Dear valued customer, we hope this message finds you well! As a company dedicated to providing exceptional insurance services, your feedback is incredibly important to us. We would love to hear your thoughts on your recent experience, as it helps us understand how we can better serve you and enhance our offerings. Join us in shaping our future by sharing your insightsâread on to discover how you can contribute!

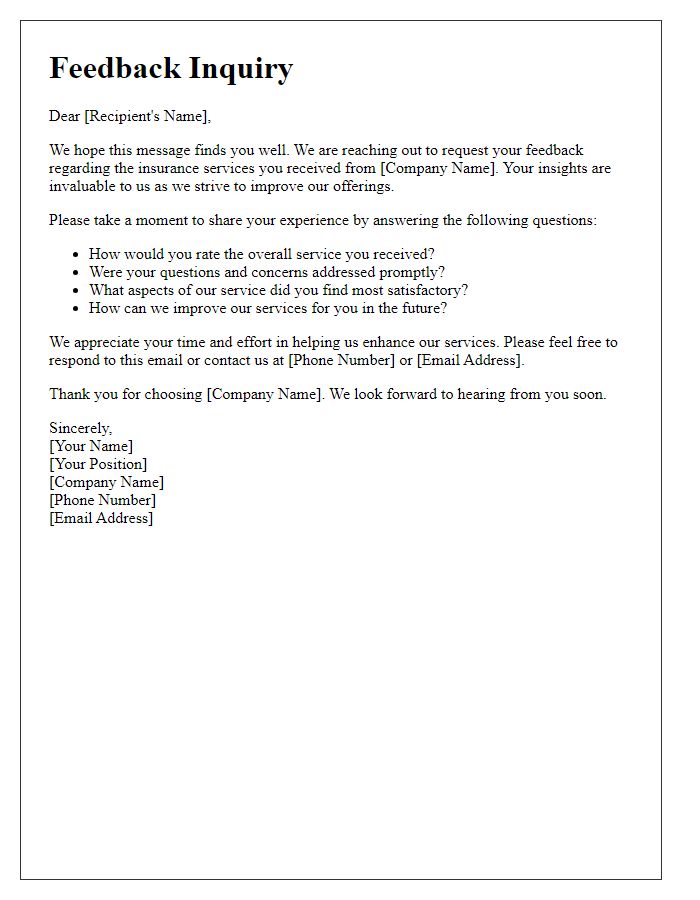

Personalized Greeting

Reliable insurance services significantly impact customers' peace of mind regarding financial protection. Positive customer experiences can foster brand loyalty among companies like Geico and State Farm. Effective communication, including feedback requests, enhances service quality and customer satisfaction metrics. Personalized greetings in these communications can create a sense of importance and enhance customer engagement. Integrating specific details such as recent interactions or policy updates can increase the likelihood of response, improving overall customer feedback collection efforts. Implementing these strategies is essential for insurers aiming to adapt and thrive in a competitive market landscape.

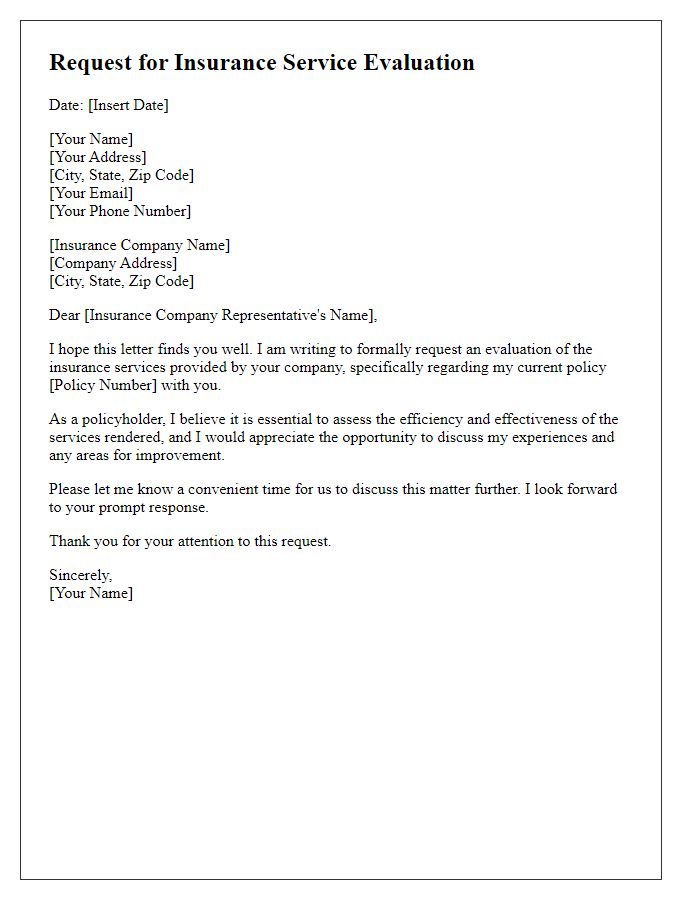

Purpose of Feedback

The primary objective of gathering feedback from clients regarding insurance services involves enhancing customer satisfaction and service quality. Clients' experiences shed light on the effectiveness of claim processes, the clarity of policy documentation, and the responsiveness of customer support teams. Real-time insights can also identify gaps in communication and service provisions. A systematic approach to collecting and analyzing this feedback can lead to actionable improvements in policy offerings, ultimately fostering trust and loyalty among clients. Regular feedback loops ensure that the insurance provider remains attuned to evolving customer needs and industry standards, promoting a culture of continuous improvement.

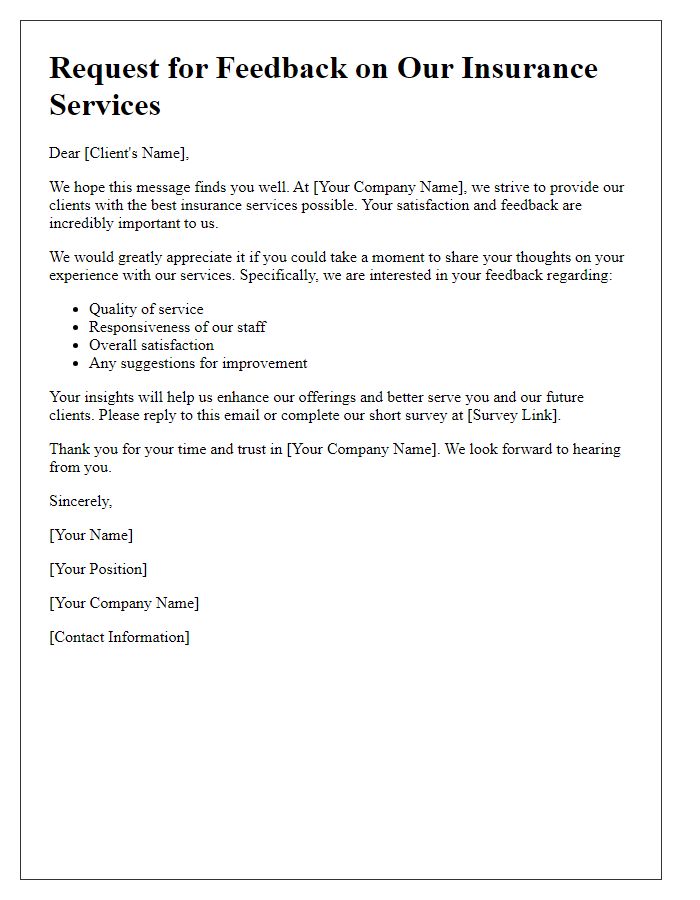

Specific Feedback Areas

Insurance companies often seek specific feedback on various aspects of their services, such as claims processing efficiency and customer service responsiveness. Timely communication during claim resolution (ideally within 7 days for initial responses) can significantly enhance customer satisfaction. Additionally, evaluating the clarity of policy documentation, particularly regarding coverage limits and exclusions, is crucial. Surveys may also inquire about the ease of navigating online platforms or mobile apps, as user-friendly interfaces (especially those with 24/7 accessibility) can improve overall client experience. Understanding clients' perceptions on premiums versus coverage value is another vital feedback area, providing insight into competitiveness in the marketplace.

Convenient Feedback Channels

Insurance companies offer multiple convenient channels for client feedback, including online surveys, email communication, and phone interviews. Online surveys allow clients to rate their experience conveniently from any device. Email communication provides a formal avenue for detailed feedback about service quality and claims processes. Phone interviews create opportunities for immediate interaction, gathering real-time insights about customer satisfaction levels. Each channel aims to enhance client experience by addressing concerns and improving services. Regularly collecting feedback enables insurers to adapt their offerings to meet evolving customer needs effectively.

Appreciation and Incentives

Customer feedback plays a crucial role in enhancing insurance services, such as auto, health, or home insurance. Recognizing client satisfaction can lead to improved service quality and tailored offerings. Incentives, such as discounts or loyalty programs, can encourage clients to share their experiences, fostering a sense of value and community. Companies often analyze feedback to identify service strengths and areas needing improvement, which helps refine claims processes, customer service interactions, and product offerings. Ultimately, appreciating clients' input and providing rewards can strengthen relationships, ensuring clients feel heard and valued in the competitive insurance market.

Comments