Navigating the world of supplemental insurance claims can often feel overwhelming, but understanding the process doesn't have to be. In this article, we'll break down the essential elements of crafting an effective inquiry letter for your supplemental insurance claim, ensuring you communicate your needs clearly and effectively. From outlining the specifics of your claim to addressing any concerns with the insurance company, we've got you covered. So, let's dive in and empower you with the knowledge to take the next step!

Claim Details: Claim number, policyholder information, and date of submission.

Supplemental insurance claims require specific details for efficient processing. Claim number serves as a unique identifier for tracking the status (usually a combination of letters and numbers). Policyholder information includes essential personal elements, such as name, address, and contact information, ensuring proper identification and correspondence. Date of submission reflects when the claim was officially filed, important for adhering to timelines for processing and any potential compensatory limits. Including these details in an inquiry can significantly streamline communication with the insurance provider.

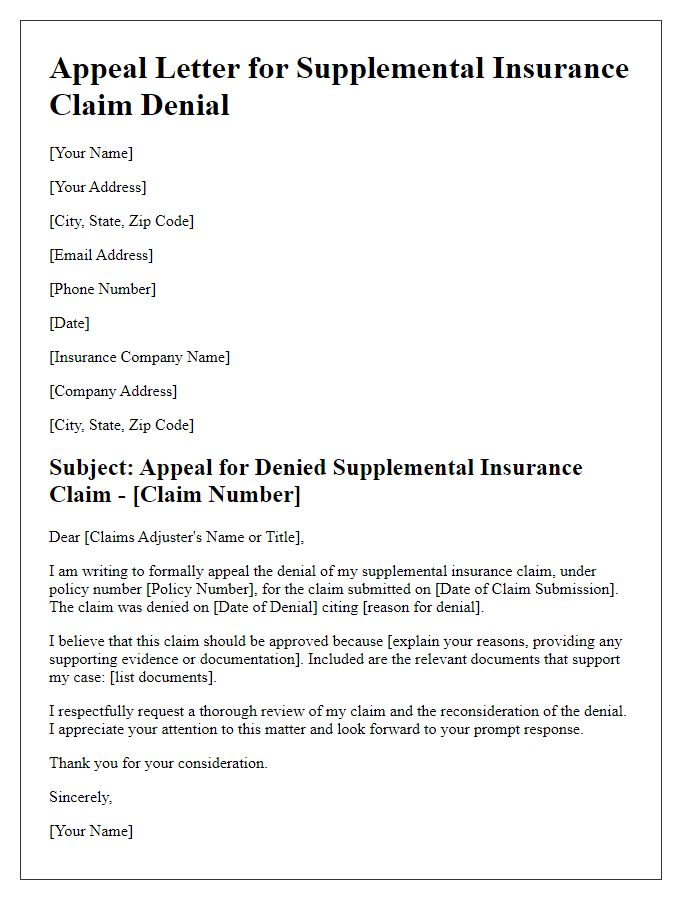

Specific Inquiry: Clarification or reason for inquiry about the claim's status or decision.

Supplemental insurance claims require precise follow-ups to ensure timely processing. In cases where a claim's status needs clarification, policyholders often reach out to their insurance provider for detailed updates. Requests for information commonly revolve around specific identifiers like claim numbers (often alphanumeric codes), request dates (noting the timeline since submission), and involved medical services or treatments (e.g., specific procedures like MRIs or surgeries). Additionally, the inquiry might include questions about documentation requirements (such as bills or discharge summaries). Each aspect ensures that the inquiry is directed towards obtaining an accurate understanding of the claim's current standing and any potential reasons for delays, enhancing communication between the insured and the insurer.

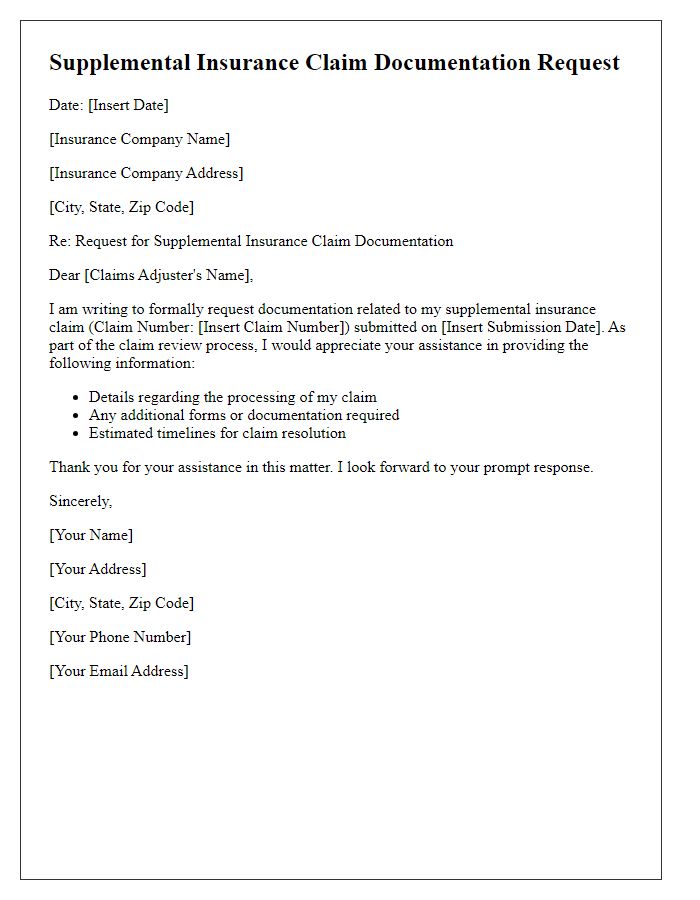

Supporting Documentation: Include any relevant medical reports, receipts, or additional documentation.

Supplemental insurance claims often require substantial supporting documentation to facilitate the review process. Necessary documents may include detailed medical reports from healthcare providers (such as hospitals or physician offices) which outline diagnosis and treatment received. Original receipts for medical expenses, including prescriptions and treatments, must be attached to substantiate the claim. Additional documentation may encompass diagnostic imaging results (like X-rays or MRIs), as well as any correspondence from insurance companies that may further clarify the nature of the claim. Providing comprehensive and organized documentation not only expedites the claim processing but also increases the likelihood of a favorable outcome.

Contact Information: Ensure updated contact details for a prompt response.

Maintaining updated contact information is crucial for effective communication regarding supplemental insurance claims. Accurate details, including current phone number, email address, and physical mailing address, allow insurers to reach policyholders easily for necessary documentation or clarification. Timely updates prevent delays in processing claims, enhance the overall efficiency of customer service interactions, and ensure that all correspondence is received without significant interruption. Keeping records of previous communication dates and reference numbers can also aid in tracking claim status, making follow-up inquiries more straightforward.

Professional Language: Maintain a formal tone and clear, concise language throughout the letter.

Supplemental insurance claims often require detailed documentation for review and processing. Claimants frequently encounter challenges obtaining timely responses from insurance providers, particularly regarding the status of their claims. Various types of supplemental insurance, such as critical illness or accident policies, may cover a range of medical expenses that primary insurance does not address. For instance, a policyholder may inquire about a claim related to an unexpected hospitalization after a car accident, which occurred in June 2023. Clear communication is essential, detailing the claim number, date of service, and specific coverage benefits outlined in the policy documents. Contacting the claims department directly through the dedicated phone line can facilitate a faster resolution. A written follow-up, summarizing the previous communication, can also ensure that the inquiry receives appropriate attention from the claims adjuster.

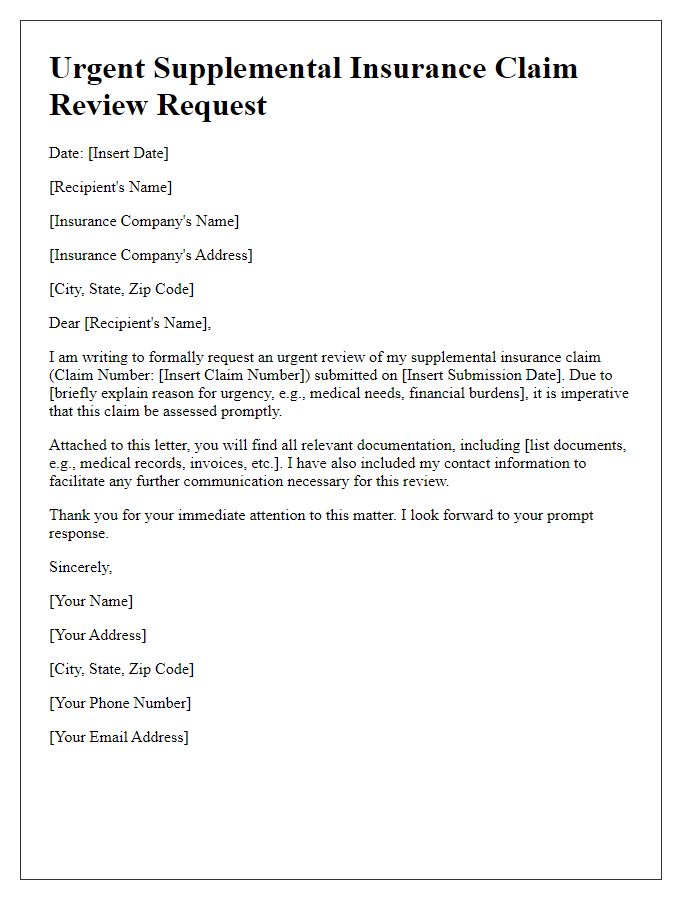

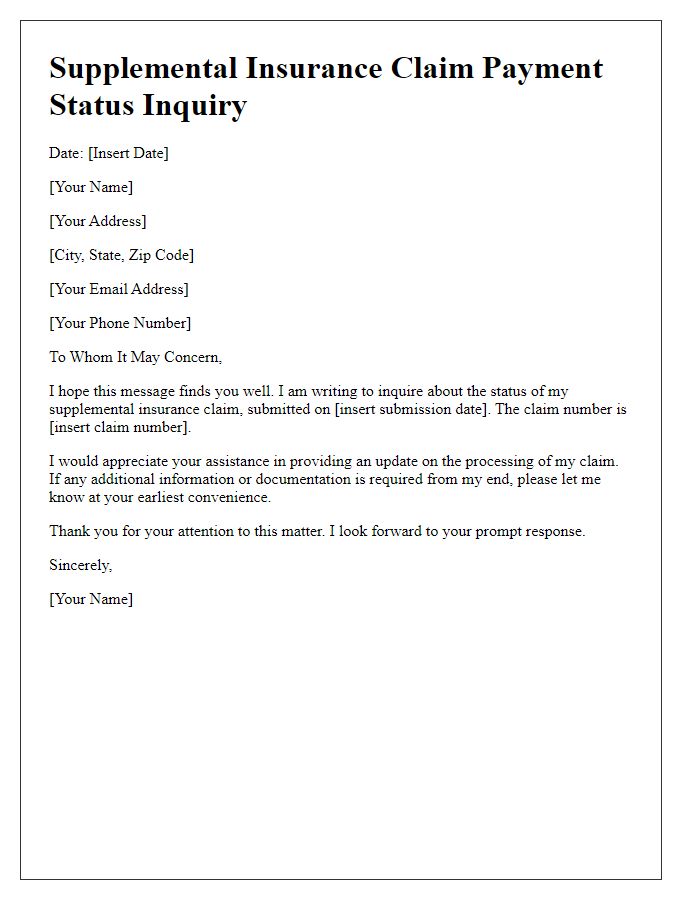

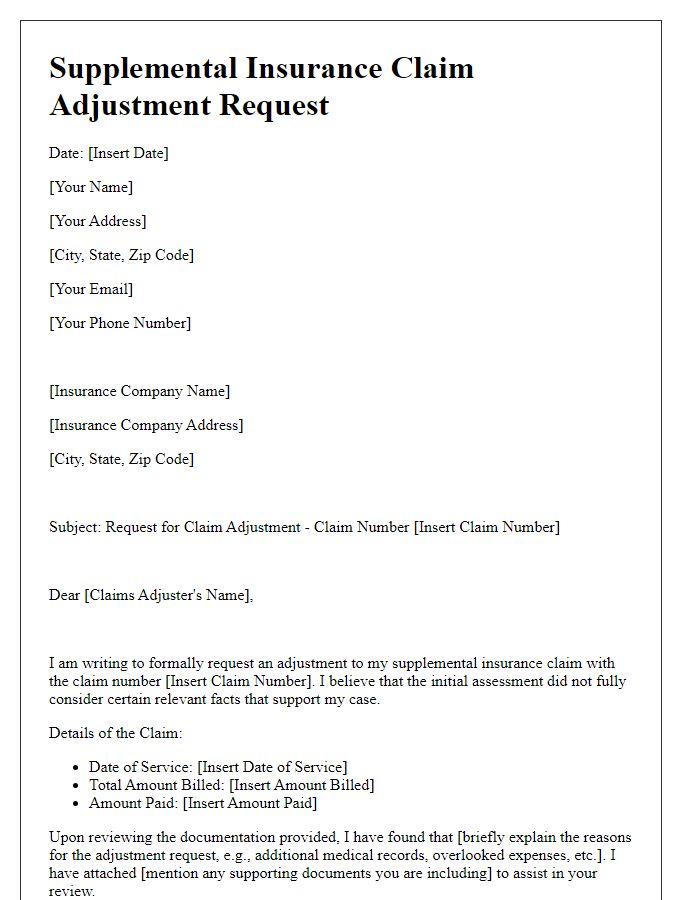

Letter Template For Supplemental Insurance Claim Inquiry Samples

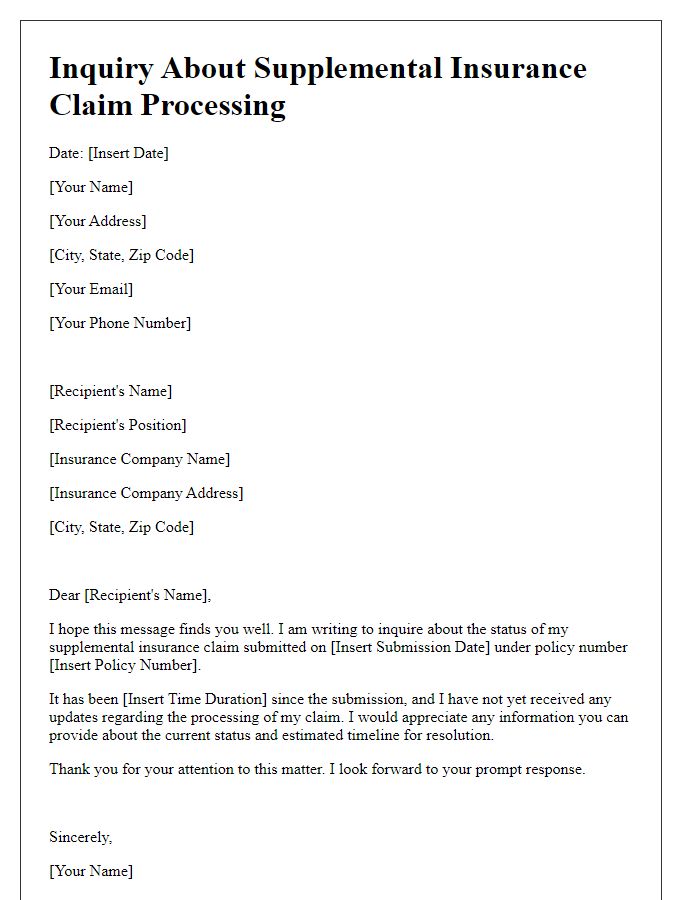

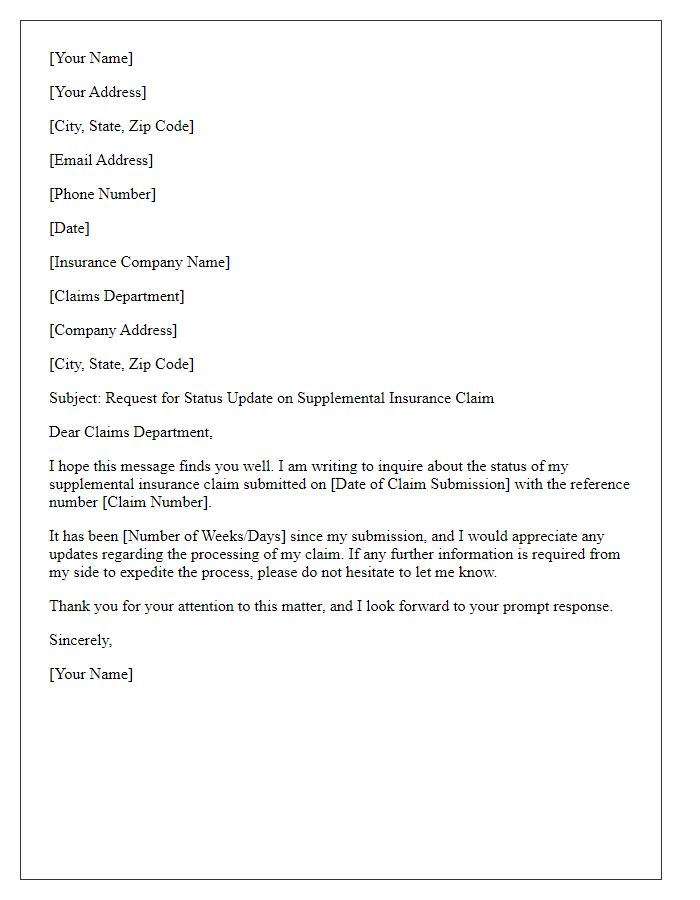

Letter template of inquiry regarding supplemental insurance claim processing

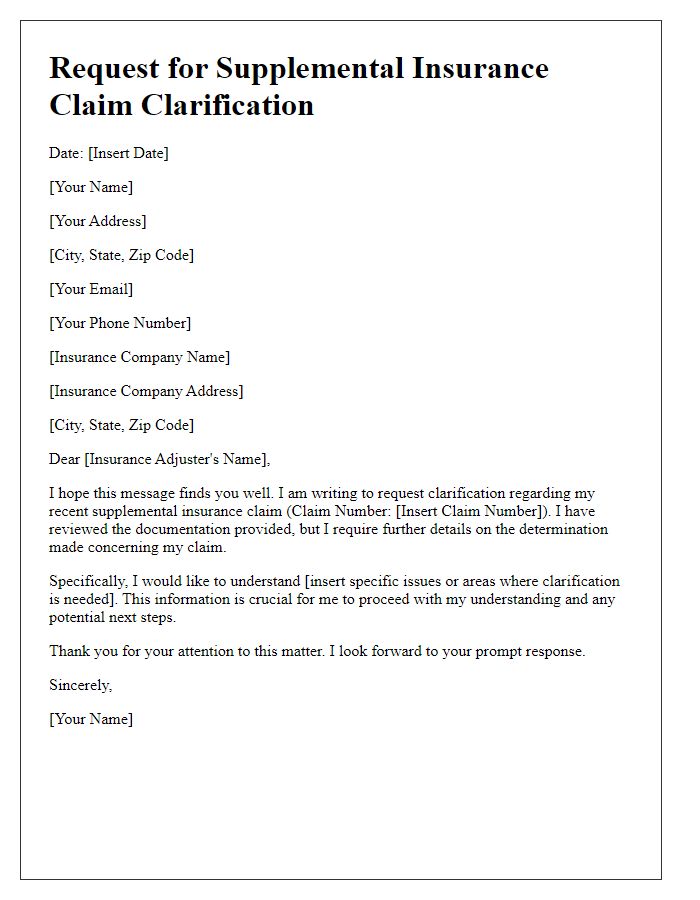

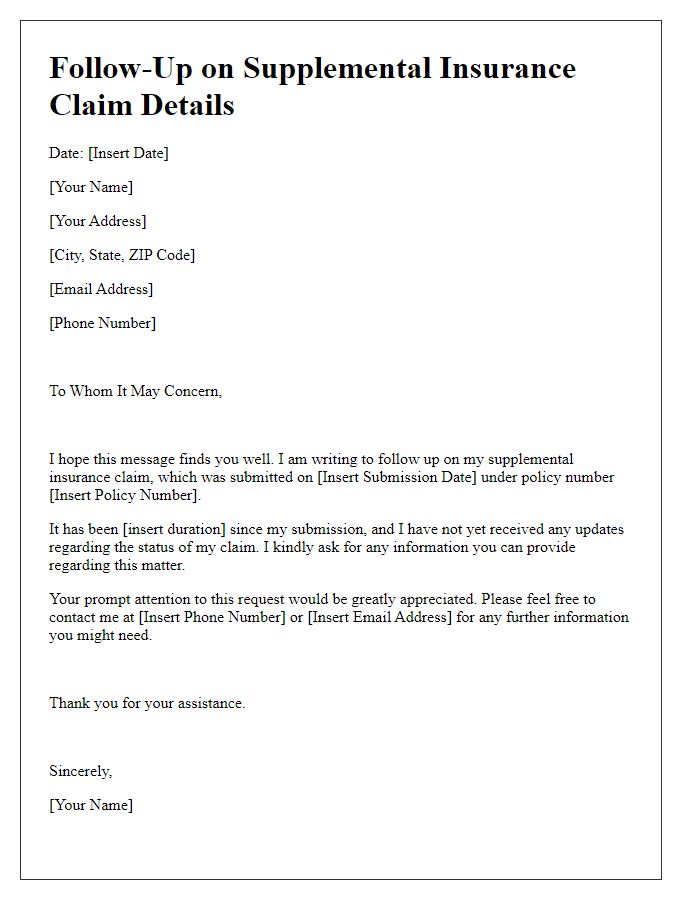

Letter template of request for supplemental insurance claim clarification

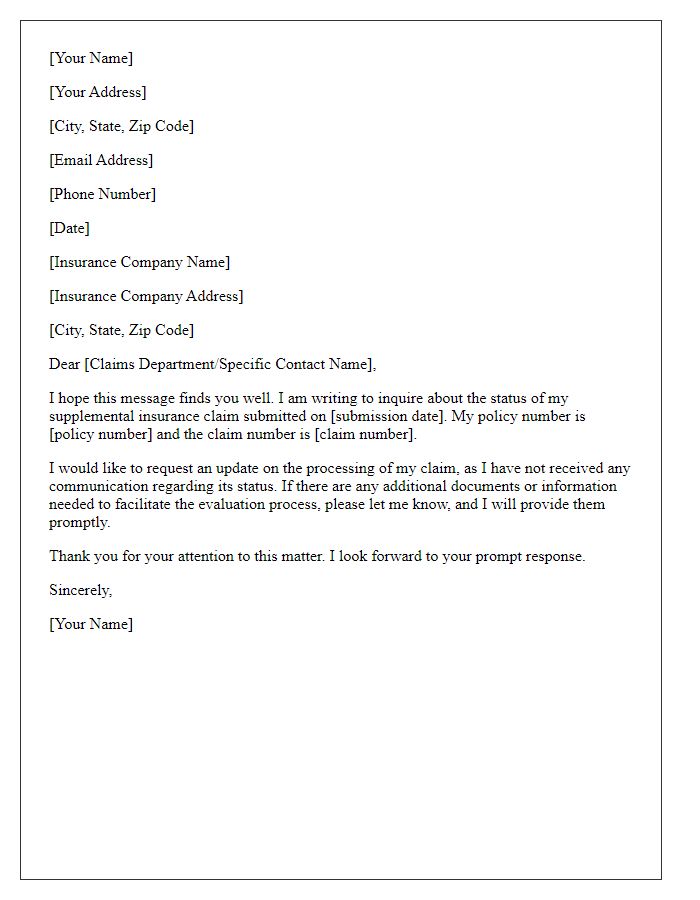

Letter template of supplemental insurance claim information update inquiry

Comments