Are you ready to simplify the process of receiving your insurance proceeds? Navigating the world of insurance can often feel overwhelming, but knowing how to properly address the disbursement can make a significant difference. In this article, we'll share a straightforward letter template that ensures your request is clear and professional. Join us as we break down each essential component and help you take the next step towards receiving your funds.

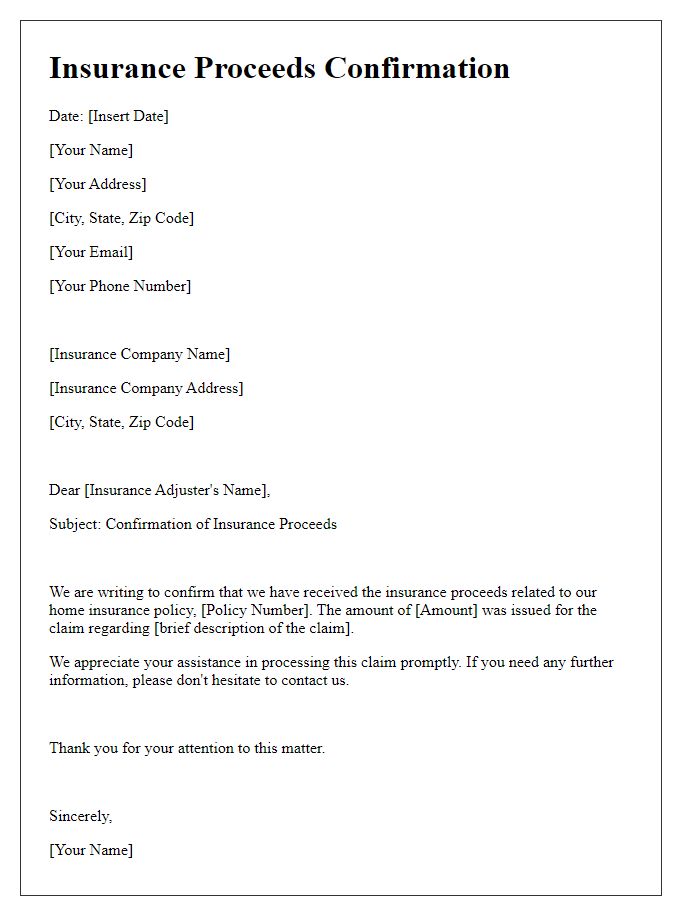

Policyholder Information

The insurance proceeds disbursement process involves the policyholder's vital information, including full name, policy number, and contact details, which are critical for verification and processing. Accurate details ensure swift processing of claims within established timelines, typically 30 to 60 days post-approval. The policyholder's address must be current and correspond with records maintained by the insurance company to prevent delays. Additionally, the method of disbursement, whether a direct deposit to a bank account or a physical check, must be clearly specified to facilitate seamless transactions. Proper identification, such as a government-issued ID, may also be required to confirm the policyholder's identity during disbursement.

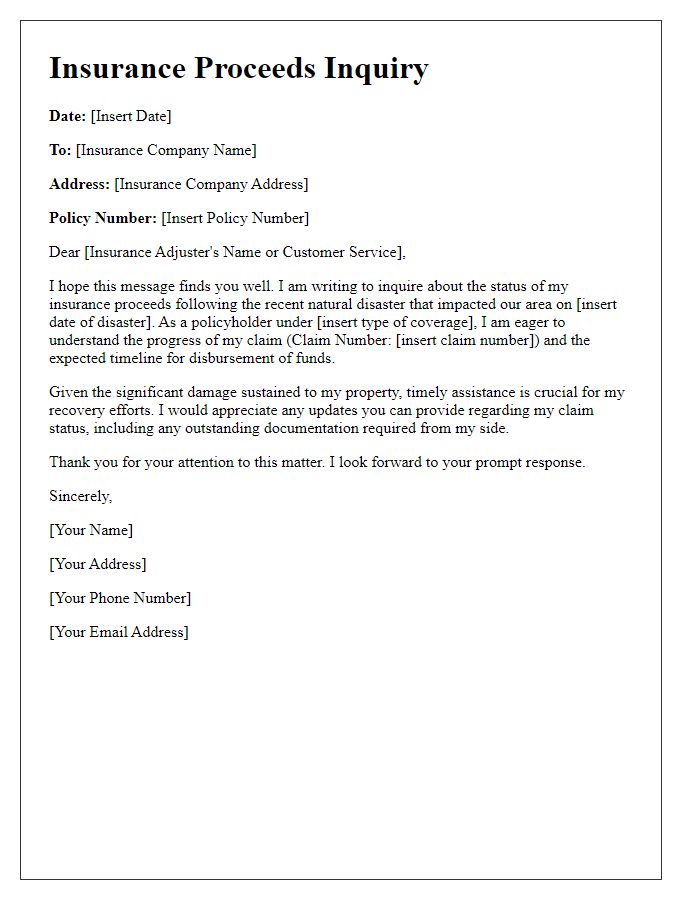

Claim Details

Insurance claims can involve intricate details. For instance, a homeowner may file a claim for water damage caused by a leak in a roof (often covered under homeowners' insurance policies) affecting structural components like the ceiling and walls. A claim reference number (e.g., 123456789) is vital for tracking purposes. The disbursement may include payment amounts based on the assessment from a certified adjuster, such as $15,000 for repairs. Timelines play a critical role; for example, payment can take 14 days after the approval. Notably, disbursement checks are typically issued to the homeowner and contractors, ensuring that necessary repairs are completed promptly.

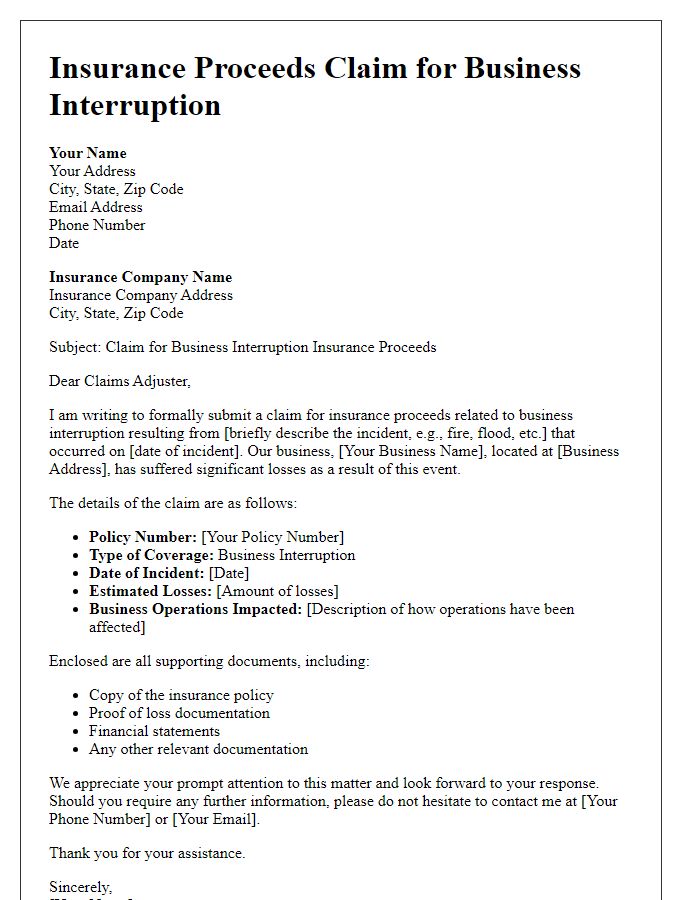

Payment Breakdown

In recent years, insurance proceeds disbursement has undergone scrutiny regarding transparency and clarity in payment breakdowns. Insurers are now expected to provide detailed documentation that outlines the allocation of funds under various coverage categories. For example, in homeowner's insurance claims, disbursements may include categories such as dwelling reconstruction costs, personal property replacement values, and additional living expenses. Each category typically requires specific documentation, like invoices or repair estimates, totaling to significant amounts such as $150,000 for reconstruction or $20,000 for personal belongings. Furthermore, the policyholder's deductible amount, which might stand at $1,000, should be clearly stated, indicating the portion of the claim that will be debited from the total disbursement sum. This emphasis on providing a comprehensive payment breakdown enhances policyholder understanding and satisfaction.

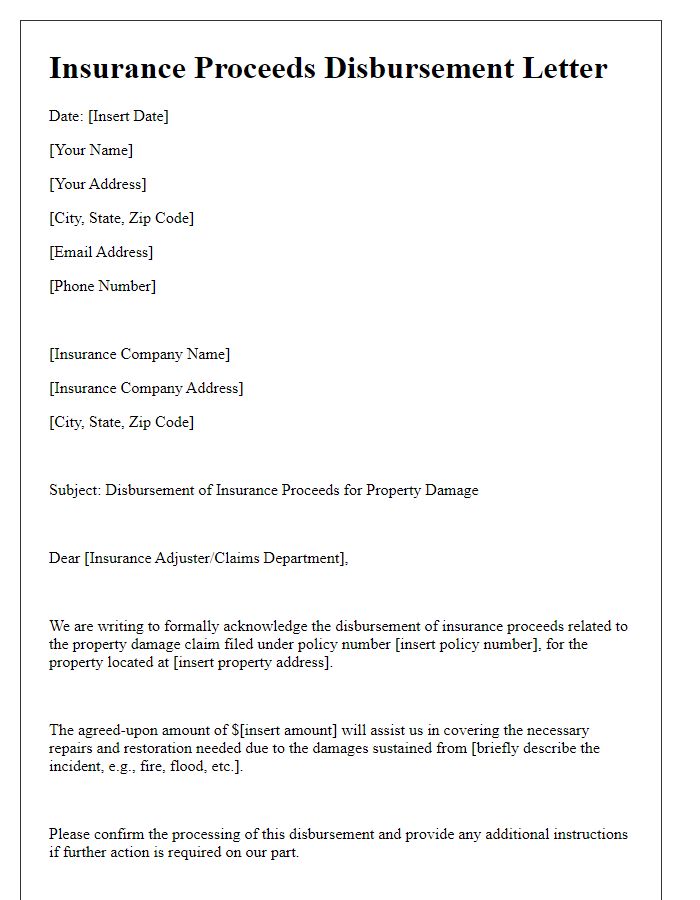

Disbursement Instructions

Disbursement instructions for insurance proceeds from a policy (such as a homeowners insurance claim following property damage) require clarity to ensure the proper allocation of funds. Policyholders must provide essential details, including the claim number assigned by the insurance company (e.g., Claim #123456), the name of the insured party, and the mailing address for the disbursement check (e.g., 123 Main Street, Anytown, USA). Additionally, it is important to specify the preferred method of payment, whether by check or direct deposit, and include relevant banking information if applicable. Clear guidelines for distributing the funds, such as reimbursement for repairs or direct payment to contractors, should also be outlined to facilitate prompt processing of the claim. Accurate and comprehensive instructions will expedite the disbursement process, ensuring a smooth transition for financial recovery.

Contact Information

Insurance companies, like XYZ Insurance (founded in 1985), often require detailed contact information for effective communication regarding the disbursement of proceeds. Essential details include the policyholder's full name, policy number (unique identifier assigned to the individual account), mailing address (including city, state, and zip code), and a contact number (preferably a mobile number for immediate updates). Additionally, email addresses (for electronic communication) serve as a critical tool for expedited information sharing. Accurate contact information streamlines the process, ensuring timely and efficient disbursement of funds related to claims, such as those concerning property damage or life insurance payouts, as outlined in the policy terms.

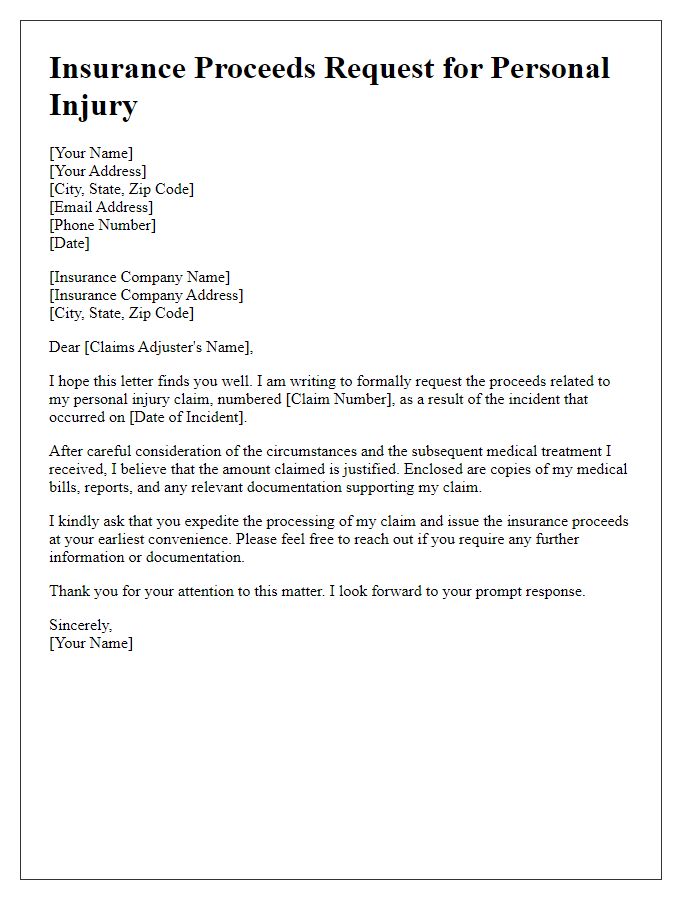

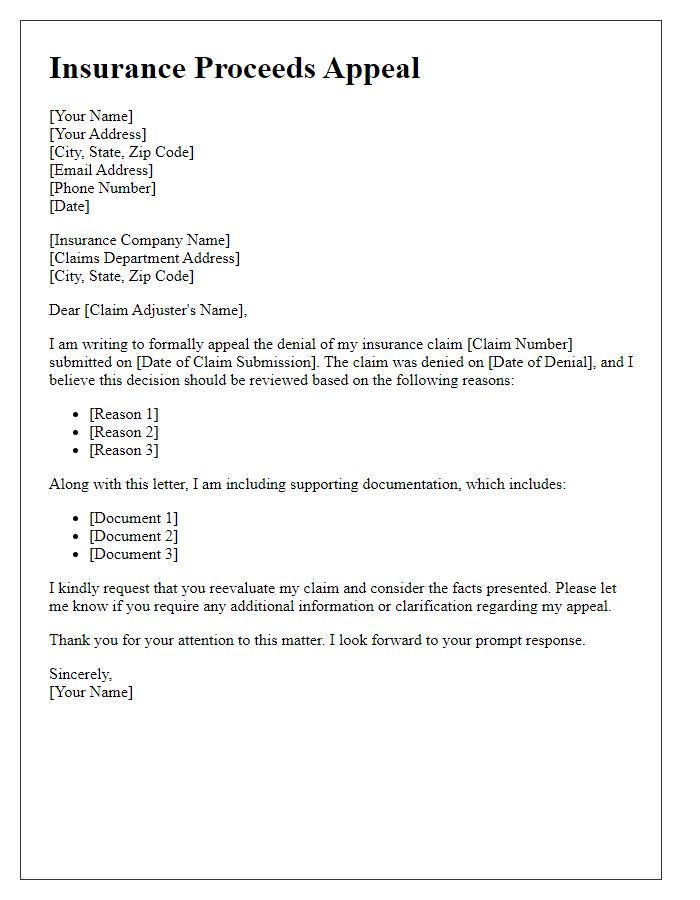

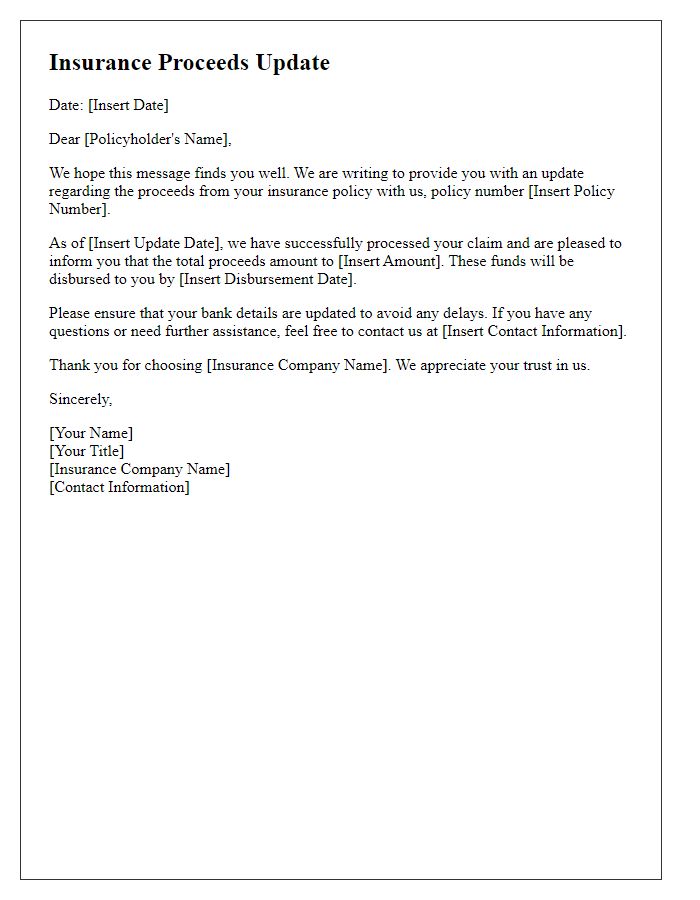

Letter Template For Insurance Proceeds Disbursement Samples

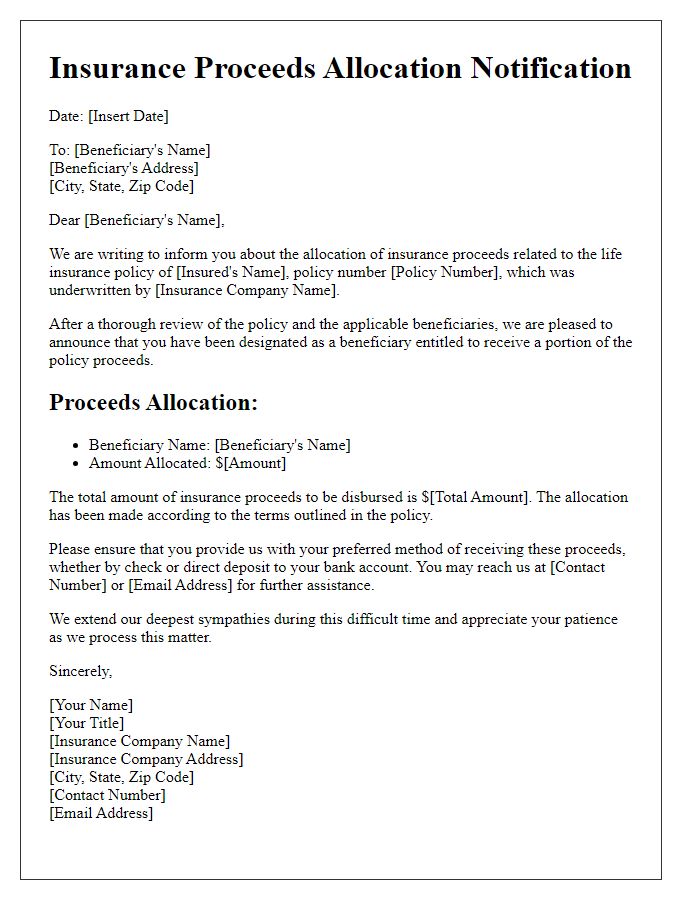

Letter template of insurance proceeds allocation for life insurance beneficiaries.

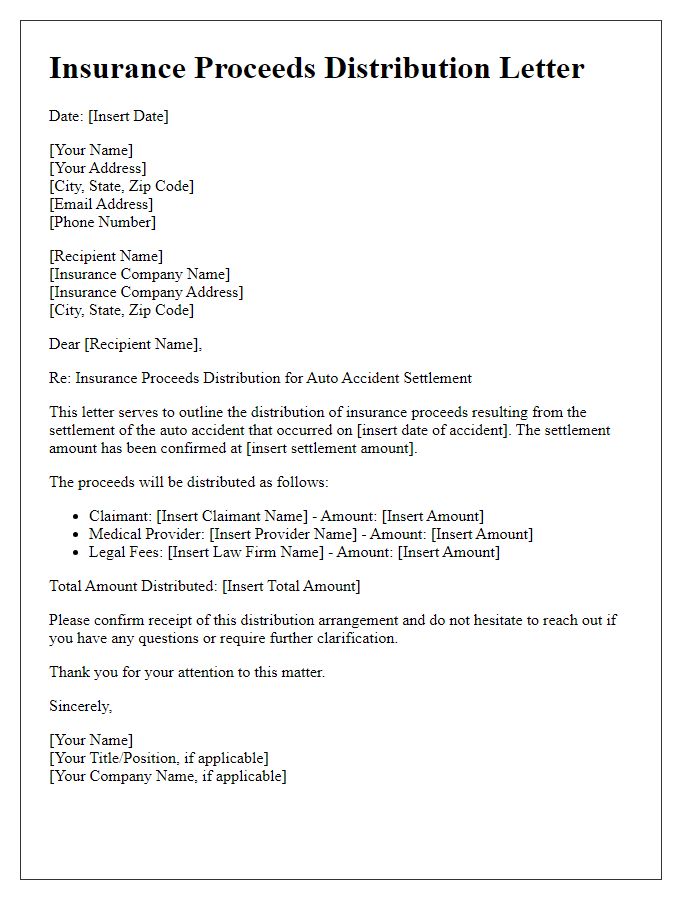

Letter template of insurance proceeds distribution for auto accident settlement.

Comments