Are you feeling a bit overwhelmed by the world of motorcycle insurance? You're not alone! Many riders have questions about the best coverage options, policy details, or even how to save money on premiums. Stick around as we dive into the essentials of motorcycle insurance and explore how you can protect your ride with confidence.

Clear Purpose Statement

Motorcycle insurance coverage is essential for safeguarding riders and their motorcycles against potential risks. Comprehensive policies protect against theft, accidents, and damages incurred from various incidents. Coverage limits vary, with many insurers offering specific policies tailored to different types of motorcycles, such as cruisers, sportbikes, or touring bikes. Riders should consider factors like liability coverage, medical payments, and personal injury protection when selecting a policy. Additionally, discounts may be available for safety courses, multiple policies, or motorcycle club memberships, providing significant savings. Understanding terms such as deductible, premium, and uninsured motorist coverage is crucial for making informed decisions.

Personal and Policy Information

Motorcycle insurance is essential for protecting riders and their vehicles against potential accidents and liability claims. Various factors influence insurance premiums including the motorcycle's make and model, which may be a Harley-Davidson or Kawasaki, the rider's age and experience, typically assessed through a driver's license record holder's history, and geographical location such as residing in California versus New York, where risk levels differ. Additionally, specific policy details like comprehensive coverage, liability limits, and deductible amounts play crucial roles in determining coverage levels. Riders should also inquire about any discounts available for safety training programs such as the Motorcycle Safety Foundation (MSF) classes, which can significantly reduce costs while promoting safer riding practices.

Specific Coverage Details

Motorcycle insurance policies, like those offered by major providers such as Progressive and Geico, include various coverage options tailored for riders. Liability coverage protects against damages incurred to third parties in accidents, typically mandated by state laws like those in California or Texas. Comprehensive coverage safeguards against non-collision incidents, including theft or natural disasters, covering motorcycles valued at thousands of dollars. Collision coverage repairs damages from accidents, regardless of fault, essential for high-performance models like Harley-Davidson or Ducati. Uninsured/underinsured motorist coverage offers protection against accidents involving drivers lacking adequate insurance, critical in urban areas with higher accident rates. Riders must carefully evaluate options and limits, often influenced by factors such as riding frequency, motorcycle make, and personal insurance history.

Questions and Clarifications Section

Motorcycle insurance policies, particularly those governed by state laws such as the Motorcycle Safety Foundation guidelines, often present various complexities. Specific coverage types, such as liability, collision, and comprehensive insurance, can vary in premium costs influenced by factors like motorcycle make and model, rider experience, and geographic location. Frequent inquiries involve policy limits, deductibles, and potential discounts for safety courses or multi-policy bundling. Additionally, clarification on the claims process is crucial, as it involves submitting an accident report and evidence within specific timeframes to ensure timely resolutions. Understanding exclusions, such as racing activities or modifications made without informing the insurer, can also impact coverage eligibility. Navigating these elements effectively requires thorough communication with insurance representatives and documentation of all interactions for reference.

Contact Information and Follow-Up Request

Motorcycle insurance policies often include a variety of coverage options designed to protect riders and their vehicles. Typical policies encompass liability coverage, which safeguards against damages to third-party property or injuries, and comprehensive coverage, which protects against theft or non-collision related incidents. Riders may seek clarification on specific terms and conditions, such as deductibles, policy limits, and geographical coverage restrictions, particularly in regions with varying laws like California or Texas. Regular follow-up with the insurance provider can ensure that queries regarding claims processing timelines or policy renewals are promptly addressed, thus facilitating smoother transactions and continuous protection for motorcycle enthusiasts.

Letter Template For Motorcycle Insurance Query Samples

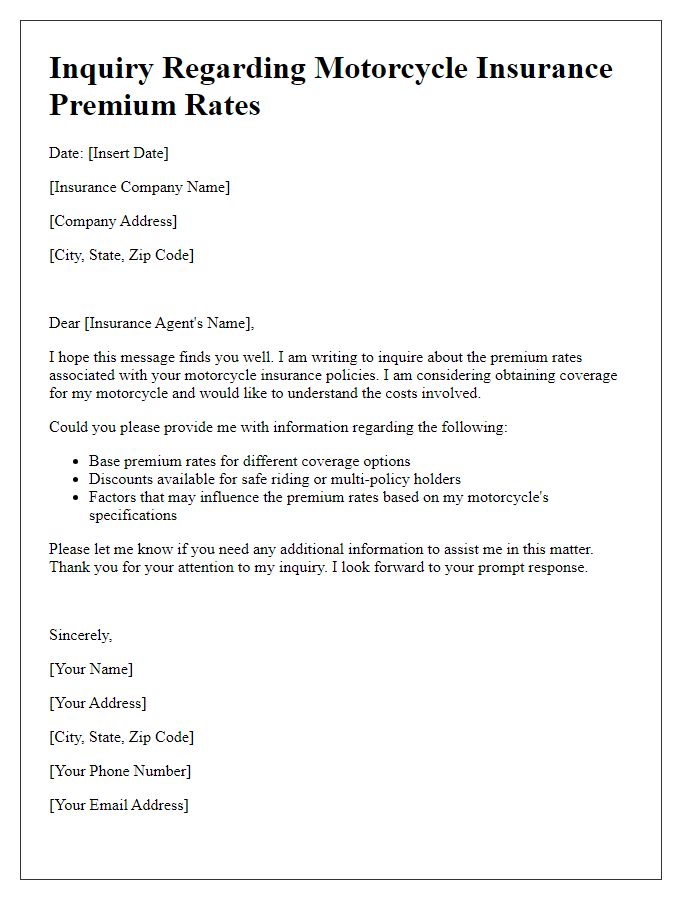

Letter template of motorcycle insurance question regarding premium rates

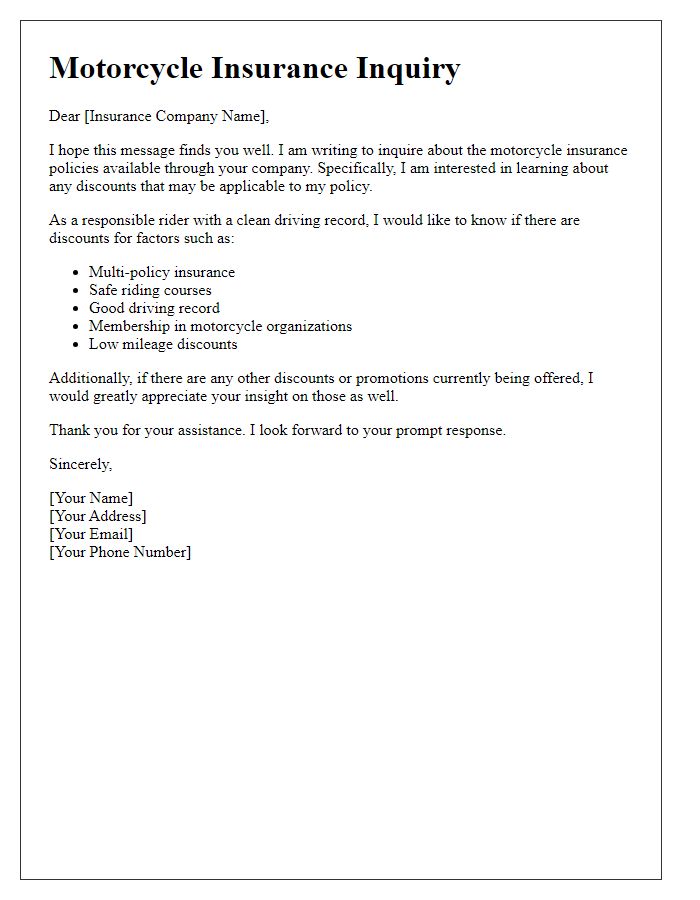

Letter template of motorcycle insurance inquiry about discounts available

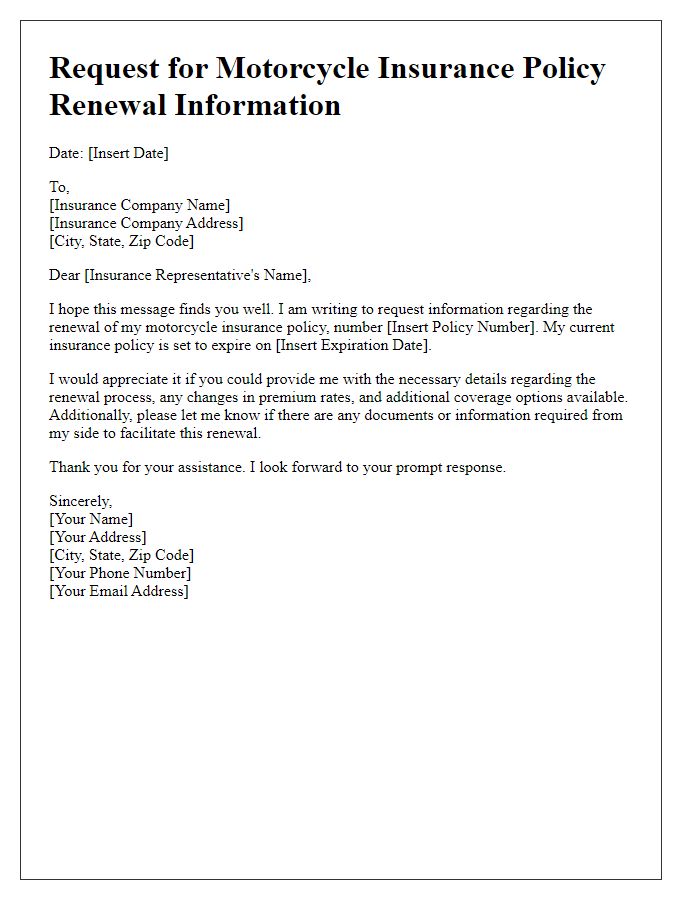

Letter template of motorcycle insurance request for policy renewal information

Letter template of motorcycle insurance question on liability coverage specifics

Letter template of motorcycle insurance follow-up regarding accident reporting process

Letter template of motorcycle insurance inquiry about adding a second rider

Comments