Hey there! If you've ever found yourself in a bit of a bind with your insurance payments, you're not alone. Life can throw unexpected curveballs, making it easy to miss a due date. In this article, we'll explore how to craft a thoughtful letter to explain your late payment and potentially mitigate any penalties. So, grab a cup of coffee and let's dive into the details!

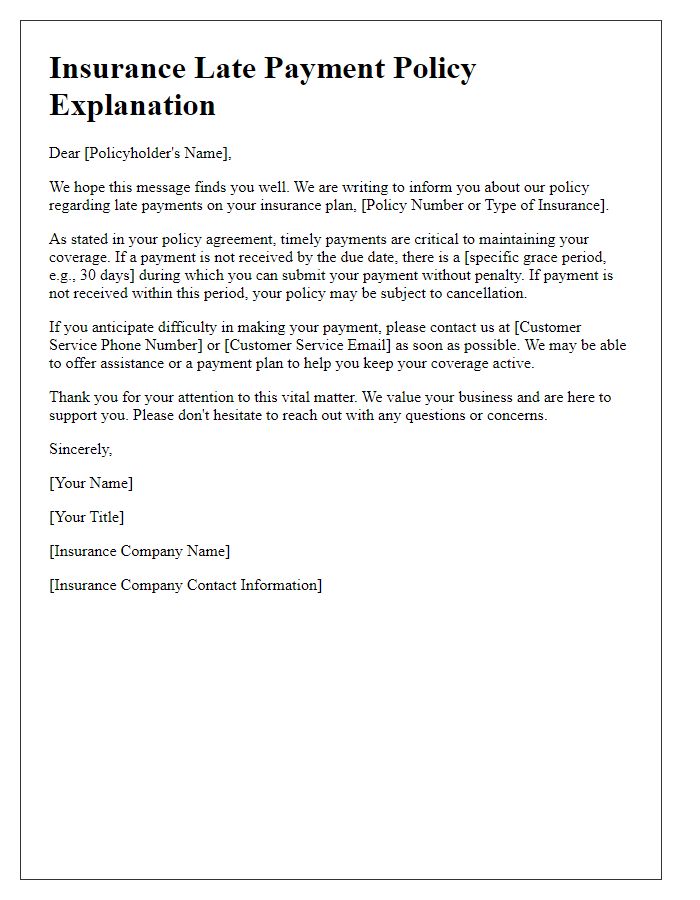

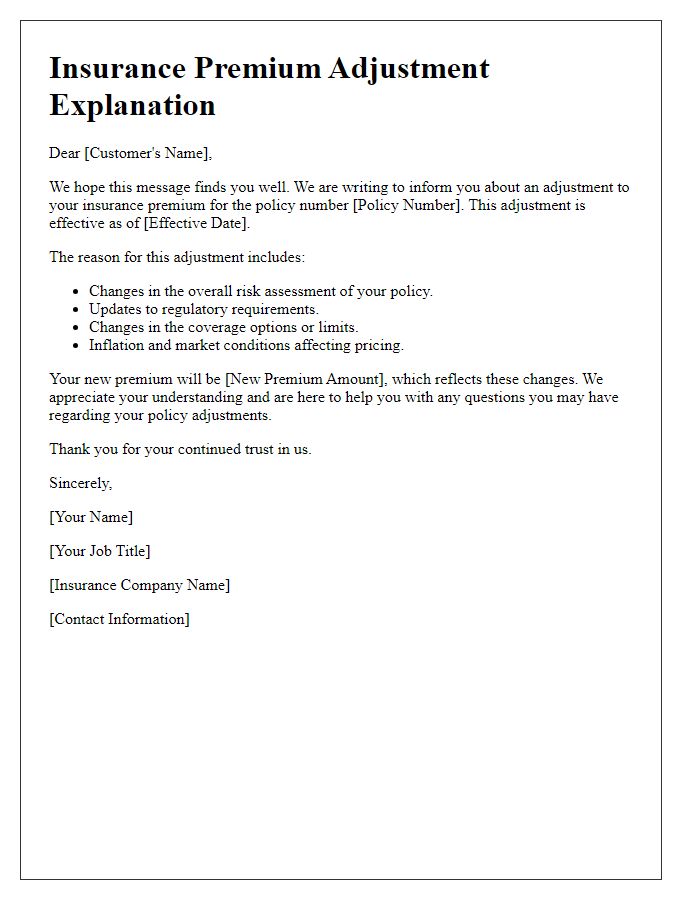

Account Information and Policy Details

Customers often face challenges when managing policy payments, particularly in the context of insurance contracts covering health, auto, or property. Late payments can result in lapses of coverage, increased premiums, or penalties. Each insurance provider maintains specific time frames for allowable late payments, often allowing a grace period ranging from 10 to 30 days. For instance, a policyholder with a home insurance policy may find their coverage at risk if the payment is not received by the provider, XYZ Insurance Company, by the 15th of each month, despite being initially set for the first. Documenting key account information, such as the policy number (e.g., P123456789), account number, and payment due dates, is crucial when preparing explanations for late payments to avoid misunderstandings and ensure continuous coverage. Additionally, providing context around the reasons for payment delays, such as financial hardships or unexpected medical expenses, can help clarify circumstances to insurers and facilitate potential leniency or options.

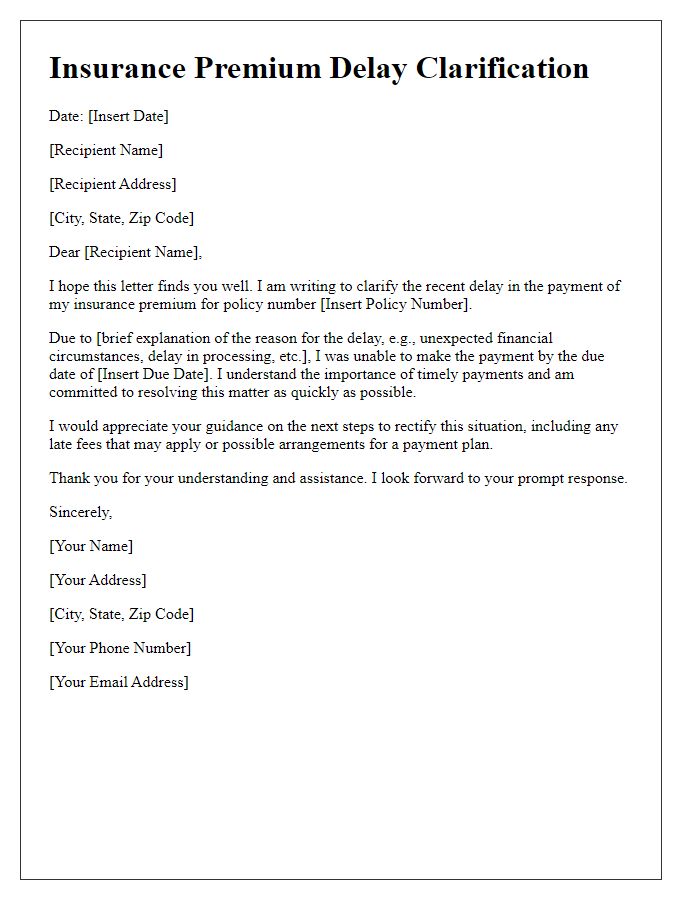

Reason for Late Payment

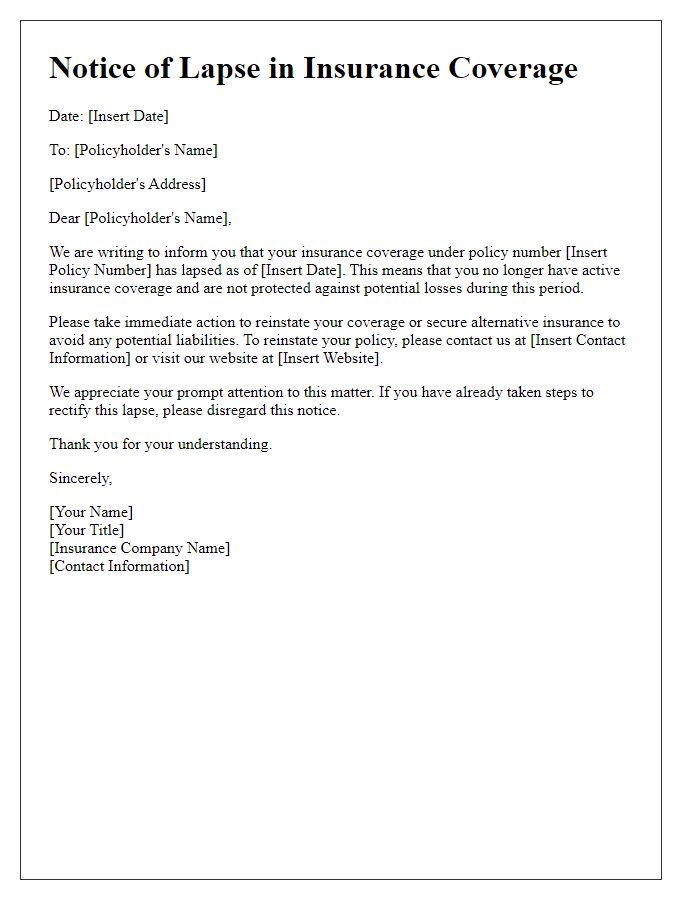

Insufficient funds in the banking account can lead to delayed payment of insurance premiums. This situation occurs when the account balance falls below the required amount on the scheduled payment date. Factors such as unexpected expenses, lack of income during certain months, or overspending can contribute to this shortfall. Insurance companies often impose late fees after a grace period, which typically lasts around 10 to 30 days, depending on the policy. Persistent late payments may lead to policy cancellation, increased premiums, or loss of coverage, affecting the policyholder's financial security and future insurability.

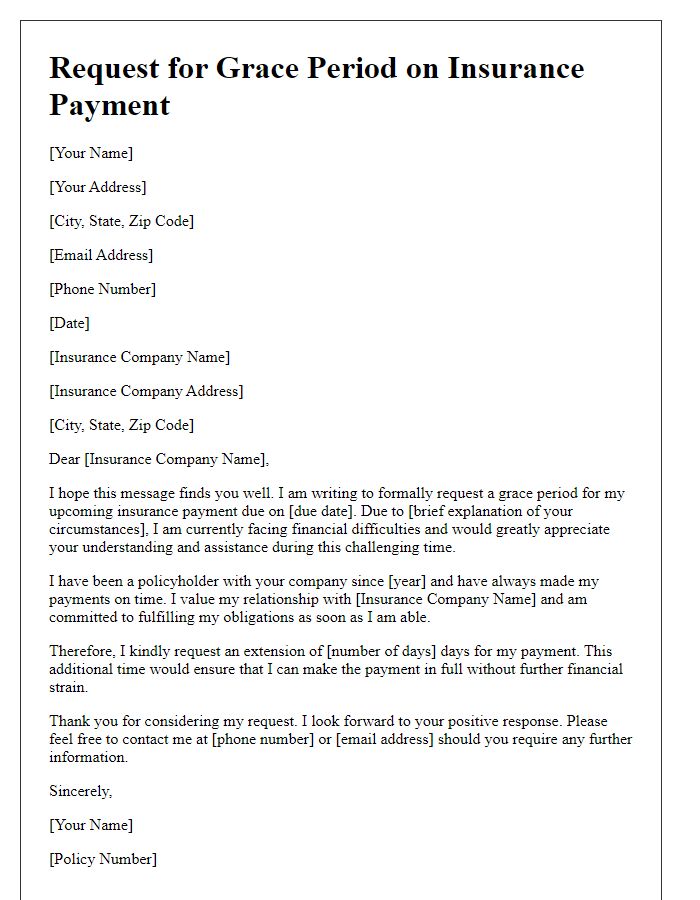

Actions Taken to Rectify Situation

Late payment of insurance premiums can lead to policy lapses, impacting coverage status. Insurers typically require an explanation in written form, outlining specific actions taken to rectify the situation. Communication with the insurance company can involve various steps, including contacting customer service representatives via phone or email, typically within 30 days of noticing the late payment. Reviewing payment records and identifying reasons for the delay, such as unexpected financial hardship or overlooked billing statements, is crucial. Additionally, providing evidence of timely future payments, such as a scheduled payment plan or recent bank statements, helps demonstrate commitment to maintaining coverage. Clear documentation of these actions reassures insurers of the policyholder's dedication to fulfilling their obligations.

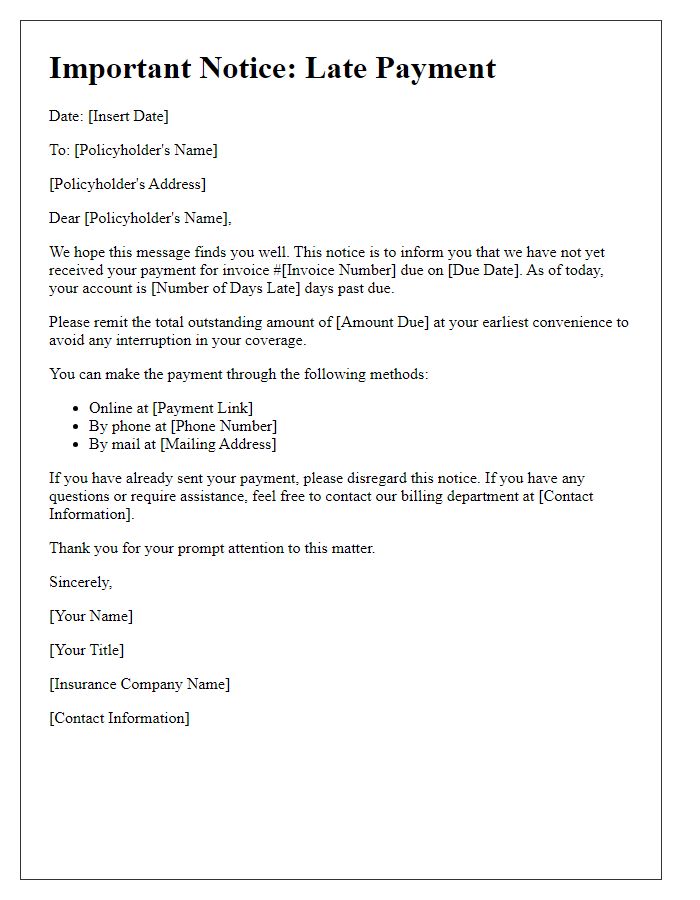

Assurance of Future Compliance

Late payment of insurance premiums can lead to policy lapses, impacting coverage for critical events. In November 2022, for example, a significant claim incident occurred where delays resulted in a $25,000 denial. Timely payments for essential insurance types, like health, auto, and home insurance, are crucial for maintaining protection against unforeseen circumstances. Policies typically allow a grace period of 10-30 days, yet continued delays can see premiums accumulating a late fee, potentially rising above 5% of the total amount due. Future compliance can be reinforced through automated payment setups, ensuring consistent adherence to renewal dates and preventing lapses in coverage and unnecessary financial strain.

Contact Information for Further Clarification

Insurance late payments can lead to policy lapses or additional fees, causing stress for policyholders. Late payments often occur due to various reasons, such as unexpected financial difficulties or oversight in payment schedules. Policyholders should communicate promptly with their insurance provider to explain the circumstances surrounding the late payment. Insurance representatives typically consider factors such as the length of the delay and the policyholder's payment history. Contact information for the insurance company, including phone numbers and dedicated email addresses, is crucial for seeking clarification and finding solutions. Providing accurate details about the policy, such as policy number and personal identification information, can expedite the process of resolving the late payment issues.

Comments