Have you ever received a notice about your insurance policy maturing and felt a mix of anticipation and confusion? Understanding the implications of this milestone can quite often feel overwhelming, but it doesn't have to be. This notice is a crucial step in securing your financial future, offering you options on how to proceed next. So, let's delve deeper into what your maturity notice means and how you can make the most of this important momentâread on to find out more!

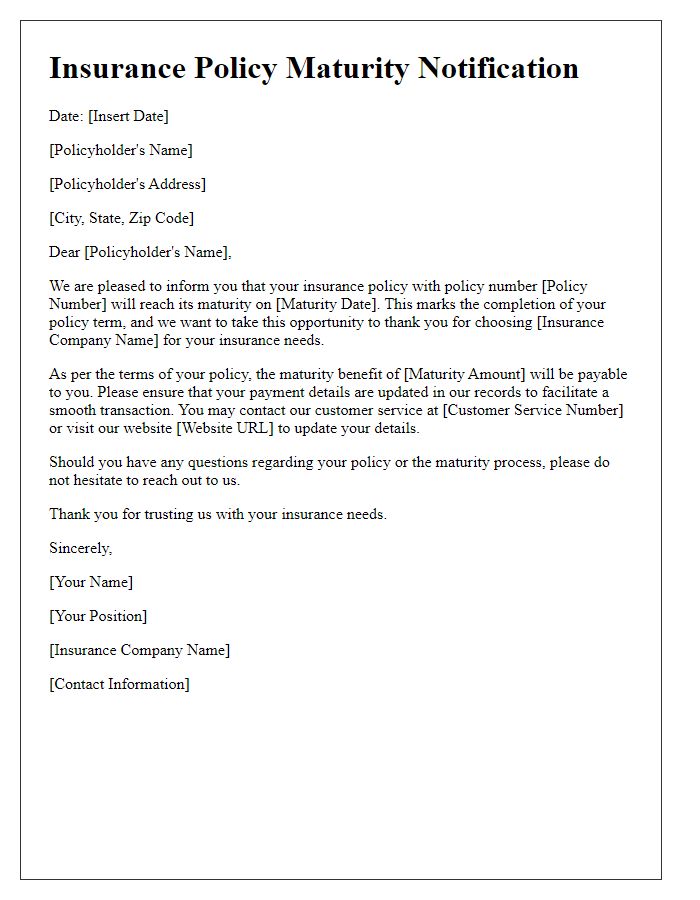

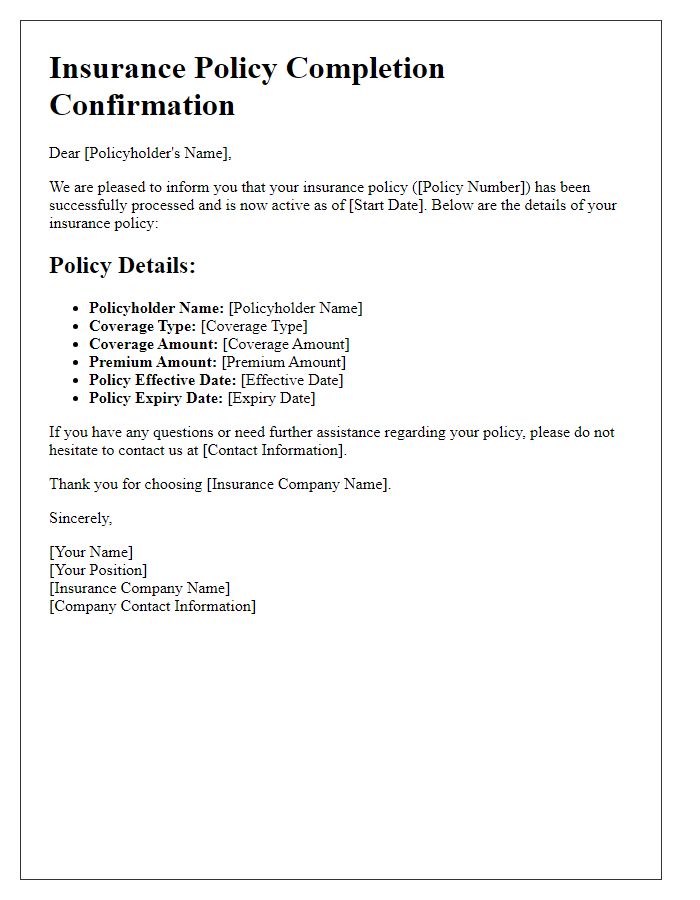

Policyholder Information

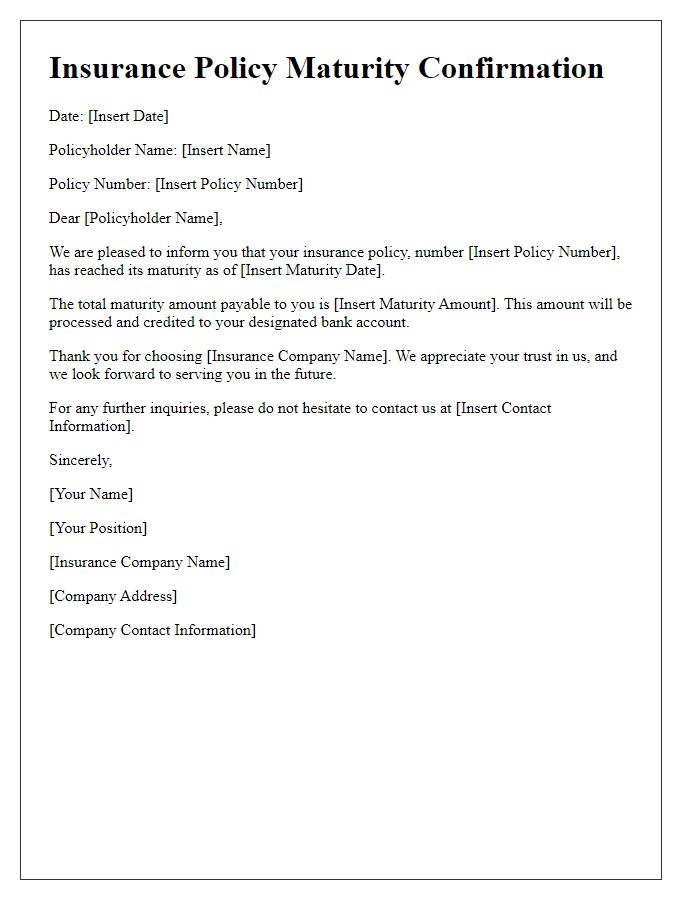

The insurance policy maturity notice notifies policyholders about the completion of their insurance policies, usually involving significant events in their financial planning. Policyholders, identifying individuals or organizations holding the policy, receive this document via formal communication methods. The notice specifies the maturity date, often listed on the insurance document placed under various terms, including whole life or endowment policies. This document may highlight the total sum assured, which refers to the guaranteed payout upon reaching maturity, alongside any bonuses that accrued throughout the policy term. Important details regarding the claim process, such as required documentation and timelines, can be crucial, ensuring policyholders understand how to access their funds effectively.

Policy Details

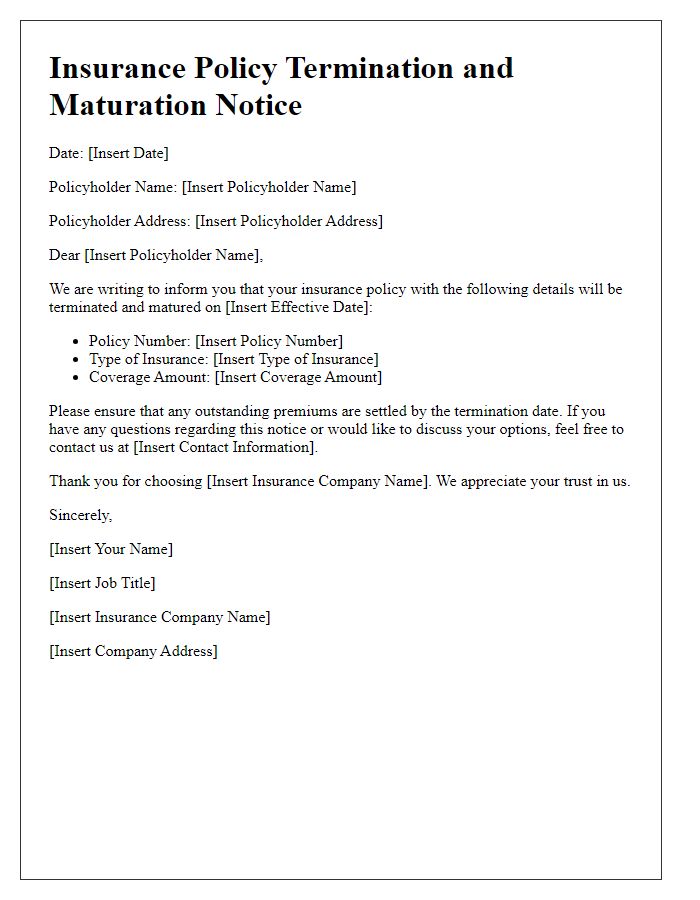

A maturity notice for an insurance policy serves as a formal communication to inform the policyholder of the culmination of their investment in a specific plan. With details such as the policy number, issue date, and maturity amount highlighted, this notice typically encompasses the benefits due upon the policy's maturity. Policyholders should pay attention to the maturity date, which signifies the end of the policy term, and the payout process. Insurers often provide guidance on how to claim the maturity benefits, including required documents. Furthermore, the notice may offer advice regarding reinvestment options or available products, ensuring the policyholder is well-informed of their next steps after the policy matures.

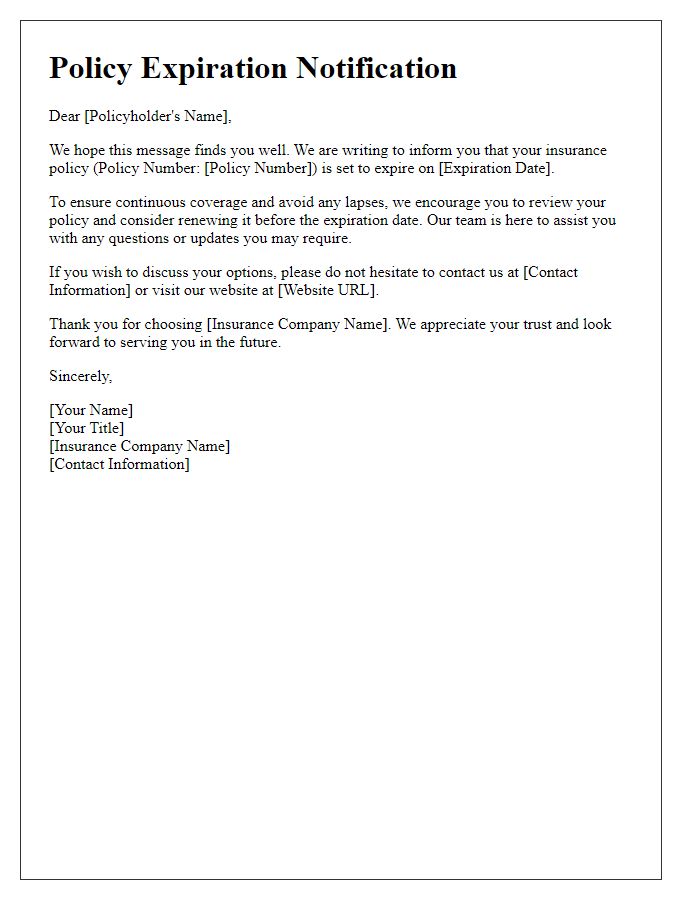

Maturity Benefits Summary

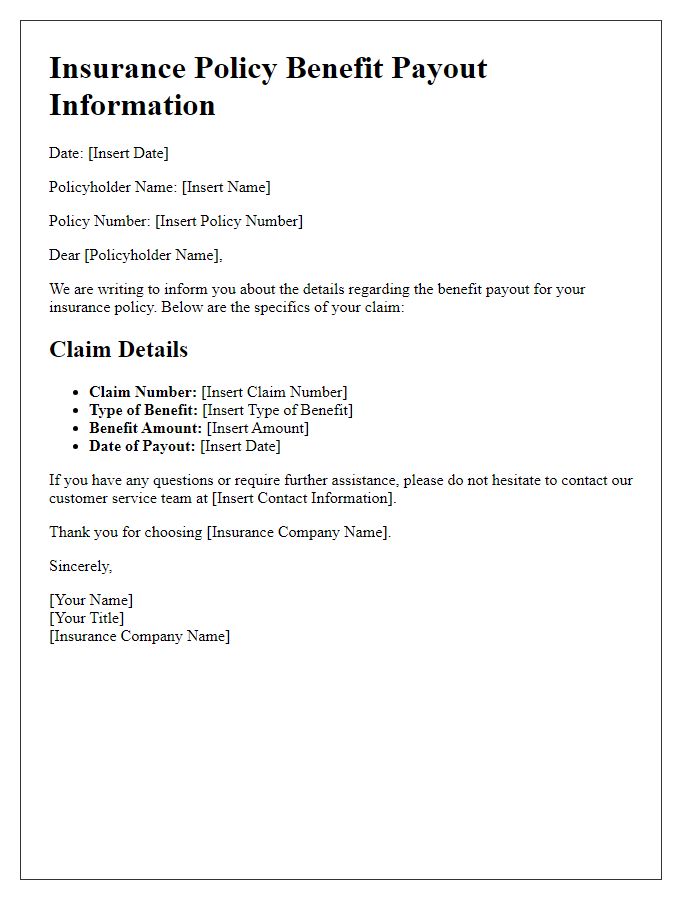

Maturity benefits from an insurance policy provide policyholders with a structured payout after the completion of the policy term. This typically includes a lump sum payment, reflecting both the premiums paid and any accrued bonuses or interest. The insured amount can significantly vary, often reaching thousands of dollars, depending on the policy's specifications and duration, which may range from 5 to 30 years. Additional options may include a surrender value, applicable if the policyholder chooses to terminate the policy before maturity. Standard documents required for claiming these benefits may include identification proof, the original policy document, and any necessary claim forms. Furthermore, the maturity notice often serves as a timely reminder, enabling the policyholder to prepare for potential financial planning or reinvestment opportunities upon receiving the payout.

Payment Options

Insurance policy maturity occurs when the term of an insurance contract, such as whole life or endowment policies, comes to an end, resulting in a payout to the policyholder. Upon reaching this maturity, the policyholder may have several payment options available for their payout. These options often include a lump-sum payment, where the total maturity amount is disbursed in one transaction, typically within a week. Alternatively, policyholders might choose a structured annuity payment plan, allowing them to receive regular monthly or annual payments over a specified period. This may provide a stable income stream for financial planning. Additionally, some insurance companies offer the possibility of reinvesting the maturity proceeds into other products, such as mutual funds or additional insurance policies, potentially maximizing long-term benefits. Policyholders are advised to review their policy documents and consult with their insurance representative to understand the implications of each option fully, including tax liabilities and potential growth opportunities.

Contact and Support Information

Insurance policy maturity notices inform policyholders about the completion of their policy term, often specifying the maturity date, payout details, and necessary actions for claims. Companies like Prudential and Allstate provide clear instructions on the claims process. Customers are usually advised to gather required documents such as identification and policy certificates. Contact details including dedicated claims support numbers and customer service email addresses facilitate easy communication. Many insurance providers also have online portals, enhancing accessibility for policyholders seeking assistance or clarification. Specific contact information plays a crucial role in ensuring a smooth and efficient claims experience.

Comments