Are you considering increasing the face value of your insurance policy? It's a smart move that can offer greater financial security for you and your loved ones, especially as life circumstances change. In this article, we'll guide you through the essential steps and considerations to make this process seamless and beneficial. So, let's dive in and explore how you can enhance your insurance coverage!

Policyholder Information

Increasing the face value of an insurance policy can provide additional financial security and peace of mind. Policyholders, such as individuals holding life insurance policies, may seek to enhance coverage due to life changes, such as marriage or having children. The current face value, typically expressed in currency (for example, $250,000), may no longer suffice to meet future financial obligations like mortgage payments or education expenses. Insurers may evaluate the policyholder's current income, health status, and changes in lifestyle to determine eligibility for an increase. Additionally, increased face value often results in higher premium payments, which must be factored into the policyholder's financial planning. Careful assessment of these elements ensures that sufficient coverage is maintained throughout various life stages.

Current Policy Overview

The current insurance policy overview includes the policyholder's name, John Smith, and the initial coverage amount of $100,000, established in 2020 with XYZ Insurance Company. The policy type is a term life insurance plan, originally lasting for 20 years, providing financial protection for the specified term. The annual premium is set at $1,200, ensuring affordable coverage. Since the policy initiation, the policyholder's circumstances have evolved, including a recent increase in dependents, highlighting the need for a higher face value. A reevaluation suggests a desired coverage increase to $200,000 to appropriately align with current family needs and financial obligations, such as mortgage balance of $250,000 and children's education fund. This adjustment will ensure the financial security of the beneficiaries and provide adequate support in case of unforeseen events.

Justification for Increase

Insurance policies often include a face value, representing the amount paid upon the policyholder's death, providing financial security to beneficiaries. A face value increase may be justified by various factors, including rising living expenses, inflation rates (measured by the Consumer Price Index), or significant life events such as marriage, birth of a child, or home purchase. For instance, inflation has steadily risen, with an average increase of approximately 3% annually over recent years. Moreover, changes in personal circumstances can necessitate a higher coverage to ensure adequate financial protection for loved ones. In such cases, a comprehensive evaluation of the current policy's face value and its alignment with present financial obligations (such as mortgages valued at hundreds of thousands of dollars) becomes crucial in assessing the need for an increase.

Financial Documentation

A request for an insurance face value increase requires clear and comprehensive financial documentation to demonstrate the need for additional coverage. Essential documents include a current income statement that reflects the individual's financial situation, such as tax returns from the previous two years, recent pay stubs, or a profit and loss statement for self-employed individuals. A comprehensive list of assets, including real estate properties valued at market rates and investment accounts, should be included to provide a holistic view of financial stability. Additionally, details of outstanding debts, such as credit card balances and mortgage loans, with corresponding monthly payment amounts enhance the clarity of overall financial health. Including a summary of existing insurance policies, highlighting current coverage levels and beneficiaries, illustrates the need for increased face value. Overall, precise and organized documentation plays a crucial role in supporting the request for a face value increase in an insurance policy, reflecting long-term financial planning and stability.

Contact Information for Further Inquiries

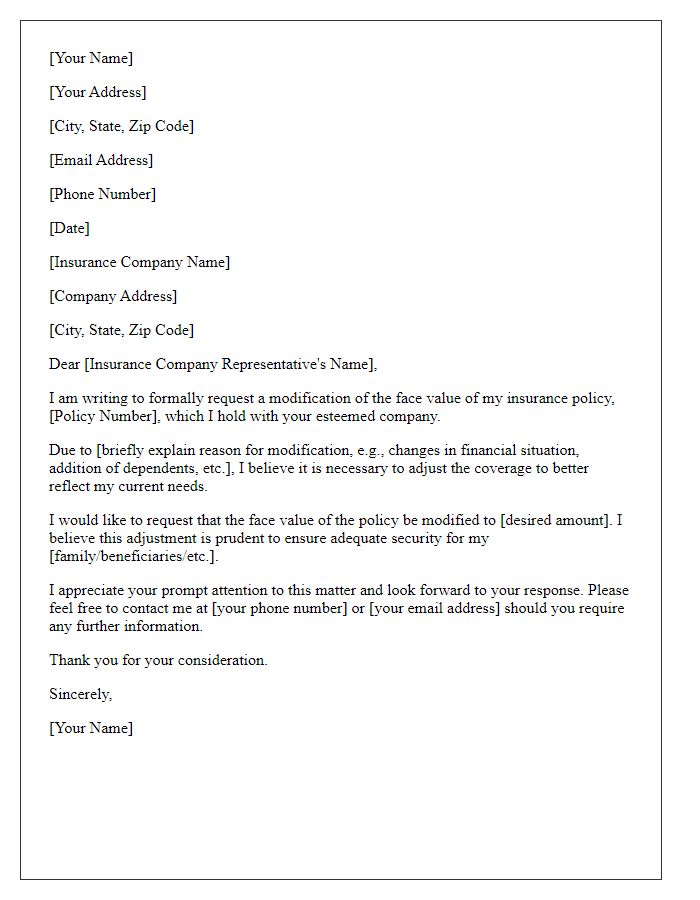

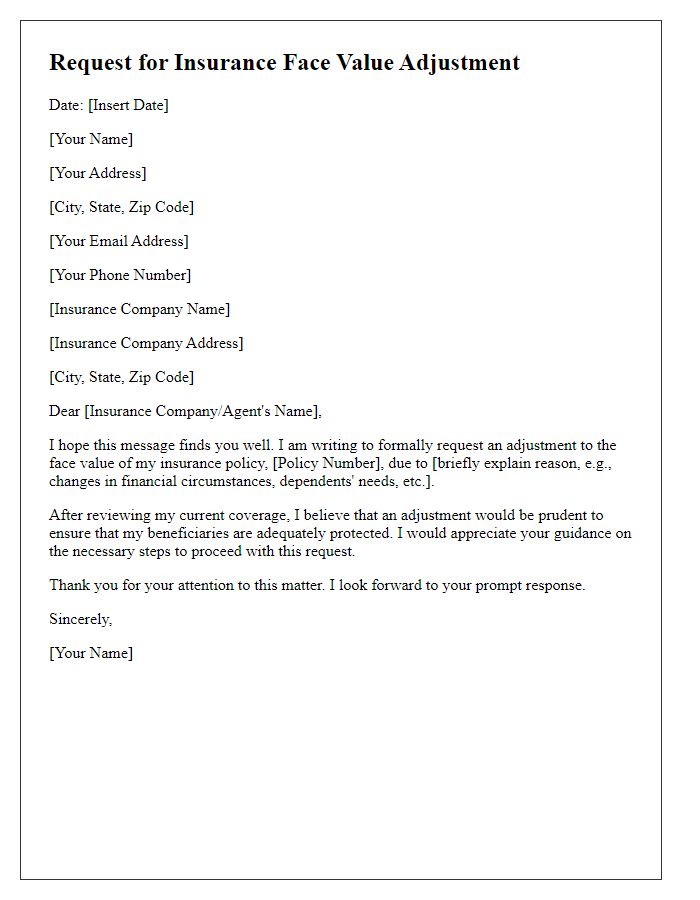

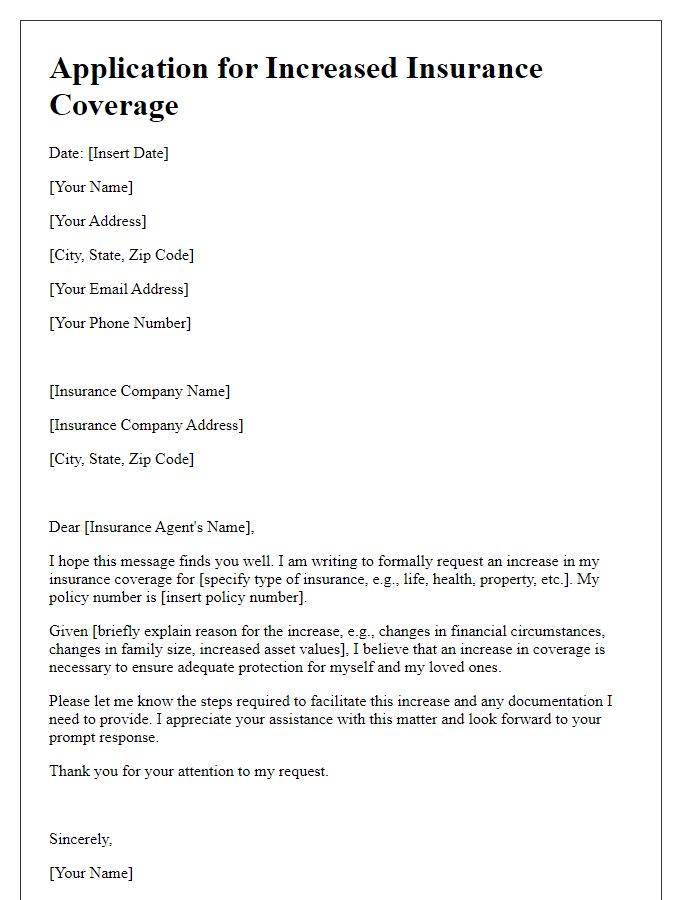

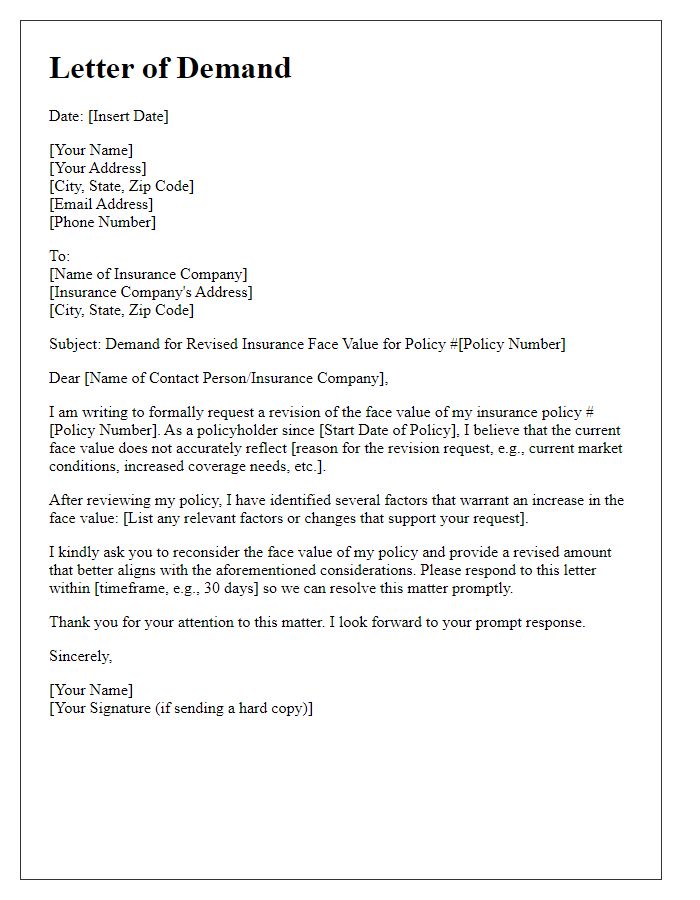

Increasing insurance face value is a critical step for individuals seeking enhanced financial security. Typically, policyholders must submit a formal request to their insurance provider in writing, detailing the desired face amount. The submission should include personal identification information, proof of current health status, and any relevant financial documentation to justify the increase. For example, many organizations require an updated medical examination to assess the risk associated with increasing the coverage. Specific timelines for processing vary, usually ranging from two to four weeks, depending on the insurer's policies. Additionally, maintaining open lines of communication is essential; contact information for further inquiries can facilitate discussions about existing coverage limits and available options, ensuring a smooth process.

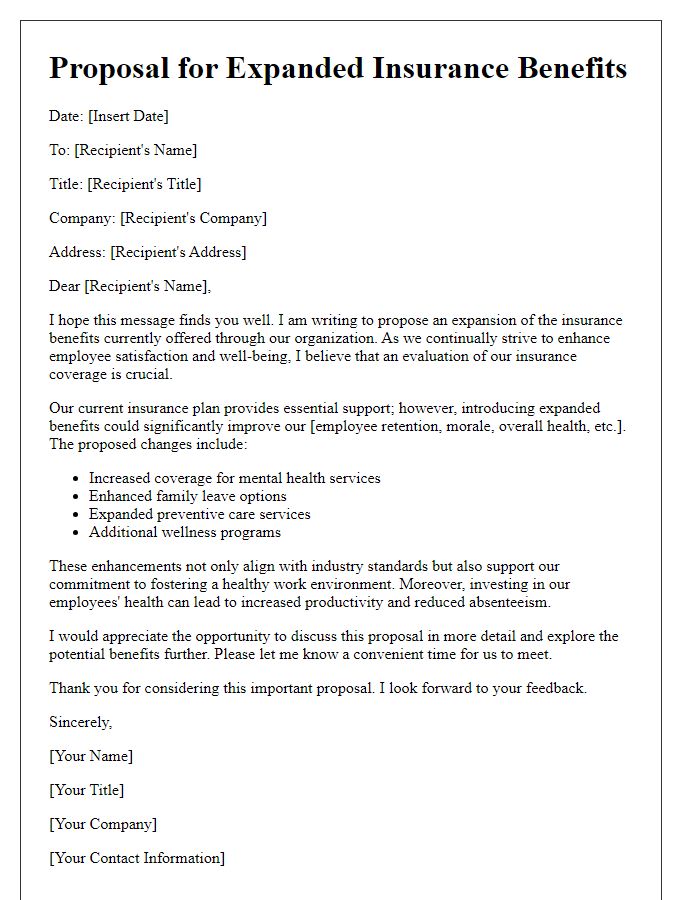

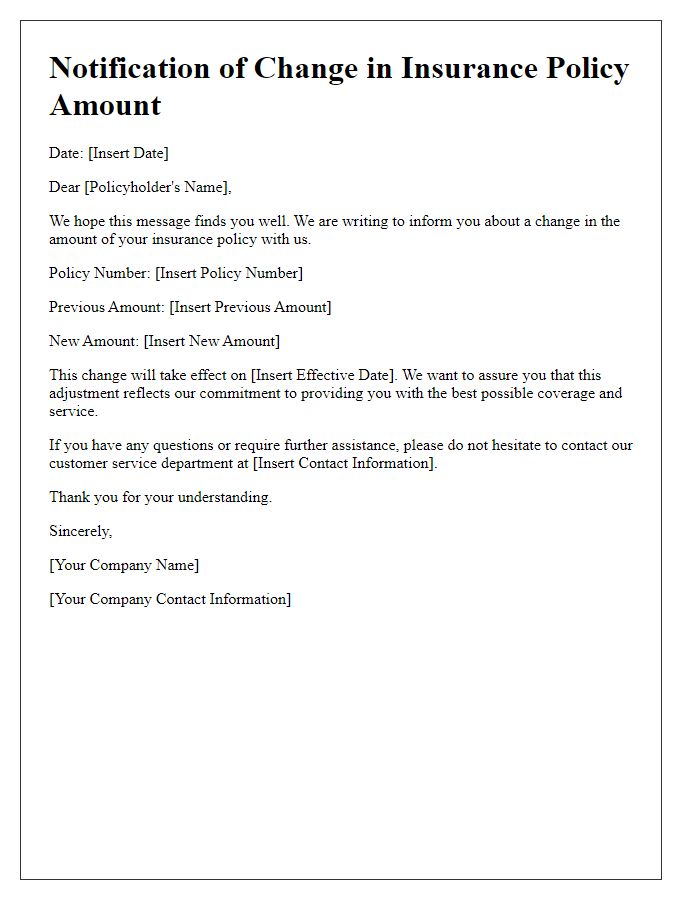

Letter Template For Insurance Face Value Increase Samples

Letter template of formal request for modification of insurance face value

Comments