Are you considering an upgrade to your insurance policy but feeling a bit overwhelmed? You're not alone! Many people find themselves unsure about the best steps to take for a seamless transition. In this article, we'll walk you through a simple letter template that can help you communicate your needs and ensure you're getting the coverage you deserveâread on to discover how easy it can be!

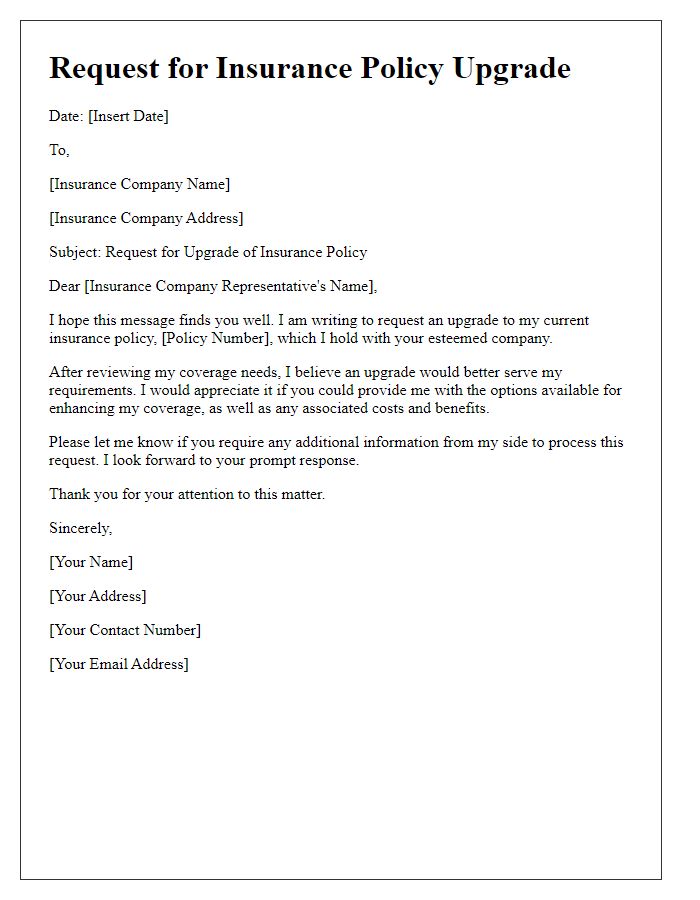

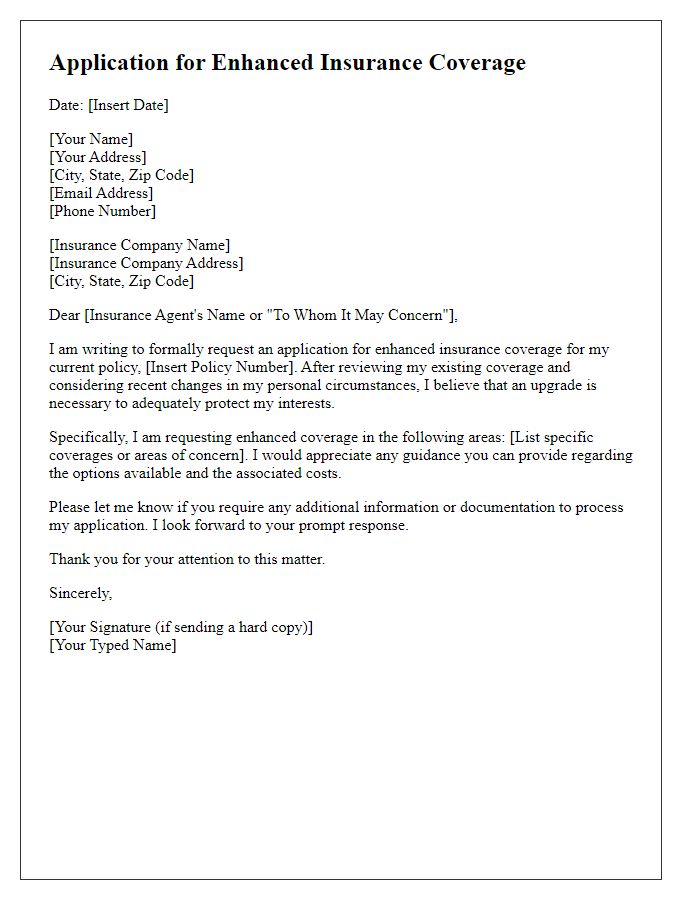

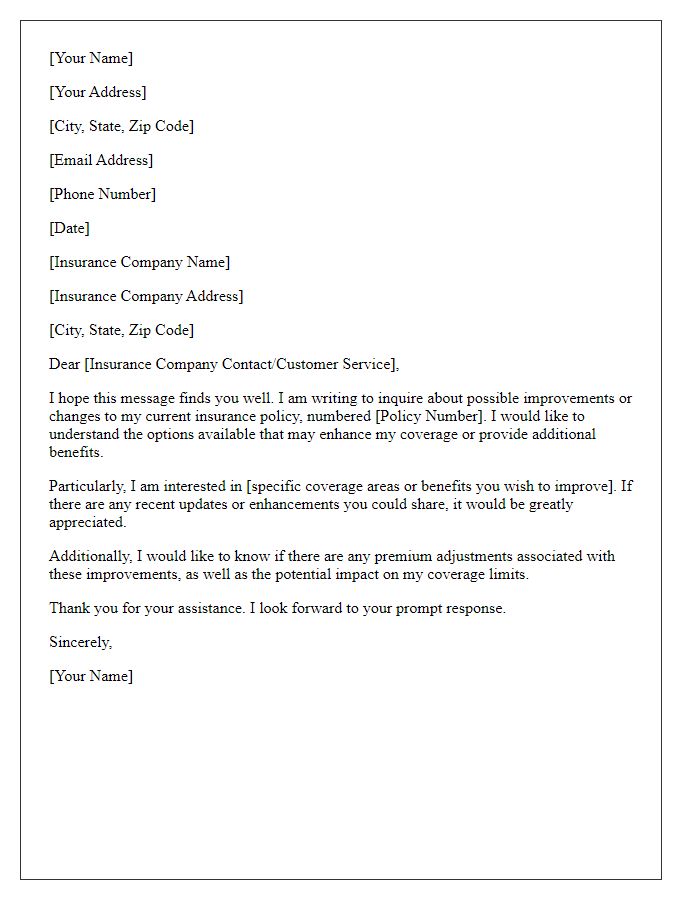

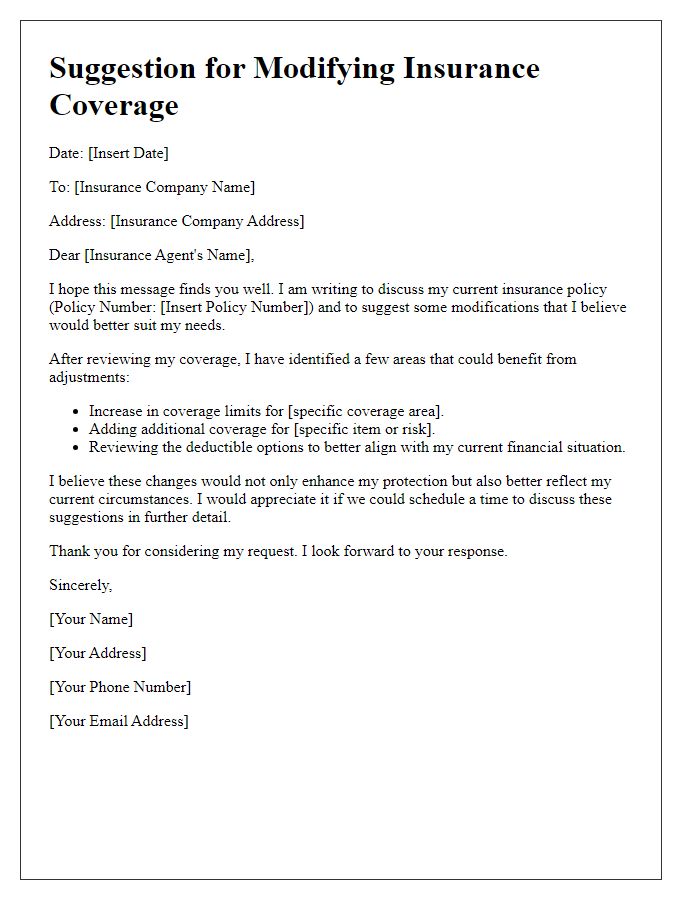

Personal Information (Name, Address, Contact Details)

For individuals seeking an upgrade in their insurance policy, personal information is crucial to facilitate the process. Essential details include the individual's full name, which ensures accurate identification in the insurance database. The current residential address, often including street number, city, state, and zip code, allows the insurance company to verify the geographic location and determine applicable coverage options. Contact details, such as phone numbers (home and mobile) and email addresses, enable the insurer to reach out for clarifications or updates regarding the policy changes. This information streamlines communication and enhances customer service, ensuring a smooth transition to the upgraded insurance policy.

Current Policy Details (Policy Number, Coverage, Insurer)

Current insurance policy details highlight essential aspects for upgrading coverage. The policy number serves as a unique identifier within the insurer's database, ensuring precise account management. Coverage encompasses the financial protection offered, which may include areas such as property damage, liability limits, and specific benefits tailored to personal needs. The insurer, a reputable company like Allstate or State Farm, administers the policy, providing customer support and claims processing. Evaluating these elements ensures the upgraded policy meets evolving requirements, such as increased home value or additional assets, guaranteeing comprehensive protection.

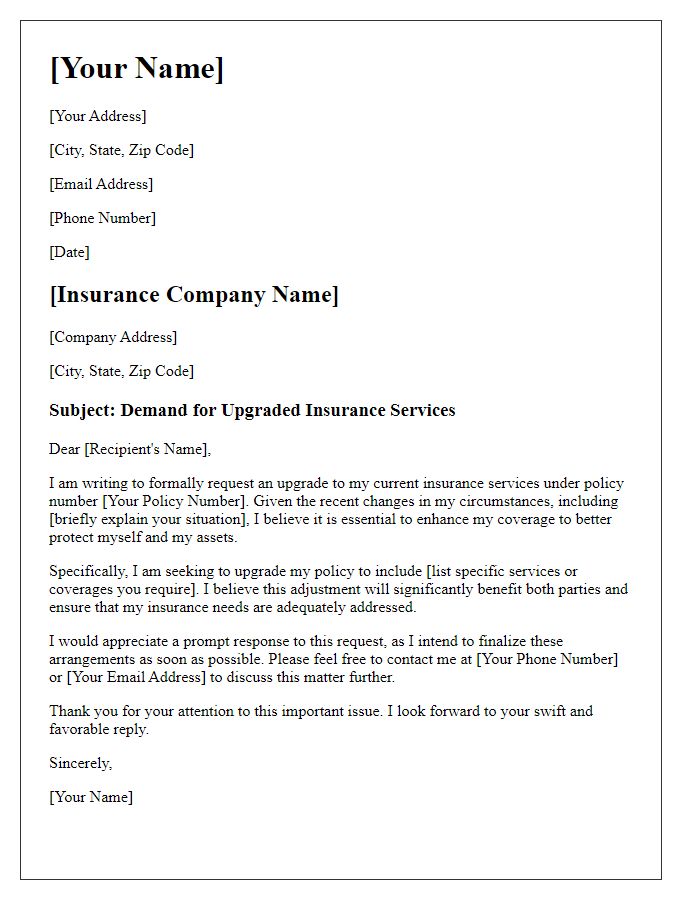

Upgrade Request (New Coverage Level, Additional Benefits)

An insurance policy upgrade commonly involves adjusting coverage levels to enhance protection against potential risks and uncertainties. Customers may seek to increase coverage limits, such as raising liability coverage to meet state requirements or adding critical illness benefits to their health insurance plan. These upgrades often involve additional premiums calculated based on various factors like age, health status, and the specific insurance provider, such as State Farm or Progressive. Customers should carefully review terms and conditions, considering exclusions and waiting periods that might apply to new benefits before finalizing their requests.

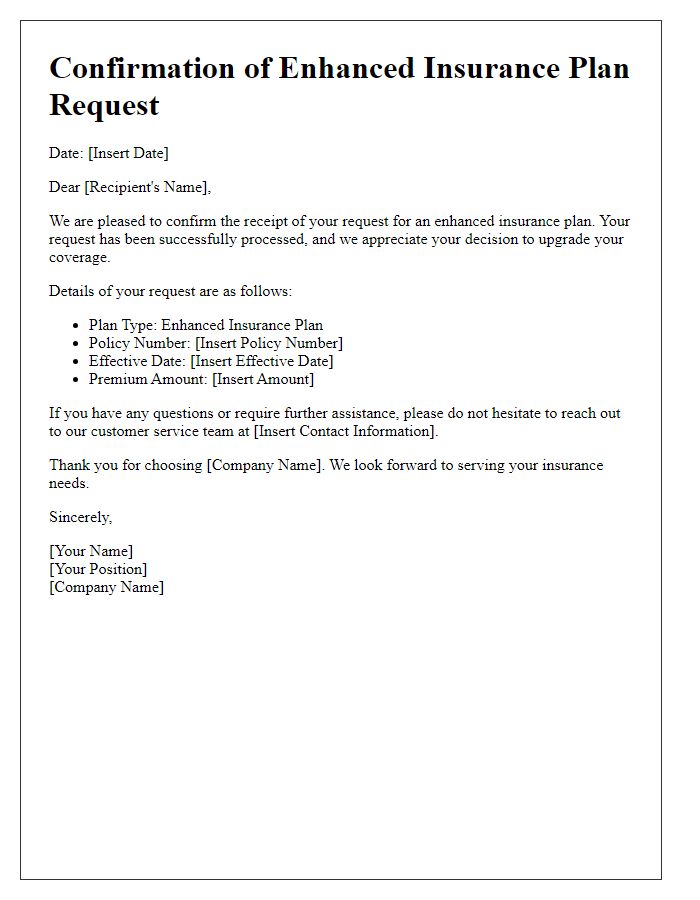

Justification for Upgrade (Increased Needs, Policy Features)

An insurance policy upgrade often reflects evolving circumstances and requirements, aligning coverage with current needs for protection. As families expand or lifestyle changes occur, increased insurance coverage becomes essential to safeguard assets and liabilities effectively. Factors such as rising healthcare costs--averaging over $11,000 per person in the United States--can warrant higher medical coverage limits. Enhanced policy features, including comprehensive liability protection and additional living expenses, provide more robust benefits, ensuring peace of mind during unexpected events. Moreover, specialized coverage for high-value items, such as collectibles or luxury vehicles, can prevent significant financial loss. Ensuring policies resonate with personal needs remains critical for adequate risk management in a dynamic environment.

Closure and Contact Information (Thank You, Phone Number, Email Address)

Insurance policy upgrades enhance coverage for policyholders, ensuring comprehensive protection against unexpected events. Professional communication emphasizes gratitude for selecting a reputable provider, such as ABC Insurance Company, serving clients since 1985. Effective contact methods facilitate seamless interactions; the customer service phone number (1-800-555-0199) connects clients to knowledgeable representatives. An email address (support@abcinsurance.com) offers an alternative route for inquiries or support. Acknowledging clients' trust and satisfaction fosters long-lasting relationships, key for retention and referrals in the competitive insurance market.

Comments