Navigating insurance coverage disputes can often feel overwhelming, but you don't have to tackle it alone. In this article, we'll break down the essential components of a strong dispute letter, ensuring your concerns are clearly articulated and effectively addressed. Understanding the nuances of your policy and the claims process can empower you to advocate for yourself. So, grab a cup of coffee and let's dive into how to craft the perfect letter to resolve your insurance issues!

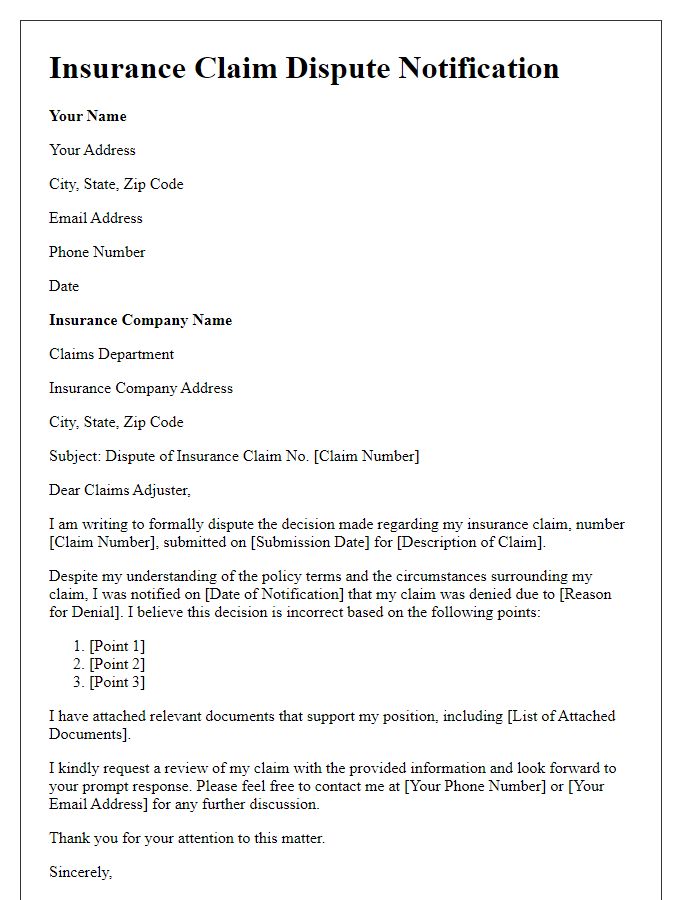

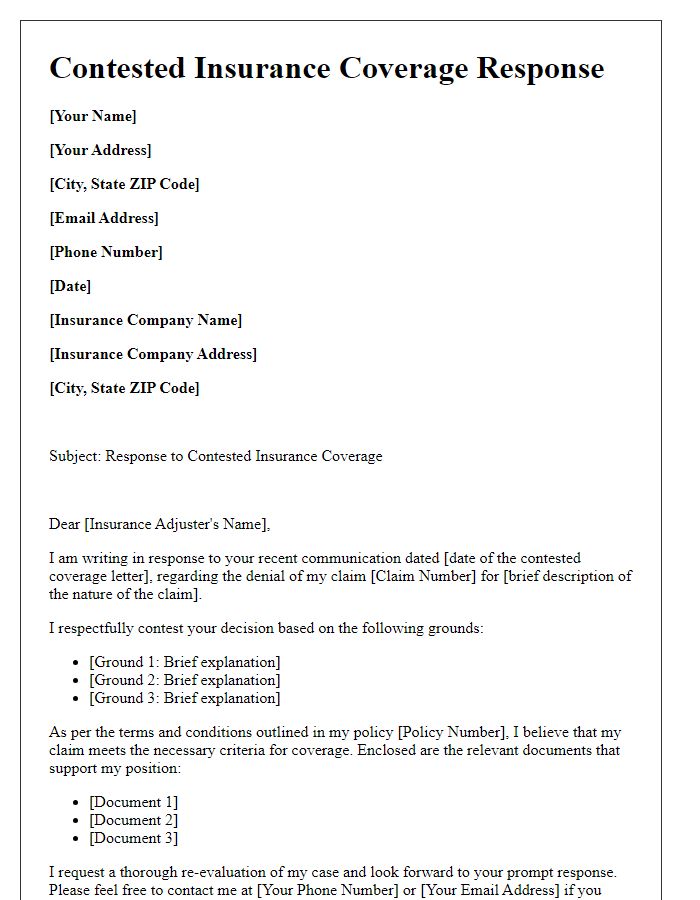

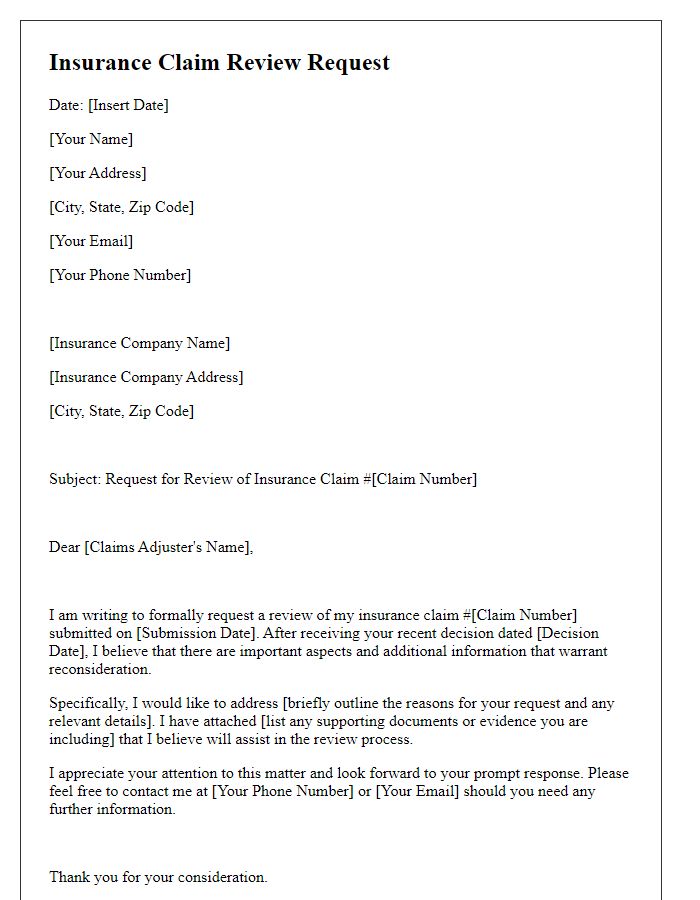

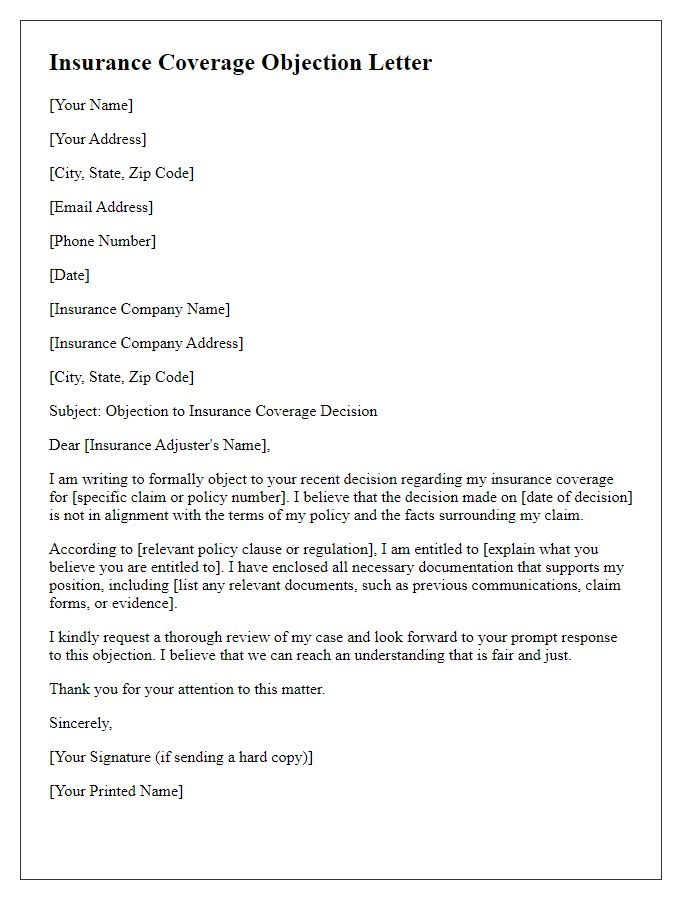

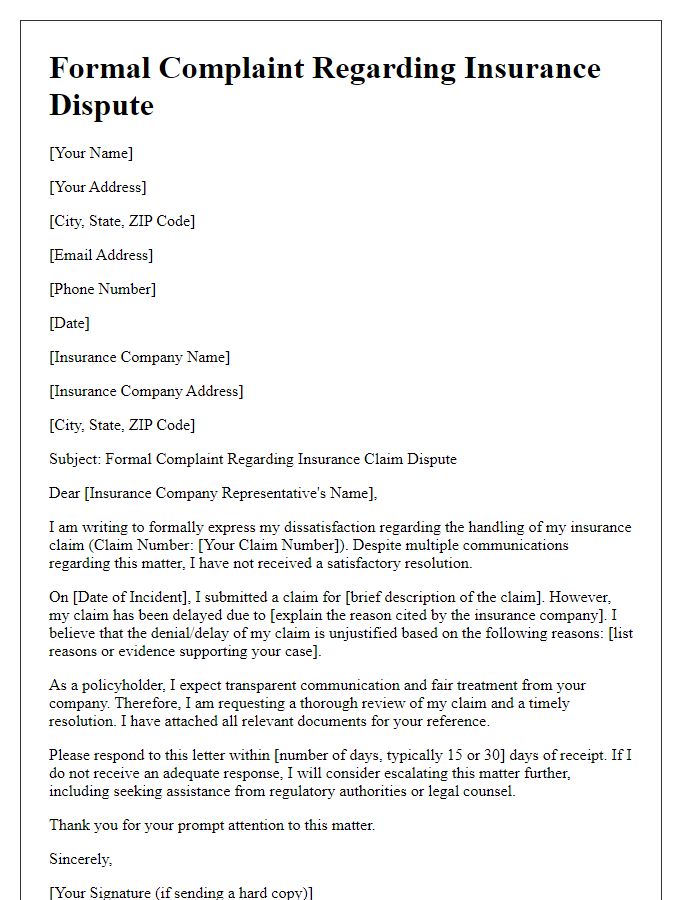

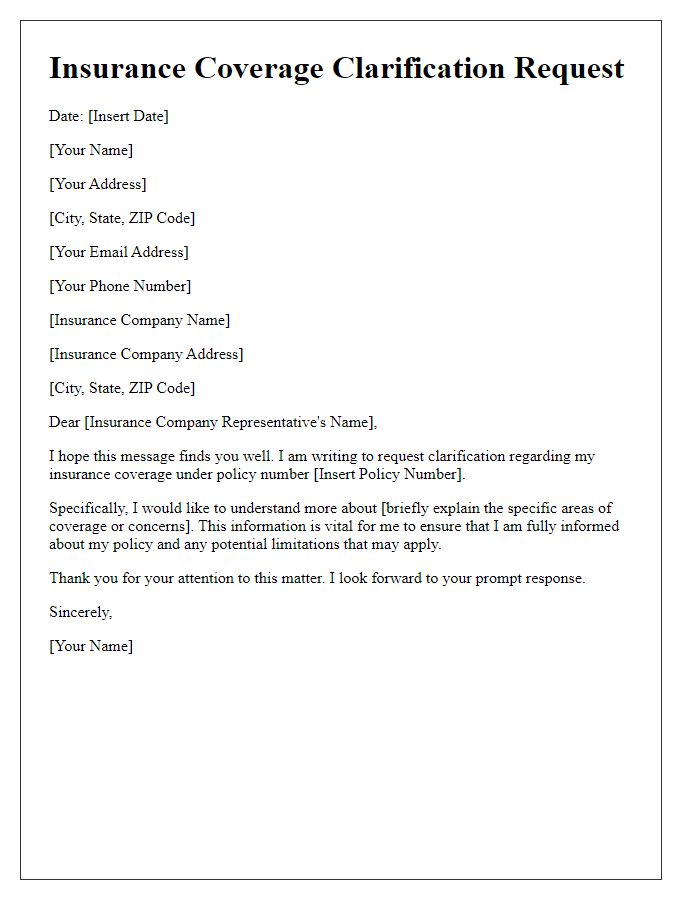

Policy Details and Holder Information

Insurance coverage disputes often arise due to misunderstandings regarding policy details and holder information. Policy details include specific terms, coverage limits, and exclusions that outline the extent of protection provided by insurance, such as auto, health, or homeowners insurance. Holder information, referring to the insured individual or entity, generally contains the name, address, and contact details of the policyholder, which is essential for claims processing. Clear communication of these elements can significantly affect the resolution of claims disputes. Any discrepancies in holder information, such as incorrect addresses or policy numbers, can lead to delays or denials in claim approval, making accuracy crucial in documentation. Understanding these factors is fundamental to navigating the complexities of insurance claims and disputes effectively.

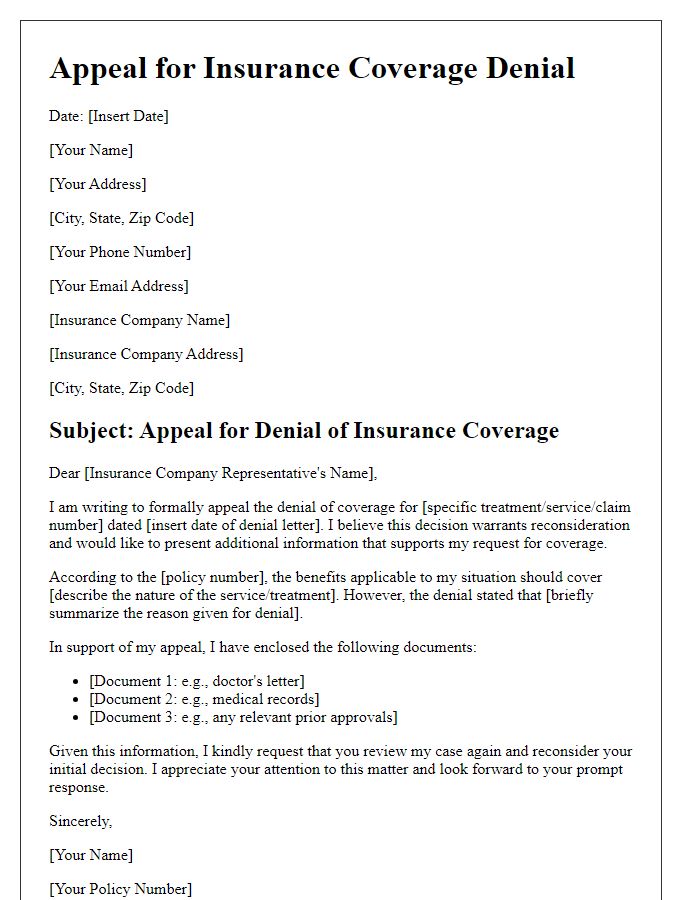

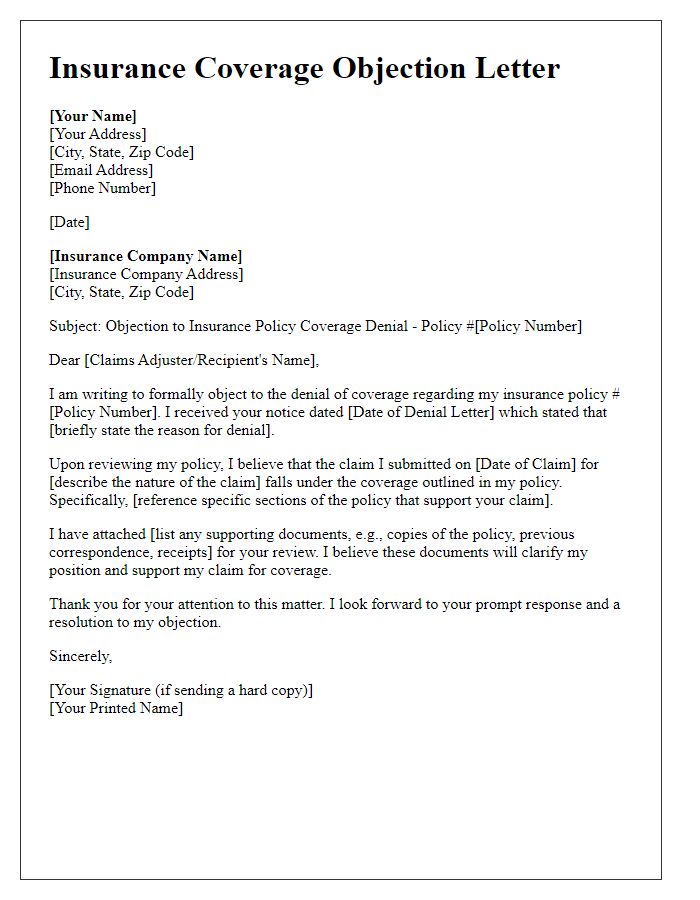

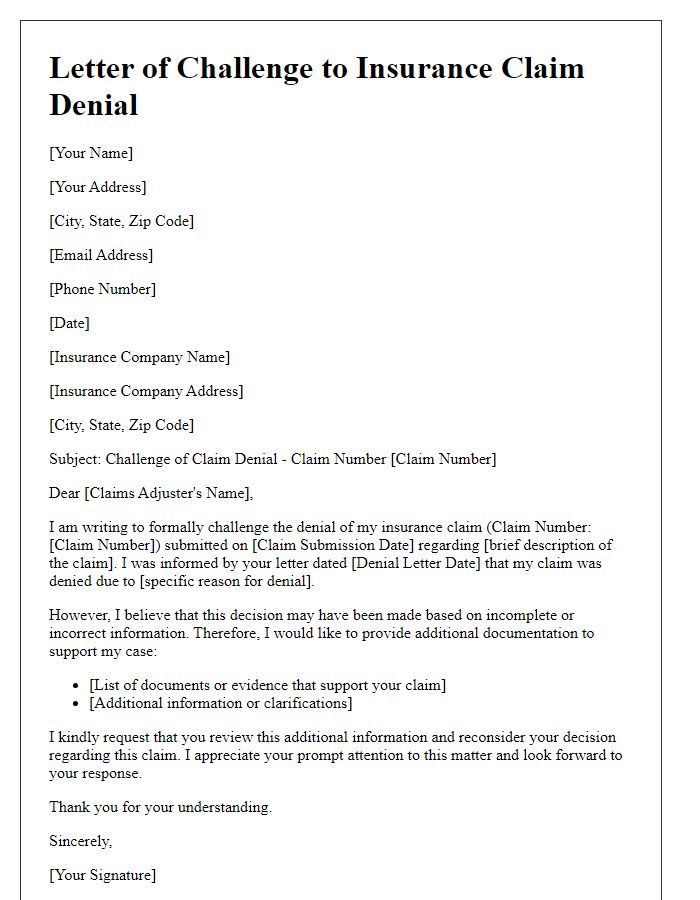

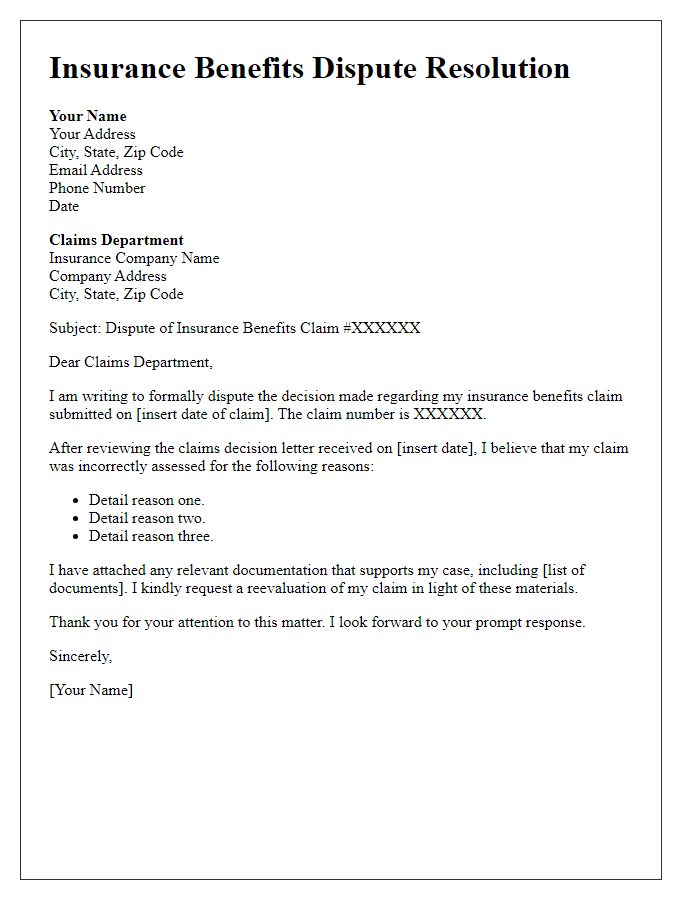

Claim Description and Dispute Overview

A comprehensive insurance coverage dispute arises when a claim, such as for property damage caused by a natural disaster like Hurricane Ida in Louisiana (August 2021), is denied or underpaid by the insurer. The insured party, facing significant financial burden due to the damages, may find the policy's terms, including coverage limits and exclusions, insufficiently clear. Disputes often center on the interpretation of specific clauses (e.g., replacement cost vs. actual cash value) and the adequacy of documentation provided during the claims process. Engaging in negotiations with an insurance adjuster can be a critical step in resolving discrepancies in payout amounts or coverage entitlements. Legal recourse often becomes necessary if initial attempts at resolution do not yield favorable outcomes, sometimes culminating in an appeal to a state insurance commissioner or filing a lawsuit in a court of law.

Supporting Evidence and Documentation

Insurance coverage disputes often arise from misunderstandings or miscommunications about policy terms and conditions. In these instances, providing supporting evidence is crucial for a successful resolution. Essential documents include the insurance policy itself, which outlines coverage limits, exclusions and specific terms agreed upon at the time of purchase. Additional evidence such as correspondence with the insurance company, including claim submissions, denial letters, and any response from insurance adjusters, can demonstrate the timeline of the dispute. Photographic evidence related to the claim, like images of damaged property or medical reports documenting injuries, further substantiates the claim. Financial documents, including receipts for repairs or medical costs incurred, can highlight the monetary impact of the incident in question. This comprehensive package of documentation can significantly bolster the argument for rightful insurance claim compensation.

Request for Specific Resolution or Action

Insurance coverage disputes often arise when policyholders seek judgments on claims that insurance companies deny or underpay. For example, a homeowner in Texas may dispute a denied claim for water damage related to an undisclosed pipe leak, which could exceed $15,000 in repair costs. Various factors complicate these claims, such as the policy language, state regulations, and timelines for filing. During the dispute process, essential documentation like the original policy agreement, photographs of the damage, and estimates from licensed contractors play a critical role. Communication with the insurance provider must be clear and documented to ensure accountability and a proper resolution, ideally aiming to reach an agreement that honors the policyholder's coverage rights while adhering to the insurance company's guidelines.

Contact Information for Follow-up

Insurance coverage disputes often involve complex negotiations and detailed documentation. Efficient communication is essential for resolution. Key components include the policyholder's name, insurance policy number, and a clear description of the disputed claim, including dates of the event and amount claimed. Insurance companies typically require a formal disputation letter, which should include the recipient's address, contact information, and a summary of the issues including specific policy clauses involved. Follow-up can be facilitated by providing multiple contact methods, such as email address and phone number, ensuring prompt responses from the insurance company. Timely communication helps maintain an organized record of interactions essential for resolving disputes.

Comments