Navigating the insurance appeal process can feel like trying to solve a complex puzzle, but it doesn't have to be overwhelming. Whether you've faced a denied claim or are simply seeking clarity on your coverage, understanding the steps involved is crucial for success. With the right guidance and a well-crafted letter template, you can effectively communicate your case and increase your chances of a favorable outcome. Ready to take the next step? Dive into our comprehensive guide to unlock the secrets of a successful insurance appeal!

Policy Details and Coverage Explanation

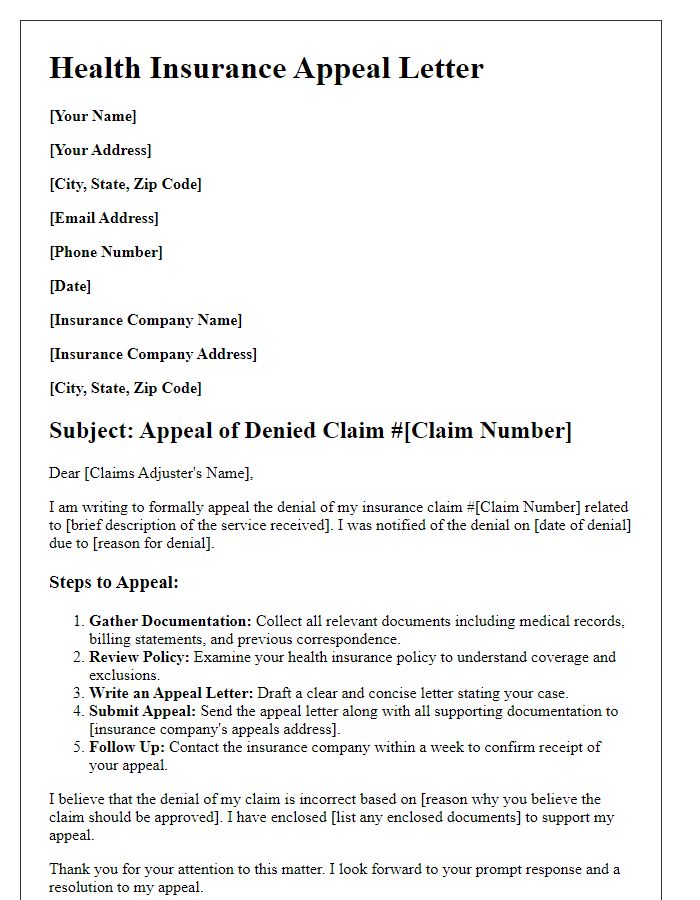

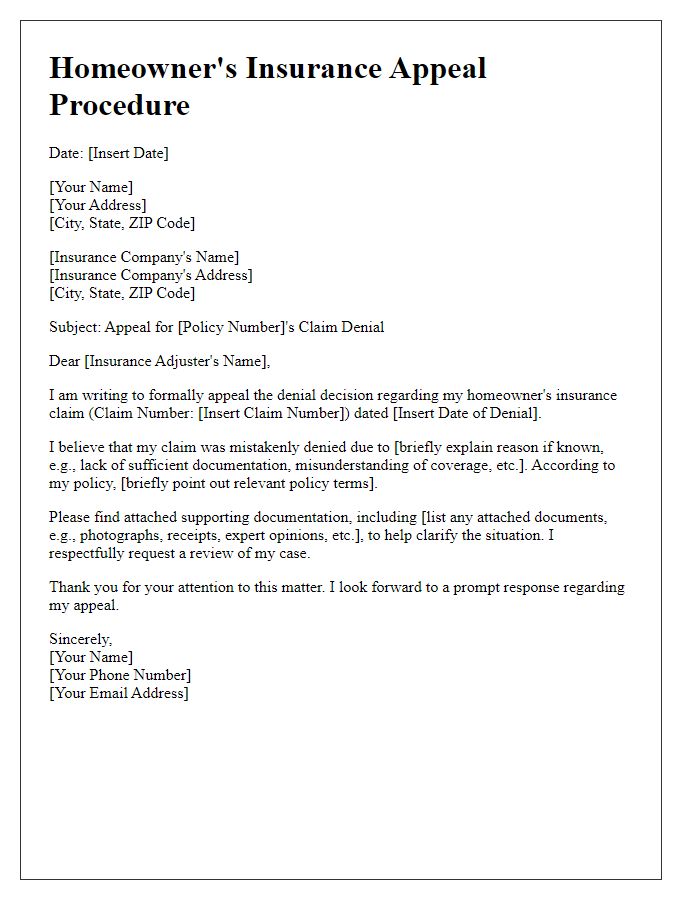

Insurance policy details serve as a crucial foundation for understanding coverage provisions. Each policy, typically ranging from individual to family plans, outlines specific protection against risks, such as property damage or medical expenses. Common attributes include the policy number, effective dates, premiums, deductibles, and coverage limits. For instance, a homeowner's policy may cover structural damage up to $300,000 while requiring a deductible of $1,000 before claims are payable. Similarly, health insurance plans can include essential health benefits, such as preventive services, hospitalization, and prescription drugs, with varying out-of-pocket maximums. Understanding these details is vital for accurately appealing coverage decisions and ensuring proper compensation for claims.

Clear Explanation of Denied Claim Reasons

Denied insurance claims often stem from specific reasons documented by the insurance company. Reasons include policy exclusions (situations not covered within the policy), lack of sufficient evidence (documentation or proof required to substantiate the claim), insufficient coverage limits (the claim amount exceeding policy limits), or missed deadlines (submitting claims after required time frames). Understanding these factors is crucial during the appeal process. Gathering necessary documentation, such as medical records, police reports, or photographs, is essential to support the appeal. Review policy terms meticulously to identify any misunderstandings concerning coverage. Seek clarification from the insurance company on denied claims to strengthen the appeal. Additionally, consider consulting with an insurance advocate familiar with the appeals process to increase the likelihood of a successful outcome.

Gather Supporting Documentation and Evidence

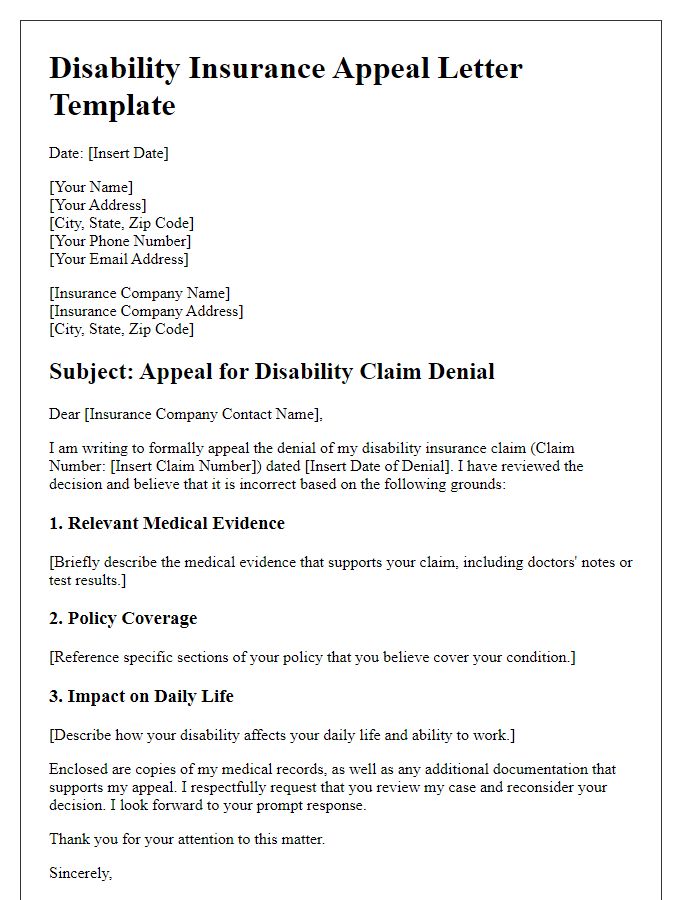

When initiating an insurance appeal process, it is crucial to gather supporting documentation and evidence to strengthen your case. Start by collecting key documents such as the original insurance policy (important for understanding coverage terms and conditions), denial letter (necessary to identify reasons for the claim rejection), and any prior correspondence with the insurance company (provides context and history of the claim). Additionally, include relevant medical records (critical for health-related claims) or repair estimates (essential for property damage claims) which clearly demonstrate the extent of the loss or need for coverage. Photographic evidence (visual proof of the situation) and witness statements (testimonies that support your case) can also enhance your appeal. Organizing these documents clearly and presenting them in a coherent manner will make your argument more compelling during the appeal review process.

Professional Tone and Formal Language Usage

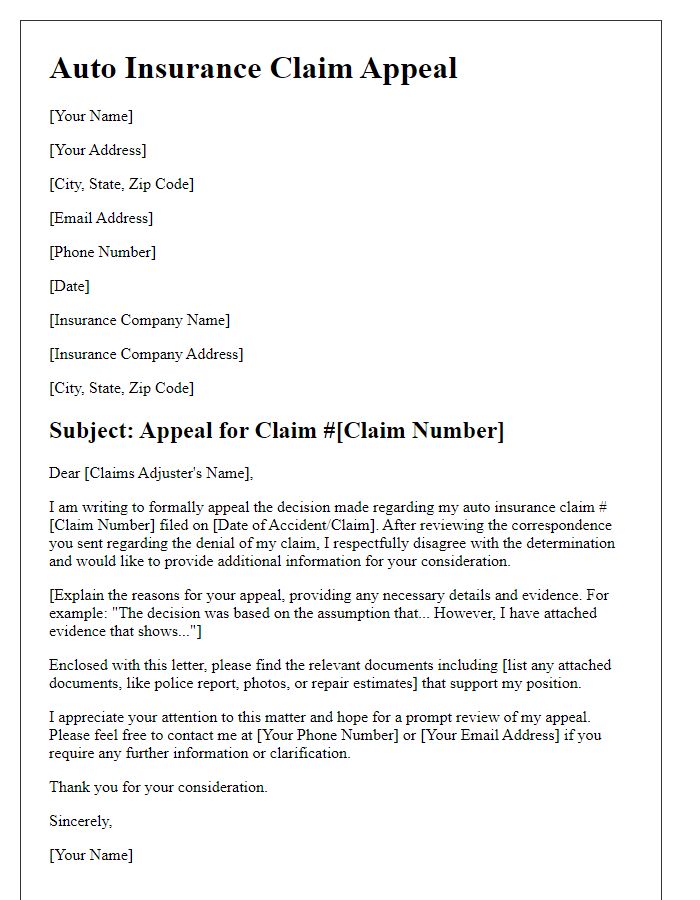

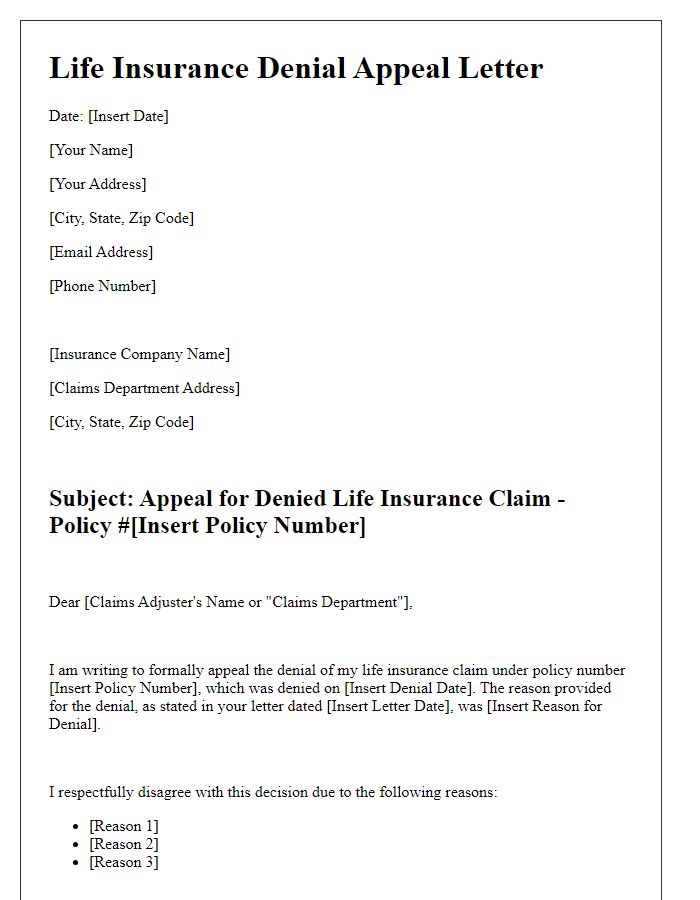

The insurance appeal process requires meticulous attention to detail and adherence to specific guidelines set by the insurance provider. First, obtain the denial letter, which outlines the reasons for rejection (such as lack of medical necessity or incomplete documentation). Next, gather supporting documents, including medical records, bills, and any relevant correspondence. Compose a formal appeal letter addressed to the claims department of the insurance company, citing the policy number and the claim's reference number. Clearly articulate the reasons for contesting the denial, referencing appropriate medical guidelines or policies. Ensure the submission adheres to any stipulated deadlines, typically ranging from 30 to 180 days post-denial. Follow up with the insurance company to confirm receipt of the appeal and obtain updates on the review process. If necessary, consider escalating the appeal by contacting the state insurance department or seeking assistance from a legal professional specializing in insurance claims.

Concise and Structured Appeal Request

The insurance appeal process requires a well-organized and articulate request to ensure proper review. Document the policy number from the insurance policy agreement, crucial for identification. Reference the claim number associated with the disputed decision, facilitating the tracking of the case in the insurance company's system. Include specific reasons for the appeal, focusing on discrepancies in coverage interpretation or additional evidence, such as medical records or receipts, supporting your argument. Utilize formal language throughout the appeal letter to maintain professionalism. Specify a clear timeline for desired response, ideally within 30 days, as many states require timely processing of appeals. Finally, include complete contact information to ensure prompt communication from the insurer regarding the appeal's outcome.

Comments