When it comes to managing your insurance, understanding your premiums is vital. Many policyholders experience adjustments that can raise a few eyebrows, but there's often a good reason behind these changes. In this article, we'll break down the key factors that influence your insurance premium adjustments and help you navigate this important aspect of your policy. So, stick around to learn more about what to expect and how to make informed decisions about your coverage!

Policyholder Information

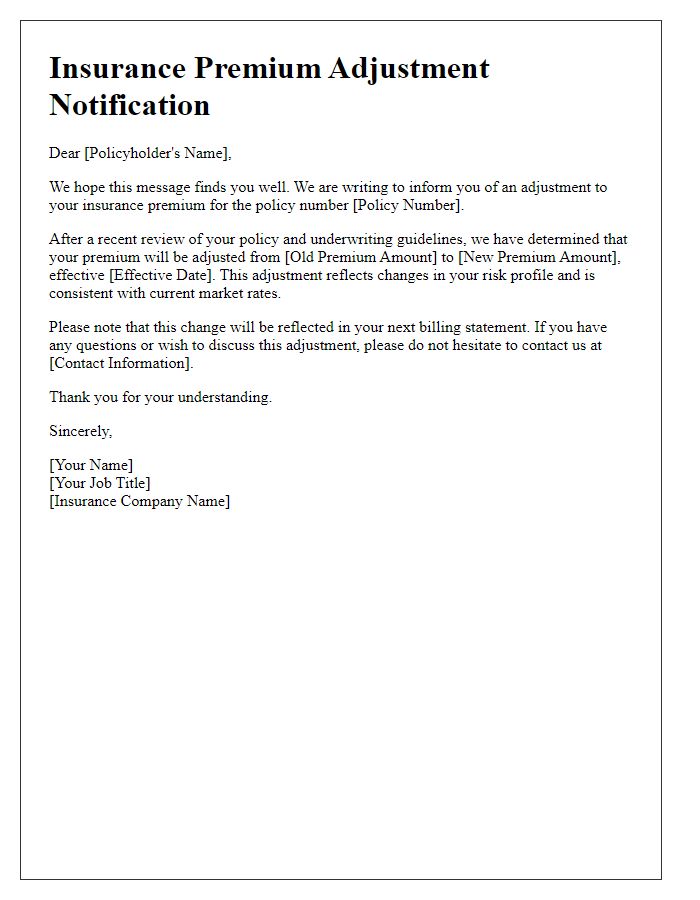

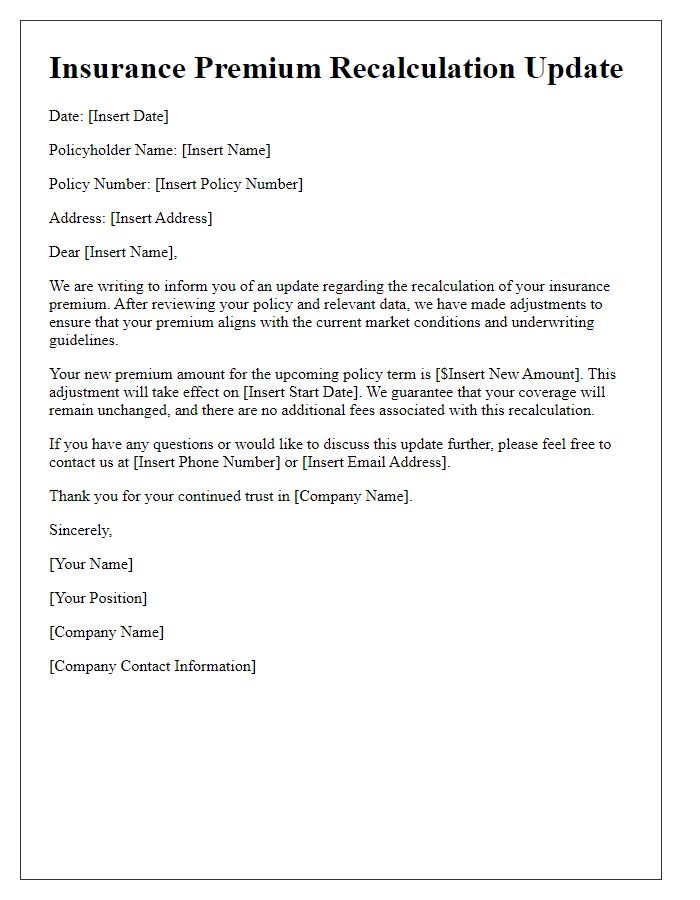

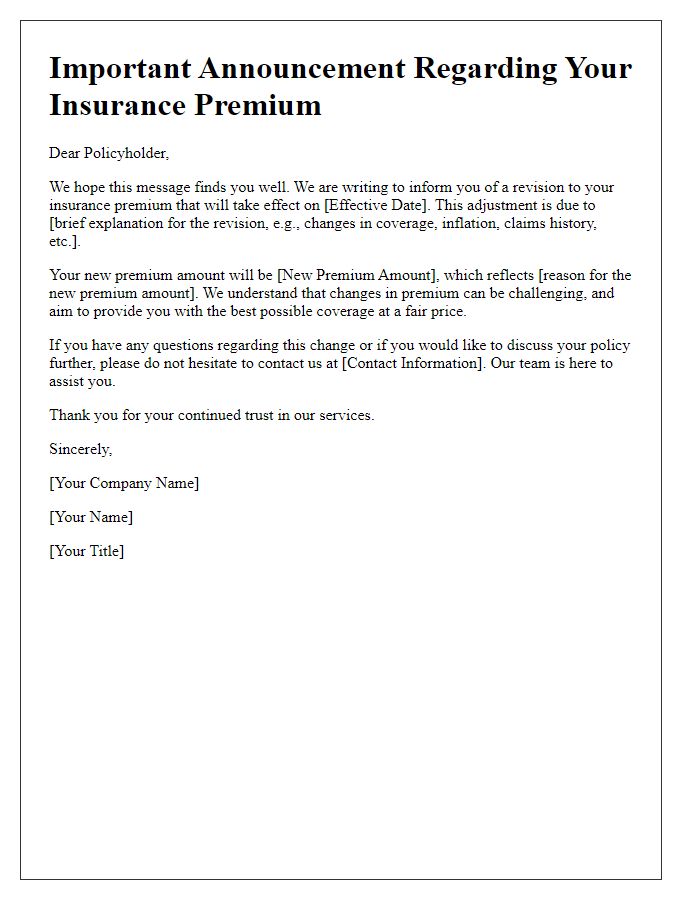

Insurance premium adjustments can occur due to various factors, such as changes in risk assessment, policyholder behavior, or modifications in coverage. An adjustment notice typically includes vital information regarding the policyholder, including their name, policy number, and contact information, ensuring clear identification for the insurer. Relevant details about the current premium amount, previous payments, and justifications for the adjustment, such as claims made or changes in underwriting guidelines, are also included. This kind of notice aims to provide transparency, enabling policyholders to understand the reasoning behind any increase or decrease in their insurance costs, ultimately aiding in financial planning and decision-making.

Policy Details

Insurance premium adjustments can significantly impact policyholders' financial planning. Insurers often reassess policies annually, considering factors such as claim history, underwriting guidelines, and changes in coverage options. The policy details, including the policy number (that uniquely identifies the coverage), effective dates (often reflecting the renewal period), and insured amounts (which define the maximum payout), are crucial for understanding adjustments. It is important for policyholders to review communication from their insurance companies to identify the reasons behind premium changes, such as increased risk assessments based on regional data (for example, natural disaster risk in Florida), or legislative changes affecting coverage requirements.

Change in Premium Amount

Insurance premium adjustments can occur due to various factors such as changes in risk assessment or updated policy terms. A significant increase in the premium amount may come from a rise in claim history or modifications in coverage levels. For example, a homeowner's insurance policy might see an adjustment after a natural disaster in the area, affecting regional risk assessments. Insurers evaluate numerous data points, including demographic information, property appraisal values, and historical claim data, to determine new premium amounts. Customers receiving this notice should carefully review their policy details and consider reaching out for clarification on any changes or underlying reasons for adjustments.

Effective Date of Adjustment

Insurance premium adjustments can result from various factors, including changes in policy terms, updated risk assessments, or claims history. Effective dates of adjustments indicate the precise moment when new premium rates, based on specific conditions, take effect. For instance, a policyholder in California may experience a premium reduction effective March 1, 2024, following a comprehensive review of their property, which showed improvements and decreased risks. Changes may also arise from state regulations in response to natural disasters, impacting homeowners insurance premiums in disaster-prone regions. Policyholders must review the adjustment notice carefully to understand the implications on their coverage and future payments.

Contact Information for Inquiries

Insurance premium adjustments can significantly influence policyholders' financial planning. Premiums related to property insurance, health insurance, or auto insurance may fluctuate due to factors like changes in risk assessments, claims history, or market trends. Policyholders seeking clarity can typically reach out to contact centers, often available through toll-free numbers (e.g., 1-800-555-0199), email addresses (like support@insurancecompany.com), or dedicated inquiry sections on the insurance provider's official website. Furthermore, local agents in specific regions (such as metropolitan areas or rural communities) can offer personalized assistance, clarifying premium modifications and providing tailored advice.

Comments