Are you looking to navigate the often confusing waters of insurance reinstatement? Understanding the nuances of insurance policies can feel daunting, but with the right guidance, you can effectively communicate your needs. In this article, we'll walk you through a simple yet comprehensive letter template that will help you request the reinstatement of your insurance policy with confidence. So, if you're ready to get your coverage back on track, keep reading for valuable insights!

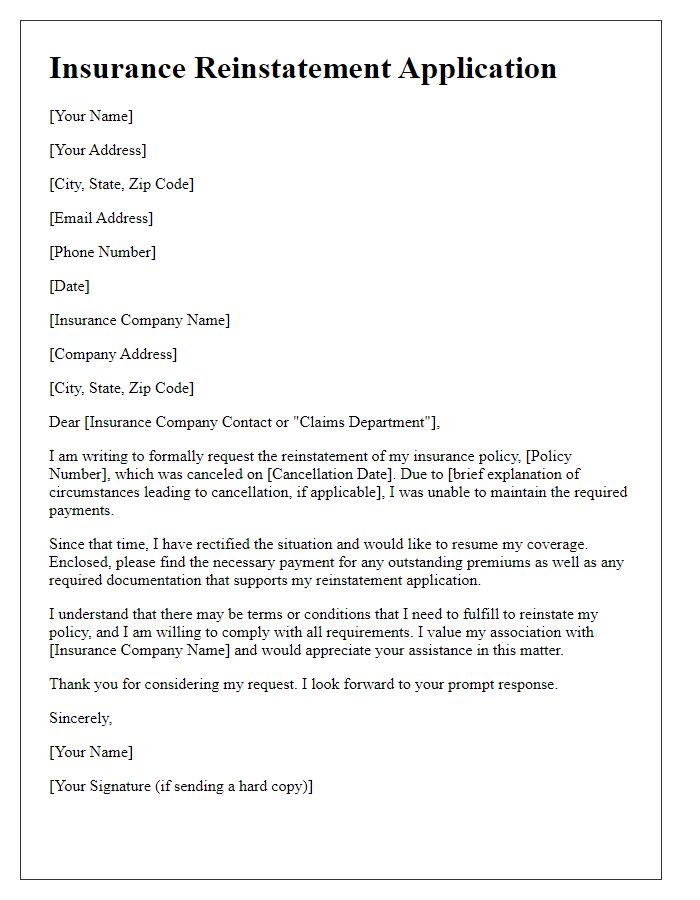

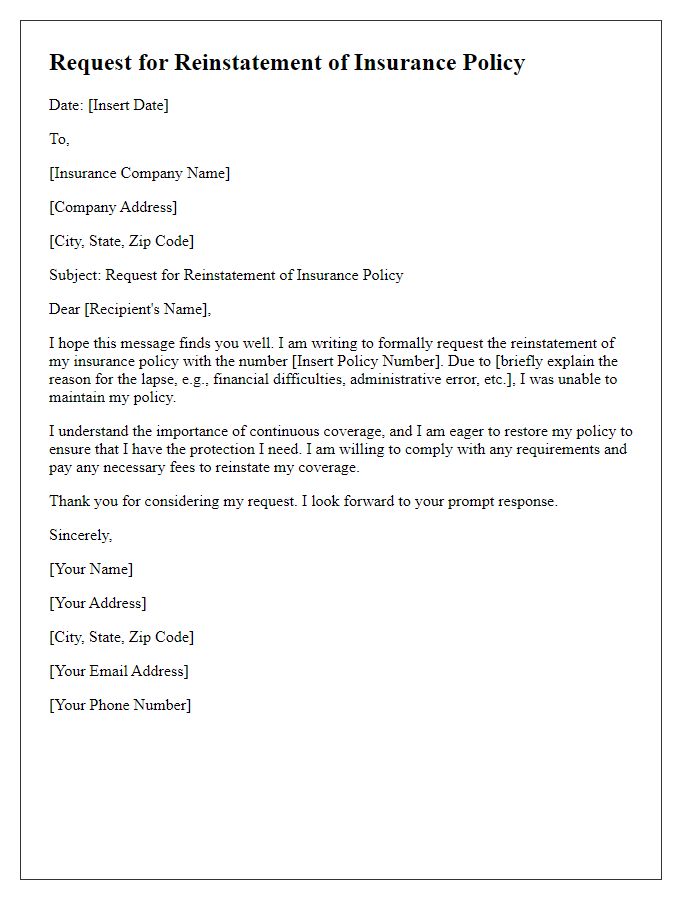

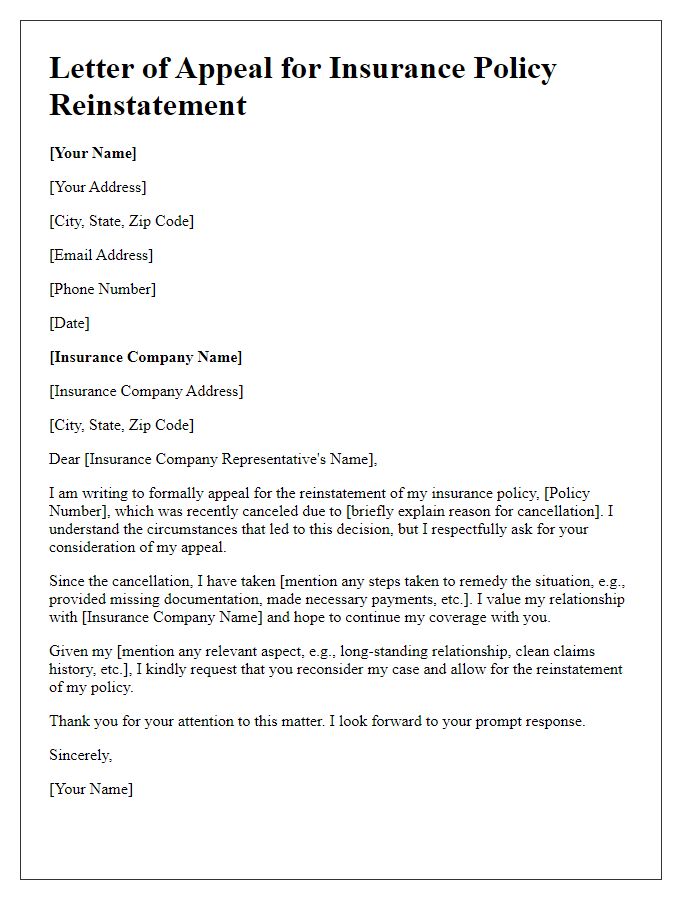

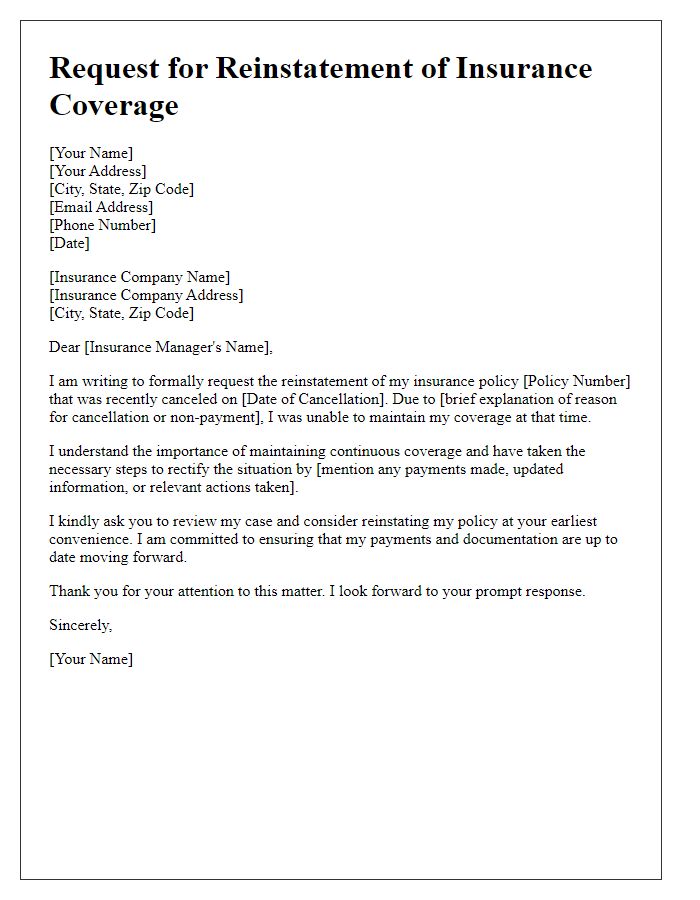

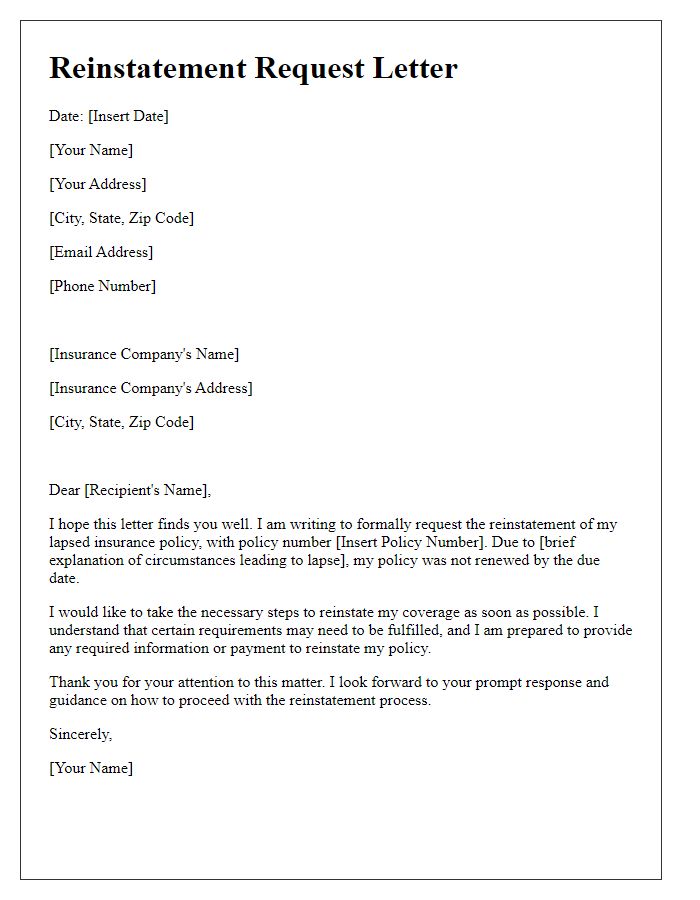

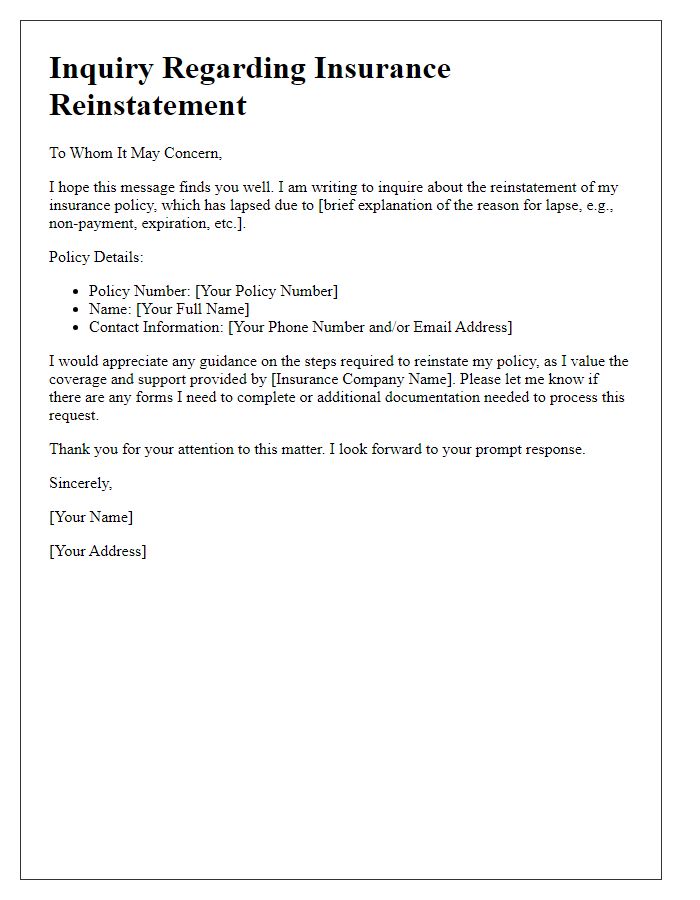

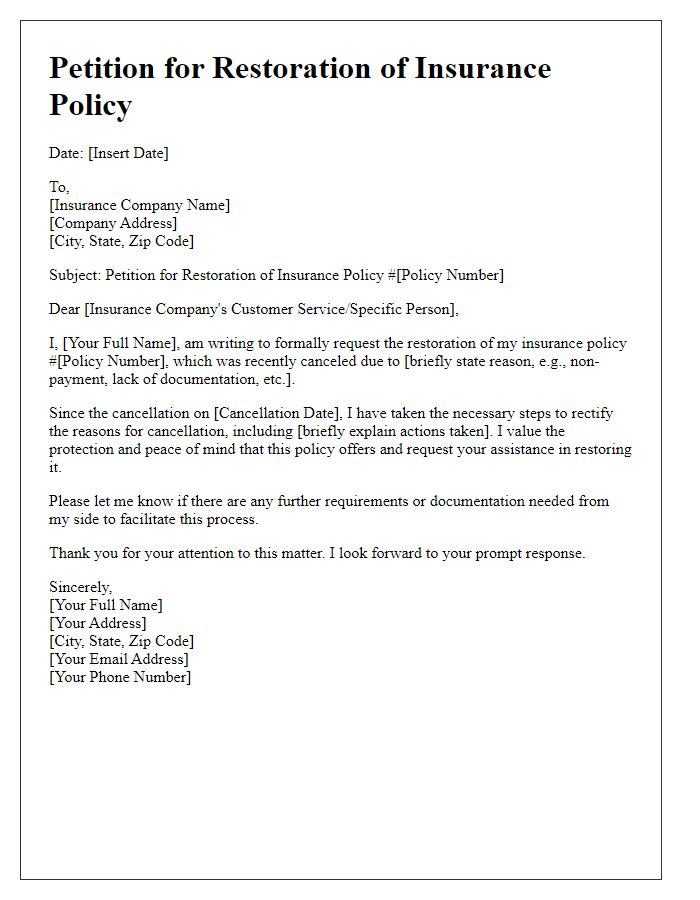

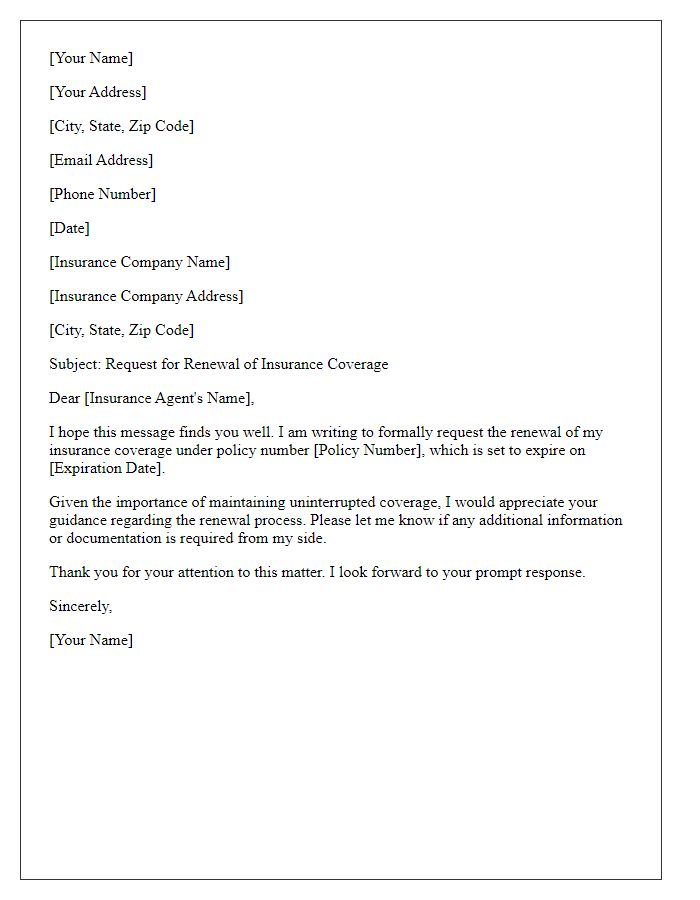

Policyholder's personal information

Insurance reinstatement requests often involve specific personal information to accurately identify the policyholder and their coverage history. Key data includes full name, which provides a unique identifier for the account. The policy number, typically a series of digits and letters, links to the specific insurance coverage in question, whether it be auto, health, or property. Contact information, such as email address and phone number, ensures effective communication during the process. Date of birth may also be required for identity verification, while the mailing address, including city and zip code, ensures that any correspondence reaches the policyholder promptly. Additional details about previous claims or payments could enhance the request's context.

Policy details and number

Insurance policy reinstatement requests often require detailed information to process effectively. An insurance policy typically encompasses a unique policy number, such as 123456789, which identifies the contractual agreement between the policyholder and the insurance provider. Policyholders must include specific policy details that outline the type of coverage, such as health, auto, or homeowner's insurance, and the effective dates, which denote the start and end date of coverage. Additionally, information may include the total premium amount and any riders or additional coverage options that enhance the basic policy, serving to tailor protection based on personal needs. This detailed context aids the insurer in promptly addressing the reinstatement request, potentially after a lapse due to non-payment or other qualifying criteria.

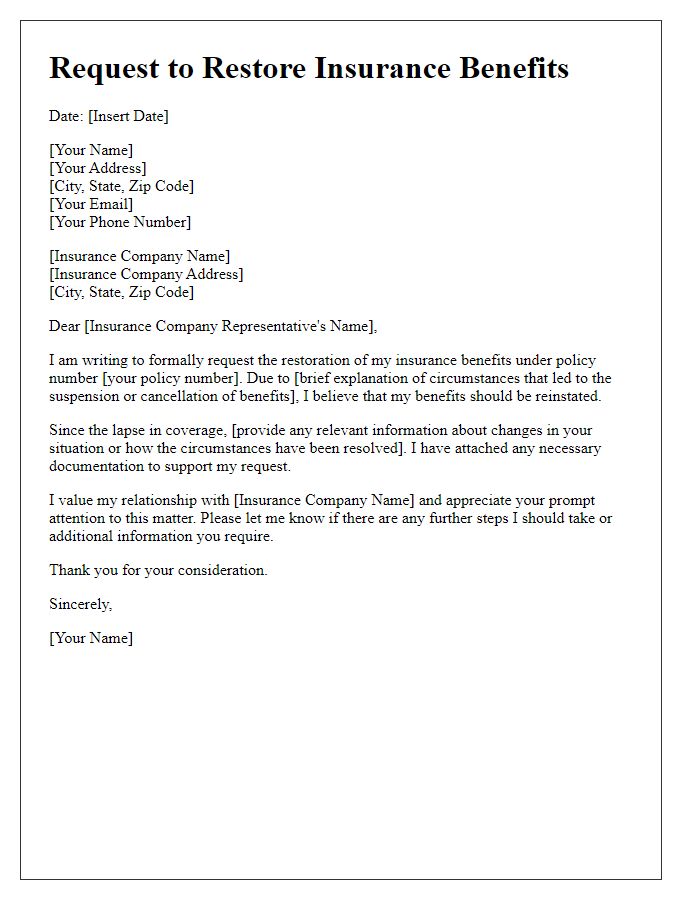

Reason for lapse explanation

Insurance policies often lapse due to various reasons, such as missed premium payments or changes in financial circumstances. Financial difficulties, resulting from events like job loss, medical emergencies, or unexpected expenses, can hinder timely payments. Additionally, negligence in communication or misunderstanding of policy terms may contribute to a lapse in insurance coverage. It is essential to provide a clear explanation of the specific circumstances that led to the lapse when requesting reinstatement. Emphasizing a commitment to maintaining regular payments in the future can strengthen the request.

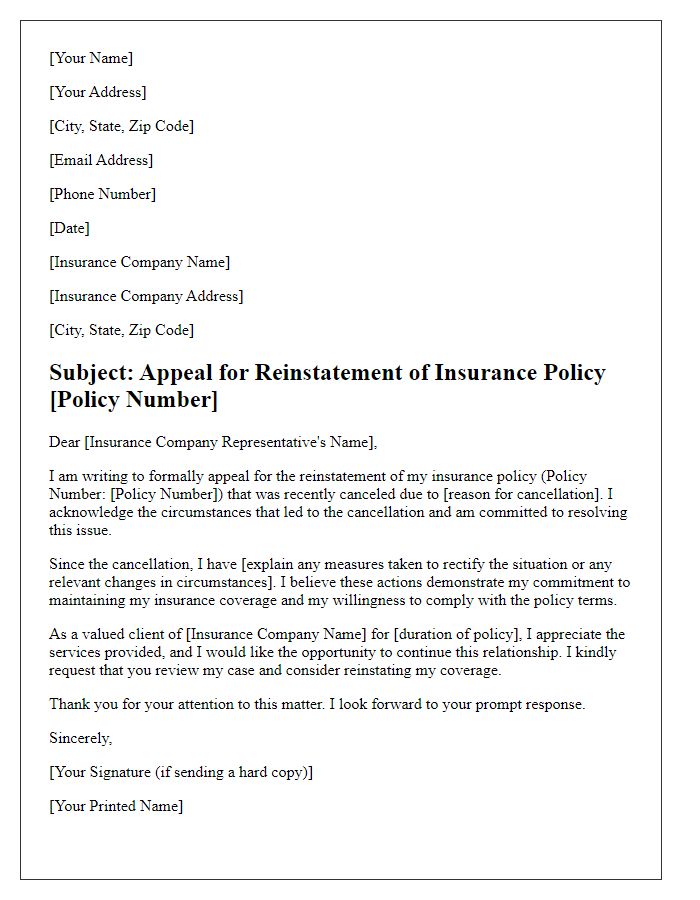

Request for reinstatement

A request for reinstatement involves persuading an insurance company to restore a policy that has lapsed or been canceled. Essential details include the policy number, the reason for the lapse, which may be non-payment or administrative error, and the effective date of the original policy. It is crucial to mention the willingness to comply with necessary requirements, such as payment of back premiums or updated documents. Providing a personal explanation of circumstances contributing to the lapse can strengthen the request. For housing insurance policies, stipulating coverage essentials for home protection, such as fire and theft, enhances the urgency of reinstatement.

Contact information for follow-up

Insurance reinstatement requests often require detailed contact information to facilitate follow-up communications. Primary contacts should include the full name of the policyholder, the insurance policy number, and the associated email address for electronic correspondence. Additionally, a reliable phone number, preferably a mobile line, should be provided to ensure immediate accessibility. It is beneficial to include a physical mailing address as well for any formal correspondence that may need to be sent via postal services. Ensuring accuracy in these details can significantly streamline the reinstatement process and enhance the chances of a favorable resolution.

Comments