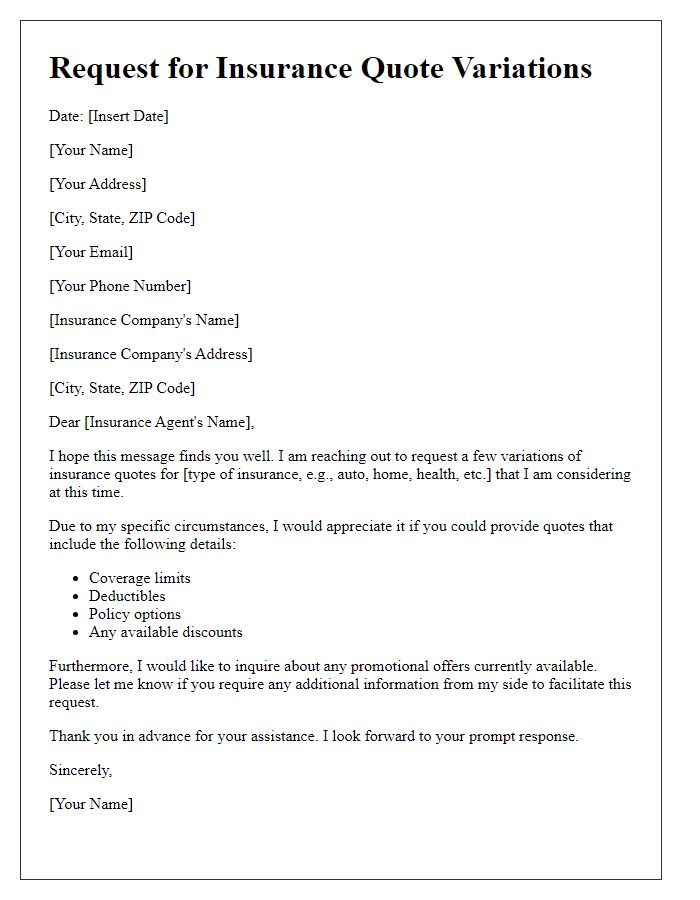

Are you feeling overwhelmed by the multitude of insurance options available today? We get it; navigating through various quotes can be a daunting task. That's why we're here to help simplify the process with a personalized letter template that makes comparing insurance quotes a breeze. Ready to take the first step towards informed decision-making? Keep reading to discover how our template can make your comparison more effective!

Policy Coverage

Requesting insurance quotes requires clear communication about desired policy coverage. Specific coverage types include liability insurance, which protects against legal claims, and comprehensive insurance, covering damage from a variety of incidents such as theft or natural disasters. Additionally, requesting detailed information about coverage limits, deductibles, and premium costs for specific scenarios like auto accidents or property damage is crucial. Policy types may vary by provider, so mentioning preferences for insurers like Geico, State Farm, or Progressive can streamline the comparison process. Timely responses are essential, typically within one week, to ensure competitive quotes are received, allowing for informed decision-making.

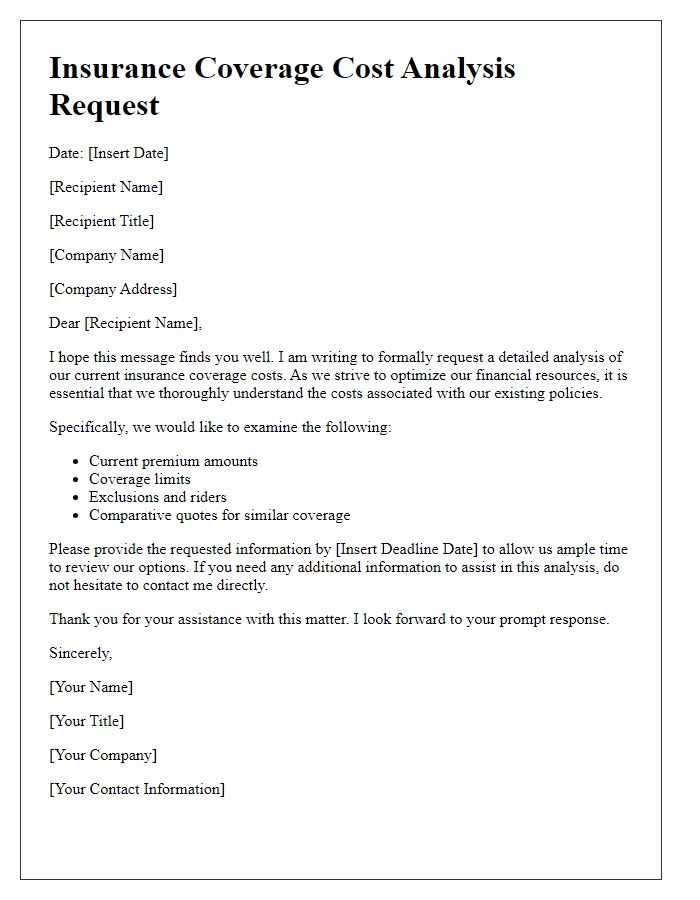

Premium Rates

When comparing insurance quotes, premium rates play a crucial role in determining affordability. Insurance providers, such as State Farm, Allstate, and Geico, often offer varying premium rates based on factors like vehicle type, personal driving history, and geographical location, which can range dramatically. For example, individuals in urban areas such as New York City may face higher premiums compared to those in rural regions like Idaho due to increased risk factors. Additionally, for health insurance, age demographics significantly influence premium costs; older individuals typically encounter higher rates due to increased medical expenses. It is essential to analyze not only the premium amounts but also the coverage details and deductibles associated with each insurance policy for effective comparison.

Deductible Options

Comparing insurance quotes involves analyzing various deductible options that impact both premiums and out-of-pocket expenses. A deductible, often ranging from $250 to $5,000, represents the amount a policyholder must pay before the insurance company covers additional costs. Health insurance, automotive insurance, and homeowner's insurance frequently present varying deductible levels. For instance, a higher deductible typically results in lower monthly premiums, appealing to those with sufficient savings to cover unforeseen expenses. Conversely, lower deductibles provide immediate assistance in emergencies, suitable for individuals with tighter budgets. Additionally, understanding the implications of different deductibles on specific claims, such as car accidents or medical treatments, is crucial for making informed choices while choosing an insurance provider.

Customer Service Quality

Customer service quality plays a crucial role in the insurance industry, particularly when individuals seek quotes for policies, including home, auto, or health insurance. Insurers often provide distinct levels of support that can significantly impact customer satisfaction. Companies like State Farm, Allstate, and Geico emphasize 24/7 availability and access to knowledgeable representatives, which enhances the client experience. Effective communication, prompt responses, and personalized advice are critical factors that influence policyholders' decisions. Research shows that over 70% of customers value responsive service, which can lead to increased loyalty and retention. Companies implementing robust customer service training programs often report a noticeable increase in their service ratings and overall customer satisfaction scores.

Insurer Reputation

Insurer reputation significantly influences consumer trust and decision-making in the insurance market. Established providers such as State Farm, noted for personalized customer service, have garnered high satisfaction ratings over the years. Consumer Reports' annual surveys often spotlight companies like USAA, which consistently ranks as one of the top insurers due to its commitment to member happiness and robust financial stability. In contrast, newer entrants may lack extensive track records, causing potential policyholders to question their reliability. Regulatory bodies such as the National Association of Insurance Commissioners (NAIC) publish complaint ratios, allowing customers to assess the frequency of grievances against the insurer. Additionally, financial ratings from agencies like A.M. Best and Moody's provide insight into an insurer's ability to meet policyholder obligations, further informing comparison decisions.

Comments