Navigating the world of tail insurance coverage can seem daunting, but understanding its importance is key for any professional in transition. This type of coverage provides essential protection against claims that may arise after a policy has lapsed, ensuring you're not left vulnerable. In this article, we'll unravel the intricacies of tail insurance and discuss who needs it, when it's appropriate, and how to find the right policy for your needs. So, let's dive deeper into the world of tail insurance and explore why it's a critical aspect of your professional journey!

Policy Terms and Conditions

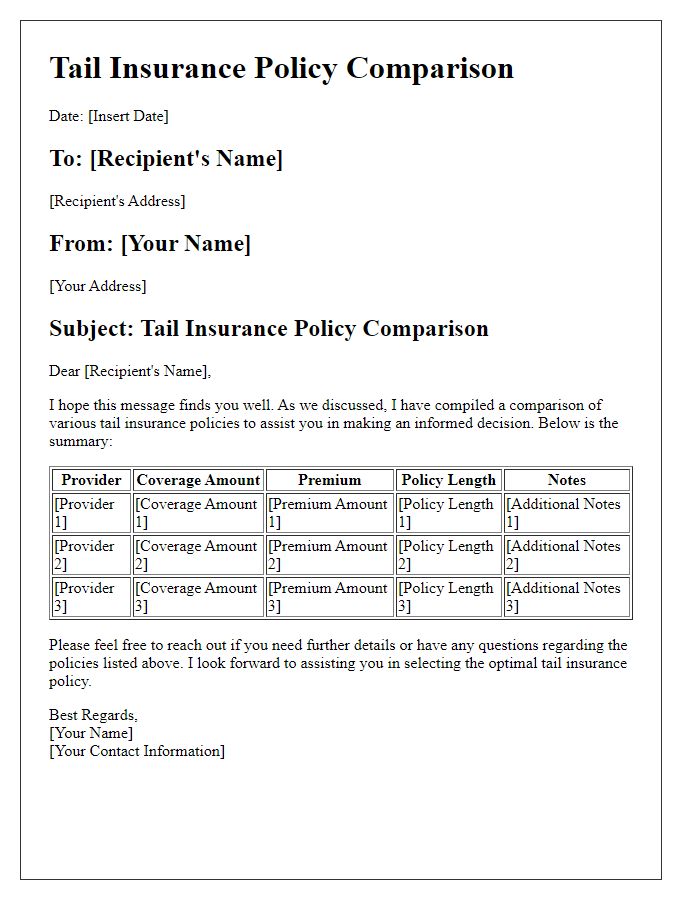

Thorough examination of tail insurance coverage reveals critical factors. Coverage duration typically extends for several years post-termination of the primary policy, often ranging from 1 to 10 years depending on specific terms. Key events like claims or allegations not disclosed during the active coverage period are generally eligible for protection, safeguarding against unexpected legal actions. Notably, premium costs vary substantially based on the policy limit and the overall risk profile of the insured party, often reaching tens of thousands of dollars. Understanding the nuances of exclusions and limitations is essential, particularly regarding incidents that occurred prior to the effective date of tail coverage. Policy language clarity is vital, particularly in jurisdictions like California or New York, where regulations may impose additional stipulations on insurance contracts.

Coverage Limits and Exclusions

Tail insurance provides essential coverage for professionals seeking protection after the termination of their primary liability insurance. The average coverage limit for tail insurance typically ranges from $1 million to $5 million, safeguarding against claims arising from incidents that occurred during the period of active coverage. Exclusions commonly found in tail insurance policies may include claims resulting from intentional misconduct, criminal acts, or pre-existing conditions known prior to the policy start date. Specific professions, such as medical practitioners within the United States, often require tail insurance to fulfill contractual obligations ensuring continuous coverage for potential claims made years after services were rendered. Understanding the nuances of coverage limits and exclusions is crucial in evaluating the adequacy of protection provided by tail insurance.

Claims History and Potential Risks

A comprehensive analysis of tail insurance coverage reveals critical insights into claims history and potential risks associated with medical malpractice in healthcare practices. Tail insurance, typically utilized in the healthcare sector, provides coverage for claims made after a policy expires, particularly in the context of occurrences that happened during the active policy period. For instance, a physician with an annual premiums averaging $20,000 may face significant risk exposure if their policy does not extend to past incidents, especially when considering that 70% of claims arise from events that occurred years earlier. Historical claims data from 2022 indicates that malpractice negligence cases can reach into the hundreds of thousands, particularly in high-stakes specialties like surgery or obstetrics. Additionally, geographical factors contribute significantly to risk profiles, as states such as California and Florida exhibit more aggressive litigation environments, resulting in elevated premiums. Understanding these elements will aid practitioners in assessing their coverage needs and managing financial liability effectively.

Financial Stability of the Insurer

In the analysis of tail insurance coverage, the financial stability of the insurer plays a crucial role in determining the reliability and sufficiency of the coverage. Insurers, such as AIG or Zurich Insurance Group, are evaluated based on their credit ratings, which assess their ability to meet financial obligations. Ratings from agencies like A.M. Best or Moody's provide insights into the insurer's financial health, often using a scale from A++ (superior) to D (poor). The insurer's loss reserves must also be adequate, indicating that they can cover future claims related to events that have already occurred but have not yet been reported. Moreover, the insurer's combined ratio, representing the sum of incurred losses and expenses divided by earned premiums, should ideally be below 100%, signifying profitability. It is essential to consider the insurer's liquidity, analyzed through metrics such as the current ratio, ensuring that there are sufficient short-term assets to meet liabilities. Overall, a thorough understanding of the insurer's financial stability provides essential assurance in the efficacy of the tail insurance coverage, protecting against unforeseen liabilities over extended periods.

Legal and Regulatory Compliance

Tail insurance coverage provides critical protection for professionals against claims arising after the expiration of a claims-made policy. This type of insurance is particularly essential in fields such as medicine, law, and corporate consulting, where reputational risk from past practices remains significant. The coverage often stems from specific regulatory requirements, such as those outlined by state medical boards or bar associations, emphasizing the importance of legal compliance. For instance, a physician facing a malpractice lawsuit years after the termination of practice might rely on tail coverage to avoid crippling financial liability. Unregulated industries may also seek such coverage to mitigate risks associated with potential legal actions, ensuring adherence to contractual obligations. Tail coverage can extend periods of protection, typically ranging from one to five years, safeguarding professionals in jurisdictions like California, New York, or Texas, where litigation can occur long after services are rendered.

Comments