Are you feeling a bit overwhelmed by the fine print in your insurance policy? You're not alone; many people struggle to understand the conditions that determine their coverage. In this article, we'll break down the key elements to help you navigate the complexities of insurance agreements and ensure you're fully informed. Ready to gain clarity and peace of mind? Let's dive in!

Policy Number and Effective Date

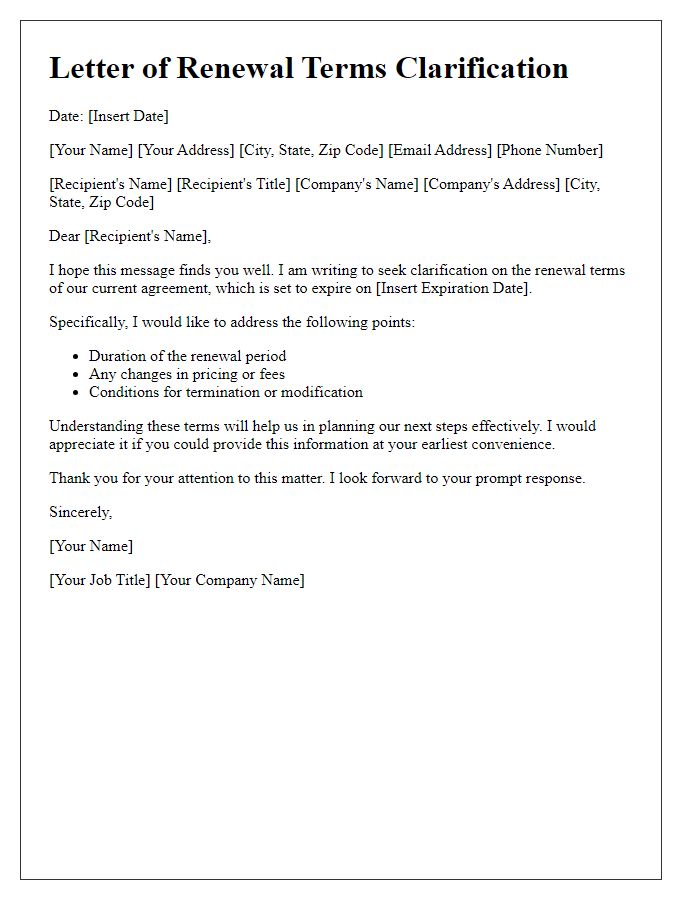

Insurance coverage conditions detail the specific terms under which the insurance policy operates. The Policy Number uniquely identifies each insurance agreement, allowing both the insurer and insured to reference the same document. The Effective Date marks the commencement of coverage, indicating when protection begins under the terms outlined in the policy. This date is crucial for understanding the timeline of coverage, especially in cases of claims or disputes. Clarity on these aspects is essential for ensuring that both parties are aware of their rights and responsibilities under the insurance contract.

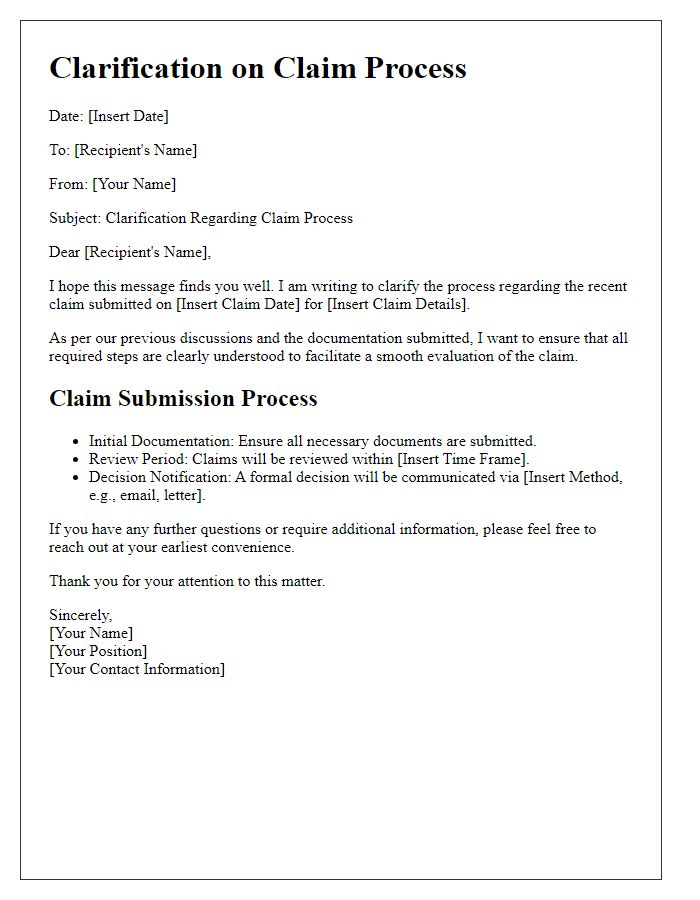

Detailed Coverage Descriptions

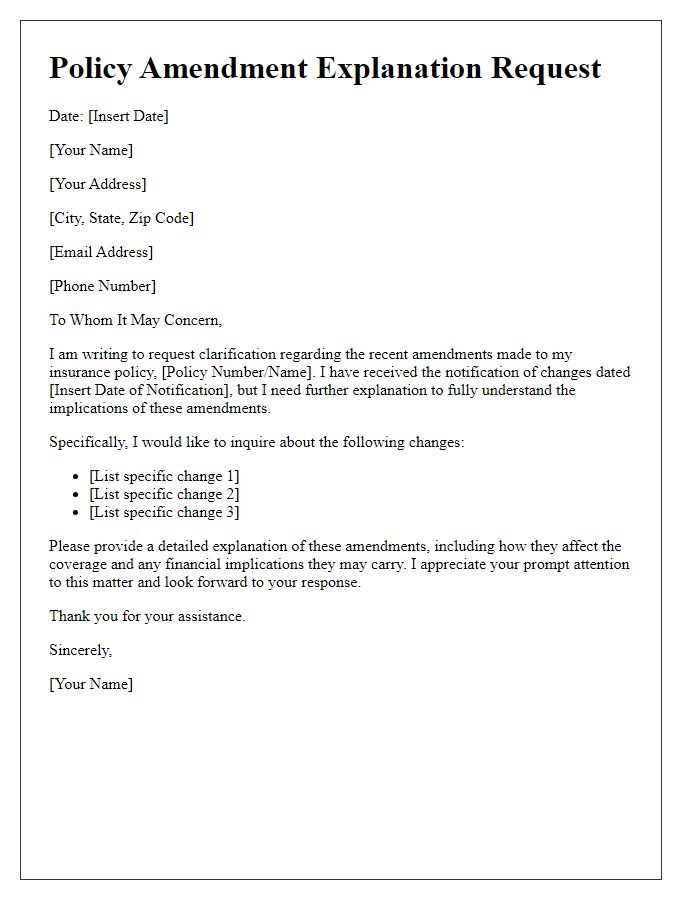

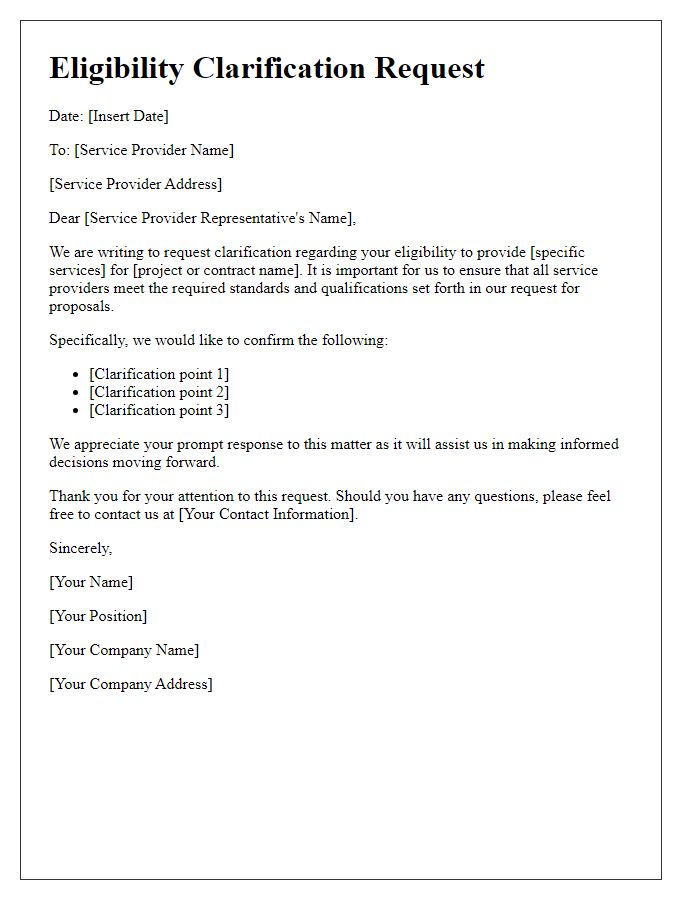

Insurance policy documentation often includes complex terminology and stipulations that can lead to confusion regarding coverage conditions. Key aspects such as premium costs, deductible amounts, and co-payment percentages are crucial for understanding financial responsibilities. Specific events covered by the policy, such as natural disasters like hurricanes or man-made incidents like theft, must be explicitly defined. Locations where coverage applies, including primary residences and vacation properties, also need clarification. Additionally, timelines for claims processing, typically ranging from 30 to 90 days, can affect consumer expectations and satisfaction. Policy exclusions, such as pre-existing conditions or certain types of damages, play a significant role in determining the overall effectiveness of coverage.

Exclusions and Limitations

Insurance policies often contain specific exclusions and limitations that can significantly impact coverage. Common exclusions include natural disasters such as floods and earthquakes, which are often not covered by standard plans. Limitations may also apply to certain types of high-risk activities, such as professional sports or extreme hobbies, where coverage may be reduced or voided. Additionally, pre-existing medical conditions frequently face restrictions, with many policies requiring full disclosure to determine coverage eligibility. Understanding these exclusions and limitations is crucial for policyholders to avoid unexpected out-of-pocket costs during claims. Always consult the policy documentation for detailed information specific to your insurance provider and plan.

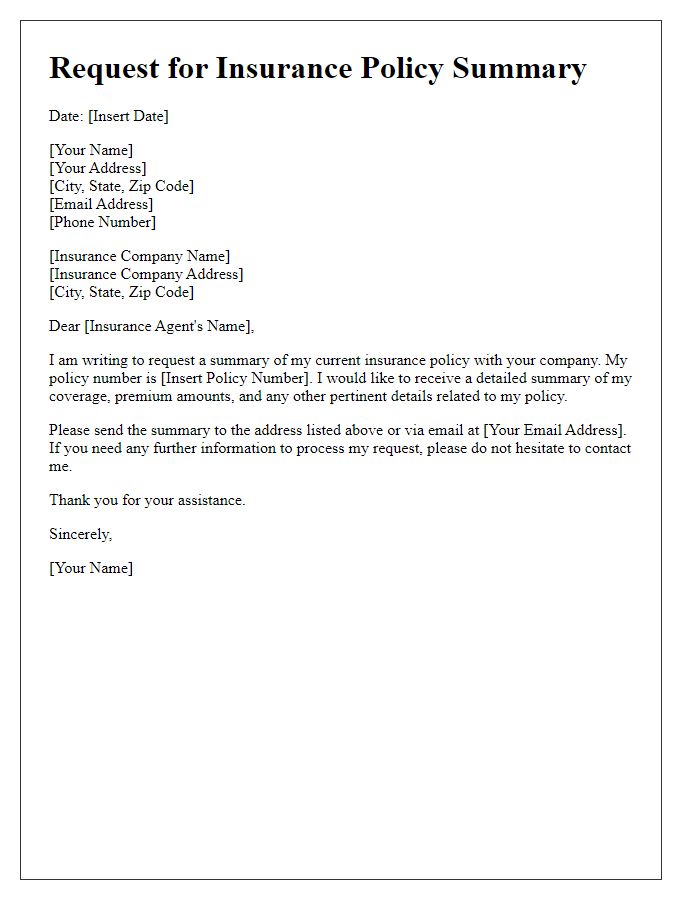

Claim Process and Requirements

The insurance claim process involves several critical steps, ensuring policyholders receive their entitled benefits efficiently. Initially, policyholders must submit a claim form detailing the incident, including specific dates, locations, and descriptions of the damage or loss. Supporting documentation is essential, such as police reports, photographs of the damage, receipts for lost items, and any expert assessments required by the insurance provider. Timeliness is crucial, as many insurance companies impose strict deadlines for claim submissions, often within 30 days post-incident. Furthermore, understanding the specific coverage conditions outlined in the policy is vital; exclusions typically cover pre-existing damages or specific high-risk activities like extreme sports. Effective communication with the insurance adjuster, who will assess the claim, will facilitate a smoother process, making it important to maintain records of all correspondence.

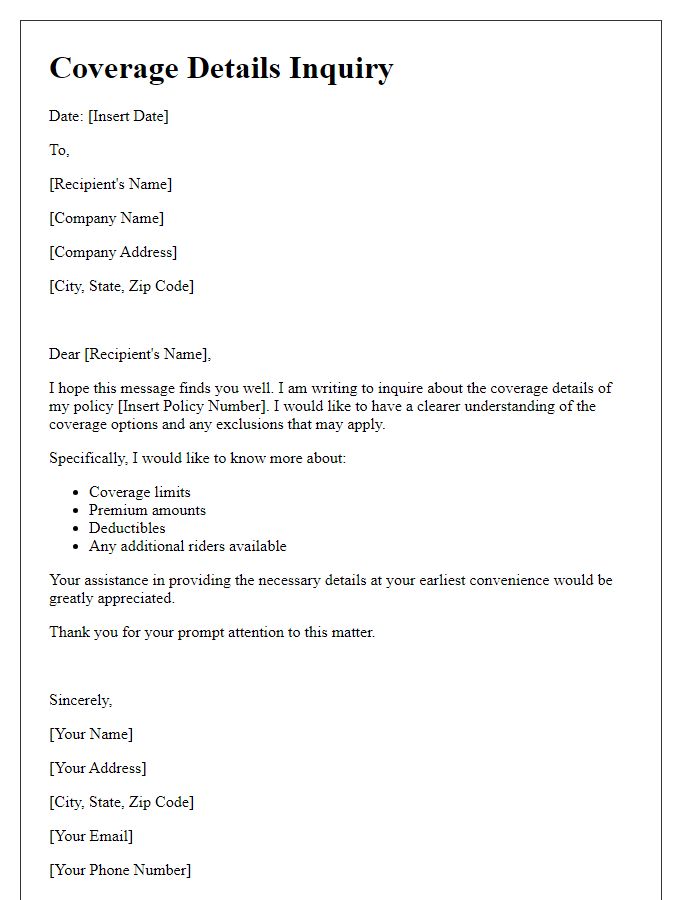

Contact Information for Inquiries

For inquiries regarding insurance coverage conditions, individuals should contact the customer service department of the specific insurance provider. This department typically operates from 8 AM to 6 PM, Monday through Friday, excluding holidays. The designated toll-free number, often prominently displayed on the insurance policy documents, allows policyholders to speak directly with a representative. Email communication is also an option, with a specified address for coverage-related questions, ensuring prompt responses within 24 to 48 hours. Additionally, insurance companies frequently offer online chat services on their official websites, providing immediate assistance for urgent matters. Understanding these contact methods ensures clarity and timely resolution of any coverage-related inquiries.

Comments