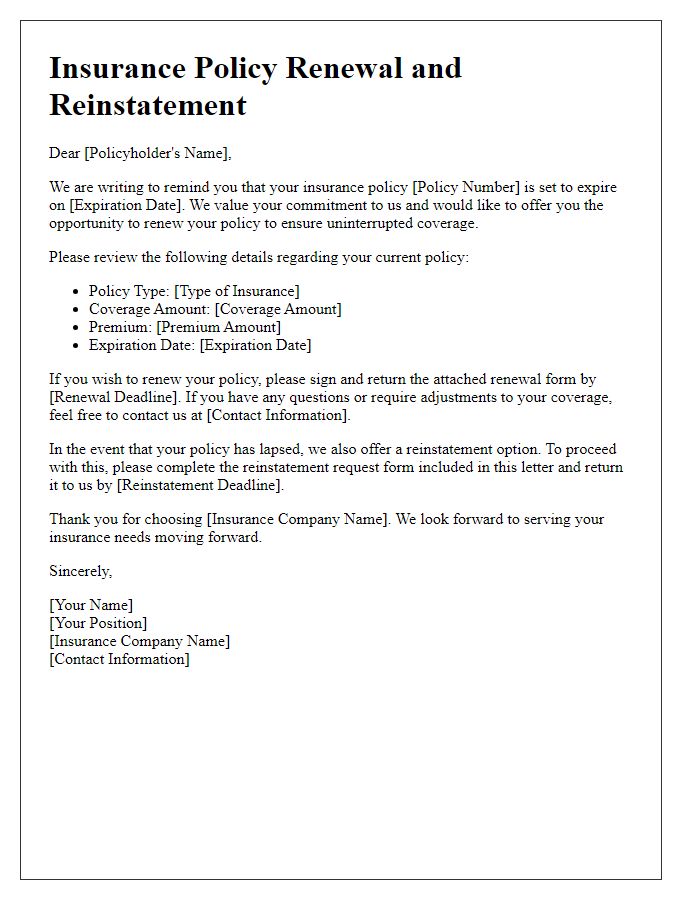

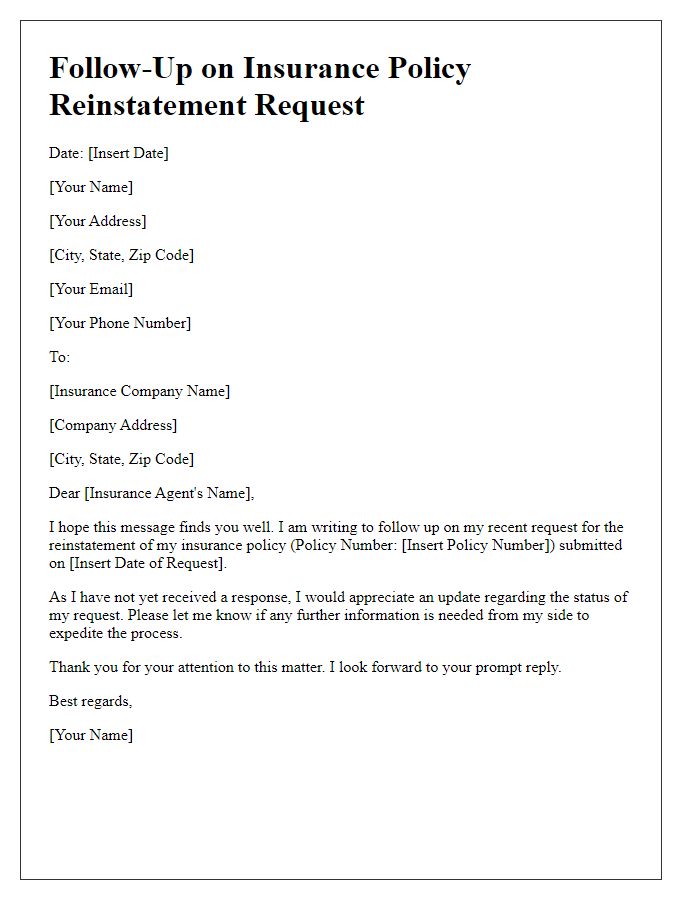

Letter Template For Insurance Policy Reinstatement Samples

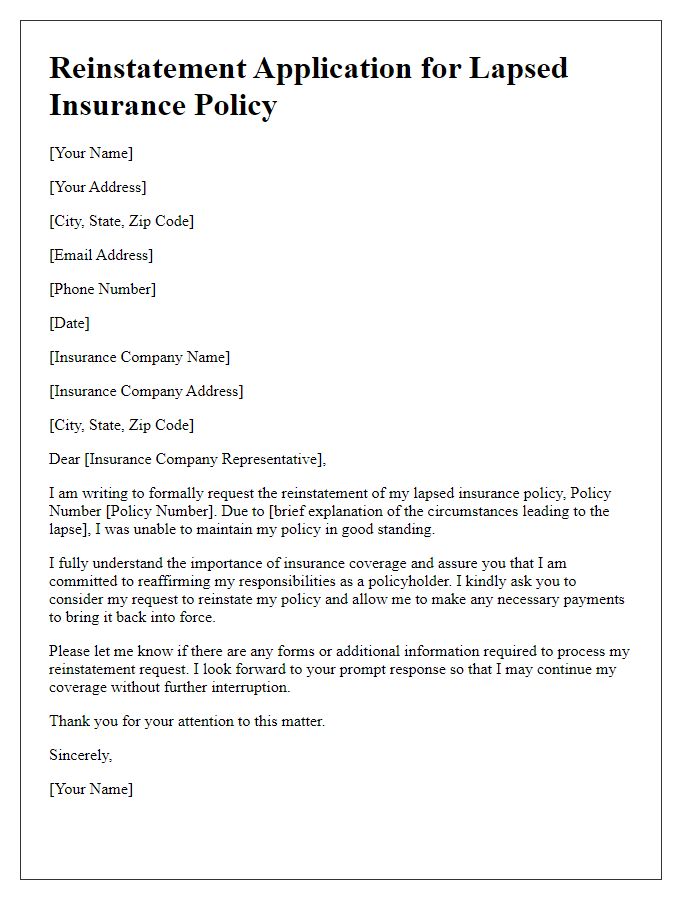

Letter template of reinstatement application for lapsed insurance policy

Comments